Conductive & EMI Shielding Plastics for 5G & IoT Market Size, Share, Trends, Industry Analysis Report

: By Product (Conductive Polymers, Metal-Filled Plastics, and Carbon-Based Plastics), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5635

- Base Year: 2024

- Historical Data: 2020-2023

Conductive & EMI Shielding Plastics for 5G & IoT Market Overview

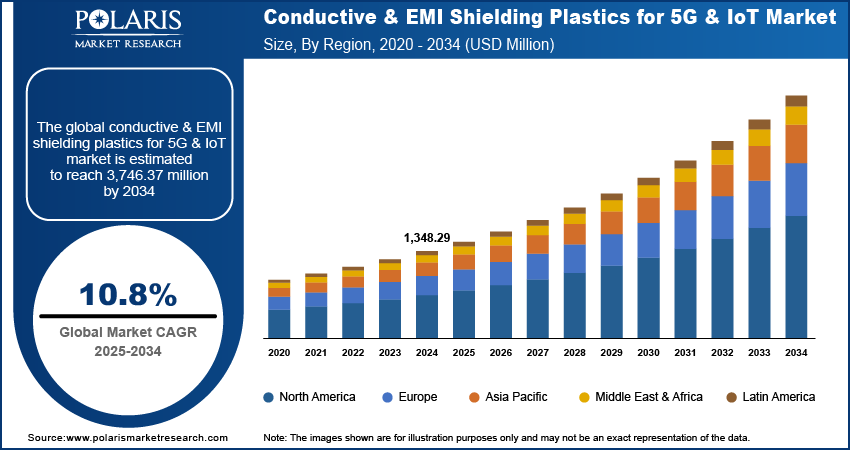

Conductive & EMI shielding plastics for 5G & IoT market size was valued at USD 1,348.29 million in 2024. The conductive & EMI shielding plastics for 5G & IoT industry is projected to grow from USD 1,490.94 million in 2025 to USD 3,746.37 million by 2034, exhibiting a CAGR of 10.8% during 2025-2034.

Conductive & EMI shielding plastics are crucial in ensuring the seamless operation of 5G networks and IoT ecosystems, addressing critical challenges posed by electromagnetic interference (EMI). These advanced materials are formulated with conductive additives, such as metallic particles or carbon-based fillers, to provide robust shielding effectiveness while maintaining lightweight properties. Conductive plastics offer superior design flexibility, corrosion resistance, and reduced weight, making them ideal for compact electronic devices. Conductive plastics are extensively used in antennas, base stations, IoT sensors, and wearable electronics to maintain signal integrity and enhance electromagnetic compatibility (EMC). The miniaturization of electronic components in IoT devices further drives the adoption of conductive EMI shielding plastics.

To Understand More About this Research: Request a Free Sample Report

The rising penetration of smartphones across the globe is propelling the conductive & EMI shielding plastics for 5G & IoT market growth. Smartphones generates high electromagnetic interference due to their processing power, multiple antennas, and support for 5G connectivity. This disrupts internal components and degrades the communication quality of smartphones. Manufacturers of smartphones rely on conductive plastics to address these challenges by shielding sensitive circuits. Additionally, the growing integration of IoT capabilities within smartphones, such as smart home controls, health tracking, and remote device management, further elevates the importance of consistent and interference-free signal transmission, which conductive plastics offer. Therefore, the rising penetration of smartphones across the globe is fueling the demand for conductive & EMI shielding plastics. For instance, according to the Groupe Speciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population have smartphones.

The conductive & EMI shielding plastics for 5G & IoT market demand is driven by the rising deployment of mmWave (millimeter-wave) 5G networks. mmWave technology requires densely packed hardware such as phased array antennas, small cells, and repeaters, all of which are highly susceptible to electromagnetic interference. This drives engineers to turn to conductive EMI plastics to shield these components effectively without adding unnecessary weight or compromising design flexibility. Moreover, mmWave 5G networks operate at extremely high frequencies, which makes them more susceptible to interference and signal loss. These high-frequency waves require robust shielding to prevent electromagnetic interference (EMI) from disrupting nearby electronic devices. Conductive plastics with EMI shielding properties help mitigate these issues by blocking unwanted interference and enhancing signal integrity in 5G infrastructure, such as small cells, antennas, and base stations. Thus, the demand for conductive & EMI shielding plastics is increasing with the rising deployment of mmWave (millimeter-wave) 5G networks.

Conductive & EMI Shielding Plastics for 5G & IoT Market Dynamics

Increasing Development of Smart Cities Globally

Smart cities rely on dense networks of sensors, cameras, and IoT devices to collect and analyze vast amounts of data, enabling informed decision-making for improved urban management. The proliferation of these wireless devices creates electromagnetic interference (EMI), which disrupts sensitive electronics and degrades signal performance. Conductive plastics with EMI shielding properties help maintain reliable connectivity among these devices and infrastructure components like smart traffic systems and utility meters by blocking interference. Additionally, the compact and corrosion-resistant nature of these plastics makes them ideal for outdoor and harsh urban environments. Therefore, as the development of smart cities increases globally, the demand for conductive & EMI shielding plastics also spurs. For instance, the Government of India released ₹46,787 crores or USD 5.435 billion to 100 Smart Cities under the SCM initiative.

Rising Miniaturization of Electronic Devices

Miniaturization of electronic devices is increasing challenges for manufacturers in managing electromagnetic interference within confined spaces. Traditional metal shielding components add weight and limit design flexibility, making them less suitable for miniaturized devices. In contrast, conductive plastics offer lightweight, moldable, and space-saving alternatives that are seamlessly incorporated into miniaturized device layouts without compromising performance. Miniaturized devices also pack more components closer together, which highlights the risk of signal interference and performance degradation. Conductive & EMI shield plastic helps mitigate these issues by providing localized shielding. Hence, the rising miniaturization of electronic devices is fueling conductive & EMI shielding plastics demand.

Conductive & EMI Shielding Plastics for 5G & IoT Market Assessment by Segment

Conductive & EMI Shielding Plastics for 5G & IoT Market Evaluation by Product

Based on product, the conductive & EMI shielding plastics for 5G & IoT market is divided into conductive polymers, metal-filled plastics, and carbon-based plastics. The carbon-based plastics segment dominated the conductive & EMI shielding plastics for 5G & IoT market share in 2024 due to their exceptional electrical conductivity, lightweight nature, and cost-effectiveness compared to traditional metallic shielding materials. These materials, particularly those incorporating carbon nanotubes and graphene, gained traction due to their superior performance in electromagnetic interference (EMI) shielding and signal integrity maintenance, critical requirements in densely packed electronic components found in 5G infrastructure and IoT devices. The ability of carbon-based plastics to be easily integrated into a wide range of polymer matrices without significantly altering mechanical properties made them a preferred choice across multiple end-use industries, including telecommunications, consumer electronics, and automotive applications. Moreover, ongoing advancements in carbon composite formulations further improved thermal stability and dispersion, contributing to their dominance during the year.

The metal-filled plastics segment is expected to grow at a robust pace in the coming years, owing to the increasing demand for materials that combine high shielding effectiveness with structural robustness. Metal fillers such as silver, nickel, and copper offer excellent conductivity and are being engineered into thermoplastic compounds to meet the rigorous thermal and electrical demands of next-generation electronic devices. The expanding deployment of edge computing devices, small cell base stations, and high-frequency components in 5G networks are propelling the demand for metal-filled plastics. Additionally, manufacturers are investing in scalable production technologies to reduce the cost of metal-filled formulations, making them more accessible for widespread industrial adoption.

Conductive & EMI Shielding Plastics for 5G & IoT Market Insight by Application

In terms of application, the conductive & EMI shielding plastics for 5G & IoT market is segregated into antennas and base stations, small cells and repeaters, fiber optic connectors, smart home devices, wearable electronics, industrial IoT, and others. The antennas and base stations accounted for a major market share in 2024 due to the rapid global rollout of 5G infrastructure and the corresponding need for advanced EMI shielding materials. Telecom operators and network providers expanded their deployment of macro base stations to support higher bandwidth and lower latency, significantly increasing the demand for high-performance shielding solutions. Engineers favored lightweight, durable conductive & EMI shielding plastics over metals to reduce the weight of enclosures and improve installation efficiency, especially in outdoor environments. These materials also offered better corrosion resistance and design flexibility, which proved essential for antennas and base stations in diverse climatic conditions. The continuous evolution of beamforming and massive MIMO technologies further intensified the need for precise EMI management, strengthening the segment's dominance.

Conductive & EMI Shielding Plastics for 5G & IoT Market Regional Analysis

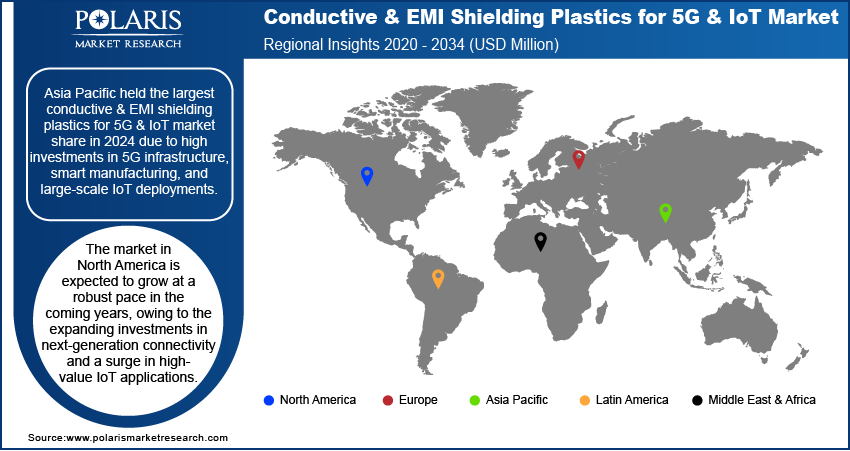

By region, the conductive & EMI shielding plastics for 5G & IoT market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific held the largest conductive & EMI shielding plastics for 5G & IoT market share in 2024 due to high investments in 5G infrastructure, smart manufacturing, and large-scale IoT deployments. China’s extensive electronics manufacturing ecosystem, coupled with its government-led initiatives such as “Made in China 2025” and widespread adoption of smart city technologies, accelerated the integration of conductive and EMI shielding plastics across the telecom, automotive, and consumer electronics sectors. Major domestic players ramped up production capabilities, while global suppliers expanded their footprint to tap into the region, contributing to conductive & EMI shielding plastics for 5G & IoT market expansion. Additionally, the presence of key 5G component manufacturers and ongoing innovation in lightweight, thermally stable shielding materials contributed to Asia Pacific’s market dominance.

The market in North America is expected to grow at a robust pace in the coming years, owing to the expanding investments in next-generation connectivity and a surge in high-value IoT applications. The US is estimated to lead the region during the forecast period due to ongoing innovation in edge computing, autonomous vehicles, industrial automation, and aerospace electronics. These applications demand superior EMI shielding to ensure data integrity, system reliability, and compliance with stringent regulatory standards, all of which conductive & EMI shielding plastics offer. Furthermore, strong research and development initiatives, combined with the presence of advanced material science companies and robust defense-sector demand, position North America as a key region in future market expansion.

Conductive & EMI Shielding Plastics for 5G & IoT Key Market Players & Competitive Analysis Report

The competitive landscape of conductive & EMI shielding plastics for the 5G and IoT market is characterized by strategic mergers, acquisitions, partnerships, and collaborations aimed at enhancing technological capabilities and expanding product portfolios. Major players are actively engaging in these strategies to capitalize on the rising demand driven by the proliferation of connected devices and the rollout of 5G networks. Major companies are acquiring niche firms specializing in advanced polymer technologies to boost their offerings in conductive plastics that mitigate electromagnetic interference (EMI). These acquisitions not only expand their product portfolios but also provide access to proprietary technologies and intellectual property critical for innovation. Companies are also forming strategic alliances to co-develop materials that offer superior conductivity and shielding performance while maintaining cost-effectiveness.

The conductive & EMI shielding plastics for 5G & IoT market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Avient Corporation, BASF, Celanese, Dow Inc., DSM Engineering Plastics, Ensinger, Laird Performance Materials, Molex, Parker Hannifin Corporation, Premix Group, RTP Company, Sabic, and Techmer PM.

RTP Company is a prominent player in the conductive and EMI shielding plastics market, specializing in advanced polymer compounds tailored for high-performance applications in 5G and IoT technologies. The company offers thermoplastic compounds designed to replace traditional metal shielding, providing significant advantages such as weight reduction, design flexibility, and cost-effectiveness. RTP's EMI shielding plastics are formulated with conductive additives such as metal-coated fibers or carbon-based fillers. In addition to shielding effectiveness, RTP's compounds can be customized to provide electrostatic discharge (ESD) control where needed. This flexibility makes them suitable for applications ranging from telecom base stations and antennas to automotive electronics and industrial automation systems.

Premix Group is a major private limited company specializing in the development and production of advanced conductive plastics, including EMI shielding solutions tailored for 5G and IoT applications. Premix focuses on creating high-performance polymer compounds that address the growing demand for lightweight, efficient, and sustainable alternatives to traditional metal-based shielding. The company's innovative materials are designed to ensure signal integrity and minimize electromagnetic interference (EMI) in next-generation communication technologies. Premix commitment to innovation and quality has positioned it as a key player in the conductive plastics market.

Key Companies in the Conductive & EMI Shielding Plastics for 5G & IoT Market

- Avient Corporation

- BASF

- Celanese

- Dow Inc.

- DSM Engineering Plastics

- Ensinger

- Laird Performance Materials

- Molex

- Parker Hannifin Corporation

- Premix Group

- RTP Company

- Sabic

- Techmer PM

Conductive & EMI Shielding Plastics for 5G & IoT Market Developments

May 2024: Premix, a Finnish company that manufactures electrically conductive (EC) plastic compounds and masterbatches, announced the official opening of its first US plant to produce electrically conductive (EC) plastic compounds and masterbatches.

October 2020: Nanotech Energy Inc., the leading manufacturer of graphene, introduced Nanotech EMI Armour Paint & Sheets, graphene-powered coatings, and films for electromagnetic interference (EMI) and radio frequency interference (RFI) shielding.

Conductive & EMI Shielding Plastics for 5G & IoT Market Segmentation

By Product Outlook (Revenue, USD Million, 2020-2034)

- Conductive Polymers

- Metal-Filled Plastics

- Carbon-Based Plastics

By Application Outlook (Revenue, USD Million, 2020-2034)

- Antennas and Base Stations

- Small Cells and Repeaters

- Fiber Optic Connectors

- Smart Home Devices

- Wearable Electronics

- Industrial IoT

- Others

By Regional Outlook (Revenue, USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Conductive & EMI Shielding Plastics for 5G & IoT Market Report Scope

|

Report Attributes |

Details |

|

Conductive & EMI Shielding Plastics for 5G & IoT Market Value in 2024 |

USD 1,348.29 Million |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 1,490.94 Million |

|

Revenue Forecast in 2034 |

USD 3,746.37 Million |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global conductive & EMI shielding plastics for 5G & IoT market size was valued at USD 1,348.29 million in 2024 and is projected to grow to USD 3,746.37 million by 2034.