Connected Thermostat Market Size, Share, Trends, Industry Analysis Report

By Technology (Wi-Fi Enabled, Bluetooth Thermostats), By Distribution Channel, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6062

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

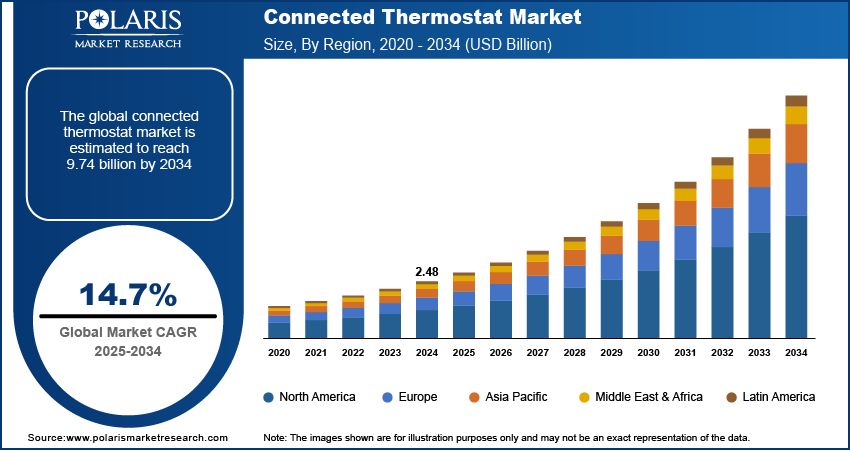

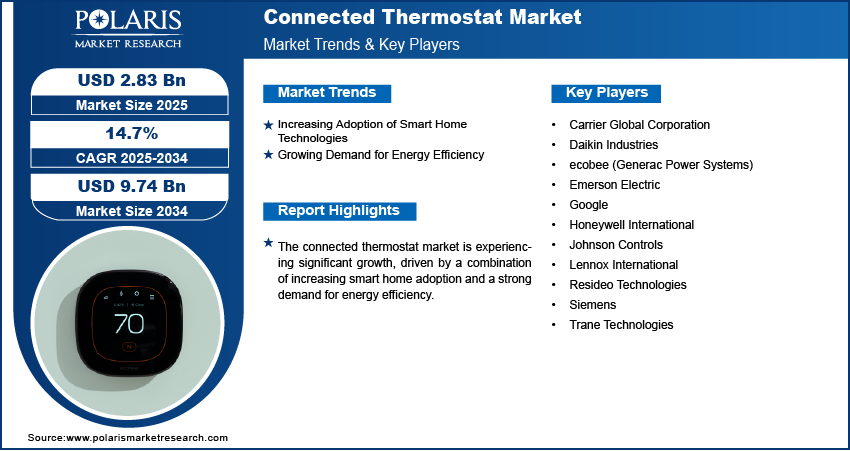

The global connected thermostat market size was valued at USD 2.48 billion in 2024 and is anticipated to register a CAGR of 14.7% from 2025 to 2034. The connected thermostat market is propelled by growing demand for energy efficiency, integration within smart home and IoT ecosystems, and rising consumer preference for remote and voice-controlled convenience. Technological advancements like AI-driven learning algorithms, geofencing, and predictive maintenance further accelerate adoption, while government incentives for energy-efficient appliances boost market growth.

Key Insights

- By technology, the Wi-Fi-enabled segment held the largest share in 2024 due to its extensive range and robust connectivity, allowing for seamless integration with broader smart home ecosystems and reliable remote access.

- By distribution channel, the online distribution channels segment held the largest share in 2024, driven by the convenience of e-commerce platforms as they offer vast product selections, competitive pricing, and the ability for consumers to easily compare options and read reviews.

- By application, the retrofit and renovation segment held the largest share in 2024, primarily because of the immense existing base of residential and commercial buildings that are being upgraded.

- By end use, the residential segment held the largest share in 2024, fueled by the large number of households globally and increasing consumer demand for smart home solutions. Homeowners are seeking improved comfort.

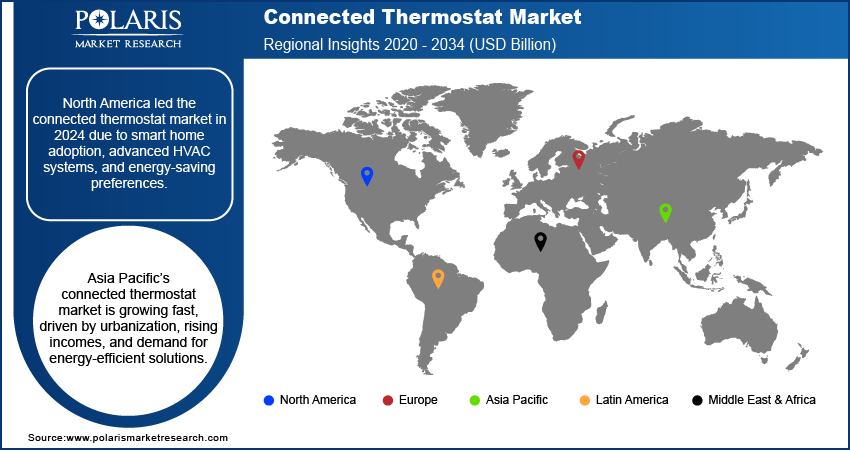

- By region, North America held the largest share in 2024, attributed to the high penetration of smart home technologies, a well-developed HVAC infrastructure, and a strong consumer inclination toward energy-saving innovations and home automation.

Industry Dynamics

- The increasing adoption of smart home technologies is significantly boosting the demand for connected thermostats, as consumers aim for more integrated and automated living environments.

- A growing demand for energy efficiency and the potential for substantial cost savings are compelling factors for both residential and commercial users to invest in connected thermostats.

- Continuous advancements in the Internet of Things (IoT) and Artificial Intelligence (AI) are enhancing the capabilities and appeal of connected thermostats.

Market Statistics

- 2024 Market Size: USD 2.48 billion

- 2034 Projected Market Size: USD 9.74 billion

- CAGR (2025-2034): 14.7%

- North America: Largest market in 2024

A connected thermostat is an advanced temperature control device that links to the internet, allowing users to remotely manage their home's heating, ventilation, and air conditioning (HVAC) systems via smartphones or other internet-enabled devices. These thermostats often include features such as programmable schedules, learning capabilities, and real-time energy usage monitoring.

Ongoing technological advancements are a powerful driver for the connected thermostat, continuously enhancing device capabilities and user experience. Innovations in artificial intelligence (AI) are allowing thermostats to become increasingly intelligent, learning complex patterns of energy use, occupancy, and even individual preferences to optimize heating and cooling with minimal user input. This includes predictive capabilities that anticipate heating or cooling needs based on weather forecasts or peak energy pricing, making energy management more intuitive and efficient.

The evolving landscape of smart grid infrastructure and the proliferation of utility-led demand response (DR) programs are increasingly driving the industry growth. Smart grids enable two-way communication between utilities and consumers, allowing for more dynamic energy management. Connected thermostats play a critical role in this system by facilitating automated participation in demand response programs. During periods of high energy demand or grid strain, utilities can send signals to smart thermostats to subtly adjust temperatures, reducing overall energy consumption without significantly impacting occupant comfort.

Drivers and Opportunities

Increasing Adoption of Smart Home Technologies: The widespread and increasing adoption of smart home technologies propels the demand for connected thermostats. As consumers become more familiar and comfortable with smart devices such as voice assistants, smart lighting, and smart security systems, the integration of connected thermostats into these ecosystems becomes a natural progression. The convenience of managing various home functions from a single platform or through voice commands enhances the overall appeal of a smart home, making connected thermostats an essential component for comprehensive home automation. This trend reflects a broader shift in consumer preferences toward technologically advanced solutions that offer both convenience and enhanced control over their living environments.

According to the Project Drawdown, a climate solutions research organization, the adoption of smart thermostats is projected to grow significantly, potentially reaching 55% to 59% of households with internet access by 2050, as stated in their "Smart Thermostats" solution overview. This growth is expected to boost energy efficiency across 1.4 to 1.5 billion homes. This projection highlights how the increasing penetration of internet-connected households paves the way for greater adoption of smart thermostats, driving the industry growth.

Growing Demand for Energy Efficiency: The escalating demand for energy efficiency is a primary driver propelling the demand for connected thermostats. With rising energy costs and growing awareness of environmental impact, consumers are actively seeking solutions to reduce their energy consumption and lower utility bills. Connected thermostats provide a compelling solution to this need by offering intelligent control over heating, ventilation, and air conditioning (HVAC) systems, which are typically the largest energy consumers in a household. The ability to monitor, manage, and optimize energy usage remotely or through automated schedules directly addresses the financial and environmental concerns of homeowners.

The ENERGY STAR program, a joint program of the U.S. Environmental Protection Agency and the U.S. Department of Energy, emphasizes the significant savings potential. According to the organization, for the average American household, almost half of the annual energy bill goes to heating and cooling, which can amount to more than $900 per year. Using an ENERGY STAR certified smart thermostat helps homeowners save money and maintain comfort by intelligently managing temperature settings. Therefore, the rising focus on energy savings directly fuels the adoption of connected thermostats.

Segmental Insights

Technology Analysis

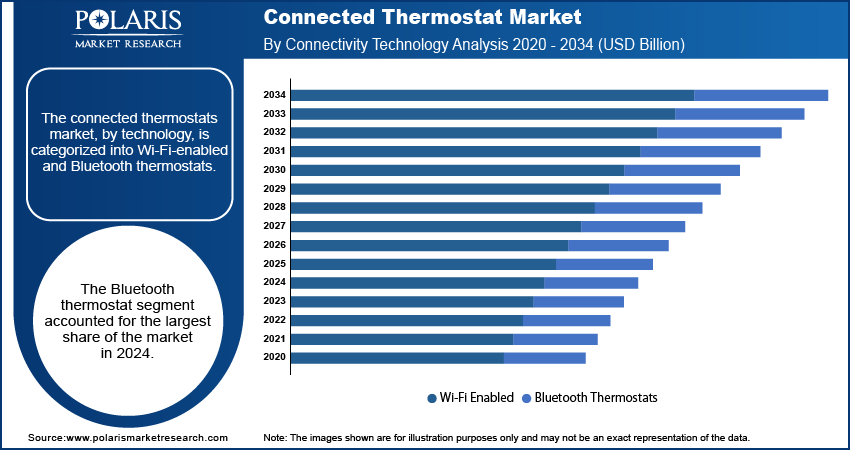

Based on technology, the segmentation includes Wi-Fi-enabled and Bluetooth thermostats. The Bluetooth thermostats segment held the largest share in 2024. Bluetooth thermostats offer a more limited range and are often focused on direct device-to-device communication rather than cloud-based remote access. Ongoing advancements in Bluetooth Low Energy (BLE) are enhancing their capabilities. These improvements are making Bluetooth a more viable option for specific applications, particularly where lower power consumption is a priority or for basic, localized control that does not require constant internet reliance. This makes them attractive for smaller dwellings or for specific zones within a larger building where complex smart home integration is not the primary concern.

The Wi-Fi-enabled segment is anticipated to register the highest growth rate during the forecast period. Wi-Fi offers a broad coverage range within a typical home, allowing seamless communication between the thermostat and other connected devices, as well as enabling robust remote access via the internet. This capability for off-site control and monitoring is highly valued by consumers who wish to manage their home's climate from anywhere. Furthermore, Wi-Fi enabled devices integrate easily with existing home internet infrastructure, making installation relatively straightforward for many users.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes online, retail stores, wholesale stores, and others. The online segment held the largest share in 2024. The convenience offered by e-commerce platforms, including the ability to compare multiple brands, read user reviews, and access detailed product specifications from the comfort of one's home, appeals to a wide demographic. Online retailers often feature a vast selection, competitive pricing, and efficient delivery services, which are strong incentives for consumers. Furthermore, direct-to-consumer sales by manufacturers through their own websites also contribute to the dominance of online channels.

Application Analysis

Based on application, the segmentation includes new construction and retrofit & renovation. The retrofit & renovation segment held the largest share in 2024. This dominance is largely attributable to the vast existing base of residential and commercial buildings that were constructed before the widespread integration of smart home technologies. Property owners in this segment are increasingly seeking upgrade their traditional climate control systems to connected thermostats to realize benefits such as enhanced energy efficiency, remote management capabilities, and improved comfort. The process of replacing an older, less efficient thermostat with a modern connected one is a relatively straightforward and impactful upgrade, making it an appealing entry point for smart home adoption without requiring extensive structural changes.

The new construction segment is anticipated to register the highest growth rate during the forecast period.. As modern and energy efficient building practices increasingly emphasize energy efficiency, sustainability, and integrated smart technologies from the ground up, connected thermostats are becoming a standard inclusion in newly built homes and commercial properties. Builders and developers are recognizing the value of pre-installing these devices as a selling point, enhancing the appeal and future-proofing of their properties. The seamless integration during the construction phase reduces installation complexities and allows for a more cohesive smart home ecosystem design. Furthermore, evolving building codes and green building initiatives are encouraging, and in some cases mandating, the inclusion of energy-efficient solutions such as connected thermostats in new developments.

End Use Analysis

Based on end use, the segmentation includes commercial, residential, and industrial. The residential segment held the largest share in 2024. This dominance is primarily driven by the large number of households globally and the increasing consumer interest in smart home solutions for personal comfort and convenience. Homeowners are actively seeking ways to manage their indoor climate more efficiently, reduce energy bills, and integrate their heating and cooling systems into broader smart home ecosystems. The availability of user-friendly products, coupled with rising awareness about the long-term cost savings and environmental benefits, makes connected thermostats a popular upgrade for residential properties. The sheer volume of individual homes transitioning to smart technologies ensures that the residential sector maintains its leading position in terms of overall penetration and sales volume.

The commercial segment is anticipated to register the highest growth rate during the forecast period. Officials across office buildings, retail spaces, hospitality, and healthcare facilities are increasingly recognizing the significant operational and energy efficiency benefits offered by connected thermostats. These advanced systems allow for centralized control over large-scale heating and cooling operations, leading to substantial energy savings and reduced operating costs. Furthermore, the push for green building initiatives, corporate sustainability goals, and the need to provide a comfortable environment for employees and customers are driving the accelerated adoption of these technologies in commercial settings.

Regional Analysis

The North America connected thermostat market accounted for the largest share in 2024, largely driven by a high penetration of smart home technologies and a well-established infrastructure for heating, ventilation, and air conditioning (HVAC) systems. Consumers in this region generally exhibit a strong interest in adopting energy-saving solutions, influenced by a growing environmental awareness and the desire to reduce rising electricity costs. The emphasis on home automation and comfort also contributes to the widespread acceptance of connected thermostats across both residential and commercial sectors. Early adoption of smart devices and a robust competitive landscape among manufacturers, offering a diverse range of products, further supports the market in North America.

U.S. Connected Thermostat Market Insights

In North America, the U.S. is a key contributor to the demand for connected thermostats. The country benefits from a mature smart home ecosystem, where consumers are increasingly integrating various smart devices to create cohesive automated environments. The demand for energy efficiency is a strong driving force, with homeowners and businesses alike seeking intelligent solutions to optimize their energy consumption. Government incentives and utility programs promoting energy-efficient upgrades also play a role in encouraging adoption. The U.S. is characterized by a strong consumer preference for innovative technologies that offer convenience, remote accessibility, and personalized climate control, contributing to sustained growth and a substantial presence.

Europe Connected Thermostat Market Trends

The industry in Europe is experiencing steady growth, influenced by stringent energy efficiency regulations and a progressive shift toward smart home infrastructure. Many European countries have ambitious targets for reducing carbon emissions and promoting sustainable energy practices, which directly support the adoption of smart technologies such as connected thermostats. Consumers across the region are becoming more aware of their energy footprint and are keen to invest in solutions that offer both environmental benefits and cost savings on utility bills. The market is also propelled by ongoing technological advancements and a diverse array of manufacturers offering solutions tailored to various European building standards and consumer preferences.

The Germany connected thermostat market is driven by its strong emphasis on energy conservation and a technologically adept consumer base. The country's strict building energy efficiency standards and a general environmental consciousness among its population create a fertile ground for the adoption of smart heating solutions. German consumers are often early adopters of innovative technologies that promise long-term benefits, including reduced energy consumption and enhanced home comfort. The presence of both international and local manufacturers offering advanced connected thermostat solutions, coupled with robust infrastructure for smart home integration, further supports the development and strong presence of the industry in Germany.

Asia Pacific Connected Thermostat Market Overview

Asia Pacific is rapidly emerging as a dynamic and fast-growing regional market for connected thermostats. This growth is fueled by increasing urbanization, rising disposable incomes, and a growing awareness of energy management solutions across both residential and commercial sectors. As countries in this region experience significant economic development, there is a corresponding rise in demand for modern, convenient, and energy-efficient living and working environments. Government initiatives to promote smart cities and sustainable development also contribute to the increased adoption of connected devices, including smart thermostats. The expanding internet infrastructure and the increasing penetration of smartphones further facilitate the industry growth across Asia Pacific.

China Connected Thermostat Market Overview

China is a key country driving the growth of the connected thermostat market in Asia Pacific. The country's massive population, rapid urbanization, and significant investments in smart city projects create an immense opportunity for smart home technologies. There is a strong government push for energy conservation and environmental protection, which encourages the adoption of energy-efficient devices in both new modular construction and existing buildings. Chinese consumers are increasingly tech-savvy and receptive to innovative products that offer convenience and advanced features. The presence of a strong local manufacturing base and intense competition among domestic and international players also contributes to the rapid development and expansion of the connected thermostat within China.

Key Players and Competitive Insights

The competitive landscape is characterized by a mix of established HVAC manufacturers and technology-focused companies, leading to a dynamic environment centered on innovation, smart home ecosystem integration, and user experience. Competition often revolves around features such as energy-saving algorithms, compatibility with various smart home platforms, ease of installation, and intuitive user interfaces. Companies are consistently investing in research and development to offer more advanced features, such as predictive heating and cooling, geofencing capabilities, and artificial intelligence-driven optimizations, to differentiate their offerings and capture a larger consumer base in a rapidly evolving sector.

A few prominent companies in the industry include Google, Resideo Technologies, ecobee (Generac Power Systems), Johnson Controls, Honeywell International, Siemens, Emerson Electric, Carrier Global Corporation, Lennox International, Trane Technologies, and Daikin Industries.

Key Players

- Carrier Global Corporation

- Daikin Industries

- ecobee (Generac Power Systems)

- Emerson Electric

- Honeywell International

- Johnson Controls

- Lennox International

- Resideo Technologies

- Siemens

- Trane Technologies

Connected Thermostat Industry Developments

January 2025: Resideo introduced the new Honeywell Home X2S smart thermostat at CES 2025. This Matter-enabled and ENERGY STAR-certified thermostat offers features such as smart home compatibility with Amazon Alexa, Google Home, and Apple Home, along with indoor air quality awareness.

October 2024: Ecobee introduced the ecobee Smart Thermostat Lite, a pro-exclusive model tailored for professional installers. This hardwired device is durable, simple to install, and does not require charging or additional power sources.

Connected Thermostat Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Wi-Fi Enabled

- Bluetooth Thermostats

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Online

- Retail Stores

- Wholesale Stores

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- New Construction

- Retrofit & Renovation

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Residential

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Connected Thermostat Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.48 billion |

|

Market Size in 2025 |

USD 2.83 billion |

|

Revenue Forecast by 2034 |

USD 9.74 billion |

|

CAGR |

14.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.48 billion in 2024 and is projected to grow to USD 9.74 billion by 2034.

The global market is projected to register a CAGR of 14.7% during the forecast period.

North America dominated the share in 2024.

A few key players include Google, Resideo Technologies, ecobee (Generac Power Systems), Johnson Controls, Honeywell International, Siemens, Emerson Electric, Carrier Global Corporation, Lennox International, Trane Technologies, and Daikin Industries.

The Bluetooth thermostat segment accounted for the largest market share in 2024.

The new construction segment is expected to witness the fastest growth during the forecast period.