Construction and Demolition Waste Market Size, Share, Trends, Industry Analysis Report: By Waste Type, Service, Application (Residential, Commercial and Industrial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM2185

- Base Year: 2024

- Historical Data: 2020-2023

Construction and Demolition Waste Market Overview

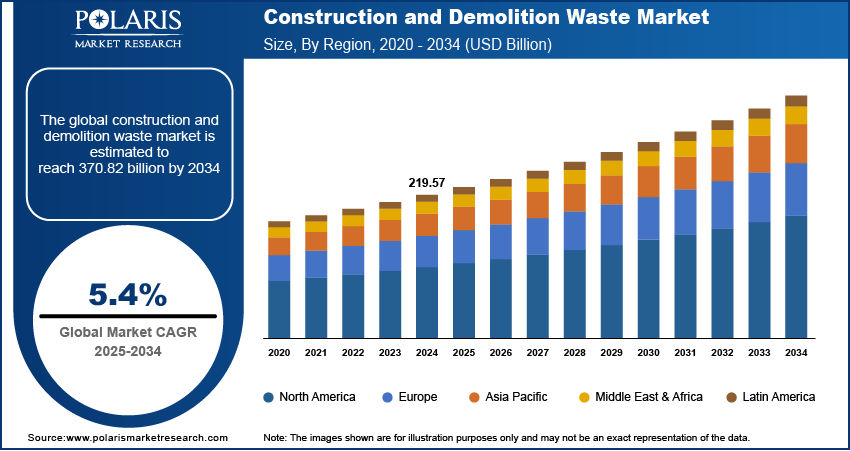

Construction and demolition waste market size was valued at USD 219.57 billion in 2024. The market is expected to reach USD 231.19 billion by 2025 and 370.82 billion by 2034, exhibiting a CAGR of 5.4% during the forecast period.

The global construction and demolition waste market encompasses the management, recycling, and disposal of waste materials generated from construction, renovation, and demolition activities. This market plays a crucial role in addressing environmental sustainability by minimizing landfill usage and promoting material reuse. Increasing urbanization and industrialization are fueling market growth by driving the development of residential and commercial spaces like malls, schools, and parks. This rise in construction activity creates a growing need for efficient handling of construction and demolition waste. For instance, as per the data published by the United Nations, the worldwide urban population is expected to reach 68% by 2050.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in recycling equipment are enhancing material recovery rates, further supporting market growth. The construction and demolition waste market demand is further driven by high environmental awareness and the emphasis on circular economy practices.

Construction and Demolition Waste Market Dynamics

Government Regulations on Waste Management

The construction and demolition waste market growth is driven by the implementation of stringent government regulations aimed at reducing construction waste and encouraging recycling. These regulations require construction companies to adopt sustainable waste management practices. For example, the Waste Framework Directive in the European Union mandates that at least 70% of construction and demolition waste must be recycled or recovered. This regulatory push has significantly increased recycling rates and reduced landfill dependency, boosting the market size. In the US, similar guidelines under the Resource Conservation and Recovery Act (RCRA) are prompting companies to adopt innovative waste management technologies. Therefore, as government regulations aimed at reducing construction waste increase, the demand for efficient handling of construction and demolition waste also spurs.

Advancements in Recycling Technologies

The rapid advancement in recycling technologies is reshaping the construction and demolition waste market. Innovations such as automated sorting machines, cone crushers, and mobile recycling units are improving efficiency and material recovery rates. For instance, the integration of Artificial Intelligence sorting equipment enables precise separation of materials such as concrete, wood, and metal, reducing contamination and increasing recycling efficiency. These technological advancements are enhancing the profitability of waste recycling operations and making sustainable practices more accessible to smaller players in the industry. Moreover, the adoption of green technologies and sustainability aligns with the global focus on reducing greenhouse gas emissions, further propelling market growth.

Construction and Demolition Waste Market Segment Insights

Construction and Demolition Waste Market Assessment by Service Outlook

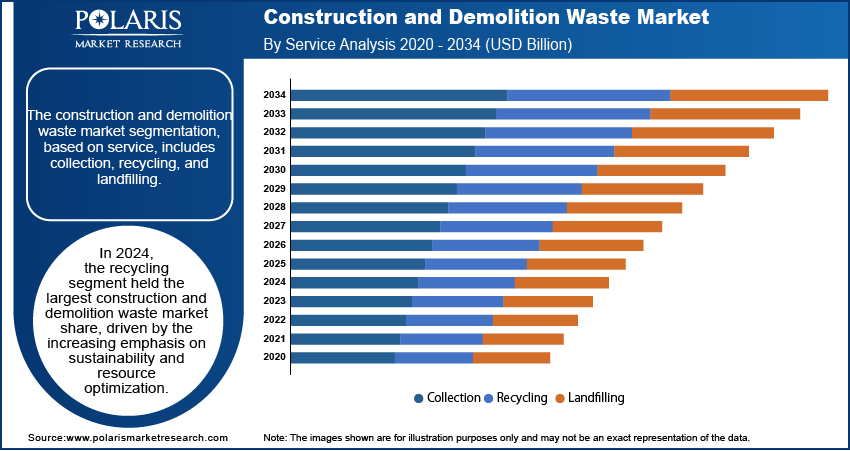

The construction and demolition waste market segmentation, based on service, includes collection, recycling, and landfilling. In 2024, the recycling segment held the largest market share, driven by the increasing emphasis on sustainability and resource optimization. Recycling offers significant environmental and economic benefits, such as reducing the demand for virgin materials and lowering disposal costs. Furthermore, the high recoverability rate and the ability to reduce construction costs make recycling highly attractive to construction industry stakeholders.

Construction and Demolition Waste Market Evaluation by Application Outlook

The construction and demolition waste market segmentation, based on application, includes residential, commercial, and industrial. In 2024, the commercial segment held a significant market share due to large-scale commercial construction projects generating significant volumes of waste. The adoption of advanced recycling technologies in commercial projects to ensure better waste management further contributed to segment dominance.

Construction and Demolition Waste Market Regional Insights

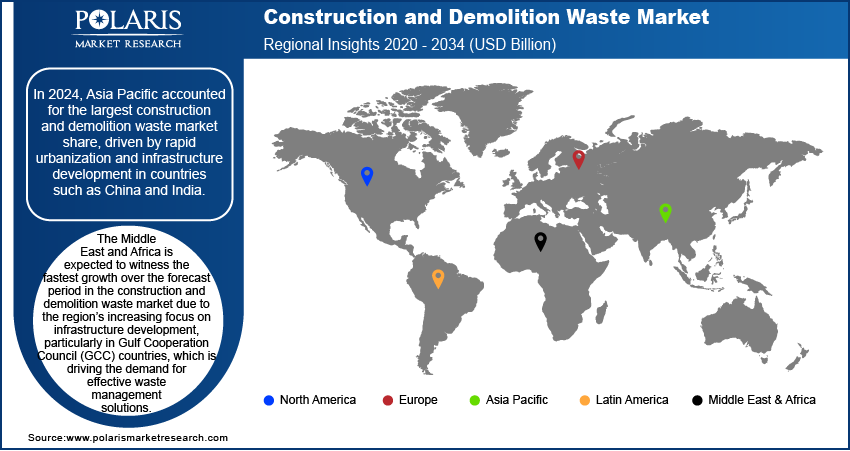

By region, the study provides construction and demolition waste market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share, driven by rapid urbanization and infrastructure development in countries such as China and India. These nations generate significant construction waste owing to large-scale residential and commercial projects. Government initiatives promoting recycling and waste management, such as India’s Swachh Bharat Mission, further propelled the market in this region.

The market in the Middle East and Africa is expected to grow fastest over the forecast period due to the region’s increasing focus on infrastructure development, particularly in Gulf Cooperation Council (GCC) countries. Moreover, countries in the region are also launching initiatives to reduce construction waste, which is fueling construction and demolition waste market growth. For instance, Saudi Arabia, a country in the MEA, launched initiatives several initiatives, including Saudi Vision 2030, to emphasize sustainable practices, including construction waste recycling.

Construction and Demolition Waste Key Market Players & Competitive Analysis Report

The competitive landscape of the construction and demolition waste industry is attributed to companies’ extensive service portfolios, advanced recycling technologies, and strong geographic presence. Companies such as Veolia Environment and Waste Management, Inc. leverage their expertise in sustainable waste solutions to maintain significant market share. These players consistently invest in R&D to innovate recycling processes, enhancing efficiency and profitability. The competitive landscape is marked by strategic mergers, acquisitions, and collaborations, enabling companies to expand their footprint and consolidate their market position.

Veolia Environment is a global leader in waste management and recycling, dominating the construction and demolition waste market with its comprehensive services and innovative solutions. The company focuses on advanced material recovery techniques to optimize recycling efficiency. Recent developments include the launch of advanced facilities in Europe to enhance recycling capabilities. Veolia’s strategic focus on sustainability and adherence to stringent regulations solidify its market leadership.

Waste Management, Inc. is engaged in extensive waste management infrastructure and robust recycling services. The company’s recent investment in AI-powered sorting systems has significantly improved material recovery rates, aligning with market trends. Additionally, Waste Management’s commitment to expanding its operations in emerging markets underscores its growth strategy, ensuring sustained market dominance.

Key Companies in Construction and Demolition Waste Market

- Veolia Environment

- Waste Management, Inc.

- Republic Services, Inc.

- Clean Harbors

- Advanced Disposal Services

- Renewi PLC

- FCC Environment

- Casella Waste Systems, Inc.

- Remondis SE & Co. KG

- SUEZ Recycling and Recovery

- Biffa Group

- Covanta Holding Corporation

- Daiseki Co., Ltd.

- Stericycle, Inc.

- Enviro-Serve

Construction and Demolition Waste Market Developments

January 2024: Vermeer launched the LS3600TX low-speed shredder, its latest innovation for the recycling industry. The Vermeer LS3600TX is specifically designed to excel at processing various materials, including light construction and demolition waste, wood waste with contaminants, and municipal solid waste.

March 2023: Frontier Waste Solutions acquired Absolute Waste Services, Inc., a provider of residential, commercial, and roll-off waste collection services based in Corpus Christi, Texas.

April 2022: Eqiom announced the successful commissioning of its Gennevilliers construction waste recycling pilot plant. The plant aimed to recycle 50,000t of construction waste in 2022.

Construction and Demolition Waste Market Segmentation

By Waste Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Concrete

- Bricks

- Metals

- Wood

- Others

By Service Outlook (Revenue, USD Billion, 2020 - 2034)

- Collection

- Recycling

- Landfilling

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Construction and Demolition Waste Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 219.57 billion |

|

Market Size Value in 2025 |

USD 231.19 billion |

|

Revenue Forecast in 2034 |

USD 370.82 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global construction and demolition waste market size was valued at USD 219.57 billion in 2024 and is projected to grow to USD 370.82 billion by 2034.

The global market is projected to grow at a CAGR of 5.4% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share, driven by rapid urbanization and infrastructure development in countries such as China and India.

Some of the key players in the market are Veolia Environment; Waste Management, Inc.; Republic Services, Inc.; Clean Harbors; Advanced Disposal Services; Renewi PLC; FCC Environment; Casella Waste Systems, Inc.; Remondis SE & Co. KG; SUEZ Recycling and Recovery; Biffa Group; Covanta Holding Corporation; Daiseki Co., Ltd.; Stericycle, Inc.; and Enviro-Serve.

In 2024, the recycling segment held the largest market share in the construction and demolition waste market, driven by the increasing emphasis on sustainability and resource optimization.

In 2024, the commercial segment held significant market growth in the construction and demolition waste market due to large-scale commercial construction projects generating significant volumes of waste.