Cross Laminated Timber Market Size, Share, Trends, & Industry Analysis Report

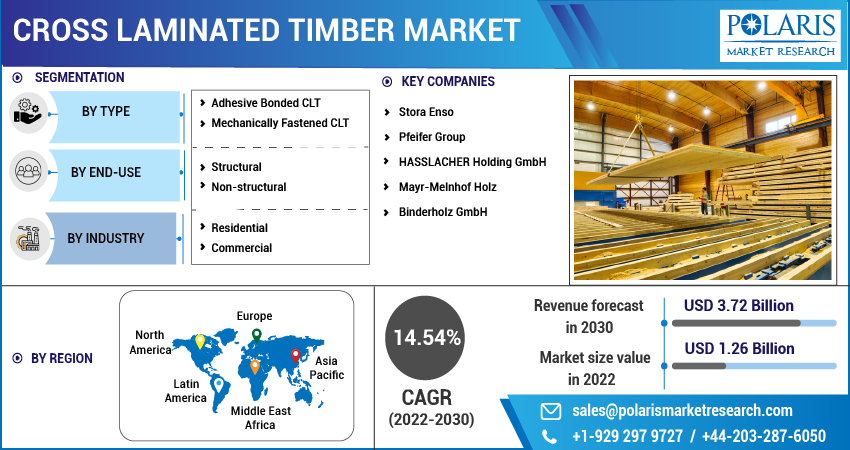

: By Raw Material, By Type (Adhesive Bonded CLT and Mechanically Fastened CLT), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 114

- Format: PDF

- Report ID: PM2792

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

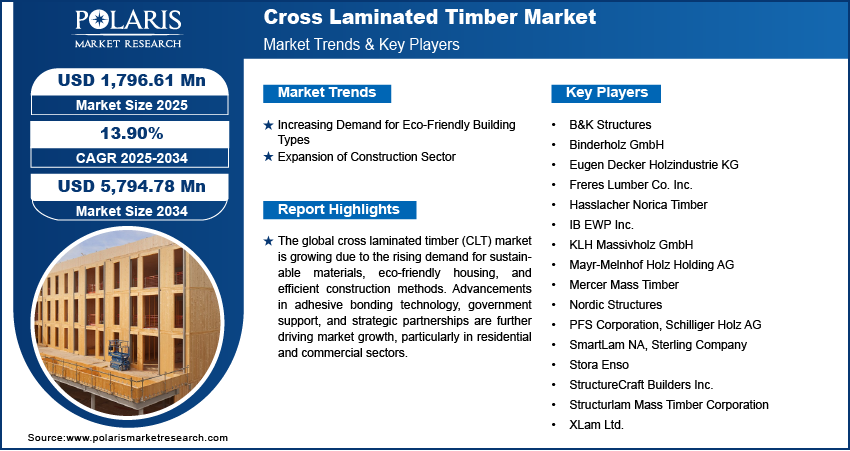

The global cross laminated timber (CLT) market size was valued at USD 1,589.63 million in 2024 and is expected to reach USD 1,796.61 million by 2025 and USD 5,794.78 million by 2034, exhibiting a CAGR of 13.90% during 2025–2034.

The global cross-laminated timber (CLT) market is growing due to the increasing demand for sustainable construction materials and innovative building solutions. CLT is an engineered wood product that has gained popularity across various industrial applications due to its strength, durability, and environmental benefits. In particular, the residential sector is witnessing a surge in CLT adoption due to the rising demand for eco-friendly housing solutions and efficient construction methods.

A key driving factor fuelling the CLT market growth is the advancement in adhesive bonding technology, which enhances the structural integrity and performance of CLT panels. Adhesive bonded CLT offers superior strength and stability, being suitable for various construction applications, including residential, commercial, and industrial buildings. Government policies and regulations are also favoring the use of sustainable materials such as CLT. For instance, the European Union's Green Deal encourages the adoption of eco-friendly construction practices, thereby boosting the demand for CLT products. Additionally, joint ventures and collaborations among key industry players are fostering innovation and expanding the market for cross laminated timber.

To Understand More About this Research: Request a Free Sample Report

In addition to its environmental and performance benefits, CLT is gaining popularity due to its ability to support modern architectural designs and structural innovations. Its flexible design allows for open layouts and wide-span structures without reducing strength or safety, thus making it suitable for urban redevelopment and public infrastructure projects. Furthermore, the prefabrication capabilities of CLT significantly reduce on-site waste and labor demands, making it an efficient solution for projects with tight timelines. Urban planners and regulatory authorities are increasingly supporting the use of CLT products due to their alignment with circular economy principles and low-carbon construction objectives. Collectively, these factors highlight the important role of CLT in transforming modern construction practices on a global scale.

Market Dynamics

Increasing Demand for Eco-Friendly Building Types

The construction industry is experiencing transformation owing to environmental concerns and growing demand for sustainable products. Cross laminated timber has emerged as a preferred material due to its renewable nature, carbon sequestration capabilities, and reduced environmental impact compared to traditional materials such as concrete and steel. Also, the production of CLT uses less energy, and its application in construction helps reduce greenhouse gas emissions, which supports global initiatives to combat climate change.

Governments and regulatory bodies are actively promoting the adoption of sustainable materials. For instance, the European Union's Green Deal emphasizes the use of eco-friendly construction materials, which is expected to encourage the integration of CLT products in urban development projects. Additionally, advancements in cross-laminated timber manufacturing have significantly improved the fire resistance and structural integrity of CLT, leading to its increase in demand for building applications. Hence, the increasing demand for eco-friendly building types propels the requirement for CLT products.

Expansion of Construction Sector

The construction sector is growing across the globe due to factors such as rapid urbanization, increasing population, and the rising demand for modern infrastructure. This expansion is fueling the need for innovative building materials that offer efficiency, sustainability, and adaptability. Since CLT's prefabrication is capable of reducing construction timelines, in addition to the reduced labor costs, the demand has significantly risen over the period. Also, the use of CLTs has minimized on-site waste, thereby being preferred as an attractive option for developers and contractors.

Growth in technology has boosted the demand for CLT products. The integration of technologies, including Building Information Modeling (BIM) and Computer Numerical Control (CNC) machinery, is further helping the contractors to create precise designs and fabrication that are used to build complex architectural projects. Therefore, the introduction of such innovations is contributing to the use of CLT products in both residential and commercial constructions.

Segment Insights

Market Assessment by Raw Material

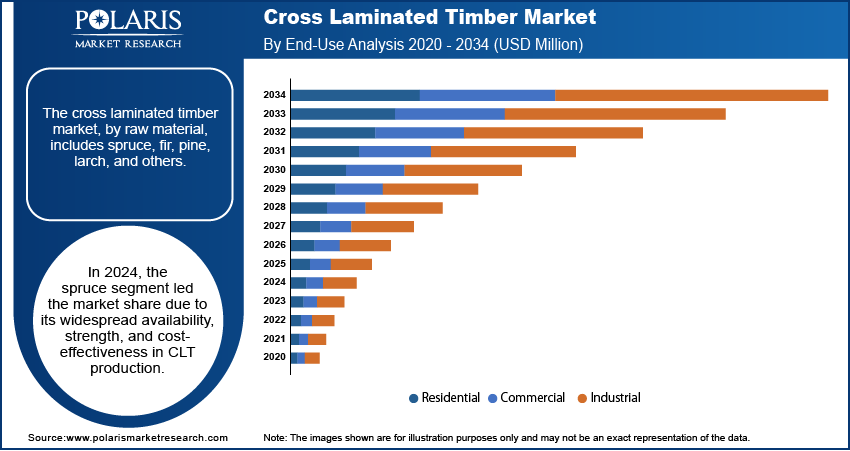

The global cross-laminated timber market segmentation, by raw material, includes spruce, fir, pine, larch, and others. In 2024, the spruce segment held the largest market share due to its widespread availability, superior mechanical strength, and cost-effectiveness. Spruce wood is lightweight and durable in nature, which is ideal for structural applications in residential, commercial, and industrial buildings. Also, factors including consistent density and easy workability have led to a rise in demand for spruce as a raw material for manufacturing cross-laminated timber (CLT) panels. In addition, CLT produced from spruce is extensively used in applications such as flooring, roofing, and wall systems, particularly in high-performance green buildings where strength-to-weight ratio and sustainability are considered the most.

Market Evaluation by Type

The global cross-laminated timber market, based on type, is bifurcated into adhesive-bonded CLT and mechanically fastened CLT. In 2024, the adhesive-bonded CLT segment held a significant market share due to its superior structural performance, enhanced dimensional stability, and widespread acceptance in industrial applications. The market revenue for the segment is growing due to the increasing demand for prefabricated, sustainable building materials in residential and commercial construction. In addition, adhesive-bonded CLT panels have higher load-bearing capacity and smoother surfaces, which makes them a preferred product for both visible interior and high-precision architectural designs.

Market Outlook by End Use

The global market, based on end use, is segregated into residential, commercial, and industrial. The residential segment is expected to witness the highest growth rate during the forecast period due to increasing demand for sustainable housing solutions, rising urbanization, and supportive green building initiatives. Cross laminated timber has key advantages, such as a high strength-to-weight ratio, design flexibility, and excellent thermal performance, thus generating a high demand for residential and multi-story structures. Moreover, the market growth for this segment is mainly fueled by the growing consumer awareness toward eco-friendly construction materials and the need for quicker project delivery in industrial applications.

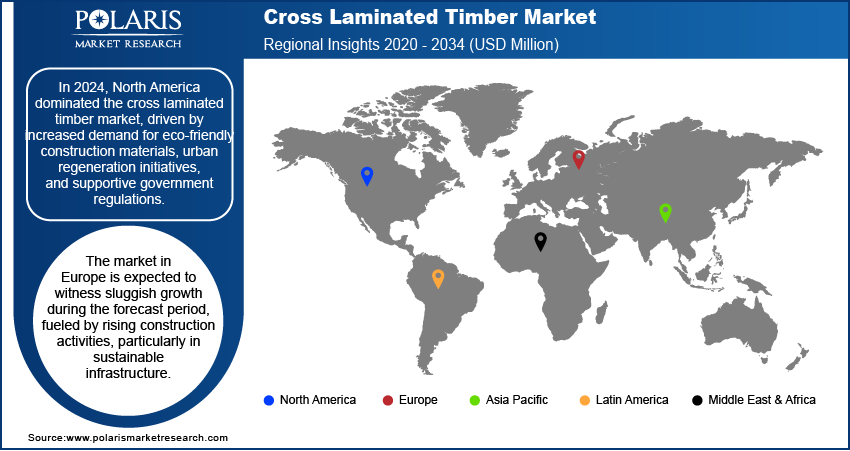

Regional Analysis

By region, the study provides the cross laminated timber market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the global market revenue share. Factors such as advanced building codes, rising adoption of green construction practices, and large-scale residential and commercial infrastructure investments contribute to the growth of the region. The region is also witnessing key trends in hybrid construction models and tall wood buildings supported by policy frameworks. Additionally, strong growth by government incentives and environmental mandates is a key driving factor for the market growth in the region. Further considerable strategic developments, such as mergers between timber suppliers and developers, help boost the market expansion in North America.

Europe was the second-leading regional market in 2024, fueled by strict environmental regulations, innovation in engineered wood technologies, and widespread public and private investments in sustainable infrastructure. Rising housing demand and increasing construction activities across countries such as Spain, Italy, Ireland, and the Nordics have favored the demand for CLT products across the region. Favorable macroeconomic trends and evolving supply and demand trends, particularly in multi-family housing, are positively influencing the adoption of CLT products. According to iBinder Group, Ireland accounted for the strongest growth in the construction sector in 2023 with an expansion of 3.2%.

Key Players and Competitive Analysis

The competitive landscape of the cross laminated timber market features a dynamic mix of well-established industry leaders and emerging players aiming to strengthen their market share in a rapidly expanding end-use environment. Intense competition, particularly in residential and commercial applications, has led to increased pressure on pricing, influencing overall profitability. Leading companies are prioritizing raw material innovation, particularly with spruce and pine, alongside strategic partnerships and R&D initiatives to enhance product performance and sustainability credentials.

Stora Enso is a global provider of renewable solutions in packaging, biomaterials, wooden construction, and paper. Stora's wood products division specializes in mass timber construction, offering cross laminated timber (CLT) under Sylva kit. Stora Enso operates four CLT production units across Europe, including facilities in Austria, Sweden, and the Czech Republic, with a combined annual capacity of 490,000 m³. These CLT products are utilized in various applications, such as floors, roofs, walls, and stairs, providing sustainable alternatives to traditional building materials.

Mayr-Melnhof Holz Holding AG, headquartered in Leoben, Austria, is a European timber processing company specializing in sawn timber and engineered wood products. Its business segments encompass sawmills and further processing, including glued laminated timber (glulam), cross-laminated timber, and wood-based panels. The company's CLT product line, branded as MM crosslam, offers high-performance, PEFC-certified panels suitable for various structural applications.

List of Key Companies in Cross Laminated Timber Market

- B&K Structures

- Binderholz GmbH

- Eugen Decker Holzindustrie KG

- Freres Lumber Co. Inc.

- Hasslacher Norica Timber

- IB EWP Inc.

- KLH Massivholz GmbH

- Mayr-Melnhof Holz Holding AG

- Mercer Mass Timber

- Nordic Structures

- PFS Corporation

- Schilliger Holz AG

- SmartLam NA

- Sterling Company

- Stora Enso

- StructureCraft Builders Inc.

- Structurlam Mass Timber Corporation

- XLam Ltd.

Cross Laminated Timber Industry Developments

June 2023: Mayr-Melnhof Holz expanded its business in Europe and Austria by opening the world's first PEFC-certified cross laminated timber production facility in Leoben. The facility boasts an annual production capacity of up to 140,000 m³ of CLT, significantly enhancing the company's ability to meet the growing market demand for sustainable building materials.

February 2022: Mayr-Melnhof Holz acquired the Swedish sawmill group Bergkvist Siljan. The acquisition has increased Mayr-Melnhof Holz's annual lumber production capacity by approximately 50%, positioning it as the third-largest sawmill group in Europe.

Cross Laminated Timber Market Segmentation

By Raw Material Outlook (Revenue, USD Million, 2020–2034)

- Spruce

- Fir

- Pine

- Larch

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Adhesive Bonded CLT

- Mechanically Fastened CLT

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Cross Laminated Timber Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,589.63 million |

|

Market Size Value in 2025 |

USD 1,796.61 million |

|

Revenue Forecast by 2034 |

USD 5,794.78 million |

|

CAGR |

13.90% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,589.63 million in 2024 and is projected to grow to USD 5,794.78 million by 2034.

The global market is projected to register a CAGR of 13.90% during the forecast period.

In 2024, North America accounted for the largest market share, driven by increasing demand for sustainable building materials, urban regeneration projects, and government incentives promoting green construction.

A few of the key players in the market are Stora Enso, Mayr-Melnhof Holz Holding AG, Binderholz GmbH, KLH Massivholz GmbH, Schilliger Holz AG, Hasslacher Norica Timber, Eugen Decker Holzindustrie KG, XLam Ltd., Structurlam Mass Timber Corporation, SmartLam NA, Freres Lumber Co. Inc., IB EWP Inc., Nordic Structures, StructureCraft Builders Inc., Mercer Mass Timber, PFS Corporation, B&K Structures, and Sterling Company.

In 2024, the spruce segment held the largest market share due to its abundant availability, cost-effectiveness, and suitability for manufacturing high-quality, durable CLT products used in construction.

The adhesive bonded CLT segment is expected to witness a higher growth rate during the forecast period due to its superior strength, faster assembly times, and alignment with sustainability goals in the construction sector.