Deburring Machine Market Size, Share, Trends, Industry Analysis Report

By Type (Vibratory Deburring, Barrel Tumbling, Brush Deburring), By Operation Mode, By Deburring Media, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6388

- Base Year: 2024

- Historical Data: 2020-2023

Overview

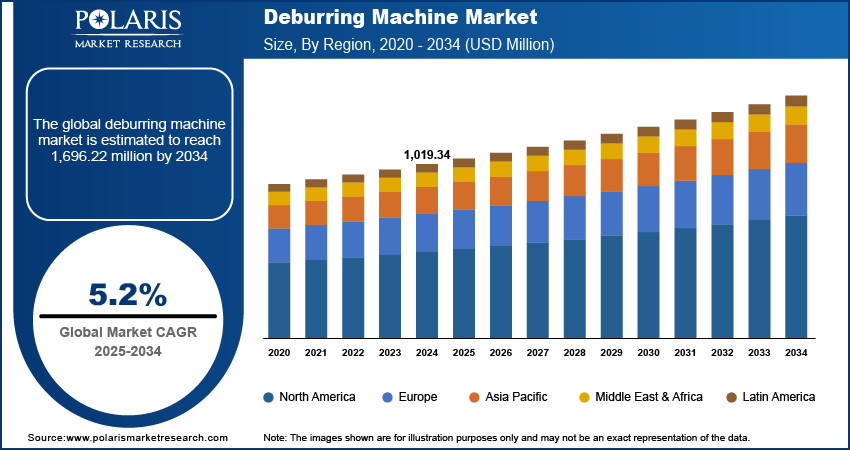

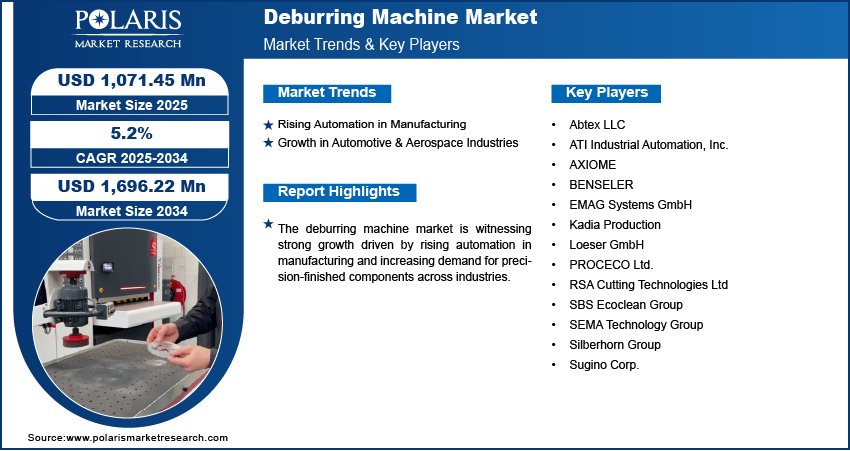

The global deburring machine market size was valued at USD 1,019.34 million in 2024, growing at a CAGR of 5.2% from 2025 to 2034. Key factors driving industry growth include increasing demand for precision components, advancements in deburring technologies, rising automation in manufacturing, and the growing automotive and aerospace industries.

Key Insights

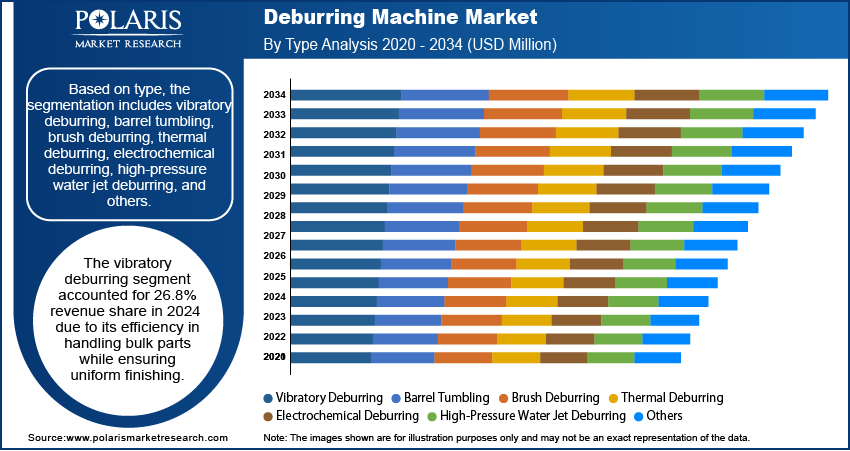

- The vibratory deburring segment held a 26.8% revenue share in 2024, valued for its efficient, uniform finishing of bulk components.

- The semi-automatic segment is projected to register a 5.0% CAGR during the forecast period, balancing automated efficiency with essential operator oversight.

- The ceramic media segment dominated with a 37.9% share in 2024, driven by its exceptional durability and ability to deliver high-quality finishes.

- The aerospace & defense segment is expected to register the highest CAGR of 5.9% during 2025–2034, fueled by strict demands for precision, safety, and regulatory compliance in components.

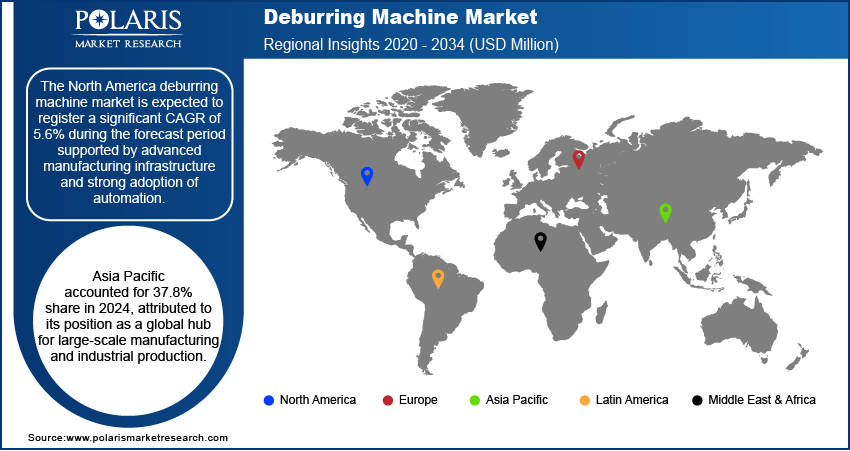

- The North America deburring machine market is projected to grow at a 5.6% CAGR, driven by advanced manufacturing infrastructure and high automation adoption rates.

- The U.S. held a 78.1% share of the North American market in 2024, owing to its sophisticated manufacturing base and early integration of automated technologies.

- Asia Pacific captured 37.8% of the global market share in 2024, reflecting its role as a major center for high-volume manufacturing and industrial output.

- The industry in India is growing rapidly, fueled by expansion in its automotive, electronics, and industrial manufacturing sectors, driven by the demand for precision components.

Industry Dynamics

- In the manufacturing sector, the rising shift toward automation is propelling the use of automated solutions to improve efficiency, precision, and reduce operational costs, which is creating market growth opportunities.

- The expanding automotive and aerospace sectors fuel demand for deburring machines, as they require precision-finished, burr-free components for critical performance and safety.

- The rapid expansion of the automotive and aerospace sectors creates strong demand for automated deburring machines that ensure the precision and safety of critical components.

- High initial investments and integration complexity for advanced automation restrain the adoption, particularly for small and medium-sized manufacturers.

Market Statistics

- 2024 Market Size: USD 1,019.34 million

- 2034 Projected Market Size: USD 1,696.22 million

- CAGR (2025–2034): 5.2%

- Asia Pacific: Largest market in 2024

AI Impact on Deburring Machine Market

- AI-powered vision systems automatically identify burrs and adapt machining paths in real-time, ensuring superior, consistent finishing without manual intervention.

- AI optimizes deburring cycles and predicts maintenance needs, reducing machine downtime and energy consumption while boosting overall production throughput.

- Automation driven by AI minimizes the need for skilled manual labor to operate machines or perform complex programming, addressing workforce shortages.

- AI algorithms analyze production data to continuously improve deburring parameters, leading to less material waste and lower cost per part over time.

A deburring machine, defined as an industrial equipment designed to remove sharp edges, burrs, and surface irregularities from metal, plastic, or composite components, is increasingly gaining importance with the rising demand for precision engineering. The need for highly accurate and smooth-finished components across sectors such as automotive, aerospace, and medical devices has been driving the market growth. Precision components improve product performance and also enhance durability and safety, making deburring processes essential in modern manufacturing. The reliance on automated deburring machines becomes critical in maintaining consistency and efficiency in production lines as industries shift toward tighter tolerances and miniaturized designs.

Advances in deburring technologies have transformed traditional manual processes into highly efficient, automated solutions. Innovations such as robotic deburring, ultrasonic systems, and integration of computer numerical control machines allow for higher accuracy, reduced cycle time, and cost-effectiveness in large-scale production. In May 2024, BENSELER introduced a CO2-free thermal deburring process using hydrogen. This method removes burrs from components made of aluminum, zinc, and steel in a single step without producing carbon dioxide emissions. These advancements improve operational efficiency and also ensure compatibility with Industry 4.0 initiatives, where smart manufacturing and automation are essential priorities. Moreover, the integration of advanced deburring systems helps manufacturers reduce material wastage, minimize errors, and achieve superior surface finishes, thereby positioning modern deburring machines as a vital enabler of next-generation manufacturing practices.

Drivers & Opportunities

Rising Automation in Manufacturing: Rising automation in manufacturing is driving growth opportunities as industries increasingly adopt automated solutions to enhance efficiency, accuracy, and cost-effectiveness. Automated deburring machines reduce reliance on manual labor, minimize human error, and deliver consistent quality even in high-volume production environments. In October 2024, Lissmac, with J. Schmalz GmbH, automated grinding machine loading using robotics, AI, and 3D vision sensors. This cell identifies and picks components from a pallet for deburring, particularly reducing the need for manual labor. Automation ensures shorter cycle times and higher throughput without compromising on precision, as manufacturers focus on lean production and just-in-time processes. This shift also supports integration with smart manufacturing systems, allowing real-time monitoring and process optimization, thereby making automated deburring a crucial component of modern industrial workflows.

Growth in Automotive & Aerospace Industries: The growth of the automotive and aerospace industries drives the demand for these machines due to the critical need for high-quality, precision-finished components in these sectors. In automotive manufacturing, components such as gears, engine parts, and braking systems require burr-free surfaces to ensure performance, safety, and longevity. Similarly, the aerospace sector demands extremely tight tolerances and flawless finishes to meet strict safety and regulatory standards. Deburring machines enable manufacturers to meet these quality benchmarks efficiently, ensuring reliability in parts that operate under high stress and complex conditions. In June 2025, AV&R and Saint-Gobain Surface Solutions collaborated on the AV&R BF-X 200-c robotic machine for testing, demonstration, and innovation purposes. The requirement for advanced deburring solutions is expected to drive market growth as these industries continue to expand globally.

Segmental Insights

Type Analysis

Based on type, the segmentation includes vibratory deburring, barrel tumbling, brush deburring, thermal deburring, electrochemical deburring, high-pressure water jet deburring, and others. The vibratory deburring segment accounted for 26.8% revenue share in 2024 due to its efficiency in handling bulk parts while ensuring uniform finishing. This method is particularly favored for its cost-effectiveness and versatility in processing components of different sizes and materials. It provides a consistent surface finish while reducing labor requirements, making it a preferred choice for industries with high-volume production needs. Additionally, the segment’s ability to balance efficiency with quality output has reinforced its adoption across automotive, aerospace, and general metalworking applications.

Operation Mode Analysis

In terms of operation mode, the segmentation includes automatic, semi-automatic, and manual. The semi-automatic segment is expected to witness the fastest growth at a CAGR of 5.0% during the forecast period, owing to its ability to provide a balance between automation and operator control. Manufacturers prefer semi-automatic machines as they offer flexibility in production while remaining more cost-effective than fully automated systems. These machines enable precise deburring for complex geometries while maintaining reduced operational complexity. Therefore, as industries aim for solutions that optimize efficiency without requiring high capital investment, semi-automatic deburring systems are increasingly becoming the preferred choice in production facilities.

Deburring Media Analysis

The segmentation, based on deburring media, includes ceramic, steel, plastic, and organic compounds. The ceramic segment accounted for a 37.9% share in 2024 due to its superior durability and effectiveness in providing high-quality surface finishes. Ceramic media is widely used for heavy-duty applications where aggressive cutting and polishing are required, particularly in automotive and aerospace component manufacturing. Its long lifespan and ability to handle a wide range of materials, from metals to composites, contribute to its dominance. Moreover, the preference for ceramic media is also linked to its consistency in achieving precise results, making it a reliable choice for industries requiring high-performance deburring processes.

End Use Analysis

Based on end use, the segmentation includes automotive, aerospace & defense, electronics, medical devices, metalworking, and others. The aerospace & defense segment is expected to register a CAGR of 5.9% during the forecast period. The dominance is attributed to the rising need for precision-engineered components that meet strict safety and regulatory standards. Components such as turbine blades, structural parts, and engine elements require flawless finishes to perform reliably under extreme conditions. Deburring machines play a critical role in achieving these requirements by ensuring burr-free surfaces and extended component lifespans. Therefore, as aerospace and defense manufacturing continues to highlight advanced materials and complex geometries, the demand for efficient deburring solutions is expected to rise steadily in the coming years.

Regional Analysis

The North America deburring machine market is expected to grow at a significant CAGR of 5.6% during the forecast period, supported by advanced manufacturing infrastructure and strong adoption of automation. The region’s well-established aerospace, automotive, and medical device industries create a steady demand for high-precision finishing solutions. Additionally, the presence of leading technology providers and growing focus on Industry 4.0 integration strengthen the regional market. Manufacturers in North America are increasingly investing in innovative deburring technologies that improve productivity and quality, further supporting the market’s expansion.

U.S. Deburring Machine Market Insights

The U.S. held 78.1% market share in the North America deburring machine landscape in 2024 due to its advanced manufacturing ecosystem and strong adoption of automation technologies. The country’s well-established aerospace, automotive, and medical device industries consistently demand high-precision finishing solutions, driving the growth of deburring equipment. Additionally, the focus on integrating smart manufacturing and Industry 4.0 solutions has encouraged the use of technologically advanced deburring systems that enhance efficiency and product quality.

Asia Pacific Deburring Machine Market Trends

The market in Asia Pacific accounted for a 37.8% share in 2024, attributed to its position as a global hub for large-scale manufacturing and industrial production. Rapid industrialization, with strong automotive and electronics manufacturing bases, has created a high demand for efficient finishing solutions. According to a Niti Aayog report, India's electronics sector was valued at USD 155 million in FY23, with production contributing USD 101 million, reflecting growth opportunities for deburring. The region also benefits from expanding aerospace and medical device production, where precision and surface quality are critical. Additionally, rising investments in automation and the availability of cost-competitive production facilities further accelerate the adoption of deburring machines in Asia Pacific.

India Deburring Machine Market Overview

The market in India is expanding due to the rapid growth of its automotive, electronics, and industrial manufacturing sectors, which increasingly require precision-engineered components. Increased industrialization and investments in modern production facilities have boosted the use of advanced deburring machines. Furthermore, the growing focus on enhancing component reliability and meeting global export standards is pushing Indian manufacturers to incorporate efficient surface finishing solutions into their workflows.

Europe Deburring Machine Market Outlook

The deburring machine industry in Europe is projected to hold a substantial share by 2034, due to the region’s strong focus on precision engineering and advanced manufacturing practices. Europe’s well-developed automotive and aerospace sectors continue to drive the demand for high-quality surface finishing solutions. According to December 2024 International Council on Clean Transportation data, 10.6 million new cars were registered in the EU states during 2023, boosting the need for deburring technologies. Additionally, strict regulatory requirements regarding product quality and safety standards push manufacturers toward adopting advanced deburring technologies. The region’s focus on sustainability and energy-efficient processes also encourages innovation in deburring systems, reinforcing its long-term market presence.

Germany Deburring Machine Market Trends

The growth is driven by the country’s leadership in precision engineering and its strong presence in the automotive and aerospace sectors. German manufacturers prioritize high-quality standards and advanced finishing techniques, making deburring technologies an essential part of production. In addition, the country’s continuous investments in automation and innovation enables the adoption of refined deburring systems designed to support complex manufacturing requirements while maintaining superior surface finishes.

Key Players & Competitive Analysis

The deburring machine industry is witnessing competition as manufacturers aim to meet growing demands for precision components across automotive, aerospace, and medical device sectors. Companies are investing heavily in advanced technologies, with industry leaders such as EMAG, Loeser, and SEMA Technology pioneering robotic deburring systems, AI-powered quality control, and environmentally sustainable processes.

Revenue growth is being driven by the industry's shift toward high-speed, eco-friendly deburring solutions, particularly in the rapidly expanding Asia Pacific manufacturing sector. Companies are making strategic R&D investments and forming partnerships to tap into previously underserved markets, especially targeting small and medium enterprises that need cost-effective automation solutions.

The landscape is becoming increasingly complex due to geopolitical uncertainties and ongoing supply chain challenges. These factors are forcing vendors to rethink their strategies, with many now prioritizing localized production and building more resilient supply networks. Established market leaders are focusing on delivering customized solutions to maintain their competitive edge, while newer companies are competing aggressively on both pricing and innovative features.

A few major companies operating in the deburring machine market include Abtex LLC; ATI Industrial Automation, Inc.; AXIOME; BENSELER; EMAG Systems GmbH; Kadia Production; Loeser GmbH; PROCECO Ltd.; RSA Cutting Technologies Ltd; SBS Ecoclean Group; SEMA Technology Group; Silberhorn Group; and Sugino Corp.

Key Players

- Abtex LLC

- ATI Industrial Automation, Inc.

- AXIOME

- BENSELER

- EMAG Systems GmbH

- Kadia Production

- Loeser GmbH

- PROCECO Ltd.

- RSA Cutting Technologies Ltd

- SBS Ecoclean Group

- SEMA Technology Group

- Silberhorn Group

- Sugino Corp.

Deburring Machine Industry Developments

- July 2025: MC Machinery Systems launched a Finishing Division through a partnership with Italy's EMC Srl. This expands its portfolio to provide end-to-end fabrication capabilities, including surface finishing alongside laser cutting and bending.

- April 2025: Brother Industries launched new deburring machines in its SPEEDIO series, including a compact 4-axis BT15 spindle model for die-cast parts. It offers simplified teaching point setup and automated tool path generation to minimize preparation time.

Deburring Machine Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Vibratory Deburring

- Barrel Tumbling

- Brush Deburring

- Thermal Deburring

- Electrochemical Deburring

- High-Pressure Water Jet Deburring

- Others

By Operation Mode Outlook (Revenue, USD Million, 2020–2034)

- Automatic

- Semi-automatic

- Manual

By Deburring Media Outlook (Revenue, USD Million, 2020–2034)

- Ceramic

- Steel

- Plastic

- Organic Compounds

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Aerospace & Defense

- Electronics

- Medical Devices

- Metalworking

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Deburring Machine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,019.34 Million |

|

Market Size in 2025 |

USD 1,071.45 Million |

|

Revenue Forecast by 2034 |

USD 1,696.22 Million |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,019.34 million in 2024 and is projected to grow to USD 1,696.22 million by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period.

The market in Asia Pacific accounted for a 37.8% share in 2024.

A few of the key players in the market are Abtex LLC; ATI Industrial Automation, Inc.; AXIOME; BENSELER; EMAG Systems GmbH; Kadia Production; Loeser GmbH; PROCECO Ltd.; RSA Cutting Technologies Ltd; SBS Ecoclean Group; SEMA Technology Group; Silberhorn Group; and Sugino Corp.

The vibratory deburring segment accounted for 26.8% revenue share in 2024.

The semi-automatic segment is expected to register a CAGR of 5.0% during the forecast period