Data Center Robotics Market Share, Size, Trends, Industry Analysis Report

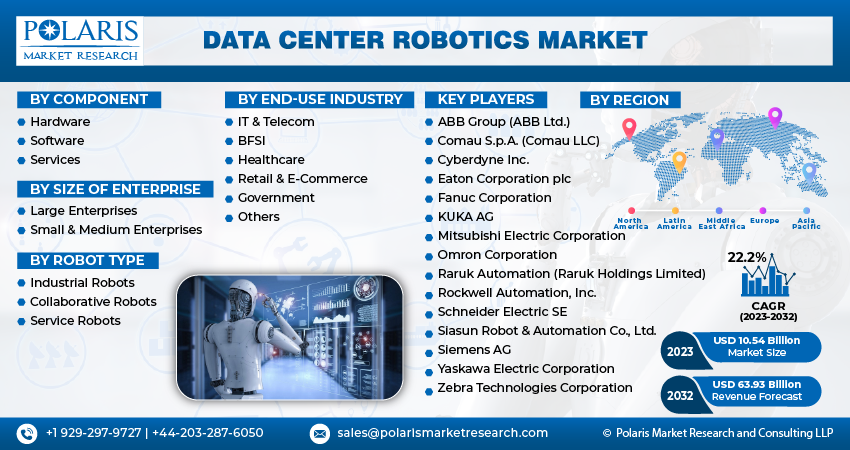

By Component (Hardware, Software, and Services); By Size of Enterprise; By Robot Type; By End-Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 115

- Format: PDF

- Report ID: PM4053

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

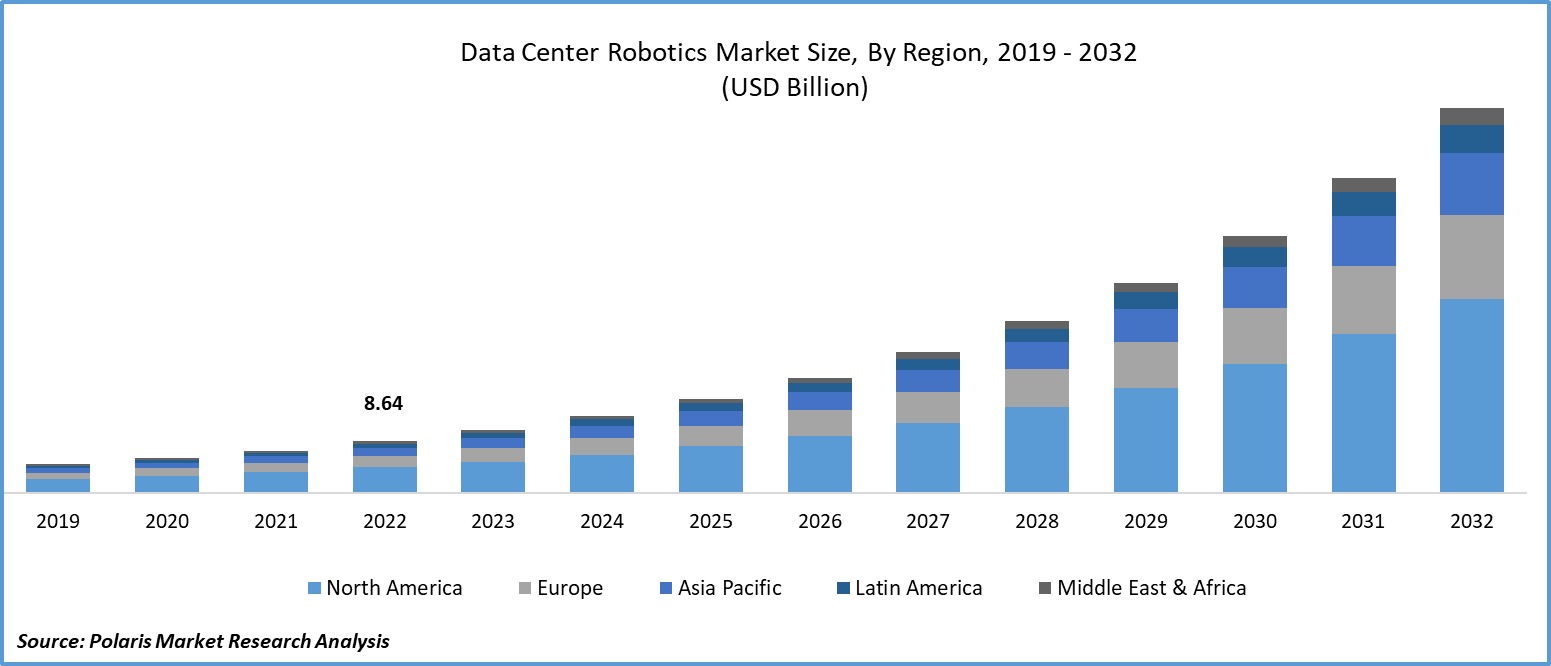

The global data center robotics market was valued at USD 8.64 billion in 2022 and is expected to grow at a CAGR of 22.2% during the forecast period.

The integration of robotics in the data center market represents a transformative shift in how these critical facilities operate. The impact of robotics is profound, leading to increased efficiency, enhanced reliability, and reduced operational costs. The automation imperative is a powerful driver behind this trend, as organizations seek to manage the ever-growing volumes of data.

To Understand More About this Research: Request a Free Sample Report

While initial investment costs may present a restraint, the long-term benefits of data center robotics far outweigh the upfront expenses. The ability to scale and adjust according to evolving requirements presents significant opportunities for data centers. As the data center robotics market advances, it stands ready to assume an even more crucial role in influencing the trajectory of data center operations, guaranteeing their position as pioneers in technological advancement.

- For instance, in October 2023, Nvidia, the foremost chip manufacturer, has unveiled an extended collaboration with Foxconn Technology Group aimed at creating a novel category of data centres capable of fuelling artificial intelligence services.

The integration of robotics in data centers has revolutionized their operations, enabling increased efficiency, enhanced reliability, and reduced operational costs. These robotic systems perform a wide range of tasks, from hardware maintenance and cable management to inventory tracking and security surveillance. Unlike human operators, robots can work 24/7 without fatigue, ensuring uninterrupted service availability.

For Specific Research Requirements: Request for Customized Report

Furthermore, robots are adept at performing tasks in confined or hazardous environments, reducing risks to human personnel. Their precision and accuracy in tasks like component assembly and disassembly lead to fewer errors and higher system uptimes. This not only increases overall operational efficiency but also enhances the quality of service provided by data centers.

Growth Drivers

- Increased focus on towards automation is projected to spur the product demand.

The primary driver behind the adoption of robotics in data centers is the growing need for automation. As data volumes continue to rise steeply, manual intervention in data center operations becomes increasingly impractical. By leveraging robotics, data center operators can automate routine and labor-intensive tasks, allowing human resources to focus on more strategic activities.

Moreover, automation significantly improves response times to maintenance and repair needs. Robots equipped with advanced sensors and AI-driven algorithms can swiftly identify and rectify issues, minimizing downtime and enhancing the overall reliability of the data center infrastructure.

Report Segmentation

The market is primarily segmented based on component, size of enterprise, robot type, end-use industry, and region.

|

By Component |

By Size of Enterprise |

By Robot Type |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- Software segment is expected to witness highest growth during forecast period

The software segment is projected to grow at a CAGR during the projected period. Advanced algorithms and AI-driven software are revolutionizing operations, enabling precise task execution and real-time decision-making. This surge in software sophistication enhances data center efficiency, reliability, and security. Additionally, the integration of intuitive interfaces facilitates seamless human-robot collaboration, optimizing overall performance. The ability to remotely monitor and control robotic systems further augments operational flexibility. As data centers increasingly rely on sophisticated software solutions, this segment is poised to remain a key driver of innovation and efficiency in the rapidly evolving landscape of data center robotics.

By Size of Enterprise Analysis

- Large enterprises segment accounted for the largest market share in 2022

The large enterprises segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. These entities are recognizing the substantial benefits of integrating robotics into their data center operations. Automation enhances efficiency, reduces downtime, and improves overall system reliability. Large enterprises, with their extensive data processing needs, find that robotics provide a competitive edge by optimizing resource utilization. Moreover, the scalability of robotic systems aligns with the expansion plans of these organizations, ensuring seamless growth. As the demand for high-performance computing continues to surge, the large enterprise segment is poised to be a significant driver of the data center robotics market's expansion.

By Robot type Analysis

- Industrial robots segment accounted for the largest market share in 2022

The industrial robots segment is experiencing remarkable growth within the data center robotics market. These specialized robots are tailored to handle intricate tasks within the data center environment, such as hardware maintenance, cable management, and inventory tracking. Their precision and efficiency significantly enhance operational performance. Moreover, industrial robots are adept at navigating confined spaces, ensuring optimal use of available infrastructure. As data centers expand in size and complexity, the demand for these highly specialized robots continues to rise. Their pivotal role in streamlining operations and ensuring uninterrupted service availability cements the industrial robots segment as a key driver of growth in the data center robotics market.

The collaborative robots segment is experiencing rapid expansion in the data center robotics market. These robots are designed to work alongside human operators, augmenting their capabilities in tasks that require dexterity and precision. In data centers, collaborative robots excel in scenarios like cable management, equipment installation, and fine-tuning. Their ability to collaborate with human workers in real-time enhances operational efficiency. Additionally, collaborative robots are equipped with advanced safety features, minimizing risks in shared workspaces. As data centers prioritize seamless human-robot interaction, the collaborative robots segment is poised for substantial growth, driven by their capacity to optimize workflows while ensuring a safe and productive working environment.

By End-Use Industry Analysis

- IT & Telecom segment held the significant market revenue share in 2022

The IT & telecom segment is witnessing robust growth in the data center robotics market. With the escalating demand for high-speed, reliable data processing, these industries are turning to robotics for enhanced efficiency and operational excellence. Robots are adept at handling complex tasks like hardware maintenance, cable management, and security surveillance, ensuring uninterrupted service availability. Moreover, they excel in confined spaces, optimizing space utilization in densely populated data centers. As IT and telecom infrastructures continue to evolve, the integration of robotics is becoming increasingly essential, positioning this segment as a significant driver of growth in the data center robotics market.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The region's mature IT infrastructure, coupled with a surge in data processing demands, has fueled the adoption of robotics in data center operations. Companies are increasingly leveraging automation to enhance efficiency and reliability. Additionally, stringent regulatory requirements for data security and operational uptime have propelled the demand for advanced robotic solutions. North America's tech-savvy ecosystem and willingness to invest in cutting-edge technologies further drive this growth. As data centers continue to evolve to meet escalating demands, the North American market remains a pivotal hub for innovation and expansion in the realm of data center robotics.

The Asia-Pacific region is witnessing a significant surge in the data center robotics market. Rapid industrialization, coupled with a burgeoning digital economy, has propelled the demand for advanced data center solutions. Governments and businesses alike are recognizing the pivotal role of robotics in enhancing operational efficiency and ensuring uninterrupted service availability. Moreover, the region's diverse and dynamic market landscape presents a fertile ground for innovation and adoption. As data centers evolve to meet the escalating demands of this thriving market, Asia-Pacific stands as a key driver of growth in the data center robotics sector, poised to play a central role in shaping the industry's future.

Key Market Players & Competitive Insights

The data center robotics market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB Group (ABB Ltd.)

- Comau S.p.A. (Comau LLC)

- Cyberdyne Inc.

- Eaton Corporation plc

- Fanuc Corporation

- KUKA AG

- Mitsubishi Electric Corporation

- Omron Corporation

- Raruk Automation (Raruk Holdings Limited)

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siasun Robot & Automation Co., Ltd.

- Siemens AG

- Yaskawa Electric Corporation

- Zebra Technologies Corporation

Recent Developments

- In July 2021, Zebra Technologies Corporation completed its acquisition of Fetch Robotics, a trailblazer in on-demand automation. This strategic move aimed to expedite the realization of Zebra's Enterprise Asset Intelligence vision and bolster its expansion in intelligent industrial automation. By embracing innovative approaches to enhancing workflows, this acquisition enabled Zebra to assist customers in operating with greater efficiency within the context of increasingly automated, data-driven environments.

Data Center Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 10.54 billion |

|

Revenue forecast in 2032 |

USD 63.93 billion |

|

CAGR |

22.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, By Size of Enterprise, By Robot Type, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |