Cryogenic Waste Neutralization Market Size, Share, Trends, Industry Analysis Report

: By Technology (Cryogenic Freezing, Supercritical Cryogenic Treatment, and Plasma-Based Cryogenic Neutralization), Waste Type, Deployment Mode, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5557

- Base Year: 2024

- Historical Data: 2020-2023

Cryogenic Waste Neutralization Market Overview

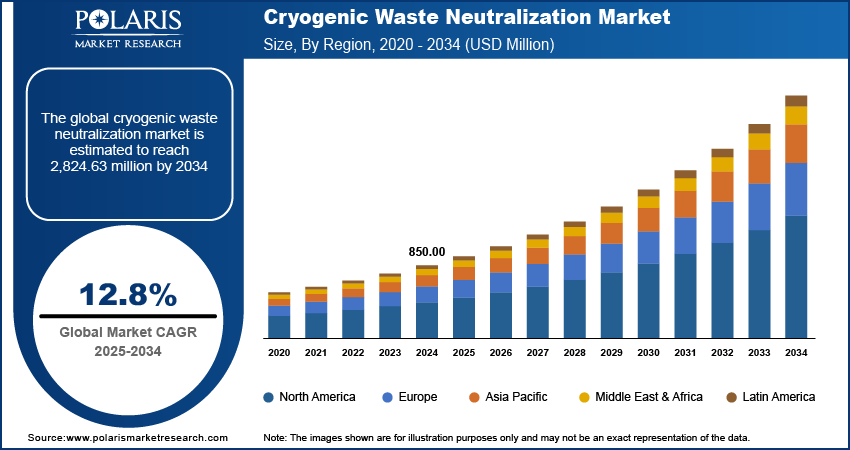

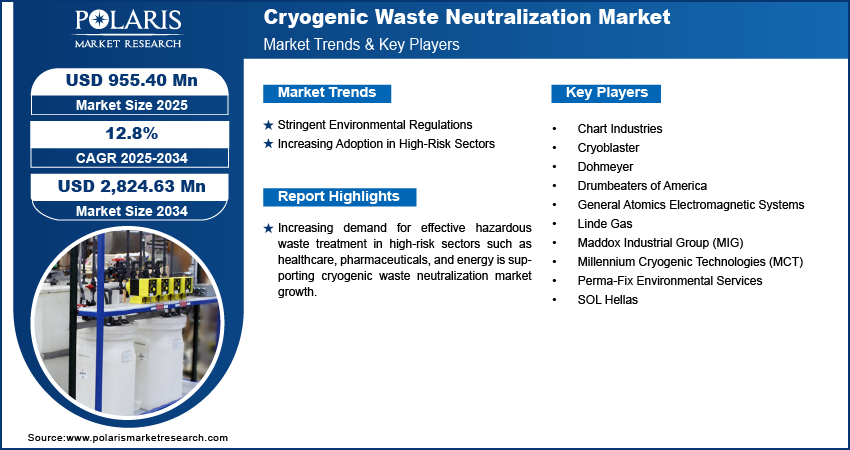

The global cryogenic waste neutralization market size was valued at USD 850.00 million in 2024 and is expected to reach USD 955.40 million by 2025 and USD 2,824.63 million by 2034, exhibiting a CAGR of 12.8%a during 2025–2034.

The cryogenic waste neutralization market involves technologies and processes that use extremely low temperatures to neutralize hazardous waste, including industrial, medical, and chemical byproducts. This method helps in reducing environmental impact by safely containing and treating volatile and toxic substances. Increasing regulatory pressure on hazardous waste management and disposal is driving the adoption of cryogenic waste neutralization, contributing to the cryogenic waste neutralization market growth.

To Understand More About this Research: Request a Free Sample Report

Surging production in pharmaceuticals, chemicals, and electronics industries is escalating hazardous waste output, accelerating cryogenic waste neutralization market demand. The necessity for efficient, eco-friendly disposal methods is boosting adoption of cryogenic waste neutralization solutions. Additionally, innovations in cryogenic waste treatment, such as plasma-based cryogenic neutralization and supercritical freezing, are optimizing efficiency and scalability. The development of cost-effective and energy-efficient solutions is strengthening cryogenic waste neutralization market expansion.

Cryogenic Waste Neutralization Market Dynamics

Stringent Environmental Regulations

Growing enforcement of hazardous waste disposal regulations is significantly contributing to cryogenic waste neutralization market growth. For instance, the UK's Technical Guidance WM2 provides comprehensive guidelines for hazardous waste classification, compelling industries to adopt advanced neutralization technologies to ensure compliance. Regulatory bodies across industrialized economies are imposing stringent waste management standards, compelling industries to integrate cryogenic neutralization technologies for compliance. The need for effective hazardous waste treatment methods is driving market demand, particularly in sectors such as pharmaceuticals, chemicals, and nuclear energy. Increased governmental oversight and rising environmental awareness are fueling market expansion, encouraging companies to invest in sustainable and regulatory-compliant waste disposal solutions. The push toward zero hazardous waste discharge policies is creating new opportunities for advanced cryogenic waste neutralization technologies to dominate industrial waste management practices.

Increasing Adoption in High-Risk Sectors

Increasing demand for effective hazardous waste treatment in high-risk sectors such as healthcare, pharmaceuticals, and energy is supporting cryogenic waste neutralization market trends. For instance, the US Environmental Protection Agency (EPA) has published interim guidance on the destruction and disposal of perfluoroalkyl substances (PFAS), highlighting the need for specialized treatment methods to safely manage hazardous materials. The need to safely neutralize biohazardous, chemical, and radioactive waste is driving market demand, encouraging widespread adoption of cryogenic solutions. The expansion of biotechnology, nuclear energy, and semiconductor manufacturing industries is amplifying market growth, as these sectors require precise and efficient waste disposal technologies. Increasing investments in waste and rising awareness of occupational safety are further strengthening market dynamics. Advanced cryogenic neutralization methods are becoming essential for mitigating health and environmental management infrastructure risks, ensuring compliance with regulatory standards, and enhancing the overall market size for sustainable waste treatment solutions.

Cryogenic Waste Neutralization Market Segment Insights

Cryogenic Waste Neutralization Market Assessment by Technology Outlook

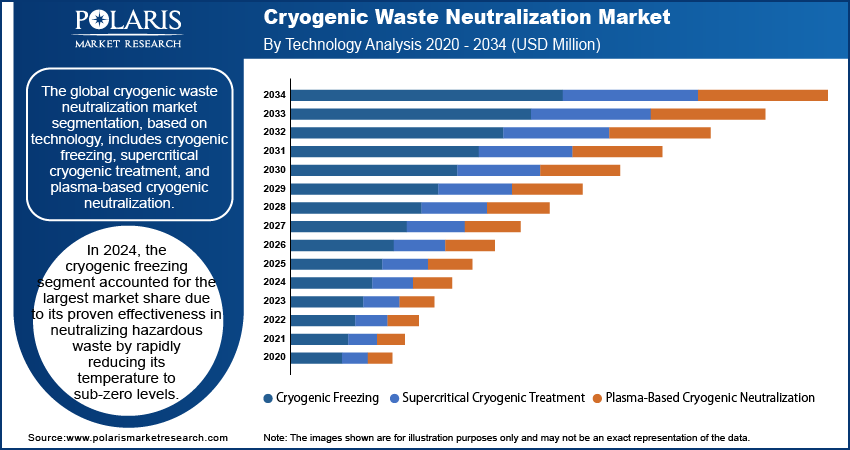

The global cryogenic waste neutralization market segmentation, based on technology, includes cryogenic freezing, supercritical cryogenic treatment, plasma-based cryogenic neutralization. In 2024, the cryogenic freezing segment accounted for the largest market share due to its proven effectiveness in neutralizing hazardous waste by rapidly reducing its temperature to sub-zero levels. This process prevents the volatilization of toxic substances, thereby minimizing environmental contamination risks. The technology is widely adopted across industries dealing with chemical, pharmaceutical, and biomedical waste due to its ability to stabilize reactive compounds. Additionally, the relatively lower operational complexity and cost compared to more advanced techniques make it an economically viable choice for large-scale applications. The well-established regulatory approvals for cryogenic freezing further strengthen its market position, enabling industries to meet stringent waste disposal standards efficiently.

The plasma-based cryogenic neutralization segment is expected to witness the highest CAGR over the forecast period due to its advanced capability to decompose hazardous waste at a molecular level. Unlike traditional cryogenic freezing, plasma-based systems utilize ionized gases to break down toxic compounds into their elemental forms, effectively neutralizing persistent organic pollutants and complex chemical structures. Growing environmental concerns and increasingly stringent waste disposal regulations are pushing industries toward high-efficiency, low-emission solutions. The adoption of plasma-based cryogenic technology is accelerating, particularly in sectors handling hazardous waste streams that require complete neutralization, such as electronic waste recycling, specialty chemicals, and high-risk biomedical applications.

Cryogenic Waste Neutralization Market Evaluation by End-Use Industry Outlook

The global cryogenic waste neutralization market segmentation, based on end-use industry, includes healthcare, pharmaceuticals, chemical manufacturing, electronics, aerospace & defense, and others. In 2024, the chemical manufacturing segment accounted for the largest market share due to its significant production of hazardous waste that necessitates specialized neutralization methods. Industrial processes involving petrochemicals, agrochemicals, and specialty chemicals generate toxic by-products that must be effectively managed to prevent environmental contamination. Cryogenic waste neutralization plays a crucial role in safely stabilizing and treating reactive chemical waste before disposal or reuse. The increasing regulatory pressure on chemical manufacturers to adopt sustainable waste management practices has further propelled the adoption of cryogenic solutions. Additionally, advancements in cryogenic treatment technology have enabled more efficient processing of high-volume waste, ensuring compliance with evolving environmental standards.

The electronics industry segment is expected to register the highest CAGR over the forecast period due to the rising demand for semiconductor manufacturing and precision electronic components. The sector generates substantial quantities of hazardous waste, including solvents, etchants, and rare-earth metal residues, which require specialized treatment to prevent environmental damage. Cryogenic waste neutralization is particularly effective in stabilizing and safely handling these materials without compromising component quality. The shift toward miniaturized and high-performance electronics has increased the need for contamination-free manufacturing environments, where cryogenic technology plays a vital role.

Cryogenic Waste Neutralization Market Regional Analysis

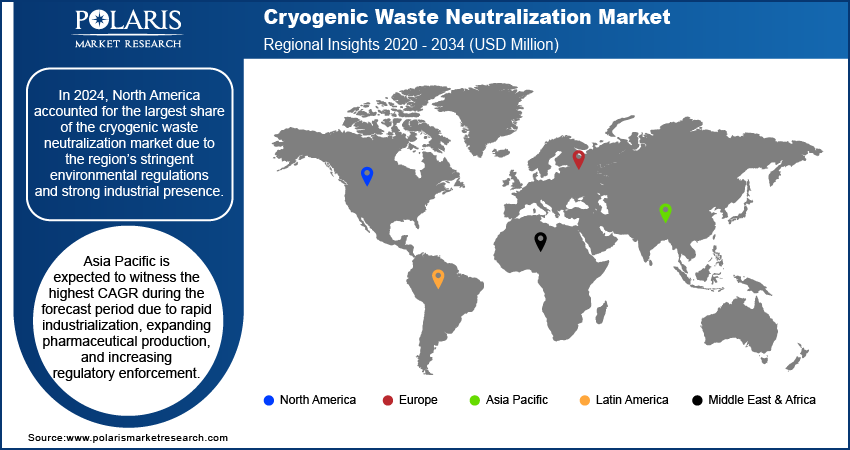

By region, the study provides cryogenic waste neutralization market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the cryogenic waste neutralization market share due to the region’s stringent environmental regulations and strong industrial presence. The enforcement of strict waste disposal policies by agencies such as the US Environmental Protection Agency (EPA) and Canada’s Environmental Protection Act has driven industries to adopt advanced neutralization technologies. The presence of a well-established pharmaceutical, chemical, and electronics manufacturing sector further accelerates demand for cryogenic solutions. Additionally, continuous investments in research and development for sustainable waste management, coupled with government incentives for adopting eco-friendly disposal methods, have solidified North America’s dominance in this market.

Asia Pacific is expected to witness the highest CAGR during the forecast period due to rapid industrialization, expanding pharmaceutical production, and increasing regulatory enforcement. Countries such as China, India, and Japan are witnessing heightened demand for advanced waste treatment solutions due to growing chemical and semiconductor manufacturing activities. Rising environmental awareness and government initiatives aimed at hazardous waste management are further driving adoption. Additionally, the expansion of high-tech industries and the need for compliance with international waste disposal standards have prompted companies to integrate cryogenic technologies into their waste treatment strategies, fueling cryogenic waste neutralization market growth.

Cryogenic Waste Neutralization Market – Key Players & Competitive Analysis Report

The competitive landscape of the cryogenic waste neutralization market is shaped by global leaders and regional players aiming for market share through technological innovation, strategic alliances, and regional expansion. Leading companies leverage advanced R&D capabilities, advanced cryogenic technologies, and extensive distribution networks to meet the increasing demand for sustainable and efficient waste management solutions. Cryogenic waste neutralization market trends indicate rising adoption of cryogenic treatment techniques, driven by stringent environmental regulations, industrial waste management requirements, and advancements in material recovery. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to enhance their market positioning and accelerate technology commercialization. Post-merger integration and collaborative partnerships play a crucial role in strengthening competitive standing and expanding operational footprints.

Regional companies address specific regulatory frameworks and industry requirements by providing cost-effective, customized solutions and capitalizing on local economic dynamics. Competitive benchmarking involves assessing market entry strategies, expansion opportunities, and ecosystem partnerships to align with evolving industry needs. The market is witnessing rapid technological advancements, including supercritical cryogenic treatment, plasma-based neutralization, and AI-driven waste management systems, reshaping industry dynamics. Companies are increasingly investing in supply chain optimization, sustainable procurement strategies, and carbon-neutral operations to comply with environmental mandates and enhance long-term viability. Pricing strategies, revenue growth analysis, and competitive intelligence are critical for identifying market opportunities and maintaining profitability. Ultimately, the cryogenic waste neutralization market is driven by continuous innovation, regulatory compliance, and strategic investments. Leading players focus on technological advancements, market penetration, and adaptive strategies to navigate economic fluctuations and regulatory shifts, ensuring sustained growth in a highly competitive global market.

Cryoblaster is engaged in the dry ice blasting cleaning business, specializing in equipment and accessories for surface rehabilitation. Founded in 2011 by Delta Diffusion S.A.R.L., Cryoblaster is headquartered in Frontonas, France. The company's product portfolio includes a range of dry ice blasters like the ATX80, ATX25 Pneumatic, and ATX Nano, designed for industrial cleaning applications in sectors such as plastics, foundry, food processing, and aeronautics. Cryoblaster provides services including dry ice cleaning, laser cleaning, and training, with a presence in several countries like Belgium, Switzerland, Canada, and Qatar. The company's expertise in cryogenic cleaning technologies positions it well for potential applications in cryogenic waste neutralization, though it is not specifically noted for this area. Cryogenic waste neutralization involves using extremely low temperatures to manage and process waste, which aligns with Cryoblaster's expertise in handling cryogenic materials like dry ice.

Dohmeyer is engaged in providing cryogenic solutions, specializing in cryogenic processing technology for various industrial applications. Founded in 1978, Dohmeyer is headquartered in New Jersey, USA. The company's product portfolio includes cryogenic equipment and systems designed for applications such as cryogenic recycling, deflashing, and cleaning. Dohmeyer provides services related to cryogenic processing, including equipment design, installation, and maintenance, with a presence in North America and Europe. The company is known for its expertise in enhancing efficiency in solid waste recycling through advanced cryogenic processing technologies. Cryogenic waste neutralization involves using extremely low temperatures to manage and process waste, which aligns with Dohmeyer's capabilities in handling cryogenic materials and processes.

List of Key Companies in Cryogenic Waste Neutralization Market

- Chart Industries

- Cryoblaster

- Dohmeyer

- Drumbeaters of America

- General Atomics Electromagnetic Systems (GA-EMS)

- Linde Gas

- Maddox Industrial Group (MIG)

- Millennium Cryogenic Technologies (MCT)

- Perma-Fix Environmental Services

- SOL Hellas

Cryogenic Waste Neutralization Industry Developments

In January 2024, Air Products highlighted its latest advancements in cryogenic freezing technology at the International Production & Processing Expo, highlighting innovative solutions designed to enhance efficiency and product quality in the freezing process.

Cryogenic Waste Neutralization Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Cryogenic Freezing

- Supercritical Cryogenic Treatment

- Plasma-Based Cryogenic Neutralization

By Waste Type Outlook (Revenue – USD Million, 2020–2034)

- Chemical Waste

- Biomedical Waste

- Radioactive Waste

- Industrial Hazardous Waste

- Electronic Waste

- Others

By Deployment Mode Outlook (Revenue – USD Million, 2020–2034)

- On-Site Treatment

- Off-Site Treatment

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Healthcare

- Pharmaceuticals

- Chemical Manufacturing

- Electronics

- Aerospace & Defense

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cryogenic Waste Neutralization Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 850.00 million |

|

Market Size Value in 2025 |

USD 955.40 million |

|

Revenue Forecast in 2034 |

USD 2,824.63 million |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cryogenic waste neutralization market size was valued at USD 850.00 million in 2024 and is projected to grow to USD 2,824.63 million by 2034.

The global market is projected to register a CAGR of 12.8% during the forecast period.

In 2024, North America accounted for the largest share of the market due to the region’s stringent environmental regulations and strong industrial presence.

A few of the key players in the market are Chart Industries, Cryoblaster, Dohmeyer, Drumbeaters of America, General Atomics Electromagnetic Systems (GA-EMS), Linde Gas, Maddox Industrial Group (MIG), Millennium Cryogenic Technologies (MCT), Perma-Fix Environmental Services, and SOL Hellas.

In 2024, the cryogenic freezing segment accounted for the largest market share due to its proven effectiveness in neutralizing hazardous waste by rapidly reducing its temperature to sub-zero levels.

In 2024, the chemical manufacturing segment accounted for the largest market share due to its significant production of hazardous waste that necessitates specialized neutralization methods.