Custom Software Development Market Size, Share, Trends, Industry Analysis Report

: By Type, By Deployment Mode (Cloud and On-premise), By Enterprise Size, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5623

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

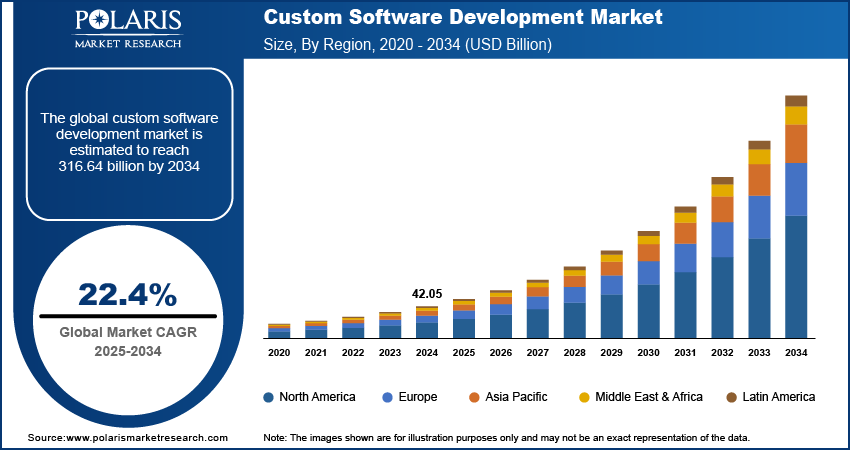

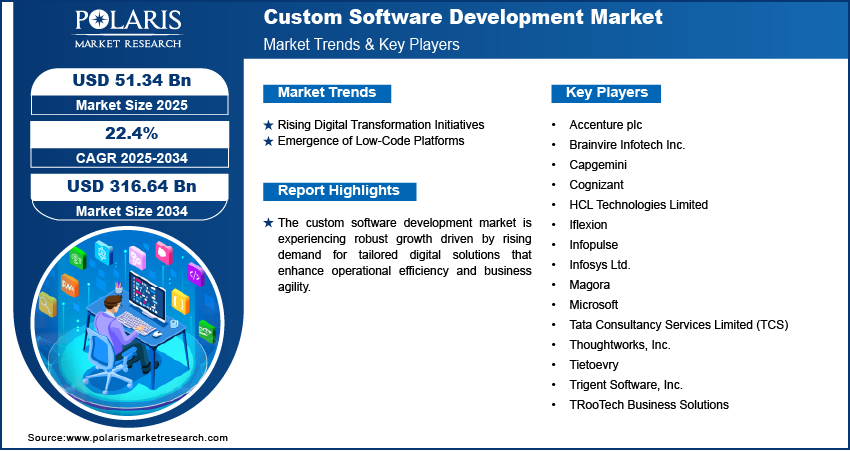

The global custom software development market size was valued at USD 42.05 billion in 2024, growing at a CAGR of 22.4% during 2025–2034. The increased demand for customized software that can integrate seamlessly with cloud-based systems and the growing adoption of robotic process automation across sectors are fueling market growth.

Key Insights

- The enterprise software segment accounted for the largest market share in 2024, owing to the increased demand for scalable and secure digital solutions across large organizations.

- The SMEs segment is projected to witness significant growth, primarily driven by the growing recognition of custom software development among small and medium-sized businesses.

- North America led the market in 2024. The regional market dominance is attributed to its advanced technological landscape and robust presence of major software vendors.

- Asia Pacific is projected to witness significant growth. Rapid digitalization and growing investments in IT infrastructure are driving regional market growth.

Industry Dynamics

- Increased focus on the modernization of legal systems among businesses is fueling the demand for custom software development.

- The introduction of low-code platforms is fueling market development by democratizing software development and accelerating development cycles.

- The growing integration of advanced technologies is creating several market opportunities.

- Shortage of skilled web-based solutions developers and engineers is hindering market growth.

Market Statistics

2024 Market Size: USD 42.05 billion

2034 Projected Market Size: USD 316.64 billion

CAGR (2025-2034): 22.4%

North America: Largest Market in 2024

AI Impact on Custom Software Development Market

- AI accelerates coding, testing, and debugging with automated code generation and error detection.

- AI enables adaptive applications tailored to specific business needs and user behaviors.

- Intelligent project management tools optimize resource allocation, timelines, and cost control.

- AI-powered analytics improve software performance post-deployment through predictive maintenance and updates.

To Understand More About this Research: Request a Free Sample Report

Custom software development refers to the process of designing, creating, deploying, and maintaining software tailored specifically to the needs of individual users or organizations. This market has witnessed steady growth due to the increasing demand for personalized digital solutions that align precisely with specific business processes. One of the key drivers propelling this growth is the increasing adoption of cloud computing. For instance, a January 2024 IBEF report estimated that 40% of Indian organizations will adopt cloud services by 2024. Additionally, India’s data center capacity is projected to nearly double from 770 MW in 2022 to 1,500 MW by 2025, reflecting rapid digital infrastructure growth. There is a rising need for customized software that can seamlessly integrate with cloud environments as enterprises shift from traditional infrastructure to cloud-based systems. Cloud computing offers scalability, flexibility, and cost-efficiency, which encourages organizations to invest in custom-built solutions to optimize their development to operations market, enhance accessibility, and streamline workflows.

The expansion is attributed to the increasing adoption of robotics process automation across industries. For instance, an August 2024 Statistics Canada report stated that large enterprises led robotics adoption with 9.1%, sourcing externally at 76.6% over in-house development, which was 3.3%. Medium-sized firms were most likely to develop robotics internally at 12.1%, while small enterprises had the lowest adoption rate at 1.6%. This rising demand for customized automation systems is boosting the growth. The demand for software that can support and control robotic systems has grown substantially as businesses strive for greater efficiency and productivity. Robotic automation requires software solutions that are highly specific to the task, environment, and industry application, making custom software a strategic necessity. Custom-built software enables businesses to tailor robotic processes to their unique operational requirements, improving precision and reducing manual intervention. This trend highlights the evolving role of custom software as an enabler of intelligent automation and next-generation operational transformation.

Market Dynamics

Rising Digital Transformation Initiatives

The rising digital transformation initiatives across industries are driving the custom software development market growth as organizations increasingly seek to modernize legacy systems and improve operational agility. Digital transformation requires businesses to adopt technologies that are tailored to their unique processes, goals, and customer interactions, necessitating customized software solutions. Unlike off-the-shelf products, custom software allows companies to align digital capabilities with strategic objectives, enabling seamless integration with existing systems and improved user experiences. In September 2024, Shopify, Oracle, and Deloitte Digital collaborated to launch a Next Gen Retail Commerce model, combining Shopify’s commerce platform with Oracle’s enterprise solutions. The collaboration aims to enhance omni-channel retail solutions, operational efficiency, and data-driven personalization for enterprise retailers. Custom software becomes central to supporting end-to-end digital workflows and competitive differentiation in an evolving digital landscape as enterprises prioritize data-driven decision-making, automation, and innovation.

Emergence of Low-Code Platforms

The emergence of low-code platforms is fueling the demand for custom software development by democratizing software creation and accelerating development cycles. In March 2025, Mendix 10.21 launched AI-driven productivity enhancements for developers. The major updates included Maia AI improvements, simplified page building with local variables, faster REST API integration via OpenAPI, and view entities for streamlined data modeling. These platforms empower both professional developers and business users to build tailored applications with minimal coding effort, reducing dependency on extensive programming resources. While low-code tools simplify development, they also expand the possibilities for custom software by enabling rapid prototyping, iterative design, and faster deployment of personalized solutions. This evolution improves the agility of custom software development, making it more accessible and adaptable to changing business needs, thereby strengthening its role as a cornerstone of enterprise innovation.

Segment Insights

Market Assessment by Type Outlook

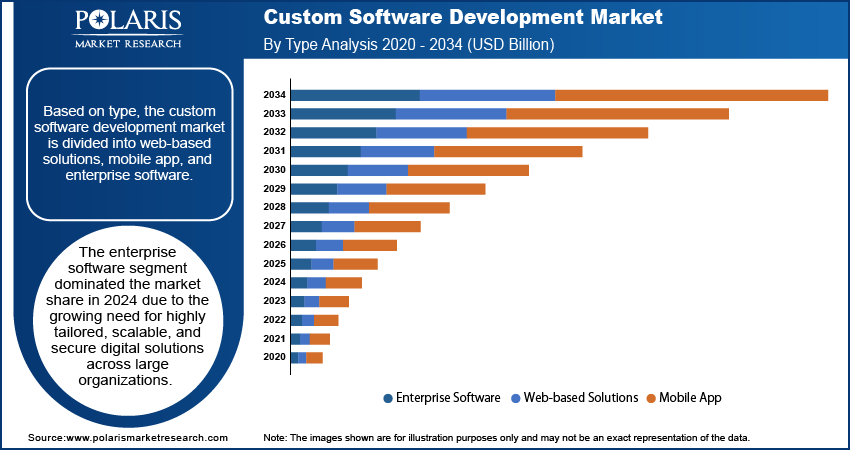

The segmentation based on type, includes web-based solutions, mobile app, and enterprise software. The enterprise software segment dominated in 2024 due to the growing need for highly tailored, scalable, and secure digital solutions across large organizations. Enterprise software enables businesses to address complex operational requirements such as enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management through customized platforms. Custom-developed enterprise applications offer the flexibility and control needed to meet these dynamic demands as enterprises continue to digitize core processes and demand seamless integration across departments and systems. This strong alignment with strategic business goals has positioned enterprise software as a leading contributor to the market’s growth.

Market Evaluation by Enterprise Size Outlook

The segmentation based on enterprise size, includes large enterprises and SMEs. The SMEs segment is expected to witness a faster growth during the forecast period due to the increasing recognition among small and medium-sized businesses of the value of customized digital solutions. SMEs are embracing custom software to streamline operations, enhance customer engagement, and gain competitive advantage in niche markets. The rising affordability and accessibility of development tools, such as low-code platforms and cloud-based infrastructure, have lowered entry barriers for smaller firms. As a result, more SMEs are investing in tailored solutions that align with their unique operational needs, enabling agility and innovation without the constraints of standardized software.

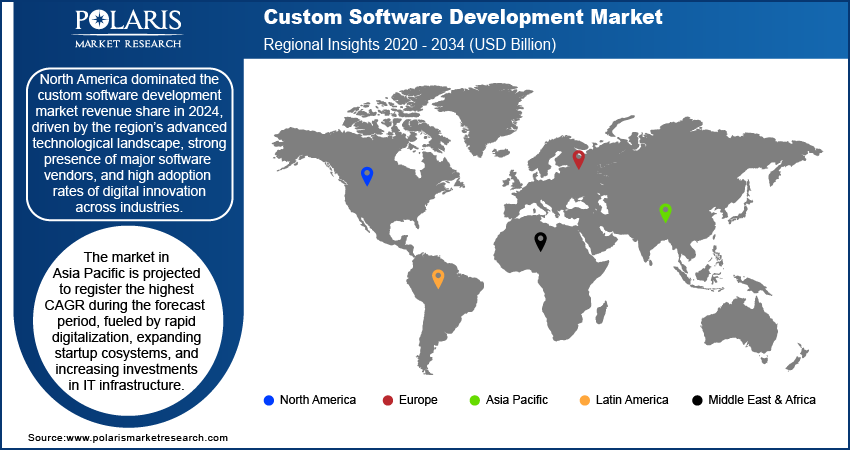

Regional Analysis

By region, the report provides the custom software development insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the revenue share in 2024, driven by the region’s advanced technological landscape, strong presence of major software vendors, and high adoption rates of digital innovation across industries. Businesses in North America have consistently prioritized IT modernization and digital transformation, creating a robust demand for customized solutions that support evolving business models. Significant public-sector investments in digital infrastructure further reinforce the custom software development expansion. For instance, an October 2022 GSA report noted that in June 2022, the TMF Board allocated USD 100 million to modernize public-facing digital services and technology systems, aiming to enhance customer experience for US citizens through streamlined and improved government platforms. Furthermore, the mature cloud infrastructure and skilled developer ecosystem in the region enable the rapid deployment of custom applications. This supportive environment has solidified North America’s leadership in driving enterprise-specific software innovation and adoption.

The Asia Pacific region is projected to register the highest CAGR during the forecast period, fueled by rapid digitalization, expanding startup ecosystems, and increasing investment in IT infrastructure. For instance, an April 2025 IBEF report indicated that India's IT sector contributed 7.5% of GDP in FY23, with projections to reach 10% by FY25. This growth reflects the industry's expanding role in the nation's economy and development. There is a growing need for software tailored to local market dynamics and operational requirements as businesses across emerging economies in the region embrace digital transformation. The demand is further amplified by the increasing penetration of mobile and web-based technologies and government-led initiatives supporting technology-driven growth. This rising emphasis on localized, scalable, and efficient digital solutions is propelling the adoption of custom software across diverse industries in Asia Pacific.

Key Players & Competitive Analysis Report

The market is characterized by intense competition between global leaders and regional players, all competing for market share through innovation, strategic partnerships, and geographic expansion. Global firms leverage robust R&D capabilities and cutting-edge technologies such as AI, cloud, IoT, and vast distribution networks to deliver tailored solutions that meet demand for digital transformation and scalable business models. Custom software development market trends highlight rising needs for disruptive technologies, such as generative AI and low-code platforms driven by economic shifts, geopolitical factors, and enterprise modernization. Large players prioritize M&A, joint ventures, and post-merger integration to enhance capabilities and enter new markets to maintain dominance. Regional players, meanwhile, compete by addressing niche demands with cost-optimized solutions and localized expertise. A few key major players are Accenture plc; Brainvire Infotech Inc.; Capgemini; Cognizant; HCL Technologies Limited; Iflexion; Infopulse; Infosys Ltd.; Magora; Microsoft; Tata Consultancy Services Limited (TCS); Thoughtworks, Inc.; Tietoevry; Trigent Software, Inc.; and TRooTech Business Solutions.

Accenture plc is into consulting, technology services, and custom software development, recognized for its ability to execute and vision in creating tailored solutions. The company leverages cutting-edge technologies, such as AI, machine learning, and cloud computing, to design scalable, secure, and high-performance applications that address specific business challenges across industries such as healthcare, financial services, and retail. It customizes enterprise applications using programming languages such as Java, Python, and C++ to enhance operational efficiency, improve customer engagement, and support data-driven decision-making. Accenture also specializes in modernizing legacy systems to adopt newer technologies and streamline workflows. Its industrialized methods enable rapid deployment of solutions such as SAP Fiori apps while customizing user interfaces to meet unique business requirements. Accenture continues to help organizations reinvent their operations and create innovative products through bespoke software solutions, recognized as a leader in Gartner’s Magic Quadrant for custom software development services.

HCL Technologies Limited is a global IT services and consulting company renowned for its expertise in custom software development and innovative technology solutions. HCL delivers tailored software solutions to meet the unique needs of businesses in diverse sectors such as healthcare, finance, and manufacturing with over 40 years of experience and a strong presence across 44 countries. Its custom software development services include embedded systems engineering, cloud-based applications, enterprise software, and digital transformation initiatives. HCL employs agile methodologies and cutting-edge technologies such as AI, IoT, and DevSecOps to design scalable and secure applications that enhance operational efficiency and customer experience. The company also focuses on modernizing legacy systems, integrating advanced features, and ensuring compliance standards. HCL’s approach emphasizes end-to-end capabilities, from feasibility studies to testing and maintenance, enabling clients to achieve their business goals effectively. Additionally, its robust portfolio includes solutions for data management, automation, and marketing platforms. HCL Technologies continues to drive digital transformation globally by delivering high-quality custom software that aligns with evolving market demands and technological advancements recognized for its domain-specific expertise and innovative practices.

List of Key Companies

- Accenture plc

- Brainvire Infotech Inc.

- Capgemini

- Cognizant

- HCL Technologies Limited

- Iflexion

- Infopulse

- Infosys Ltd.

- Magora

- Microsoft

- Tata Consultancy Services Limited (TCS)

- Thoughtworks, Inc.

- Tietoevry

- Trigent Software, Inc.

- TRooTech Business Solutions

Custom Software Development Industry Developments

September 2025: Brainvire announced the successful development of an enterprise-grade e-commerce solution for home furniture retailer Ashley. Brainvire stated that the project involved the development of a full-featured Shopify website. It also included integration with Microsoft Dynamics 365 to ensure seamless business operations.

September 2025: Tietoevry revealed the completion of the divestment of its Tech Services business. Following the completion, the digital engineering business and vertical software businesses are now a part of the company’s business portfolio.

August 2024: Brainvire launched a mobile app designed to improve children's Chinese language acquisition through interactive features such as games, speech-to-text, and flashcards. The platform enables schools to deliver personalized, engaging learning experiences for students.

May 2024: Proxet Group partnered with Palantir Technologies to enhance AI-driven data solutions for enterprises. The collaboration aims to expand Palantir’s developer ecosystem, offering businesses of all sizes advanced data analysis tools for sectors like healthcare, fintech, and supply chain optimization.

Custom Software Development Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Web-Based Solutions

- Mobile App

- Enterprise Software

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-premise

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprise

- SMEs

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Custom Software Development Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.05 billion |

|

Market Size Value in 2025 |

USD 51.34 billion |

|

Revenue Forecast by 2034 |

USD 316.64 billion |

|

CAGR |

22.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 42.05 billion in 2024 and is projected to grow to USD 316.64 billion by 2034.

The global market is projected to register a CAGR of 22.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Accenture plc; Brainvire Infotech Inc.; Capgemini; Cognizant; HCL Technologies Limited; Iflexion; Infopulse; Infosys Ltd.; Magora; Microsoft; Tata Consultancy Services Limited (TCS); Thoughtworks, Inc.; Tietoevry; Trigent Software, Inc.; and TRooTech Business Solutions.

The enterprise software segment dominated the market share in 2024.

The SMEs segment is expected to witness a faster growth during the forecast period.