Digital Trust Market Size, Share, Trend, Industry Analysis Report

By Component (Solution, Services), By Technology, By Enterprise Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6358

- Base Year: 2024

- Historical Data: 2020-2023

Overview

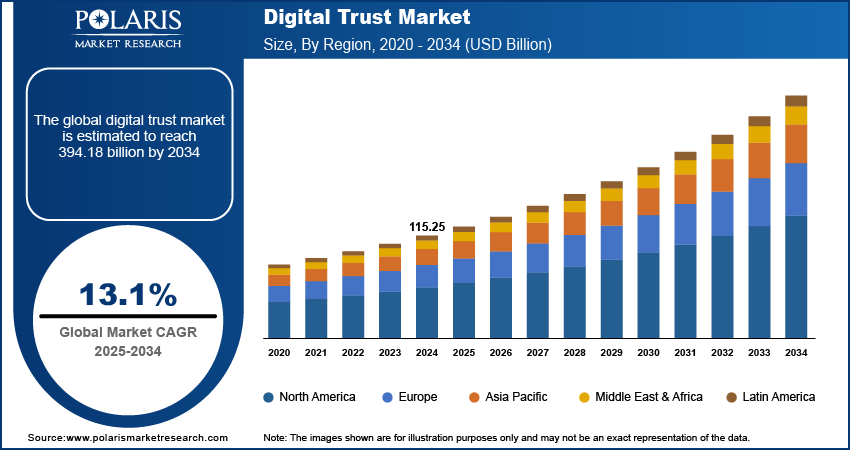

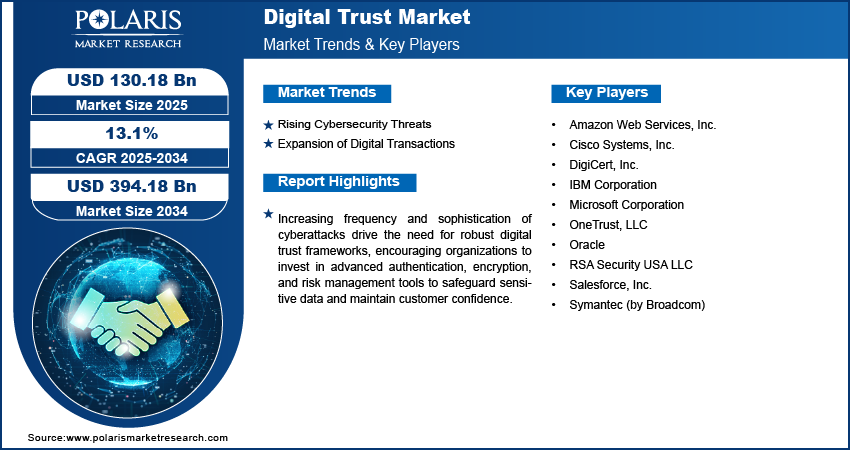

The global digital trust market size was valued at USD 115.25 billion in 2024, growing at a CAGR of 13.1% from 2025 to 2034. Increasing frequency and sophistication of cyberattacks drive the need for robust digital trust frameworks, encouraging organizations to invest in advanced authentication, encryption, and risk management tools to safeguard sensitive data and maintain customer confidence.

Key Insights

- The solution segment held ~59% of the market share in 2024, driven by rising demand for advanced cybersecurity, encryption, and identity management tools.

- The BFSI segment led in 2024 due to strict compliance needs, high-value transaction security, and real-time fraud detection requirements.

- North America captured ~38% of the market in 2024, supported by mature cybersecurity frameworks and AI-driven digital trust technologies.

- The U.S. dominated the regional market in 2024, driven by innovation in cybersecurity, digital payments, and decentralized identity solutions.

- The market in Asia Pacific is projected to register the highest CAGR from 2025 to 2034, fueled by digital transformation and rising cyber threats in emerging economies.

- The market in China is expanding rapidly due to national initiatives integrating AI and blockchain for secure digital identity in finance and e-governance.

Industry Dynamics

- Increasing frequency and sophistication of cyberattacks are driving demand for robust digital trust solutions across enterprises and public sectors.

- The growing adoption of cloud services, remote work, and digital identities is accelerating the need for secure authentication and data protection.

- Integration of AI and blockchain enhances verification accuracy and builds consumer confidence in digital transactions and identity management systems.

- Lack of global regulatory harmonization creates compliance complexity and hinders interoperability of digital trust solutions across international markets.

Market Statistics

- 2024 Market Size: USD 115.25 billion

- 2034 Projected Market Size: USD 394.18 billion

- CAGR (2025–2034): 13.1%

- North America: Largest market in 2024

AI Impact on Digital Trust Market

- AI enables real-time anomaly detection and predictive analytics, helping organizations proactively defend against sophisticated cyber threats, boosting user confidence in digital platforms.

- Automating identity verification and fraud prevention with AI streamlines digital operations and protects both organizational and personal identities with less human intervention.

- Rapid AI advancement raises concerns on the ethical use of data, trust in digital communications, and transparency, making consumer education and responsible AI deployment critical.

- AI-driven digital trust solutions must balance privacy, regulatory compliance, and the growing risks linked to deepfake content, biometric spoofing, and phishing attacks.

The digital trust market refers to the ecosystem of technologies, frameworks, and services that ensure secure, transparent, and reliable interactions in the digital environment. It encompasses identity verification, cybersecurity, data privacy, risk management, and compliance solutions to establish confidence in digital transactions and online engagement. Stringent global data protection laws such as GDPR, CCPA, and PSD2 mandate organizations to adopt robust security and privacy measures, supporting investment in solutions that enhance digital trust and ensure legal compliance.

The shift to hybrid and remote work environments increases the need for secure identity management, zero-trust architectures, and endpoint protection, supporting the growth of the digital trust market. Moreover, deployment of artificial intelligence, blockchain, and biometrics in security solutions improves verification accuracy, reduces fraud risk, and enhances transparency, making these innovations central to building and maintaining digital trust.

Drivers & Opportunities

Rising Cybersecurity Threats: Rising cybersecurity threats are compelling organizations to strengthen their digital trust strategies. The growing number of cyberattacks, coupled with their increasing complexity, has heightened the risk of data breaches, identity theft, and financial fraud. According to the Cybersecurity and Infrastructure Security Agency, ransomware incidents across various sectors surged over 70% from 2022 to 2023. Businesses are recognizing that maintaining customer confidence requires advanced measures such as multi-factor authentication, encryption technologies, and proactive risk management tools. These solutions protect sensitive information and help companies comply with regulatory standards. The focus is shifting toward building a secure digital environment where customers feel safe engaging online, ensuring that trust becomes a key competitive advantage in the evolving digital economy.

Expansion of Digital Transactions: The rapid expansion of digital transactions is transforming how businesses approach security and trust. In 2024, the RTP network processed USD 246 billion in payments, a 94% increase in value, and 343 million transactions, up 38% year-on-year. The surge in e-commerce, online banking, and cashless payment systems has created a pressing need for strong verification and fraud prevention measures. Consumers now expect smooth yet secure experiences across all digital touchpoints, from account creation to payment completion. To meet these expectations, organizations are investing in technologies that can detect suspicious activities in real-time and validate user identities without disrupting convenience. This growing reliance on digital trust frameworks helps prevent financial losses, protects customer data, and fosters long-term relationships built on reliability and transparency.

Segmental Insights

Component Analysis

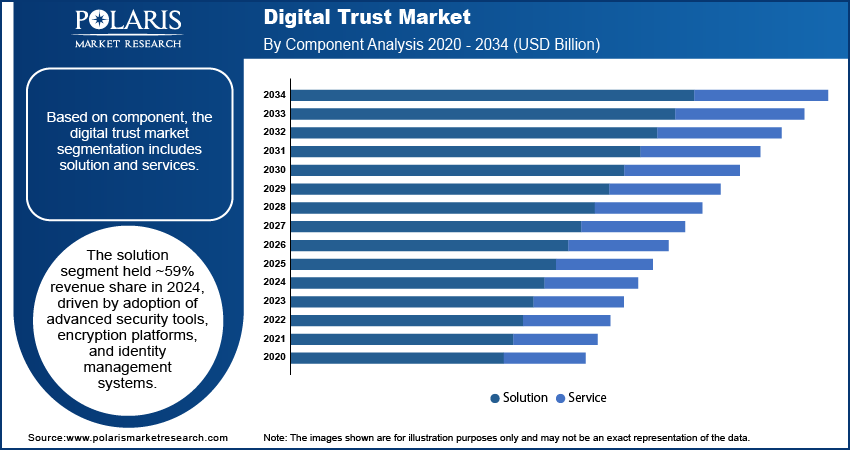

Based on component, the segmentation includes solution and services. The solution segment dominated the market with ~59% of the revenue share in 2024 due to the growing adoption of advanced security tools, encryption platforms, and identity management systems designed to counter increasingly sophisticated cyber threats. Organizations are prioritizing integrated digital trust solutions that provide end-to-end protection, enhance compliance, and maintain transparency in digital interactions. The ability to deliver scalable and automated threat detection while supporting seamless user experiences has further positioned solutions as the preferred choice for enterprises seeking to strengthen their trust infrastructure.

The services segment is expected to register the highest CAGR from 2025 to 2034 driven by the rising need for consulting, managed services, and continuous monitoring to adapt to evolving cyber risks. Enterprises are seeking expert support to implement, optimize, and maintain digital trust systems, ensuring maximum efficiency and compliance with shifting regulations. Growing outsourcing trends for cybersecurity management, combined with the demand for 24/7 incident response capabilities, are accelerating service adoption.

Technology Analysis

In terms of technology, the segmentation includes, AI & ML, privacy enhancing technologies (PETs), cloud computing, multi-factor authentication (MFA), and others. The AI & ML segment held the largest revenue share in 2024 due to their role in enabling predictive threat detection, automated identity verification, and adaptive fraud prevention. These technologies analyze vast data streams in real time, identifying anomalies and emerging attack patterns faster than traditional methods. Their ability to continuously learn and improve detection accuracy makes AI and ML essential for modern digital trust ecosystems.

The cloud computing segment is expected to register the highest CAGR from 2025 to 2034 due to rising adoption of cloud-native security models that enable scalable, flexible, and cost-effective trust management. Enterprises are moving critical workloads to the cloud, necessitating robust cloud-integrated authentication, encryption, and compliance solutions to safeguard sensitive information in distributed environments.

Enterprise Size Analysis

In terms of enterprise, the segmentation includes small & medium size and large enterprises. The large enterprises segment accounted for the largest revenue share in 2024 due to their vast digital infrastructures, complex operations, and high exposure to cyber threats. These organizations invest heavily in multi-layered trust frameworks, leveraging advanced analytics, AI-driven threat intelligence, and global compliance measures to protect diverse stakeholder interactions across multiple platforms and geographies.

The small & medium size segment is projected to register the highest CAGR from 2025 to 2034 due to increasing digitalization of operations, growing exposure to cyber risks, and cost-effective access to advanced trust technologies via cloud-based and subscription models. These businesses are rapidly adopting scalable security solutions to meet regulatory requirements and build consumer confidence.

End Use Analysis

In terms of end use, the segmentation includes banking, financial services, and insurance (BFSI); healthcare and life sciences; retail and e-commerce; IT and telecommunications; government sector; and others. The banking, financial services, and insurance (BFSI) segment held the largest revenue share in 2024 due to the sector’s need for strict regulatory compliance, high-value transaction security, and real-time fraud detection. Institutions are implementing advanced authentication, biometric verification, and blockchain-based trust mechanisms to safeguard assets and maintain customer confidence in a high-risk digital environment.

The healthcare and life sciences segment is expected to register the highest CAGR from 2025 to 2034, fueled by the need to protect sensitive patient data, comply with privacy regulations, and secure growing telehealth and connected device ecosystems. Rising threats to electronic health records and medical research data are prompting rapid adoption of advanced encryption, identity management, and secure data exchange systems.

Regional Analysis

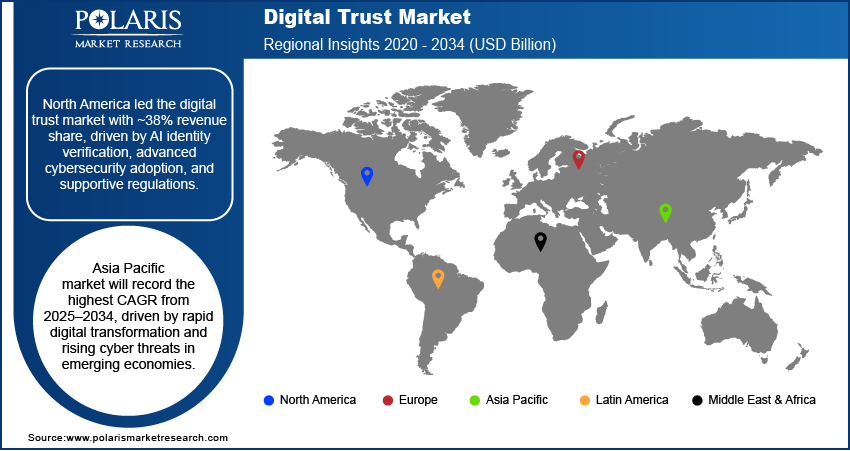

The North America digital trust market accounted for the largest revenue share of ~38% in 2024, due to strong adoption of advanced cybersecurity frameworks, rapid integration of AI-driven identity verification, and a mature regulatory environment that promotes secure digital interactions. The region benefits from high investment in cloud infrastructure, widespread digital transformation across industries, and an established ecosystem of trust service providers. Financial institutions, e-commerce platforms, and government agencies are driving demand for robust authentication and fraud prevention solutions, ensuring high compliance standards. Strategic collaborations between technology firms and regulators further strengthen the market position, making North America a leading hub for digital trust innovation.

U.S. Digital Trust Market Insights

The U.S. held the largest revenue share in 2024 due to its leadership in cybersecurity innovation, high penetration of digital payment systems, and early adoption of decentralized identity management solutions. The country’s financial sector demands advanced fraud detection technologies to protect large-scale online transactions, while healthcare and e-government services require strict data privacy compliance. Federal regulations such as NIST frameworks and CCPA create a structured environment for secure digital ecosystems. Continuous investments in R&D by major tech firms support advance solutions, while consumer awareness of privacy protection boosts adoption rates. This combination of technological, regulatory, and market maturity drives the country’s dominance.

Asia Pacific Digital Trust Market Trends

The market in Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to rapid digital transformation in banking, retail, and public services, coupled with increasing cyber threats targeting emerging economies. In 2024, the Asian Development Bank reported that digital adoption in Asia Pacific surged by 28% year-on-year, with over 1.3 billion people using digital financial services. Expanding internet penetration and mobile-first user behavior are fueling demand for digital trust solutions across the region. Governments are implementing stricter cybersecurity and data protection laws, encouraging adoption among enterprises. The growing use of AI-powered verification systems and blockchain-based identity management is supporting trust in digital transactions. Cross-border e-commerce expansion, coupled with rising digital literacy, is further accelerating investments in authentication, fraud prevention, and secure data sharing technologies.

China Digital Trust Market Overview

The industry in China is growing due to its large-scale rollout of AI and blockchain for identity verification, driven by national initiatives to secure financial transactions and e-governance platforms. The country’s booming e-commerce and fintech industries demand highly scalable digital trust frameworks. Rapid adoption of mobile payments and super-app ecosystems creates a high-transaction environment requiring real-time fraud detection. Implementation of national cybersecurity laws and stricter compliance measures is pushing both public and private sectors to upgrade their trust infrastructure. Domestic tech giants are investing heavily in AI-powered authentication, while government-backed projects ensure fast deployment of advanced trust and verification technologies across industries.

Europe Digital Trust Market Assessment

The industry in Europe is growing significantly due to the widespread implementation of the EU’s eIDAS regulation, which standardizes electronic identification and trust services across member states. Strong data privacy laws such as GDPR are driving enterprises to invest in secure identity verification and encryption technologies. The growth of cross-border trade within the EU demands interoperable trust frameworks that ensure compliance and security in digital transactions. Rising cybercrime incidents are pushing financial institutions and public services to strengthen authentication systems. Additionally, initiatives promoting digital sovereignty and secure cloud adoption are accelerating demand for regionally compliant trust services, enhancing Europe’s market presence in digital trust solutions.

Key Players & Competitive Analysis

The competitive landscape of the digital trust market is shaped by dynamic industry analysis that highlights evolving security needs and regulatory compliance. Companies focus on market expansion strategies through innovative service offerings and targeted geographic penetration. Strategic alliances and joint ventures are becoming vital to enhance technological capabilities and address emerging cybersecurity threats. Mergers and acquisitions, followed by effective post-merger integration, enable market players to consolidate resources, expand client bases, and strengthen operational synergies. Technology advancements, including AI-driven identity verification, blockchain-enabled data integrity, and advanced encryption, are driving differentiation. Organizations are also prioritizing ecosystem-based approaches to create comprehensive trust frameworks that integrate authentication, privacy, and fraud prevention. Competitive success increasingly depends on the ability to adapt rapidly to shifting digital risks, deliver scalable trust solutions, and maintain compliance with global regulations, positioning the market for sustained growth amid increasing digital transactions and interconnected business environments.

Key Players

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- DigiCert, Inc.

- IBM Corporation

- Microsoft Corporation

- OneTrust, LLC

- Oracle

- RSA Security USA LLC

- Salesforce, Inc.

- Symantec (by Broadcom)

Digital Trust Industry Developments

June 2025: Oracle launched the Oracle Defense Ecosystem on Oracle Cloud Infrastructure (OCI) to accelerate innovation in the U.S. defense and government sectors by simplifying procurement and providing secure access to AI and cloud technologies that meet strict compliance requirements.

May 2025: Cisco and NVIDIA unveiled the Cisco Secure AI Factory. It is a joint architecture that integrates Cisco’s networking and security solutions with NVIDIA’s AI computing platform to deliver scalable, secure AI data centers with end-to-end protection for enterprise AI workloads.

Digital Trust Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- AI & ML

- Privacy Enhancing Technologies (PETs)

- Cloud Computing

- Multi-Factor Authentication (MFA)

- Others

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium size

- Large Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecommunications

- Government Sector

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Trust Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 115.25 billion |

|

Market Size in 2025 |

USD 130.18 billion |

|

Revenue Forecast by 2034 |

USD 394.18 billion |

|

CAGR |

13.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 115.25 billion in 2024 and is projected to grow to USD 394.18 billion by 2034.

The global market is projected to register a CAGR of 13.1% during the forecast period.

North America digital trust market accounted for the largest revenue share of ~38% in 2024 due to the strong adoption of advanced cybersecurity frameworks, rapid integration of AI-driven identity verification, and a mature regulatory environment that promotes secure digital interactions.

A few of the key players in the market are Amazon Web Services, Inc.; Cisco Systems, Inc.; DigiCert, Inc.; IBM Corporation; Microsoft Corporation; OneTrust, LLC; Oracle; RSA Security USA LLC; Salesforce, Inc.; and Symantec (by Broadcom).

The solution segment dominated the market with ~59% of the revenue share in 2024 due to the growing adoption of advanced security tools, encryption platforms, and identity management systems designed to counter increasingly sophisticated cyber threats.

The banking, financial services, and insurance segment held the largest revenue share in 2024 due to the sector’s need for strict regulatory compliance, high-value transaction security, and real-time fraud detection.