Complex Fertilizers Market Size, Share, Trends, Industry Analysis Report: By Product Type (Complete and Incomplete), Form, Crop Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1526

- Base Year: 2024

- Historical Data: 2020-2023

Complex Fertilizers Market Overview

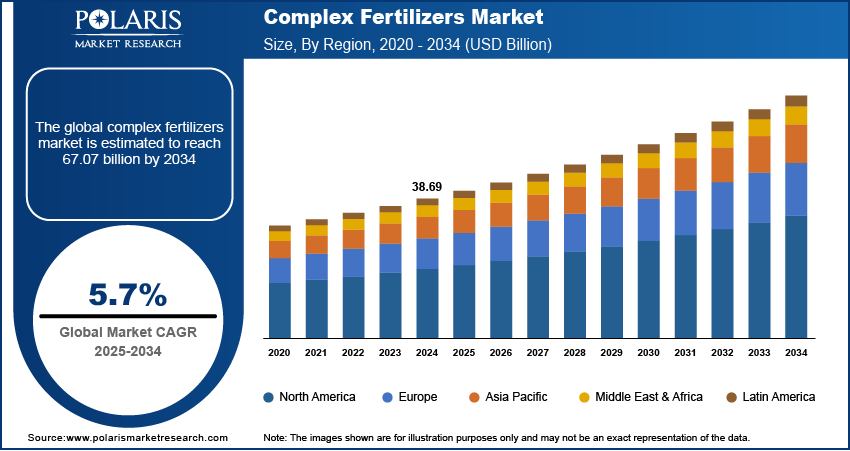

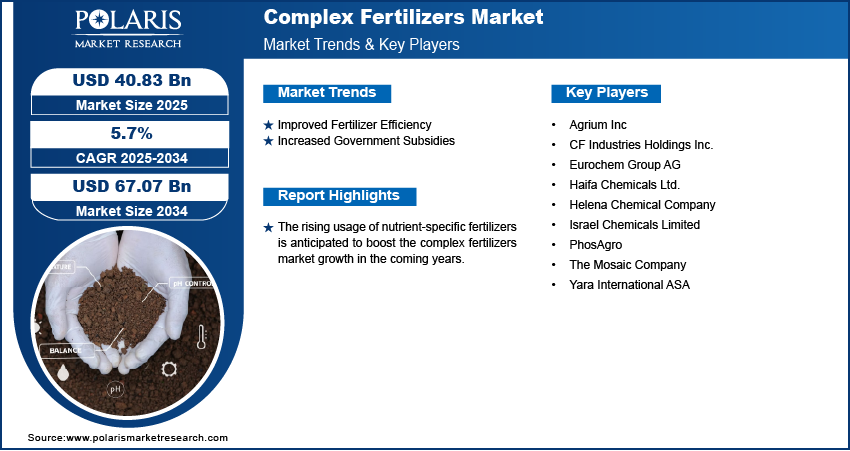

The global complex fertilizers market size was valued at USD 38.69 billion in 2024. The market is projected to grow from USD 40.83 billion in 2025 to USD 67.07 billion by 2034. It is projected to exhibit a CAGR of 5.7% from 2025 to 2034.

Complex fertilizers are created by blending two or more types of macronutrient fertilizers. The fertilizers consist of agricultural micronutrients such as potassium, nitrogen, and phosphorous, which are essential for plant growth. In addition, complex fertilizers can be mixed with other elements that provide secondary or trace nutrients, such as magnesium, sulfur, and calcium. The application of complex fertilizers offers several benefits, including cost savings, convenience in the field, and enhanced management of crop nutrition. The significant benefits of using complex fertilizers over other fertilizer types are driving the complex fertilizers market growth.

To Understand More About this Research: Request a Free Sample Report

The rising emphasis on the development of fertilizers tailored to specific crops and the advent of advanced farming techniques that ensure the safe and efficient operation of fertilizers further drive the complex fertilizers market development.

The rising usage of nutrient-specific fertilizers, along with the growing need for biofuels, is expected to drive complex fertilizers market expansion in the coming years. Increased demand for food production globally and rising emphasis on sustainability in the food industry are expected to provide lucrative opportunities for complex fertilizer producers during the forecast period.

Complex Fertilizers Market Dynamics

Improved Fertilizer Efficiency

One of the key benefits of complex fertilizers is their enhanced efficiency. Complex fertilizers are designed to release nutrients in a controlled manner to match the needs of plants. This slow-release characteristic helps reduce nutrient leaching, which is the loss of essential nutrients from the top layer of the soil by percolating precipitation. Also, it helps reduce the risk of over-fertilization. As a result, food producers can achieve higher crop yields by applying fewer inputs, resulting in enhanced cost efficiency and improved sustainability. Therefore, greater efficiency of complex fertilizers as compared to traditional fertilizers drives the complex fertilizers market demand.

Increased Government Subsidies

Several governments worldwide are recognizing the importance of fertilizers in enhancing agricultural productivity and ensuring food security. They provide subsidies, incentives, and financial support to food producers who use high-efficiency fertilizers such as liquid fertilizers and complex fertilizers that can enhance yields and reduce wastage. This government support is critical in emerging nations where farmers usually require financial incentives to invest in precision farming. The encouragement for the use of complex fertilizers through government schemes and subsidies boosts the complex fertilizers market development.

Complex Fertilizers Market Segment Insights

Complex Fertilizers Market Assessment Based on Product Type

The complex fertilizers market, based on product type, is bifurcated into complete and incomplete. The incomplete segment held a larger share of the global market in 2024. Incomplete complex fertilizers are particularly suitable for use in crops, cereals, and vegetables. Their use helps plants resist drought and disease. These fertilizers are also used in greenhouse applications, making them one of the most widely used fertilizers worldwide.

Complex Fertilizers Market Evaluation Based on Crop Type

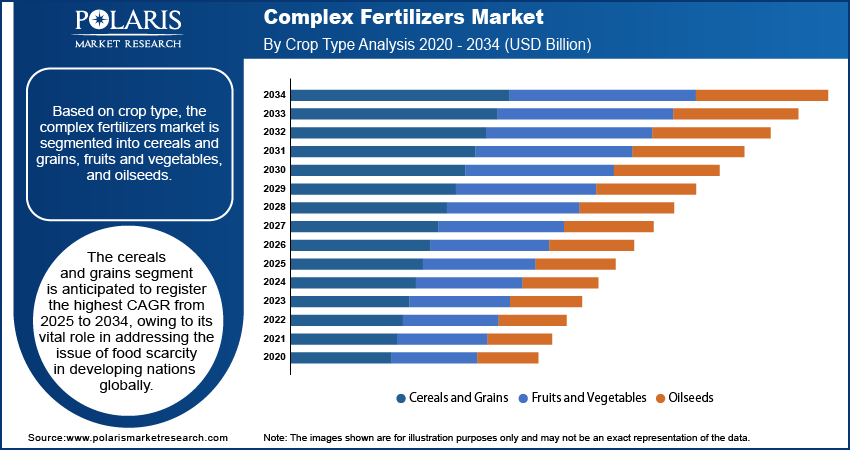

The complex fertilizers market, based on crop type, is segmented into cereals and grains, fruits and vegetables, and oilseeds. The cereals and grains segment is projected to register the highest CAGR from 2025 to 2034. This is primarily due to the increased yields of cereals and their vital role in addressing the issue of food scarcity in developing nations globally. The demand for cereals is also being propelled by the increased use of vegetable oil for human consumption and biodiesel production. Further, the growing popularity of cereals as cash crops contributes to their robust growth in the market.

Complex Fertilizers Market Regional Analysis

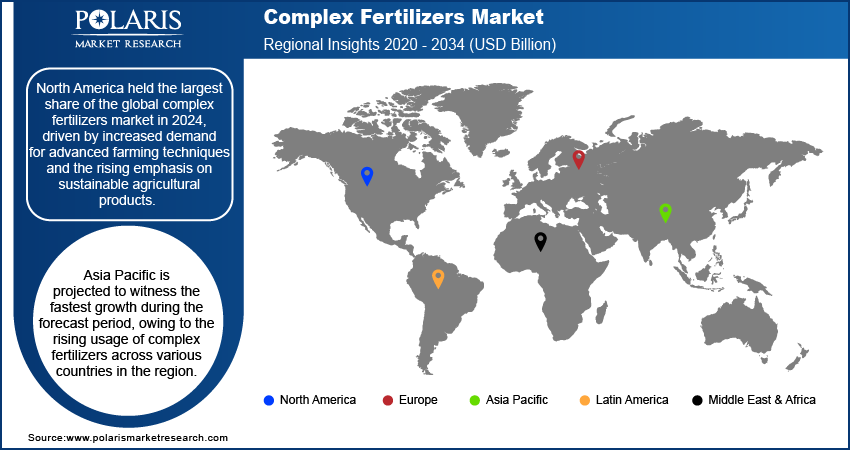

By region, the market report offers complex fertilizers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest share of the global market in 2024. The growing regional population has put pressure on current agricultural yield patterns, driving demand for advanced farming techniques and complex fertilizers. The rising emphasis on sustainable agricultural products also fuels regional market growth.

The Asia Pacific complex fertilizers market is projected to register the fastest growth during the forecast period. The various benefits offered by complex fertilizers in terms of economic savings and field convenience have led to their increased usage in various nations across Asia Pacific. Further, the rising adoption of new farming methods to improve crop yields and enhance efficiency is having a favorable impact on the market development in the region.

Complex Fertilizers Market – Key Players and Competitive Insights

The complex fertilizers market is characterized by competition. It is driven by factors such as new product offerings, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, and offering. Also, they make significant investments in R&D initiatives to introduce advanced complex fertilizers to cater to diverse consumer needs.

Several market participants are prioritizing the development of organic fertilizers that comply with stringent government regulations. The complex fertilizers market report offers a market assessment of all the key players, including Israel Chemicals Limited, CF Industries Holdings Inc., The Mosaic Company, Haifa Chemicals Ltd., Yara International ASA, Eurochem Group AG, Agrium Inc, PhosAgro, and Helena Chemical Company.

List of Key Players in Complex Fertilizers Market

- Agrium Inc

- CF Industries Holdings Inc.

- Eurochem Group AG

- Haifa Chemicals Ltd.

- Helena Chemical Company

- Israel Chemicals Limited

- PhosAgro

- The Mosaic Company

- Yara International ASA

Complex Fertilizers Industry Developments

August 2024: Yara International announced its partnership with PepsiCo to decarbonize food production. According to Yara, the alliance will equip participating PepsiCo Europe farmers with Yara’s advanced crop nutrition products and digital solutions.

September 2022: Israel Chemicals Limited introduced eqo.x, an advanced biodegradable fertilizer technology for open field agriculture. The company stated that the biodegradable coating releases nutrients in a consistent way to improve agricultural efficiency and promote sustainability.

Complex Fertilizers Market Segmentation

By Product Type Outlook

- Complete

- Incomplete

By Form Outlook

- Solid

- Liquid

By Crop Type Outlook

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Complex Fertilizers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 38.69 billion |

|

Market Size Value in 2025 |

USD 40.83 billion |

|

Revenue Forecast by 2034 |

USD 67.07 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 38.69 billion in 2024 and is projected to grow to USD 67.07 billion by 2034.

The market is projected to register a CAGR of 5.7% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Israel Chemicals Limited, CF Industries Holdings Inc., The Mosaic Company, Haifa Chemicals Ltd., Yara International ASA, Eurochem Group AG, Agrium Inc, PhosAgro, and Helena Chemical Company.

The incomplete segment accounted for a larger market share in 2024.

The cereals and grains segment is anticipated to register the highest CAGR during the forecast period.