Dental Lasers Market Size, Share, Trends, Industry Analysis Report

: By Product (Dental Surgical Lasers and Dental Welding Lasers), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM3672

- Base Year: 2024

- Historical Data: 2020-2023

Dental Lasers Market Overview

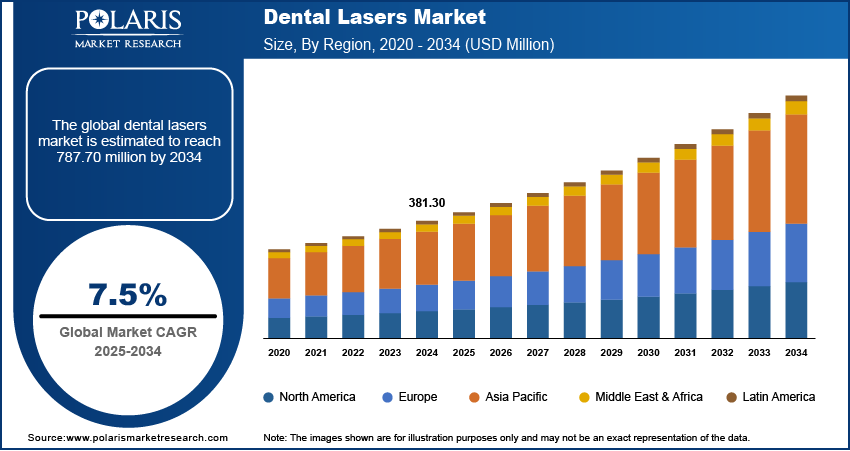

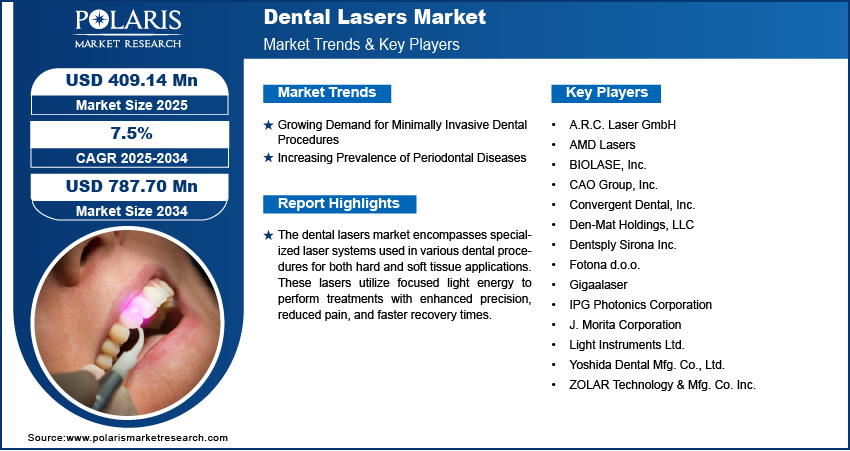

The dental lasers market size was valued at USD 381.30 million in 2024. The market is projected to grow from USD 409.14 million in 2025 to USD 787.70 million by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

The dental lasers market focuses on laser-based devices used for various dental procedures, including soft tissue and hard tissue applications. These lasers offer precision, reduced treatment time, and minimal discomfort compared to conventional techniques. The market encompasses diode lasers, CO2 lasers, and erbium lasers, among others, catering to applications such as cavity preparation, periodontal treatment, and teeth whitening. The market is expected to witness significant growth with advancements in laser technology, increasing awareness of minimally invasive dental surgeries, and growing demand for cosmetic dentistry.

Key drivers of the dental lasers market include the rising prevalence of dental disorders, the increasing demand for painless and minimally invasive treatments, and technological advancements in laser dentistry. Additionally, the growing geriatric population, which is more prone to dental conditions, and the expansion of dental clinics and hospitals worldwide contribute to the market growth.

To Understand More About this Research: Request a Free Sample Report

Dental Lasers Market Dynamics

Growing Demand for Minimally Invasive Dental Procedures

There is an increasing patient preference for minimally invasive dental treatments that offer reduced discomfort and faster recovery times. Dental lasers align with this demand by enabling precise tissue removal with minimal trauma, often eliminating the need for sutures and reducing postoperative pain. The American Dental Association (ADA) recognizes the efficacy of lasers in performing soft tissue procedures with enhanced patient comfort and improved healing outcomes. This shift towards less invasive techniques has propelled the adoption of laser technology in dental practices, as patients and practitioners alike seek methods that minimize procedural invasiveness while maintaining high standards of care, thereby driving the dental lasers market expansion.

Increasing Prevalence of Periodontal Diseases

The rising incidence of periodontal diseases has necessitated advanced treatment modalities, with dental lasers offering effective solutions for managing these conditions. According to the Centers for Disease Control and Prevention (CDC), nearly half of adults aged 30 years and older in the United States exhibit signs of gum disease, highlighting a significant public health concern. Dental lasers provide targeted therapy by precisely removing diseased tissue and bacteria, promoting regeneration, and reducing pocket depths. Their ability to perform these tasks with minimal discomfort and improved healing has made lasers a valuable tool in periodontal therapy, contributing to their increased adoption in dental practices and thereby expanding the dental lasers market demand.

Dental Lasers Market Segment Analysis

Dental Lasers Market Assessment by Product

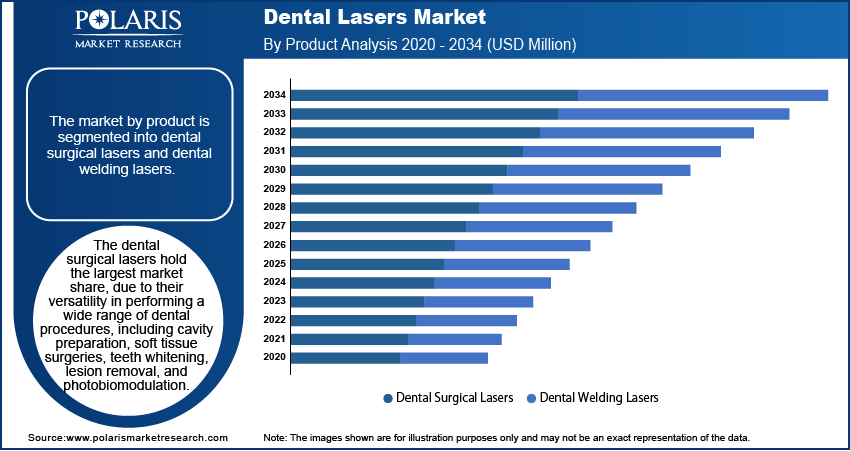

The dental lasers market segmentation, based on product, includes dental surgical lasers and dental welding lasers. The dental surgical lasers hold the largest dental lasers market share. This dominance is attributed to their versatility in performing a wide range of dental procedures, including cavity preparation, soft tissue surgeries, teeth whitening, lesion removal, and photobiomodulation. The precision and control offered by dental surgical lasers improve surgical outcomes and reduce healing times, making them a preferred choice among dental professionals. Technological advancements, such as the integration of diode lasers for treating periodontal inflammatory diseases, have further propelled the adoption of dental surgical lasers. Studies have demonstrated that diode laser treatments effectively reduce gum bleeding, pain, and inflammation while minimizing the need for anesthesia and eliminating the discomfort associated with traditional dental drills. These benefits contribute to increased patient satisfaction and drive the growth of this segment in the global market.

Dental Lasers Market Evaluation by End Use

The dental lasers market is segmented by end use into hospitals, dental clinics, and others. The dental clinics segment holds the largest market share. This prominence is attributed to the widespread availability of advanced dental equipment’s and dental care services within these clinics, which serve as primary centers for various dental treatments, including laser-assisted procedures. The integration of advance laser technology in dental clinics improves the precision and efficiency of treatments, leading to improved patient outcomes and satisfaction. Moreover, the accessibility and convenience offered by dental clinics encourage patients to seek specialized care, further driving the adoption of dental lasers in these settings. The continuous advancements in laser technology, coupled with the growing demand for minimally invasive dental procedures, position dental clinics at the forefront of the market.

Dental Lasers Market Regional Insights

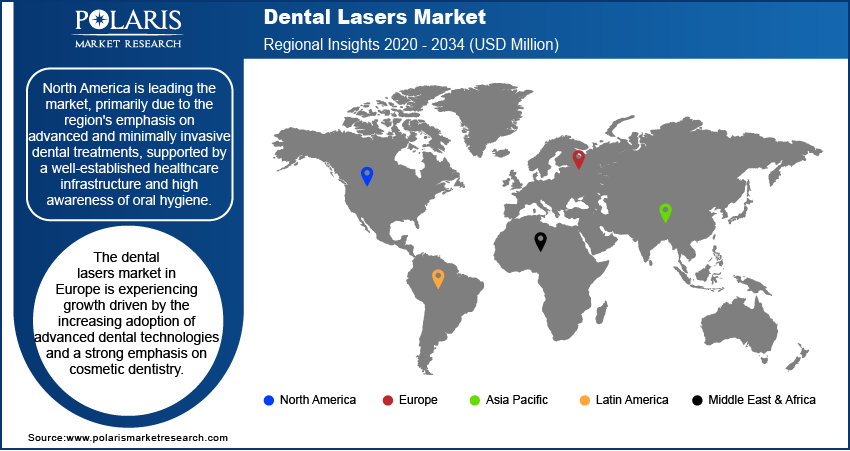

By region, the study provides dental lasers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is leading the market, primarily due to the region's emphasis on advanced and minimally invasive dental treatments, supported by a well-established healthcare infrastructure and high awareness of oral care and hygiene. The adoption of dental lasers in North America is driven by their advantages, including precise targeting, reduced bleeding, minimized trauma to surrounding tissues, and faster healing times, which align with the preferences of both patients and dental practitioners seeking more comfortable and efficient treatment options. Additionally, the presence of key market players and robust research and development initiatives further stimulate dental lasers market growth in the region.

The dental lasers market in Europe is experiencing growth driven by the increasing adoption of advanced dental technologies and a strong emphasis on cosmetic dentistry. Countries such as Germany, the UK, and France are at the forefront of this trend, with dental professionals integrating laser technologies into their practices to improve treatment precision and patient comfort. The aging population in Europe, which is more susceptible to dental ailments, further propels the demand for innovative dental solutions. Additionally, supportive regulatory frameworks and substantial investments in healthcare infrastructure contribute to the market expansion in this region.

Asia Pacific is witnessing rapid growth in the dental lasers market, primarily due to increasing awareness of oral health and a rising demand for minimally invasive dental procedures. Countries including China, India, and Japan are notable contributors to this surge, driven by their large populations and improving healthcare facilities. The increasing middle class in these nations is seeking advanced dental care, including laser treatments that offer reduced discomfort and quicker recovery times. Moreover, the region's emergence as a hub for dental tourism, offering cost-effective yet high-quality treatments, further accelerates market growth.

Dental Lasers Market – Key Players and Competitive Insights

The dental lasers market features several prominent companies actively contributing to its growth and innovation. Key players include A.R.C. Laser GmbH; AMD Lasers; BIOLASE, Inc.; CAO Group, Inc.; Convergent Dental, Inc.; Den-Mat Holdings, LLC; Dentsply Sirona Inc.; Fotona d.o.o.; Gigaalaser; IPG Photonics Corporation; J. Morita Corporation; Light Instruments Ltd.; Yoshida Dental Mfg. Co., Ltd.; and ZOLAR Technology & Mfg. Co. Inc. These companies are recognized for their active presence in the market, continually advancing dental laser technologies to enhance patient care and procedural efficiency.

In the competitive landscape, BIOLASE, Inc. stands out for its comprehensive range of laser systems designed for both hard and soft tissue procedures, emphasizing minimally invasive treatments. Fotona is noted for its dual-wavelength laser systems, offering versatility across various dental applications. Gigaalaser focuses on user-friendly diode laser systems catering to everyday dental practices. IPG Photonics Corporation brings its expertise in fiber laser technology to the dental field, providing high-precision solutions. CAO Group, Inc. offers innovative soft tissue laser products, enhancing surgical outcomes.

BIOLASE, Inc., founded in 1987 and headquartered in Foothill Ranch, California, is a prominent provider of laser systems for the dental industry. The company develops, manufactures, markets, and sells laser systems designed to perform a wide range of dental procedures, including cosmetic and complex surgical applications. BIOLASE's flagship product line, Waterlase, utilizes patented laser technology to offer minimally invasive treatment options, enhancing patient comfort and clinical outcomes.

Fotona, established in 1964, is a well-established developer of high-technology laser systems, recognized for designing, manufacturing, and supporting advanced solid-state laser systems for medical and dental applications. With a focus on innovation, Fotona offers a range of dental lasers that cater to both hard and soft tissue procedures, providing dental professionals with versatile and reliable tools. The company's commitment to quality and continuous development has solidified its position as a trusted name in the dental laser market.

List of Key Companies in Dental Lasers Market:

- A.R.C. Laser GmbH

- AMD Lasers

- BIOLASE, Inc.

- CAO Group, Inc.

- Convergent Dental, Inc.

- Den-Mat Holdings, LLC

- Dentsply Sirona Inc.

- Fotona d.o.o.

- Gigaalaser

- IPG Photonics Corporation

- J. Morita Corporation

- Light Instruments Ltd.

- Yoshida Dental Mfg. Co., Ltd.

- ZOLAR Technology & Mfg. Co. Inc.

Dental Lasers Market Developments

- February 2024: BIOLASE, Inc. launched the Waterlase iPlus Premier Edition, which debuted at the Chicago Midwinter Meeting 2024. The innovative all-tissue laser system is designed to enhance dental care efficiency.

- November 2023: Convergent Dental launched Solea Protect, an enhancement to the Solea All-Tissue Laser. The new application is designed to reduce mineral loss and protect teeth against decay, improving dental care efficiency.

Dental Lasers Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Dental Surgical Lasers

- Dental Welding Lasers

By Application Outlook (Revenue-USD Million, 2020–2034)

- Conservative Dentistry

- Endodontic Treatment

- Oral Surgery

- Implantology

- Peri-implantitis

- Periodontics

- Tooth Whitening

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Hospitals

- Dental Clinics

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Dental Lasers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 381.30 million |

|

Market Size Value in 2025 |

USD 409.14 million |

|

Revenue Forecast by 2034 |

USD 787.70 million |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy

The dental lasers market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the dental lasers market focuses on technological advancements, expanding clinical applications, and increasing awareness among dental professionals and patients. Companies emphasize research and development to introduce innovative laser systems with enhanced precision, user-friendliness, and treatment efficiency. Strategic partnerships, educational programs, and training initiatives help drive adoption among dental practitioners. Market players also expand their global presence through product launches, regulatory approvals, and collaborations with healthcare institutions. Additionally, targeted marketing efforts highlight the benefits of laser dentistry, such as minimally invasive procedures and improved patient outcomes, to boost market penetration.

FAQ's

The dental lasers market size was valued at USD 381.30 million in 2024 and is projected to grow to USD 787.70 million by 2034.

The market is projected to register a CAGR of 7.5% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the dental lasers market include A.R.C. Laser GmbH; AMD Lasers; BIOLASE, Inc.; CAO Group, Inc.; Convergent Dental, Inc.; Den-Mat Holdings, LLC; Dentsply Sirona Inc.; Fotona d.o.o.; Gigaalaser; IPG Photonics Corporation; J. Morita Corporation; Light Instruments Ltd.; Yoshida Dental Mfg. Co., Ltd.; and ZOLAR Technology & Mfg. Co. Inc

The dental surgical lasers segment accounted for the larger market share in 2024.

The dental clinics segment accounted for the larger share of the market in 2024.