Digital Agriculture Market Size, Share, Trends, Industry Analysis Report

: By Component (Solution and Services), Deployment, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5614

- Base Year: 2024

- Historical Data: 2020-2023

Digital Agriculture Market Overview

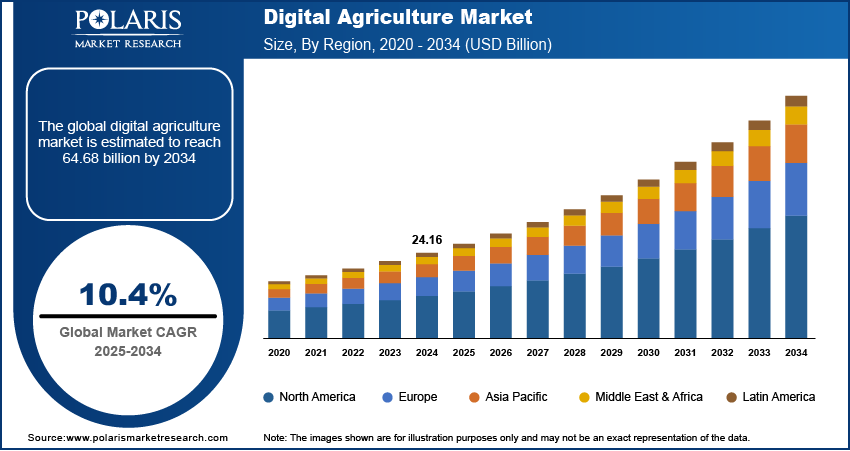

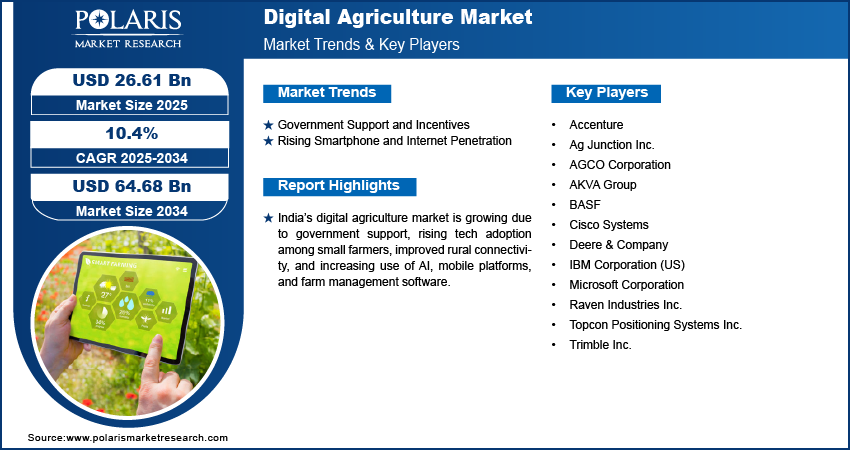

The digital agriculture market size was valued at USD 24.16 billion in 2024. The market is projected to grow from USD 26.61 billion in 2025 to USD 64.68 billion by 2034, exhibiting a CAGR of 10.4% during 2025–2034.

Digital agriculture comprises the use of digital technologies such as sensors, GPS, drones, and data analytics to improve farming efficiency and productivity. It helps farmers make informed decisions by collecting, analyzing, and applying data throughout the agricultural process.

The world’s growing population is increasing the pressure on farmers to produce more food using limited land and resources. This rising demand is encouraging the adoption of digital agriculture tools such as precision farming, which helps optimize planting, irrigation, and fertilization. Smart farming technologies play a crucial role by allowing farmers to monitor crop health and yields more accurately. Data-driven farming enables producers to make informed decisions that support efficient and sustainable, and organic food production. This ongoing shift is pushing the agricultural sector toward digital solutions that boost productivity while protecting the environment, thereby driving the digital agriculture market growth.

Rapid technological progress has made digital farming tools more effective and accessible. Innovations such as agricultural drones, IoT in agriculture, and AI in agriculture allow farmers to collect real-time data on weather, soil conditions, and crop growth. These technologies are the backbone of smart farming, enabling high levels of automation and precision. Farm management software further supports better planning and resource use, making farming more efficient and profitable. It is becoming easier and more affordable for farmers to embrace digital agriculture as tech continues to evolve.

To Understand More About this Research: Request a Free Sample Report

Digital Agriculture Market Dynamics

Government Support and Incentives

Governments worldwide are promoting digital agriculture through subsidies, policy frameworks, and research funding. According to the Indian Ministry of Agriculture & Farmers Welfare, in September 2024, the Indian government announced the approval to the launch of Digital Agriculture Mission. Many support the use of agri-tech solutions such as precision farming and remote sensing in agriculture to increase productivity and reduce environmental impact. Policies that encourage digital infrastructure, such as better internet access in rural areas, also help. These initiatives make it easier for farmers to adopt smart farming technologies and benefit from improved yields and resource use. Thus, government support and incentives drive the digital agriculture market expansion.

Rising Smartphone and Internet Penetration

Access to smartphones and internet connections is growing globally, even in remote areas. According to the World Bank, in 2023, 65% of the world's population had access to the internet. This connectivity opens the door to farm management software, mobile-based smart farming technologies, and cloud platforms that deliver real-time information. Farmers use precision farming tools, receive weather forecasts, and even sell products online with better digital access. The spread of affordable internet further supports IoT in agriculture, enabling devices such as sensors and cameras to work seamlessly, thereby fueling the adoption of digital technologies and driving the digital agriculture market development.

Digital Agriculture Market Segment Analysis

Market Assessment by Component Outlook

The market segmentation, based on component, includes solutions and services. The solution segment accounted for a larger share in 2024. This includes hardware tools that help farmers improve productivity and decision-making. These solutions offer real-time insights into crop health, soil conditions, and weather patterns, making them essential for modern farming practices. The high adoption of digital agriculture solutions is driven by their ability to increase efficiency and reduce costs. Consequently, the solution segment dominated the digital agriculture market share.

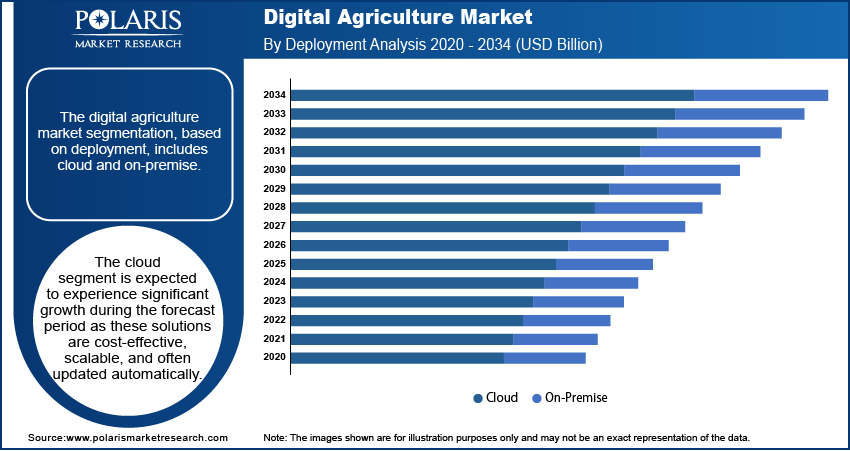

Market Evaluation by Deployment Outlook

The market segmentation, based on deployment, includes cloud and on-premise. The cloud segment is expected to experience significant growth during the forecast period. Cloud-based digital agriculture tools allow farmers to access data and software from anywhere using the internet, making it easier to manage farms remotely. These solutions are cost-effective, scalable, and often updated automatically, which reduces the need for technical support on-site. More farmers are shifting to cloud-based platforms for tasks such as crop monitoring, weather forecasting, and farm management as internet access continues to improve, especially in rural areas, thereby driving the segmental growth.

Digital Agriculture Market Regional Analysis

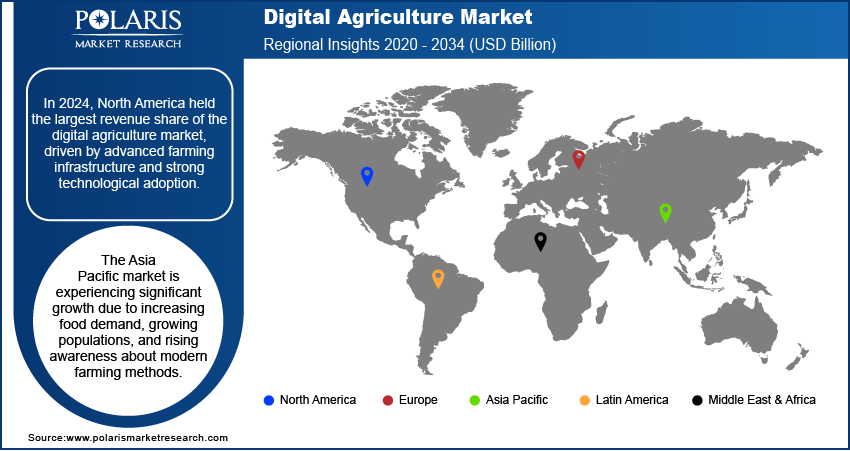

By region, the study provides the digital agriculture market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the digital agriculture market revenue, driven by advanced farming infrastructure and strong technological adoption. Farmers in the US and Canada widely use precision farming software and tools, IoT devices, and farm management software to improve productivity and reduce operational costs. Government support, high internet penetration, and strong investments in agri-tech startups contribute to the regional market growth. Large-scale farms and access to modern equipment also make it easier to integrate 5G smart farming technologies. Additionally, the presence of major players in the region is driving the adoption of digital farming in North America.

The Asia Pacific market is experiencing significant growth due to increasing food demand, growing populations, and rising awareness about modern farming methods. Countries such as China, Japan, and Australia are investing heavily in agri-tech solutions, including drones, data analytics, and remote sensing technologies. Smallholder farmers are gradually adopting smart agriculture tools, supported by improving internet connectivity and government initiatives. For instance, according to the World Bank, in 2023, 87% of Japan's population had access to the Internet. The region’s strong push for food security and sustainable farming practices is further fueling the digital agriculture market growth in Asia Pacific.

The market growth in India is driven by a large agricultural workforce and increasing government support for agri-tech innovation. The adoption of farm management software, robo advisory platforms, and AI tools is rising, especially among small and mid-sized farmers. Government schemes such as Digital India and various state-level initiatives are promoting digital literacy and infrastructure in rural areas. Access to real-time data on weather, prices, and crop health is becoming more common, with smartphone use growing rapidly in farming communities. India's market revenue is expected to grow significantly as more startups and tech companies enter the space,

Digital Agriculture Market – Key Players & Competitive Analysis Report

The digital agriculture market trends are in a state of rapid transformation, driven by a diverse array of companies that are striving to innovate and differentiate their offerings. Established global corporations command a significant share of the market through substantial investments in research and development and the application of advanced technologies. These industry leaders are actively engaged in strategic maneuvers—including mergers and acquisitions, partnerships, and collaborative ventures—to enhance their product portfolios and penetrate new market segments.

Emerging startups are making significant inroads, introducing groundbreaking solutions tailored to meet the needs of targeted market niches. The intensified competition within the sector is further fueled by ongoing advancements in product capabilities and functionalities, thereby reshaping the landscape of digital agriculture. A few major players in the market are Accenture, Ag Junction Inc., AGCO Corporation, AKVA Group, BASF, Cisco Systems, Deere & Company, IBM Corporation (US), Microsoft Corporation, Raven Industries Inc., Topcon Positioning Systems Inc., and Trimble Inc.

Accenture is a global professional services company that provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in six segments: media & technology, communications, financial services, health & public service, products, and resources. Artificial intelligence (AI) is one of the key focus areas for Accenture. The company offers various AI solutions to help clients optimize their operations, improve customer experiences, and drive business growth. These solutions include AI-powered automation, machine learning, natural language processing, and predictive analytics. Accenture has invested heavily in building a strong ecosystem of AI partners, including technology giants such as Google, Microsoft, and Amazon Web Services, as well as niche AI startups. The company's AI solutions are designed to integrate seamlessly with existing technology systems and processes, enabling clients to derive maximum value from their investments. Accenture is a leading partner for cloud professional services. The company serves over 34,000 cloud projects in nearly every industry to build secure cloud solutions. It has a network of about 400 innovation centers, studios, and centers worldwide and has offices in more than 200 cities in 50 countries. Accenture's connected crop solution is a mobile application designed to connect farmers with agro-input companies, providing a steady stream of information and advice to improve crop yield. It aims to improve productivity and address ecosystem challenges for smallholder farmers and field agents.

Trimble Inc., a global technology company, specializes in providing advanced solutions for various sectors, including agriculture, construction, geospatial, and transportation. Founded in 1978, Trimble is headquartered in Sunnyvale, California, USA. The company operates across multiple regions worldwide, including North America, Europe, Asia Pacific, and Latin America, serving a diverse clientele with its range of technological innovations. Trimble is a publicly traded company and does not have a parent company. The company offers comprehensive smart farming solutions designed to enhance productivity and operational efficiency. Recently, it has launched a suite of products incorporating 5G technology to support precision agriculture. These products include advanced GPS systems and data analytics tools that leverage 5G services to provide real-time insights and improved automation capabilities for farmers.

List of Key Companies in Digital Agriculture Market

- Accenture

- Ag Junction Inc.

- AGCO Corporation

- AKVA Group

- BASF

- Cisco Systems

- Deere & Company

- IBM Corporation

- Microsoft Corporation

- Raven Industries Inc.

- Topcon Positioning Systems Inc.

- Trimble Inc.

Digital Agriculture Industry Developments

In April 2023, AGCO and Hexagon agreed to expand the distribution of Hexagon's Ag guidance systems. With the new agreement, customers will have an option between third-party aftermarket systems and AGCO’s premium integrated guidance systems, MF Guide and Valtra Guide.

In September 2020, AGRIVI launched two new products, Precision Field and Farm Fleet, enhancing its digital agriculture platform with tools for precision farming insights and real-time machinery monitoring, now available in test mode.

Digital Agriculture Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Solution

- Services

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- Cloud

- On-Premise

By Application Outlook (Revenue USD Billion, 2020–2034)

- Yield Monitoring

- Field Mapping

- Crop Monitoring

- Livestock Monitoring

- Real-Time Safety Testing

- Soil Monitoring

- Precision Farming

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Agriculture Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.16 billion |

|

Market Size Value in 2025 |

USD 26.61 billion |

|

Revenue Forecast by 2034 |

USD 64.68 billion |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 24.16 billion in 2024 and is projected to grow to USD 64.68 billion by 2034.

The global market is projected to register a CAGR of 10.4% during the forecast period.

North America held the largest share in the global market in 2024.

A few key players in the market are Accenture, Ag Junction Inc., AGCO Corporation, AKVA Group, BASF, Cisco Systems, Deere & Company, IBM Corporation (US), Microsoft Corporation, Raven Industries Inc., Topcon Positioning Systems Inc., and Trimble Inc.

The solution segment accounted for a larger share in 2024.

The cloud segment is expected to experience significant growth as cloud-based agriculture solutions are cost-effective, scalable, and often updated automatically.