Farm Management Software Market Size, Share, Trends, Industry Analysis Report

: By Component, By Application (Precision Farming, Livestock Monitoring, Smart Greenhouse, and Others), By Deployment, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3516

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

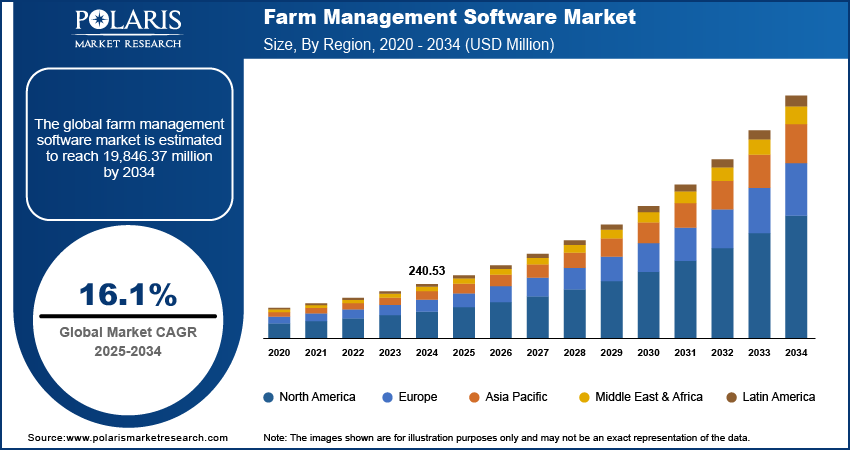

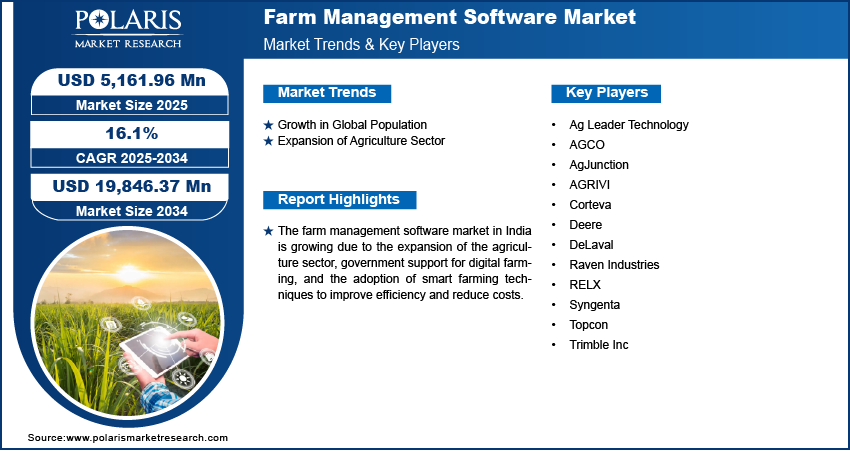

The farm management software market size was valued at USD 4.16 billion in 2024, exhibiting a CAGR of 17.2% during 2025–2034. The market is driven by a rising global population, increasing food demand, and government investments promoting digital agriculture adoption and infrastructure, alongside growing indoor farming and technological advancements such as IoT, AI, and cloud computing, enhancing farm efficiency and decision-making.

Key Insights

Precision farming led the market in 2024 due to its ability to optimize yield and resource use while addressing climate concerns.

Web-based deployment dominated due to cost-effectiveness, ease of access, and compatibility with a wide range of farm equipment and operations.

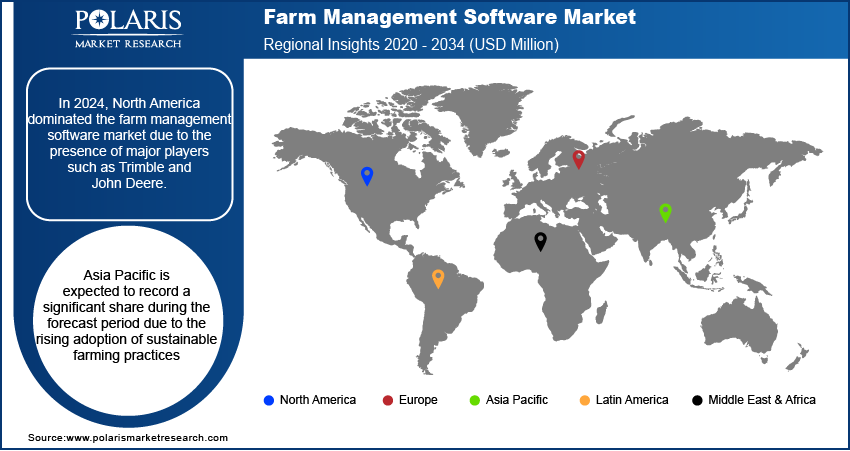

North America led in 2024 due to widespread precision agriculture practices, strong R&D investment, and supportive government digital agriculture programs.

Asia Pacific is witnessing rapid growth due to urbanization, increasing food demand, and government support for smart farming technologies.

Industry Dynamics

Growing global food demand is pushing farmers to adopt software that enhances productivity, reduces waste, and improves operational efficiency.

Government investments in digital agriculture are increasing FMS adoption through subsidies, training, and infrastructure for modernizing farm practices.

Advancements in AI, IoT, and cloud technologies are enabling smarter decision-making and predictive insights, accelerating market growth.

High initial implementation costs and a lack of digital literacy in rural areas restrict the widespread adoption of FMS among small-scale farmers.

Market Statistics

2024 Market Size: USD 4.16 billion

2034 Projected Market Size: USD 20.28 billion

CAGR (2025–2034): 17.2%

North America: Largest market in 2024

AI Impact on Farm Management Software Market

AI helps predict crop yields, weather changes, and pest risks, allowing farmers to plan better.

AI tracks animal health and behavior using sensors and cameras to catch issues early.

It helps farmers use less water, fertilizer, and pesticides by analyzing what’s truly needed.

AI turns complex farm data into easy-to-understand charts, alerts, and suggestions.

New AI features make farm software smarter and easier to use for all types of farms.

To Understand More About this Research: Request a Free Sample Report

Farm management software (FMS) is a digital tool designed to streamline agricultural operations by automating business management, record-keeping, and decision-making processes. It consolidates data across various farm activities, including crop planning, livestock management, inventory control, and financial tracking, to enhance productivity and profitability. FMS replaces traditional methods such as spreadsheets and physical logs with centralized platforms that offer real-time monitoring, reporting, and analytics. Key features of farm management software include crop rotation planning, soil and weather analysis integration, equipment maintenance tracking, and compliance management, enabling farmers to optimize resource use and reduce operational risks. Farm management software (FMS) is widely used for crop management, helping farmers schedule planting, track growth stages, and monitor soil health through integrated sensors and GPS tools.

The rising population globally is propelling the farm management software market growth. The United Nations published data stating that the world's population is projected to continue growing for the next 50 to 60 years, peaking at approximately 10.3 billion by mid-2080. This rising population is increasing the demand for food, putting pressure on farmers to optimize their operations, manage resources better, and reduce waste, creating a strong need for farm management software. This software helps farmers track crop performance, monitor livestock, manage finances, and streamline supply chains, enabling them to scale production effectively to meet the demand for food. Additionally, with larger populations, regulatory and sustainability pressures rise, and farm management software provides data-driven insights to comply with these standards while maximizing yields. Hence, as the population expands, farmers increasingly rely on technology to sustain output, making farm management software a critical tool for modern agriculture.

The farm management software market demand is driven by the rising government spending in digital agriculture. Farmers across the globe are gaining financial support to implement farm management software, with governments investing in subsidies, grants, and training programs for agri-tech and digital agriculture adoption. Increased funding also accelerates research and development, leading to more innovative and user-friendly software tailored to modern farming challenges. The Government approved the Digital Agriculture Mission in September 2024 with a total outlay of Rs. 2,817 Crores or USD 329.6 million. Government initiatives are promoting digital literacy and infrastructure improvements, such as rural internet connectivity, enabling farmers to leverage cloud-based farm management software effectively. Therefore, government investments in digital agriculture are encouraging wider adoption of farm management software across the agricultural sector.

Market Dynamics

Rising Demand for Indoor Farming

Indoor farms rely heavily on technology to monitor and adjust factors such as lighting, temperature, humidity, and nutrient levels, creating vast amounts of data that farmers must analyze in real time. Farm management software helps streamline these operations by automating climate control, tracking plant growth stages, and optimizing resource use to maximize yields. As more indoor farms scale up to meet growing food demands, they require advanced tools to manage labor, inventory, and energy efficiency, all of which farm management systems provide. Hence, the rising demand for indoor farming boosts the farm management software market expansion.

Growing Advancement in Technology

Innovations such as IoT sensors, AI-driven analytics, and cloud computing allow farmers to collect real-time data on soil health, crop conditions, and equipment performance. Such innovations propel the adoption of farm management software that processes and interprets this information. Farmers are also increasingly relying on farm management software to forecast yields, detect diseases early, and optimize inputs with machine learning, improving predictive capabilities. Additionally, mobile technology and user-friendly interfaces make farm management software accessible even to small-scale farmers, expanding the farm management software industry.

Segment Insights

Market Evaluation by Application

Based on application, the market is divided into precision farming, livestock monitoring, smart greenhouse, and others. The precision farming segment accounted for a major farm management software market share in 2024 due to rising demand to optimize yields, minimize resource waste, and enhance decision-making based on real-time data. The rising concerns over climate change and soil degradation further accelerated the demand for precision-driven practices, as farmers sought to boost productivity while maintaining environmental sustainability. Additionally, government initiatives and subsidies promoting smart agriculture technologies significantly encouraged the implementation of precision farming solutions across major agricultural economies such as the US, Brazil, India, and several European nations.

The livestock monitoring segment is expected to grow at a robust pace in the coming years. Farmers and ranchers are increasingly recognizing the value of real-time animal health tracking, behavior analysis, and automated feeding systems in maximizing herd productivity and profitability. Advances in wearable devices, biometric sensors, and AI-powered health prediction tools are transforming livestock operations, enabling early disease detection and reducing mortality rates. Moreover, rising global demand for dairy and meat products puts pressure on producers to enhance operational efficiency and animal welfare standards. Regulatory frameworks emphasizing traceability and ethical livestock practices, particularly in North America and Europe, are also driving the strong anticipated growth of livestock monitoring solutions.

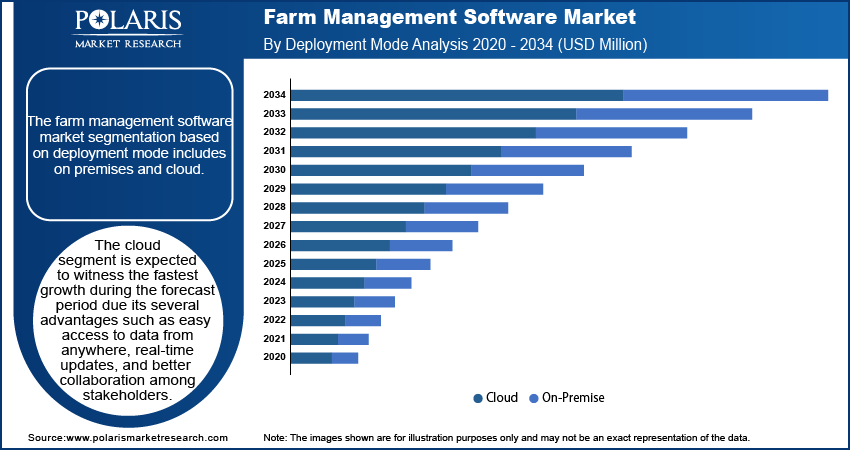

Market Insight by Deployment

In terms of deployment, the farm management software market is segregated into web-based and cloud-based. The web-based segment dominated the market share in 2024 due to its ease of access, lower upfront costs, and relatively simple integration with existing farm equipment and processes. Web platforms allowed farmers to manage operations remotely, access real-time data, and make faster decisions without the need for complex installations or high-end hardware. The widespread availability of internet connectivity, even in rural areas, and the increasing digital literacy among farmers further fueled the adoption of web-based systems. Additionally, web-based farm management solutions often featured user-friendly interfaces and customizable modules, which enabled farms of all sizes, from small family-owned operations to large commercial enterprises, to implement technology at a pace and scale suited to their needs.

Regional Outlook

By region, the farm management software market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2024 due to increasing adoption of precision farming technologies, government incentives for digital agriculture, and the rising demand for efficient agricultural practices. Farmers in the region, particularly large-scale operators, are rapidly incorporating software solutions to optimize crop production, manage resources more effectively, and enhance overall operational efficiency. The presence of several established software providers, coupled with strong investment in research and development, has also supported the dominance of the region. The rise in concerns about sustainability and food security, as well as the need to reduce environmental impact, further pushes the adoption of farm management software in the region.

The farm management software industry in Asia Pacific is expected to expand at a robust pace in the coming years, owing to the rapid urbanization, growing population, and the shift toward modern farming practices. UNFPA Asia Pacific stated that the Asia and the Pacific region is home to 60% of the world’s population and is expected to increase future. Farmers in the region are increasingly turning to software solutions, including farm management software, to monitor crop health, optimize irrigation, track weather patterns, and forecast yields more accurately to cater to the food demand of this growing population. These solutions help address challenges such as limited arable land, water scarcity, and the need for more efficient use of resources. The push for smart agriculture in China, driven by government-backed initiatives and investments in agri-tech startups, is also accelerating the farm management software market growth.

Key Players and Competitive Analysis

The farm management software (FMS) market is highly competitive, characterized by mergers and acquisitions, collaborations, and strategic partnerships aimed at expanding product portfolios and market reach. Major players have strengthened their positions through strategic acquisitions, collaborations, and partnerships. Emerging startups, such as are driving innovation with cloud-based and AI-powered FMS solutions, intensifying competition. Established tech firms have entered the market through strategic alliances, leveraging their cloud platforms to offer scalable farm management tools. Product portfolio diversification remains a key strategy in the market, with companies integrating IoT, drone analytics, and blockchain for traceability.

The market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Aegro, AgriERP, AGRIVI, AgriWebb, Agworld Pty Ltd, Bushel Inc., Conservis, Croptracker, eAgronom, Farmbrite, Navfarm, Syngenta, and xFarm Technologies.

AGRIVI is a leading global provider of farm management software, designed to empower farmers, agribusinesses, and food industry stakeholders with data-driven tools and real-time insights for optimizing agricultural operations. Established in 2013, AGRIVI has grown to serve over 30,000 clients across 150 countries, offering a comprehensive digital platform that centralizes all aspects of farm management-from planning and monitoring to analysis and reporting. The software of the company enables users to plan, track, and analyze every farm activity, including tillage, planting, crop protection, fertilization, irrigation, and harvesting, all within a user-friendly interface.

xFarm Technologies is a prominent provider of farm management software, offering a comprehensive digital platform designed to optimize agricultural operations for farms of all sizes. The xFarm platform offers farmers a suite of tools that cover the full spectrum of farm management, from administration and production to personnel oversight and logistics. xFarm Technologies places a strong emphasis on sustainability and data-driven decision-making. The company’s platform leverages AI and agronomic expertise to provide actionable insights that help farmers optimize irrigation, crop protection, fertilization, and resource allocation, ultimately improving both efficiency and environmental impact.

Key Companies in Farm Management Software Market

- Aegro

- AgriERP

- AGRIVI

- AgriWebb

- Agworld Pty Ltd

- Bushel Inc.

- Conservis

- Croptracker

- eAgronom

- Farmbrite

- Navfarm

- Syngenta

- xFarm Technologies

Farm Management Software Industry Developments

March 2025: xFarm Technologies, a leading tech company in the digitalization of agriculture, announced a strategic operation to join forces with Checkplant, an AgTech company, to extend its reach into Latin America.

September 2024: AGRIVI partnered with the Barbados Agricultural Development and Marketing Corporation (BADMC) to introduce the innovative AI-driven advisory platform to improve the productivity and sustainability of Barbados' national agriculture.

July 2024: Syngenta announced the launch of its innovative digital agricultural platform, Cropwise. Cropwise combines advanced digital solutions to provide a complete farm management system to producers, sustainably optimizing the productivity and profitability of their operations.

Farm Management Software Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Services

- Assisted Professional Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Web-Based

- Cloud-Based

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Farm Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 4.16 Billion |

|

Market Forecast in 2025 |

USD 4.87 Billion |

|

Revenue Forecast by 2034 |

USD 20.28 Billion |

|

CAGR |

17.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.16 billion in 2024 and is projected to grow to USD 20.28 billion by 2034.

The global market is projected to register a CAGR of 17.2% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Aegro, AgriERP, AGRIVI, AgriWebb, Agworld Pty Ltd, Bushel Inc., Conservis, Croptracker, eAgronom, Farmbrite, Navfarm, Syngenta, and xFarm Technologies.

The web-based segment dominated the market revenue in 2024.

The livestock monitoring segment is expected to grow at the fastest pace in the coming years.