Dermal Fillers Market Size, Share, & Industry Analysis Report

By Product (Hyaluronic Acid, Calcium Hydroxyl Apatite), By Drug Type, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6087

- Base Year: 2024

- Historical Data: 2020-2023

Overview

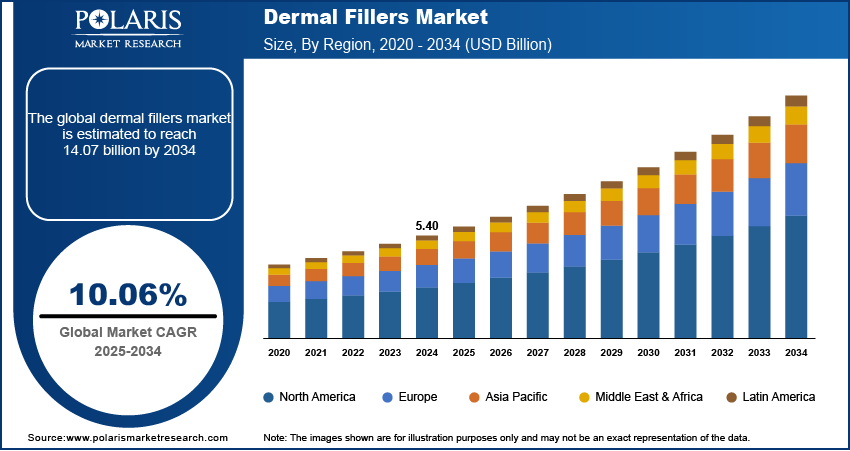

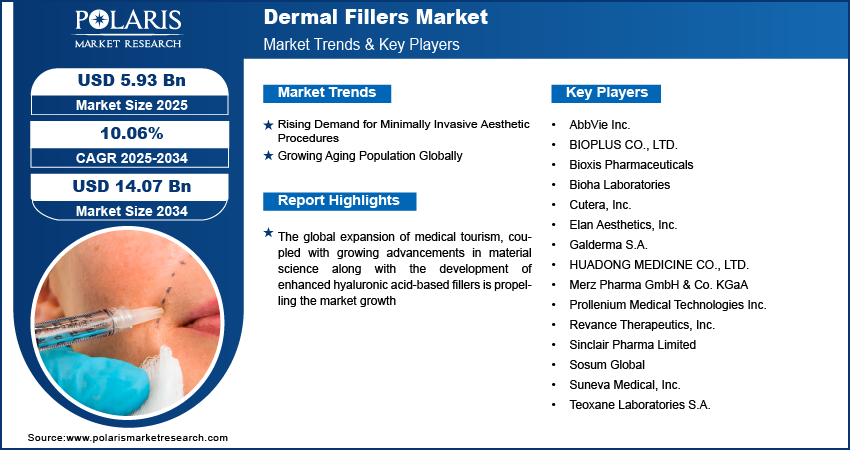

The global dermal fillers market size was valued at USD 5.40 billion in 2024, growing at a CAGR of 10.06% from 2025–2034. Rising demand for minimally invasive aesthetic procedures coupled with growing aging population is driving the market growth globally.

Key Insights

- The hyaluronic acid segment dominated the market share in 2024.

- The temporary biodegradable segment is projected to grow at the fastest rate over the forecast period, owing to the affordable treatment options and increasing acceptance of generic formulations among clinics and patients in price-sensitive markets.

- The North America dermal fillers market dominated the global market share in 2024.

- The US dermal fillers market held the largest regional share of the North America market in 2024, due to the increasing preference for minimally invasive aesthetic solutions.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is driven by a rising middle-class population and increased urbanization across countries such as China, South Korea, Thailand, and India.

- The market in India is expanding due to the rise of medical tourism and domestic interest in aesthetic procedures.

Industry Dynamics

- Rising demand for minimally invasive aesthetic procedures is supporting wider adoption of dermal fillers as a preferred treatment method for facial rejuvenation.

- Increasing aging population globally is contributing to a higher volume of wrinkle correction, skin restoration, and volume enhancement procedures.

- Integration of nanotechnology in dermal fillers is creating market opportunities, enabling more precise delivery of active ingredients, enhancing treatment efficacy while minimizing potential side effects.

- High treatment costs in developed markets and limited reimbursement policies are constraining adoption in certain consumer segments.

Market Statistics

- 2024 Market Size: USD 5.40 billion

- 2034 Projected Market Size: USD 14.07 billion

- CAGR (2025-2034): 10.06%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Dermal fillers are injectable substances formulated to restore facial volume, smooth out wrinkles, and enhance facial contours without surgical intervention. These fillers possess the ability to integrate seamlessly with the skin’s natural structure, offering immediate correction of age-related volume loss and providing subtle refinements in areas such as the lips, cheeks, and jawline. This approach enables quicker results, minimal recovery time, and high patient satisfaction, positioning dermal fillers as a preferred solution for individuals seeking personalized aesthetic enhancements.

The global expansion of medical tourism is significantly contributing to the growth of the dermal fillers market. Countries such as South Korea, Turkey, and Thailand are leading cosmetic procedures due to a combination of skilled professionals, modern healthcare infrastructure, and competitive pricing. According to the Medical Tourism Association, around 14 million people travel abroad annually for medical treatment, with many from the UK and US seeking more affordable care in less-developed countries. Patients from regions such as Europe, the Middle East, and North America are traveling to these destinations for aesthetic enhancements, including dermal filler treatments. These countries are offering affordability, ensuring adherence to global safety and quality standards, attracting a growing volume of international patients.

In addition, the growing advancements in material science along with the development of enhanced hyaluronic acid-based fillers is further propelling the market growth. Manufacturers are introducing formulations that provide extended durability, improved integration with skin tissue, and more natural aesthetic results. For instance, in February 2025, Evolus received FDA approval for two next-generation hyaluronic acid dermal fillers, Evolysse Form and Evolysse Smooth, developed with Cold‑X technology to better preserve HA structure and deliver natural-looking volume correction in nasolabial folds at varying tissue depths. These innovations improved the performance of dermal fillers in facial injectable, wrinkle correction, and lip enhancement procedures.

Drivers & Opportunities

Rising Demand for Minimally Invasive Aesthetic Procedures

The growing inclination toward non-surgical cosmetic interventions is boosting the dermal fillers market. Aesthetic procedures using injectable fillers are growing due to shorter recovery times and reduced complication risks, compared to traditional surgical approaches. The 2023 Procedural Statistics from the American Society of Plastic Surgeons (ASPS) reveal a 5% increase in plastic surgeries and a 7% rise in minimally invasive procedures over the previous year. This is leading to widespread acceptance across dermatology clinics, aesthetic centers, and ambulatory care settings. The increasing awareness surrounding the safety profile of dermal fillers, coupled with the convenience of quick in-office treatments, is attracting a diverse demographic range of patients.

Growing Aging Population Globally

The global rise in the aging population is further increasing the demand for dermal fillers. Facial volume loss, fine lines, and skin laxity become more noticeable over time, driving increased demand for treatments that help restore a youthful appearance. Dermal fillers offer a non-surgical method to address these concerns through facial volume restoration, wrinkle reduction, and lip enhancement. According to the World Health Organization (WHO), one in six people globally is expected to be aged 60 years or older by 2030. The number of individuals in this age group is projected to grow from 1 billion in 2020 to 1.4 billion by 2030, and further rise to 2.1 billion by 2050. Additionally, the population aged 80 and above is expected to triple, reaching 426 million by mid-century. This demographic shift is strengthening the demand for aesthetic products that provide natural-looking results with minimal downtime.

Segmental Insights

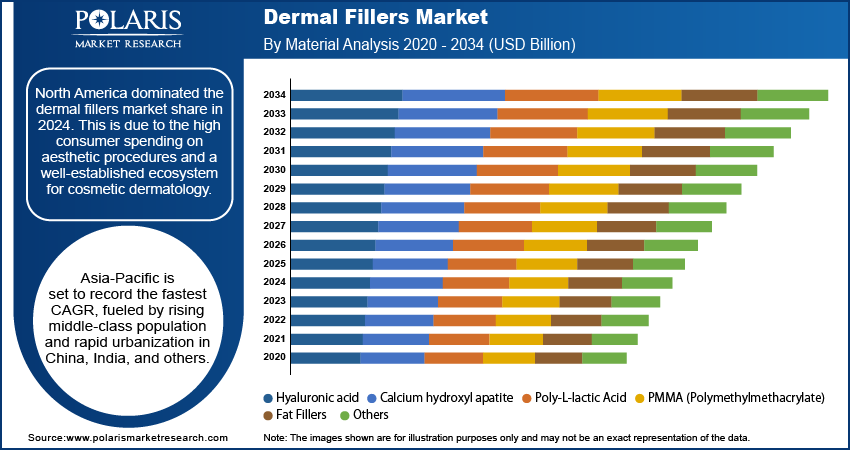

Material Analysis

Based on material, the segmentation includes hyaluronic acid, calcium hydroxyl apatite, poly-L-lactic acid, PMMA (Polymethylmethacrylate), fat fillers, and others. The hyaluronic acid segment held the largest market share in the global dermal fillers market. This dominance is attributed to its high biocompatibility, reversible nature, and widespread use in minimally invasive facial aesthetics. Hyaluronic acid fillers are favored for their ability to attract water molecules, resulting in natural-looking volume enhancement and wrinkle correction. Brands such as Juvederm and Restylane become industry standards, supported by a strong portfolio of FDA-approved products for multiple facial areas including lips, cheeks, and nasolabial folds.

The poly-L-lactic acid segment is projected to be the fastest-growing category during the forecast period. This growth is driven by the rising demand for longer-lasting collagen stimulators that provide gradual and natural-looking volume restoration. Poly-L-lactic acid works by stimulating the body’s collagen production, with effects lasting up to two years. It is increasingly used in deeper facial volume loss treatments and is gaining popularity among patients seeking durable, subtle enhancements with fewer maintenance sessions.

Product Analysis

By product, the market is segmented into non-biodegradable, biodegradable, temporary biodegradable, and semi-permanent biodegradable fillers. The biodegradable segment held the largest revenue share in 2024, due to its natural breakdown ability within the body, reducing the need for surgical removal or long-term follow-up interventions. These fillers are used in various aesthetic procedures where safety, reversibility, and controlled degradation are essential. Manufacturers continue to introduce novel biodegradable formulations with improved cross-linking technologies to meet evolving clinical needs.

The temporary biodegradable segment is anticipated to register the fastest growth from 2025 to 2034. These fillers provide short-term results and appeal to first-time users who seek flexibility in aesthetic enhancements. Also, increased adoption is observed among younger individuals who prefer customized treatments that meet evolving beauty trends. The ease of application and minimal risk of permanent alteration are key factors driving the uptake of temporary fillers across dermatology practices.

Drug Type Analysis

In terms of drug type, the segmentation comprises branded and generic products. The branded segment dominated the dermal fillers market in 2024 due to the strong market presence of globally recognized manufacturers offering high-quality, approved filler products. These products undergo rigorous clinical evaluations, ensuring safety and efficacy in various cosmetic procedures. Dermatologists and aesthetic practitioners prefer branded fillers for consistent performance, established reputation, and post-procedure support services offered by manufacturers.

The generic segment is expected to expand at the highest growth rate during the forecast period. The rise in affordable treatment options and increasing acceptance of generic formulations among clinics and patients in price-sensitive markets are driving this trend. Regulatory approvals of generic fillers in selected regions, along with improved distribution networks, are making these products more accessible.

Application Analysis

Based on application, the segmentation includes wrinkle correction treatment, scar treatment, lip enhancement, restoration of volume, and others. The wrinkle correction treatment segment accounted for the largest share of the global market in 2024 due to the widespread demand for procedures that address common signs of aging such as fine lines, nasolabial folds, and forehead creases using filler injections to restore skin smoothness and elasticity. The rise in demand for non-surgical facial rejuvenation across middle-aged and elderly populations made wrinkle correction one of the most widely performed aesthetic applications globally.

The lip enhancement segment is forecasted to grow at the fastest CAGR over the coming years. The popularity of fuller lips among younger consumers, coupled with the influence of social media and celebrity culture, is driving increased demand for lip augmentation procedures. Clinics are offering tailored lip filler services that deliver volume, symmetry, and contour improvements with minimal downtime. Additionally, the introduction of specialized fillers for lip application is boosting the segment growth.

End User Analysis

In terms of end user, the segmentation includes specialty & dermatology clinics, hospitals, and others. The specialty and dermatology clinics segment led the market in 2024, due to the presence of skilled professionals and the availability of personalized aesthetic solutions, which support high procedural volumes. Dermatologists at these facilities stay abreast of the latest filler technologies and treatment techniques, further enhancing consumer trust and procedural outcomes.

The hospitals segment is projected to witness the fastest growth through 2034. Expansion of aesthetic services within general hospitals, in Asia Pacific and the Middle East, is contributing to this trend. The International Society of Aesthetic Plastic Surgery reports that 46.9% of surgical procedures are primarily conducted in hospital settings worldwide. Patients increasingly prefer receiving cosmetic treatments in hospital settings that provide comprehensive medical oversight and access to emergency care if needed. Growing investment in infrastructure and service diversification in hospital networks is further fueling the segment's growth.

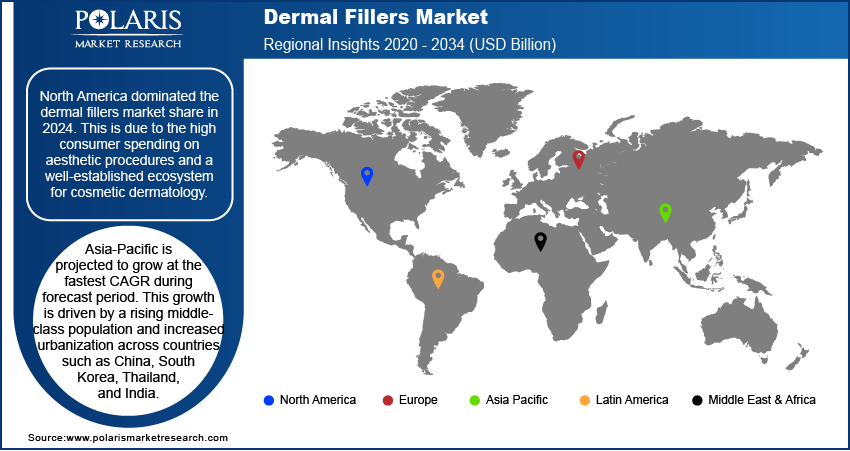

Regional Analysis

North America dermal fillers market dominated the global market in 2024. This is due to the high consumer spending on aesthetic procedures and a well-established ecosystem for cosmetic dermatology. A large proportion of the population in the region, particularly in urban areas, is opting for non-surgical facial rejuvenation procedures to address signs of aging and improve facial features. Additionally, the availability of board-certified dermatologists and plastic surgeons is enhancing the safety and quality of dermal filler treatments across clinics and aesthetic centers. These professionals adopt the latest filler technologies, contributing to the steady demand for advanced injectable products.

The US Dermal Fillers Market Insight

The US held dominating market share in North America dermal fillers landscape in 2024, due to the increasing preference for minimally invasive aesthetic solutions. Consumers are drawn to filler procedures that offer faster recovery, natural results, and minimal discomfort. According to the International Society of Aesthetic Plastic Surgery, the US recorded the highest number of aesthetic procedures globally, exceeding 6.1 million procedures. The growing influence of beauty-focused digital platforms is shaping consumer preferences, encouraging younger age groups to pursue subtle enhancements. The rise in outpatient dermatology centers and aesthetic practices is making dermal fillers more accessible to a broader population.

Asia Pacific Dermal Fillers Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is driven by a rising middle-class population and increased urbanization across countries such as China, South Korea, Thailand, and India. Cosmetic awareness is increasing among younger demographics, and the availability of affordable aesthetic procedures is accelerating the adoption of injectable treatments. Governments in ASEAN countries and China are streamlining regulatory pathways for importing dermatology devices and products, improving market accessibility for global brands. Local clinics are investing in advanced technologies to meet rising consumer expectations in urban centers.

India Dermal Fillers Market Overview

The market in India is expanding due to the rise of medical tourism and domestic interest in aesthetic procedures. International patients are drawn to India for its cost-effective, high-quality cosmetic treatments offered by skilled dermatologists and plastic surgeons. According to the India Brand Equity Foundation, medical tourism in private hospitals is expected to grow nearly twice as fast as the overall healthcare industry in FY25. This segment currently makes up about 10–12% of hospital revenue. The country’s competitive pricing structure, coupled with the presence of internationally accredited facilities, is contributing to the industry's growth. Additionally, increasing exposure to global beauty trends is influencing demand across metropolitan areas, boosting the market growth.

Europe Dermal Fillers Market

The dermal fillers landscape in Europe is projected to hold a substantial share in 2034. This is owing to the aging population seeking non-surgical anti-aging treatments in countries such as Germany, France, and Italy. These countries are equipped with a well-established infrastructure of dermatology and aesthetic clinics, providing advanced facial rejuvenation services. As per Eurostat data, the share of the aging population in the European Union reached 21.6% in 2024, up from 21.3% in 2023, reflecting a continued demographic shift toward an older population. This growth highlights the rising demand for age-related healthcare and aesthetic solutions across the region. In addition, strict regulatory oversight and high product safety standards in the European Union strengthen consumer confidence in injectable treatments. This is driving the rising popularity of dermal fillers as a trusted option for addressing age-related facial concerns across major European markets.

Key Players & Competitive Analysis Report

The dermal fillers market is moderately competitive, shaped by a growing demand for non-invasive aesthetic enhancements and the continuous development of advanced filler technologies. Key players are emphasizing long-lasting formulations, natural-looking outcomes, and biocompatibility to cater to evolving consumer preferences. Innovation is centered around cross-linking technologies, hyaluronic acid optimization, and multifunctional fillers that address volume restoration and skin revitalization. Leading companies are investing in clinical research, aesthetic physician training programs, and consumer education campaigns to boost product adoption and brand differentiation. Strategic efforts include geographic expansion into high-growth markets, portfolio diversification, and regulatory pathway optimization to accelerate product approvals. Moreover, firms are strengthening aesthetic ecosystem offerings, including complementary skin treatments and delivery technologies to enhance procedural outcomes.

Prominent players operating in the dermal fillers industry include AbbVie Inc., BIOPLUS CO., LTD., Bioxis Pharmaceuticals, Bioha Laboratories, Cutera, Inc., Elan Aesthetics, Inc., Galderma S.A., HUADONG MEDICINE CO., LTD., Merz Pharma GmbH & Co. KGaA, Prollenium Medical Technologies Inc., Revance Therapeutics, Inc., Sinclair Pharma Limited, Sosum Global, Suneva Medical, Inc., and Teoxane Laboratories S.A.

Key Players

- AbbVie Inc.

- BIOPLUS CO., LTD.

- Bioxis Pharmaceuticals

- Bioha Laboratories

- Cutera, Inc.

- Elan Aesthetics, Inc.

- Galderma S.A.

- HUADONG MEDICINE CO., LTD.

- Merz Pharma GmbH & Co. KGaA

- Prollenium Medical Technologies Inc.

- Revance Therapeutics, Inc.

- Sinclair Pharma Limited

- Sosum Global

- Suneva Medical, Inc.

- Teoxane Laboratories S.A.c

Industry Developments

- February 2025: Evolus secured FDA approval for its Evolysse Form and Evolysse Smooth injectable hyaluronic acid gels, marking its official entry into the US dermal filler market. These products are addressed as the first major technological advancement in HA-based dermal fillers in the past ten years, increasing Evolus' potential market reach by 78% to an estimated USD 6 billion.

- January 2024: Galderma received Health Canada approval for Restylane SHAYPE, its firmest hyaluronic acid injectable formulated with NASHA HD technology for deep, bone-mimicking chin augmentation. Clinical trials showed 91% patient-rated improvement at 12 months and 84% of patients would use SHAYPE again, illustrating high satisfaction and long-term efficacy.

Dermal Fillers Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Hyaluronic acid

- Calcium hydroxyl apatite

- Poly-L-lactic Acid

- PMMA (Polymethylmethacrylate)

- Fat Fillers

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Non-biodegradable

- Biodegradable

- Temporary biodegradable

- Semi-Permanent biodegradable

By Drug Type Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Generic

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Wrinkle Correction Treatment

- Scar treatment

- Lip enhancement

- Restoration of volume

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Specialty and Dermatology Clinics

- Hospitals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dermal Fillers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.40 Billion |

|

Market Size in 2025 |

USD 5.93 Billion |

|

Revenue Forecast by 2034 |

USD 14.07 Billion |

|

CAGR |

10.06% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.40 billion in 2024 and is projected to grow to USD 14.07 billion by 2034.

The global market is projected to register a CAGR of 10.06% during the forecast period.

North America dominated the market in 2024, due to the high consumer spending on aesthetic procedures and a well-established ecosystem for cosmetic dermatology.

A few of the key players in the market are AbbVie Inc., BIOPLUS CO., LTD., Bioxis Pharmaceuticals, Bioha Laboratories, Cutera, Inc., Elan Aesthetics, Inc., Galderma S.A., HUADONG MEDICINE CO., LTD., Merz Pharma GmbH & Co. KGaA, Prollenium Medical Technologies Inc., Revance Therapeutics, Inc., Sinclair Pharma Limited, Sosum Global, Suneva Medical, Inc., and Teoxane Laboratories S.A.

The hyaluronic acid segment dominated the market in 2024, due to its natural breakdown ability within the body, reducing the need for surgical removal or long-term follow-up interventions.

The hospitals segment is projected to grow at the fastest pace through 2034, driven by expanding aesthetic services and rising patient preference for hospital-based cosmetic procedures.