Contact Lens Accessories Market Size, Share, Trends, Industry Analysis Report

By Product Type (Lens Cases, Cleaning Solutions), By Material Type, By Distribution Channel, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM5675

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

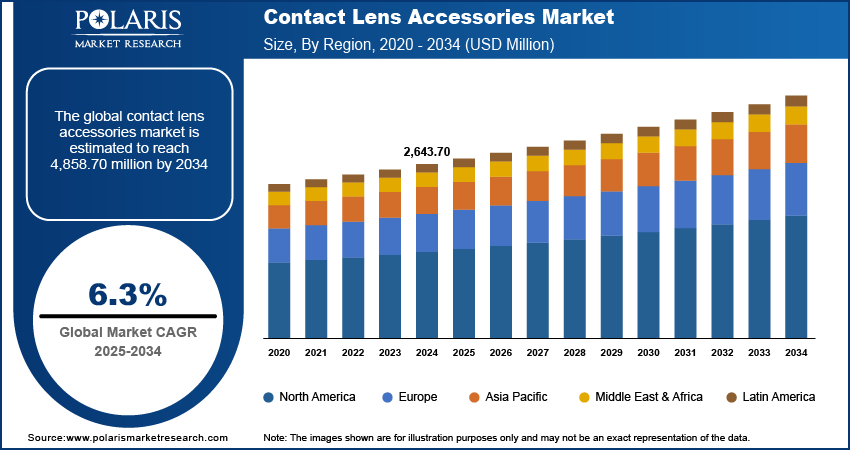

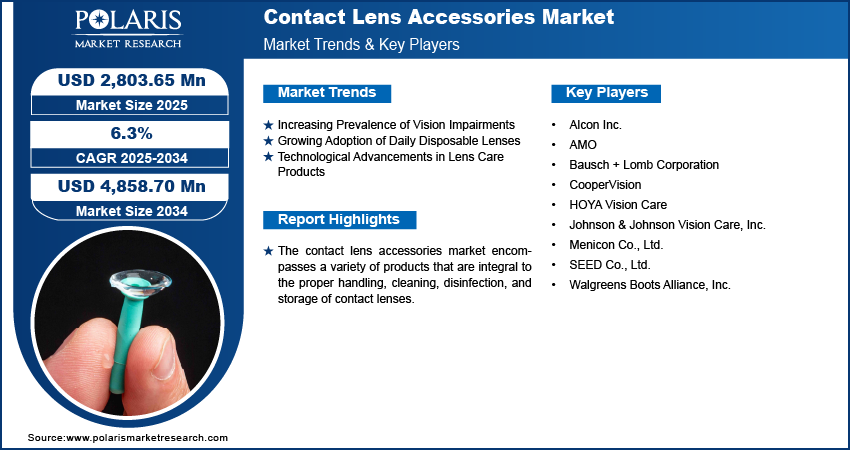

The contact lens accessories market size was valued at USD 2,643.70 million in 2024 and is expected to register a CAGR of 6.3% from 2025 to 2034. The rising number of contact lens users across the world contributes to the demand for contact lens accessories. Increasing technological advancements in lens care products are expected to boost the industry expansion in the coming years.

Key Insights

- The cleaning solutions segment held the largest share in 2024. This dominance is attributed to the necessity of these solutions for the maintenance and disinfection of reusable contact lenses, ensuring wearer safety and lens longevity.

- The plastic segment held the largest share in 2024. It is largely attributed to the widespread use of plastic in the manufacturing of essential accessories such as lens cases and certain components of cleaning solution bottles.

- The optical stores segment represented the largest share in 2024. Consumers often purchase contact lenses and their associated accessories simultaneously at these specialized outlets. This factor drives the segment dominance.

- The individuals segment accounted for the largest share in 2024. This is due to the sheer volume of individual contact lens wearers globally who require a consistent supply of accessories, such as cleaning solutions, lens cases, and comfort drops, for their personal use and lens maintenance.

- North America accounted for the largest share in 2024. This dominance can be attributed to a high awareness of vision correction options, a significant population of contact lens users, and well-established distribution channels.

- The Asia Pacific market is experiencing the highest growth rate. This rapid expansion is driven by a large and growing population base, increasing awareness of vision care, and a rising adoption of contact lenses.

Industry Dynamics

- The rising prevalence of vision impairments, such as myopia (nearsightedness), hyperopia (farsightedness), and astigmatism, propels the use of contact lenses, which drives industry growth.

- The increasing adoption of daily disposable contact lenses boosts the demand for contact lens accessories.

- Continuous technological advancements in contact lens care products are expected to offer lucrative opportunities during the forecast period.

- Limited consumer awareness related to contact lens use and its accessories, particularly in emerging markets, hinders the industry expansion.

Market Statistics

2024 Market Size: USD 2,643.70 million

2034 Projected Market Size: USD 4,858.70 million

CAGR (2025–2034): 6.3%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The contact lens accessories market encompasses a range of products essential for the care, maintenance, and convenience of contact lens wearers. These accessories or ophthalmic equipment include lens cleaning solutions, storage cases, rewetting drops, and application/removal tools. The market's definition centers on supporting the hygiene, comfort, and longevity of contact lens usage, thereby playing a crucial role in the overall eye health of lens wearers. The market dynamics are significantly influenced by the increasing number of contact lens users globally, driven by a rising awareness of vision correction needs and the aesthetic appeal of contact lenses over traditional eyeglasses.

The growing prevalence of vision impairments, such as myopia and hyperopia, necessitates the use of contact lenses, consequently boosting the demand for related accessories. Furthermore, the increasing adoption of daily disposable lenses contributes to the demand for contact lens accessories, as these lenses require frequent use of cleaning and storage solutions for handling and supplementary care. The market also benefits from technological advancements in lens care products, including the development of multipurpose solutions and antimicrobial cases, which enhance user convenience and safety, thereby fueling market development.

Market Dynamics

Increasing Prevalence of Vision Impairments

There is are rising incidence of vision impairments, such as myopia (nearsightedness), hyperopia (farsightedness), and astigmatism. A research article published on the National Center for Biotechnology Information (NCBI) website in 2023, titled "Global trends in the prevalence of myopia in children and adults," highlighted a substantial increase in myopia prevalence worldwide, particularly in East Asian countries, but also with rising trends observed in other regions. As more individuals require vision correction, the adoption of contact lenses as a convenient and aesthetically appealing alternative to ophthalmic spectacle lenses and equipment rises, is rising. The growing population of contact lens wearers directly correlates with a higher consumption of lens care solutions, storage cases, and rewetting drops necessary for maintaining lens hygiene and comfort. Thus, the increasing prevalence of vision impairments is a key factor propelling the contact lens accessories market growth.

Growing Adoption of Daily Disposable Lenses

The adoption of daily disposable contact lenses eliminates the need for daily cleaning and storage of lenses in the traditional sense. However, these lenses necessitate the use of lens cases for handling unopened lenses and the proper disposal of used ones. Furthermore, the application and removal of these lenses often involve the use of specialized tools, and wearers may still opt for rewetting drops for enhanced comfort throughout the day. A study published on the PubMed Central platform in 2022, titled "Contact lens wear and hygiene practices among young adults: A cross-sectional survey," indicated a significant preference for daily disposable lenses among younger contact lens users due to their convenience and perceived lower risk of infection. This trend directly fuels the demand for lens cases and comfort solutions, contributing significantly to the demand for contact lens accessories.

Technological Advancements in Lens Care Products

Innovations such as multipurpose solutions that clean, disinfect, and condition lenses, as well as the development of antimicrobial lens cases designed to inhibit bacterial growth, enhance user convenience and safety. Research published on the NCBI website in 2021, in an article titled "Antimicrobial efficacy of novel contact lens storage cases," explored the effectiveness of new materials and designs in reducing microbial contamination in lens cases. Such innovations improve the user experience and encourage better lens care practices. Hence, continuous technological advancements in contact lens care products are significantly contributing to the development of contact lens accessories.

Segment Insights

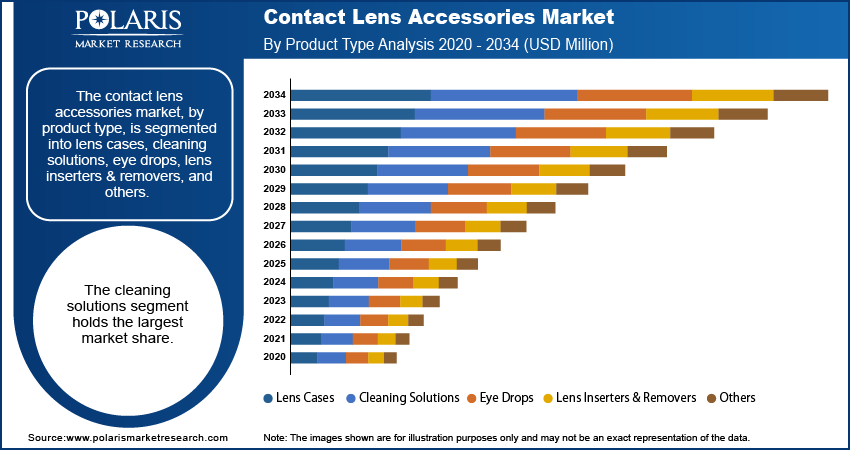

Market Assessment – By Product Type

The contact lens accessories market, by product type, is segmented into lens cases, cleaning solutions, eye drops, lens inserters & removers, and others. The cleaning solutions segment holds the largest share. This dominance can be attributed to the fundamental necessity of these solutions for the proper maintenance and disinfection of reusable contact lenses, ensuring wearer safety and lens longevity. The consistent and widespread use of cleaning solutions across a significant portion of the contact lens user base solidifies its leading position.

The eye drops segment is observed to be exhibiting the highest growth rate in the coming years. This rapid expansion is fueled by an increasing awareness among contact lens wearers regarding the importance of maintaining eye comfort and addressing issues such as dryness and irritation associated with lens wear. Factors such as prolonged digital screen usage and environmental conditions contribute to this growing need for rewetting and lubricating eye drops, positioning this segment for substantial growth.

Market Evaluation– By Material Type

The contact lens accessories market, by material type, is segmented into plastic, silicone, glass, and others. The plastic segment holds the largest share. This dominance is largely attributed to the widespread use of plastic in the manufacturing of essential accessories such as lens cases and certain components of cleaning solution bottles. The versatility, cost-effectiveness, and ease of molding plastic make it a preferred material for mass production, thereby contributing to its significant market presence within the contact lens accessories landscape.

The silicone segment is anticipated to exhibit the highest growth rate during the forecast period. This increasing preference for silicone-based materials is primarily driven by its enhanced properties, particularly in the context of lens cases and potentially some advanced application/removal tools. Silicone offers benefits such as improved hygiene due to its non-porous nature and flexibility, contributing to its growing adoption by consumers seeking premium and durable accessories. This trend suggests a strong demand for silicone-based contact lens accessories in the coming years.

Market Evaluation– By Distribution Channel

The market, by distribution channel, is segmented into online stores, optical stores, supermarkets/hypermarkets, and others. The optical stores segment represents the largest share. This significant share can be attributed to the fact that consumers often purchase contact lenses and their associated accessories simultaneously at these specialized outlets, where they also receive professional advice and guidance on product selection and usage from eye care practitioners. The established trust and convenience associated with purchasing vision care products from optical stores contribute to their leading share.

The online stores segment is experiencing the highest growth rate. The increasing penetration of C2C (Consumer-To-Consumer) e-commerce and the growing consumer preference for online shopping due to its convenience, wide product selection, and competitive pricing are driving this rapid growth. The ease of access to a variety of brands and products, coupled with the ability to make purchases from the comfort of one's home, is attracting a larger consumer base to online platforms for their contact lens accessory needs, indicating a strong market trend toward digital retail channels.

Market Evaluation– By End User

The contact lens accessories market, by end user, is segmented into individuals, clinics, hospitals, and others. The individuals segment accounts for the largest share. This is due to the sheer volume of individual contact lens wearers globally who require a consistent supply of accessories such as cleaning solutions, lens cases, and comfort drops for their personal use and maintenance of their lenses. The recurring need for these products by a vast consumer base establishes individuals as the dominant end-user segment.

The clinics and hospitals segment is anticipated to demonstrate the highest growth rate. This increasing demand stems from the growing number of eye care procedures, routine check-ups, and the provision of initial lens care kits and solutions offered to patients within these healthcare settings. Furthermore, the rising awareness of proper lens care practices advocated by eye care professionals in clinics and hospitals contributes to a greater utilization of accessories in clinics and hospitals.

Regional Analysis

The contact lens accessories market demonstrates varied regional dynamics across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region exhibits unique market characteristics influenced by factors such as the prevalence of vision disorders, the adoption rate of contact lenses, healthcare infrastructure, and consumer spending habits. While established regions show steady demand, emerging markets present significant growth opportunities, contributing to the overall global market development. Understanding these regional nuances is crucial for industry players aiming for effective market penetration and tailored entry assessments.

North America currently holds the largest share. This dominance can be attributed to a high awareness of vision correction options, a significant population of contact lens users, and well-established distribution channels. Furthermore, the presence of leading players and a strong emphasis on eye health and hygiene contribute to the substantial demand for contact lens accessories in this region. The mature healthcare system and consumer spending power further solidify North America's leading position in the global contact lens accessories landscape.

The Asia Pacific market is experiencing the highest growth rate. This rapid expansion is driven by a large and growing population base, increasing awareness of vision care, and a rising adoption of contact lenses, particularly in countries such as China and India. Moreover, improving healthcare infrastructure and a growing disposable income are contributing to a greater demand for contact lens accessories. The increasing market potential and evolving consumer preferences in Asia Pacific position it as a key area for future growth.

Key Players and Competitive Insights

A few key players actively contributing to the contact lens accessories market include Alcon Inc. (Novartis AG); Bausch + Lomb Corporation; CooperVision (CooperCompanies); Johnson & Johnson Vision Care, Inc. (Johnson & Johnson); Menicon Co., Ltd.; HOYA Vision Care (HOYA Corporation); SEED Co., Ltd.; AMO (Abbott Laboratories); and Walgreens Boots Alliance, Inc. These entities offer a diverse range of products essential for contact lens wearers, such as cleaning and disinfecting solutions, lens cases, rewetting drops, and other related accessories, demonstrating their continued presence and relevance in the market.

The competitive landscape of the contact lens accessories market is characterized by a mix of large, established multinational corporations and smaller, specialized companies. Competition among these players is driven by factors such as product innovation, pricing strategies, brand recognition, and distribution network efficiency. Market insights reveal a focus on developing advanced cleaning solutions with enhanced disinfection properties, convenient and user-friendly lens cases, and comfort-enhancing ophthalmic eye droppers. Strategic collaborations, product portfolio expansions, and increasing focus on online retail channels are also key competitive trends shaping the industry dynamics.

Alcon Inc. (Novartis AG) is headquartered in Geneva, Switzerland. The company offers a comprehensive portfolio of eye care products, including a wide array of contact lens care solutions such as multipurpose solutions, hydrogen peroxide-based systems, and daily cleaners. They also provide lens cases designed for safe storage and hygiene. Alcon's extensive product offerings directly address the needs of contact lens wearers, making it a significant player in the industry.

Bausch + Lomb Corporation has its principal executive offices in Vaughan, Ontario, Canada. The company develops, manufactures, and markets a broad range of eye health products, encompassing contact lenses and a substantial selection of lens care products. Their offerings include various cleaning and disinfecting solutions, rewetting drops for comfort, and lens cases. Bausch + Lomb's long-standing presence and diverse product line firmly establish their relevancy within the market, catering to a wide spectrum of consumer needs.

List of Key Companies

- Alcon Inc.

- AMO

- Bausch + Lomb Corporation

- CooperVision

- HOYA Vision Care

- Johnson & Johnson Vision Care, Inc.

- Menicon Co., Ltd.

- SEED Co., Ltd.

- Walgreens Boots Alliance, Inc.

Contact Lens Accessories Industry Developments

- April 2025: The US Food and Drug Administration (FDA) approved the Deseyne daily disposable contact lens, developed by Bruno Vision Care. According to the company’s press release, the lens steadily releases bioactive substances that enhance hydration and improve wearer comfort.

- March 2025: MediPrint Ophthalmics, a clinical-stage company specializing in ophthalmic drug delivery, announced the acceleration of a new clinical program targeting one of the leading causes of contact lens discontinuation—discomfort-related dropout.

Contact Lens Accessories Market Segmentation

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Lens Cases

- Cleaning Solutions

- Eye Drops

- Lens Inserters & Removers

- Others

By Material Type Outlook (Revenue – USD Million, 2020–2034)

- Plastic

- Silicone

- Glass

- Others

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Online Stores

- Optical Stores

- Supermarkets/Hypermarkets

- Others

By End User Outlook (Revenue – USD Million, 2020–2034)

- Individuals

- Clinics

- Hospitals

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Contact Lens Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,643.70 million |

|

Market Size Value in 2025 |

USD 2,803.65 million |

|

Revenue Forecast by 2034 |

USD 4,858.70 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The contact lens accessories market has been segmented into detailed segments of product type, material type, distribution channel, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A successful growth and marketing strategy for the market hinges on emphasizing user education regarding proper lens care and hygiene. Highlighting the benefits of using quality accessories in preventing infections and ensuring comfort can drive demand for contact lens accessories. Leveraging digital marketing channels to reach the digitally savvy consumer base with targeted advertising and informative content is crucial. Collaborations with eye care professionals to offer bundled products and recommendations can also enhance market penetration. Furthermore, focusing on product innovation, such as developing eco-friendly or multi-functional solutions, can attract environmentally conscious consumers and differentiate offerings in a competitive market. Expanding the online presence and ensuring seamless e-commerce experiences will further capitalize on the growing trend of online purchasing.

FAQ's

The market size was valued at USD 2,643.70 million in 2024 and is projected to grow to USD 4,858.70 million by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

North America held the largest share of the market in 2024.

A few key players include Alcon Inc. (Novartis AG); Bausch + Lomb Corporation; CooperVision (CooperCompanies); Johnson & Johnson Vision Care, Inc. (Johnson & Johnson); Menicon Co., Ltd.; HOYA Vision Care (HOYA Corporation); SEED Co., Ltd.; AMO (Abbott Laboratories); and Walgreens Boots Alliance, Inc.

The cleaning solutions segment accounted for the largest share in 2024.

Following are a few of the market trends: ? Growing Emphasis on Hygiene and Safety: With increasing awareness about eye health, consumers are prioritizing effective cleaning and disinfecting solutions and antimicrobial lens cases to minimize the risk of infections. ? Demand for Convenience and Ease of Use: Products that simplify lens care routines, such as multipurpose solutions and user-friendly lens inserters/removers, are gaining traction due to busy lifestyles. ? Sustainability Concerns Driving Product Innovation: There is a rising demand for eco-friendly accessories, leading to the development of biodegradable lens cases and recyclable packaging options.

Contact lens accessories are a range of products designed to support the use, care, and maintenance of contact lenses. These items are essential for ensuring the hygiene, comfort, safety, and longevity of contact lens wear. Common examples include lens cleaning and disinfecting solutions, lens storage cases, rewetting drops to alleviate dryness, and tools that aid in the insertion and removal of lenses. Essentially, they are all the supplementary products needed by individuals who wear contact lenses, beyond the lenses themselves.