Digital Substation Market Size, Share, Industry Analysis Report

By Module (Hardware, Fiber-Optic Communication Networks, SCADA), By Insulation (Transmission Substation, Distribution Substation), By Voltage, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM5703

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

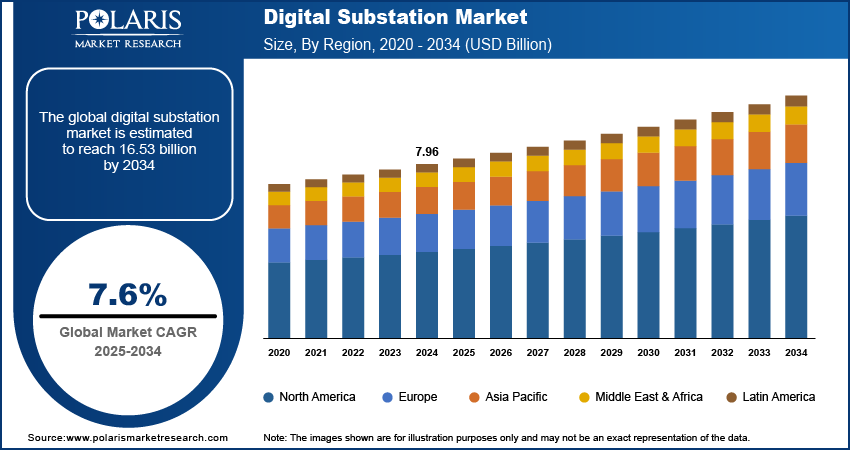

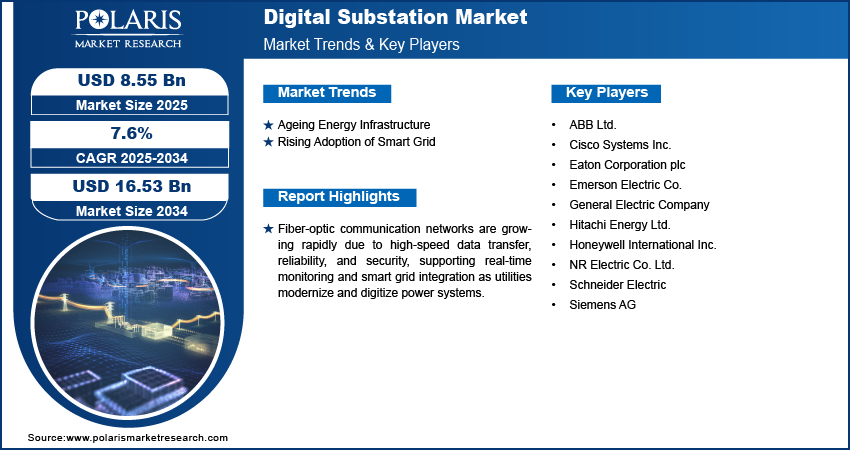

The global digital substation market size was valued at USD 7.96 billion in 2024, growing at a CAGR of 7.6% from 2025 to 2034. The market is driven by ageing energy infrastructure and increasing investments in the smart grid. Also, the rising penetration of renewable energy is expected to boost the industry expansion in the coming years.

Key Insights

- The fiber-optic communication networks segment is expected to experience significant growth during the forecast period. It is due to their high-speed data transmission, electromagnetic interference resistance, and improved reliability.

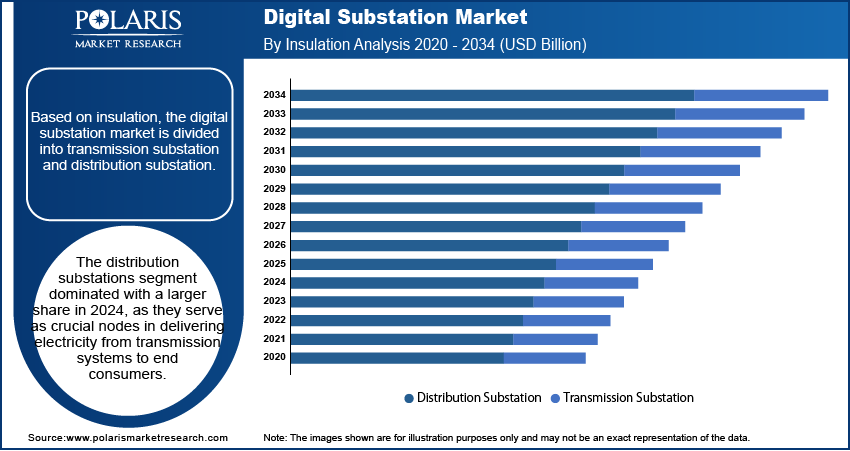

- The distribution substations segment dominated in 2024. They serve as crucial nodes in delivering electricity from transmission systems to end consumers.

- The above 500kV voltage segment is expected to record significant growth during the forecast period. It is due to the increasing need for high-capacity power transmission over long distances.

- The transportation segment is expected to witness significant growth during the forecast period. The growth is attributed to the electrification of railways, metros, and electric vehicle (EV) infrastructure.

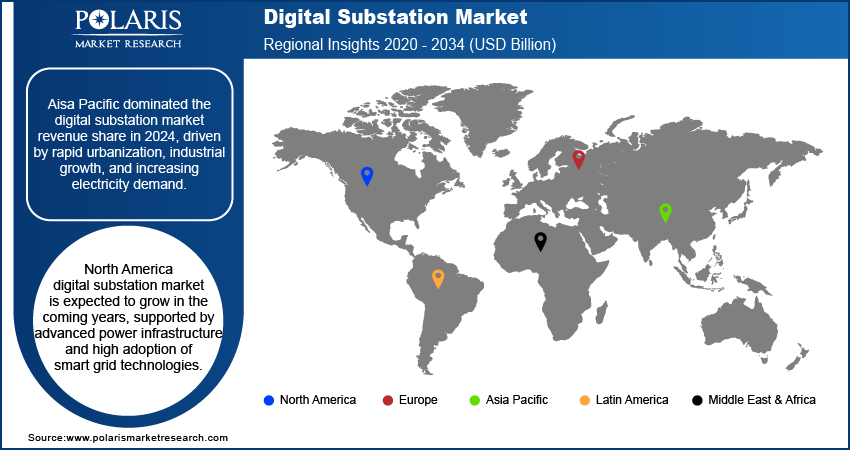

- Asia Pacific dominated the digital substation market in 2024. It is driven by rapid urbanization, industrial growth, and increasing electricity demand.

- The North America digital substation industry is expected to grow during 2025–2034. Advanced power infrastructure and high adoption of smart grid technologies boost the growth.

Industry Dynamics

- Growing electricity demand, due to rapid urbanization and industrialization, propels the market expansion.

- Aging energy infrastructure drives the demand for digital substations to reduce downtime and extend equipment life.

- Rising adoption of smart grid is expected to provide opportunities during the forecast period.

- High upfront costs hinder the adoption of digital substations.

Market Statistics

2024 Market Size: USD 7.96 billion

2034 Projected Market Size: USD 16.53 billion

CAGR (2025–2034): 7.6%

Asia Pacific: Largest market in 2024

AI Impact on Digital Substation Market

- Artificial intelligence (AI) technologies, including machine learning (ML), deep learning, and neural networks, play a key role in modern substation automation.

- The technologies enable predictive maintenance. They anticipate equipment failures before they happen, which reduces downtime.

- ML algorithms help identify anomalies and isolate faults rapidly.

- AI is used to enhance load forecasting and energy distribution efficiency.

To Understand More About this Research: Request a Free Sample Report

A digital substation replaces traditional analog control and monitoring systems with digital communication and intelligent electronic devices (IEDs) to manage power flow more efficiently. It enhances grid reliability, safety, and flexibility while enabling real-time data analysis and remote operation.

More countries and companies are investing in clean energy sources such as wind and solar, creating the need for power grids to manage variable energy inputs effectively. According to the World Economic Forum, in 2024, the world renewable energy capacity grew by 15.1%. Renewable energy does not provide a constant flow of electricity, which means utilities require smarter systems to balance supply and demand. Digital substations play a major role by offering real-time monitoring and control, making it easier to manage fluctuations in energy generation. These technologies enable smooth integration of renewable sources into the grid, helping to maintain stability and reliability, thereby driving their demand.

Growing urbanization and industries are leading to a continuous rise in electricity demand. According to the World Bank, 4.4 billion people live in urban areas, which is creating higher demand for buildings and transportation systems. New buildings, factories, transportation systems, and data centers all depend on a steady and reliable power supply. Traditional substations often struggle to handle this increased load efficiently. Digital substations offer scalable and flexible solutions to meet modern energy demands. These systems adapt to rising power needs and allow for improved control over electricity distribution, thereby driving their demand.

Industry Dynamics

Ageing Energy Infrastructure

Many existing substations were built decades ago and are no longer efficient or reliable. According to the Break Through Energy Organization, alone Europe’s energy infrastructure is 40 years old. These aging systems face problems such as frequent breakdowns, slow response times, and high maintenance costs. To solve these issues, utility companies are upgrading to digital substations, which use modern technology to improve performance. Digital substations allow for better automation, quicker fault detection, and easier data collection. This modernization helps reduce downtime and extend equipment life, thereby driving their demand in the industry.

Rising Adoption of Smart Grid

Smart grids use digital technology to make electricity delivery more reliable, efficient, and flexible. Digital substations are a major part of smart grids because they allow for real-time communication between different parts of the power system. This enables faster decision-making, remote monitoring, and automated responses to power disturbances. Utilities can detect and fix problems quickly, often without sending workers to the site with smart grids. More regions are developing smart grid infrastructure to meet modern energy needs due to which the demand for digital substations is growing. For instance, according to the International Energy Agency, China aimed to modernize and expand its power grids with smart grid with USD 442 billion in investments during 2021–2025. Thus, rising adoption of smart grid drives the digital substation market growth.

Segmental Insights

By Module Analysis

The fiber-optic communication networks segment is expected to experience significant growth during the forecast period due to their high-speed data transmission, electromagnetic interference resistance, and improved reliability. These networks enable real-time monitoring, remote control, and seamless data exchange between intelligent electronic devices (IEDs). Utilities are increasingly favoring fiber-optic systems over traditional copper wiring because of their lower latency, reduced signal loss, and enhanced security. The need for efficient communication infrastructure is expected to rise as power systems become more digitized and demand for smart grid solutions grows, thereby driving the segment growth.

By Insulation Analysis

The distribution substations segment dominated with the largest share in 2024, as they serve as crucial nodes in delivering electricity from transmission systems to end consumers. These substations are widely deployed across urban and rural areas to manage medium-voltage power distribution efficiently. Growing electricity demand, especially in residential and commercial zones, has increased the need for reliable and flexible distribution infrastructure. Digital upgrades in these substations improve real-time control, reduce downtime, and support smart metering and automation. Their widespread presence and essential role in grid performance make distribution substations drive the segment dominance.

By Voltage Analysis

The above 500kV voltage segment is expected to record significant growth due to the increasing need for high-capacity power transmission over long distances. This voltage range is commonly used in large-scale interconnections and cross-border transmission projects, especially in countries investing heavily in renewable energy and grid expansion. Digital substations operating at these voltages improve safety, efficiency, and system reliability through advanced protection and automation systems. This segment is expected to record rapid growth as global electricity demand grows and high-voltage infrastructure becomes a priority for handling bulk power flows, particularly in regions with large-scale energy projects and complex transmission networks.

By Application Analysis

The transportation segment is expected to witness significant growth during the forecast period, driven by the electrification of railways, metros, and electric vehicle (EV) infrastructure. Transportation systems require stable, uninterrupted power to ensure safety and operational efficiency. Digital substations offer real-time monitoring, fault detection, and load management, which are critical for smooth transportation operations. Governments and city planners are increasingly adopting electric transit solutions to reduce emissions and improve mobility, which, in turn, is boosting demand for modern substations. Digital substations are becoming vital for powering systems effectively and reliably as smart transportation and EV charging networks expand.

Regional Analysis

The Asia Pacific digital substation market dominated in 2024, driven by rapid urbanization, industrial growth, and increasing electricity demand. Countries such as China, Japan, and South Korea are heavily investing in smart grid infrastructure to improve energy efficiency and reduce power outages. Expanding renewable energy projects, especially solar and wind, require advanced grid systems, further boosting digital substation adoption. Supportive government policies, technological advancements, and rising investments in modernizing aging power infrastructure is driving the regional industry growth.

The India digital substation market is growing due to its ongoing power sector reforms and infrastructure development. The government’s push for renewable energy, smart cities, and reliable electricity access in rural areas is driving demand for digital technologies. State utilities and private players are investing in upgrading old substations with modern, automated systems that handle growing power loads efficiently. Digital substations help improve reliability, reduce outages, and support better load management. In the coming years, the demand for digital substation solutions is expected to rise across both urban and remote regions in India as energy demand continues to rise.

The North America digital substation market is expected to grow supported by advanced power infrastructure and high adoption of smart grid technologies. The US is leading with large-scale investments in grid modernization and integration of renewable energy sources. Utilities across the region are focused on improving grid resilience, reducing carbon emissions, and replacing aging infrastructure, which all utilize digital substation deployment. Additionally, strict regulatory standards and strong focus on grid security further support the growing demand or digital substation.

The Canada digital substation market is growing due to its focus on clean energy, remote power delivery, and sustainable infrastructure. The country relies heavily on hydroelectric power and is increasingly investing in renewable sources such as wind and solar. Digital substations help manage these resources more effectively by improving monitoring, automation, and grid stability. Harsh climates and remote areas require reliable and low-maintenance power systems, making digital substations a smart choice in the country. Additionally, government initiatives for reducing carbon emissions and upgrading outdated substations are accelerating adoption across provinces, especially in regions with high renewable energy penetration.

Key Players and Competitive Analysis

The digital substation market is highly competitive, with major players such as ABB Ltd., Siemens AG, General Electric Company, and Schneider Electric leading through advanced technologies and global reach. These companies focus on grid modernization, automation, and smart energy management. Firms such as Honeywell, Cisco Systems, and Eaton Corporation contribute with innovations in cybersecurity, communication networks, and intelligent control systems. Emerson Electric and NR Electric offer specialized solutions catering to diverse regional needs. Hitachi Energy Ltd. strengthens the landscape with next-gen digital substations that support renewable integration and grid flexibility. Strategic partnerships, R&D, and digitalization are key to maintaining market leadership.

Honeywell International, Inc., an industrial company, offers industry specific solutions to aerospace and automotive products and services. It specializes in turbochargers control, sensing and security technologies for buildings and homes; specialty chemicals; electronic and advanced materials; process technology for refining and petrochemicals; and energy efficient products and solutions for homes, business, and transportation. It operates through the following segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. The Aerospace segment provides aircraft engines, integrated avionics, systems and service solutions, and related products and services for aircraft manufacturers, turbochargers to improve the performance and efficiency of passenger cars and commercial vehicles as well as spare parts, repair, overhaul and maintenance services such as, auxiliary power units, propulsion engines, environmental control systems, wireless connectivity services, electric power systems, engine controls, flight safety, communications, navigation hardware and software, radar and surveillance systems, aircraft lighting, management and technical services, advanced systems and instruments, satellite and space components, aircraft wheels and brakes, repair and overhaul services, turbochargers and thermal systems. The Home and Building Technologies segment provides products, software, solutions and technologies that help home owners stay connected and in control of their comfort, security and energy use such as controls and displays for heating, cooling, indoor air quality, ventilation, humidification combustion, lighting and home automation; advanced software applications for building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow, temperature and electrical current; products, services and solutions for measurement, regulation, control and metering of gases and electricity; metering and communications systems for water utilities and industries; access control; video surveillance; fire products; remote patient monitoring systems; and installation, maintenance, and upgrades of systems. The Performance Materials and Technologies segment develops and manufactures materials, process technologies, and automation solutions. It provides process solutions in automation control, instrumentation, advanced software, and related services for the oil and gas, refining, pulp and paper, industrial power generation, chemicals and petrochemicals, biofuels, life sciences, and metals, minerals, and mining industries. The Safety and Productivity Solutions segment provides products, software and connected solutions which include personal protection equipment and footwear designed for work, play and outdoor activities. It also offers gas detection technology, mobile devices and software for computing, data collection and thermal printing; supply chain and warehouse automation equipment, software, and solutions; custom-engineered sensors, switches and controls for sensing and productivity solutions; and software-based data and asset management productivity solutions. The company was founded by Albert M. Butz in 1885 and is headquartered in Morris Plains, NJ. Honeywell’s integrated security solution for electrical generation and transmission facilities combines Pro-Watch access control, MAXPRO VMS, Vindicator intrusion detection, HD IP cameras, and SpotterRF radar for comprehensive perimeter protection, intelligent threat detection, and operational monitoring, reducing false alarms and supporting regulatory compliance.

ABB is a global manufacturer and seller of electrification, automation, robotics, and motion products. The company operates in various segments to serve a diverse range of industries. In the electrification segment, ABB provides a wide array of products, including renewable power solutions, electric vehicle charging infrastructure, distribution automation products, modular substation packages, and intelligent home and building solutions. The robotics & discrete automation focuses on industrial robots, autonomous mobile robotics, software, and digital services, offering solutions based on programmable logic controllers, industrial PCs, transport systems, servo motion, and machine vision. The Motion segment specializes in designing, manufacturing, and selling drives, generators, motors, and traction converters to drive the low-carbon future for industries, infrastructure, cities, and transportation. Process automation develops and sells control technologies, manufacturing execution systems, advanced process control software, marine propulsion systems, instrumentation, and turbochargers and provides services such as preventive maintenance, remote monitoring, emission monitoring, asset performance management, and cybersecurity. ABB serves a broad range of industries globally, including aluminum, chemical, automotive, data centers, mining, oil and gas, power generation, railway, food and beverage, water, and wind power. ABB Digital Substation Solutions offer fully engineered and customizable systems for digitalizing distribution substations, integrating ABB and third-party products to enhance operational efficiency, reliability, and communication capabilities, tailored to specific site requirements and delivered as standalone or composite solutions.

Key Players

- ABB Ltd.

- Cisco Systems Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- General Electric Company

- Hitachi Energy Ltd.

- Honeywell International Inc.

- NR Electric Co. Ltd.

- Schneider Electric

- Siemens AG

Industry Developments

In January 2024, Hitachi Energy launched the enhanced SAM600 3.0 process interface unit, enabling faster adoption of digital substations by consolidating functions, reducing wiring, and improving flexibility, reliability, and sustainability for grid operators, while meeting the latest industry standards and security requirements.

In December 2024, Munster Technological University, in partnership with H&MV Engineering and ABB, launched a state-of-the-art Digital Substation at its Bishopstown campus, enhancing Ireland’s energy transition efforts and advancing training, research, and workforce development in modern power engineering.

Digital Substation Market Segmentation

By Module Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Fiber-Optic Communication Networks

- SCADA

By Insulation Outlook (Revenue, USD Billion, 2020–2034)

- Transmission Substation

- Distribution Substation

By Voltage Outlook (Revenue, USD Billion, 2020–2034)

- Up to 220kV

- 220–500kV

- Above 500kV

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Utility

- Heavy Industries

- Transportation

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Digital Substation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.96 Billion |

|

Market Size Value in 2025 |

USD 8.55 Billion |

|

Revenue Forecast by 2034 |

USD 16.53 Billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.96 billion in 2024 and is projected to grow to USD 16.53 billion by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are ABB Ltd., Siemens AG, General Electric Company, Schneider Electric, Honeywell International Inc., Cisco Systems Inc., Eaton Corporation plc, Emerson Electric Co., NR Electric Co. Ltd., and Hitachi Energy Ltd.

The distribution substation segment dominated the market share in 2024.

The transportation segment is expected to witness the fastest growth during the forecast period.