Risk Management Market Size, Share, Trends, Industry Analysis Report

By Component (Solutions, Services), By Deployment, By Risk Type, By Organization Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6192

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global risk management market size was valued at USD 15.37 billion in 2024, growing at a CAGR of 14.4% from 2025 to 2034. A surge in the number of cyberattacks and data breaches has prompted enterprises to prioritize risk assessment frameworks. Risk management tools offer capabilities for early threat detection, impact modeling, and response planning, supporting businesses in mitigating losses and protecting digital assets from evolving cyber risks.

Key Insights

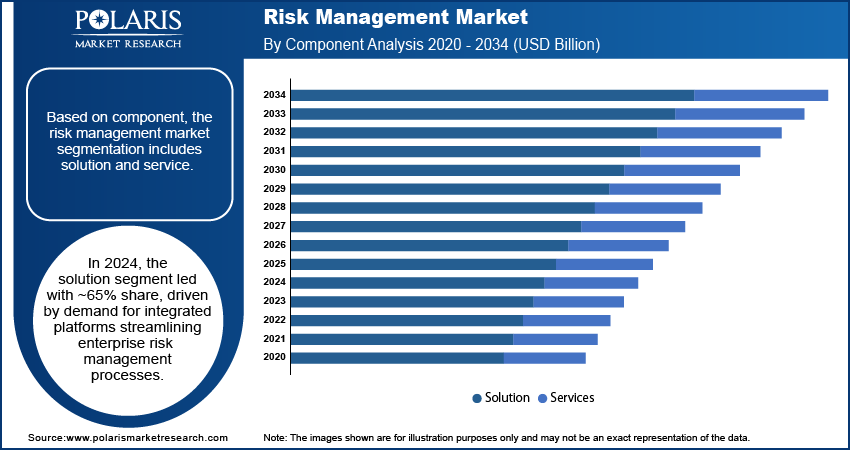

- The solutions segment held ~65% revenue share in 2024, driven by demand for integrated platforms that streamline risk identification and mitigation across enterprises.

- Cloud-based deployment led in 2024 due to scalability, remote access, and lower infrastructure costs, boosting the adoption of risk management platforms.

- The financial risk segment dominated in 2024, fueled by market volatility, interest rate fluctuations, and stringent regulatory requirements.

- North America captured ~43% of the market in 2024, supported by strong compliance mandates and advanced digital infrastructure.

- The U.S. is projected to register a CAGR of 13.3% from 2025 to 2034, driven by digitalization, fintech growth, and rising cybersecurity threats.

- Asia Pacific is expected to grow significantly from 2025 to 2034, due to rapid digital adoption and expanding financial and manufacturing sectors.

- China held a major share in Asia Pacific, driven by industrial growth, fintech expansion, and government focus on data security and governance.

Industry Dynamics

- Increasing frequency of cyberattacks and data breaches is driving organizations to adopt advanced risk assessment and mitigation solutions globally.

- Growing regulatory requirements across industries are pushing companies to implement comprehensive, automated risk management frameworks for compliance and resilience.

- Integration of AI and real-time analytics enables proactive threat detection and faster decision-making in enterprise risk management systems.

- High implementation costs and lack of skilled professionals hinder widespread adoption, especially among small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 15.37 billion

- 2034 Projected Market Size: USD 58.95 billion

- CAGR (2025–2034): 14.4%

- North America: Largest market in 2024

The risk management market encompasses solutions, services, and systems that help organizations identify, assess, mitigate, and monitor potential threats to operations, finances, reputation, and compliance. These tools enable proactive decision-making and strategic planning by minimizing exposure to internal and external risks across diverse sectors such as finance, healthcare, manufacturing, and IT. Organizations are facing rising pressure to comply with complex global regulations such as GDPR, Basel III, and SOX. Risk management platforms help streamline audits, ensure data privacy, and maintain real-time compliance tracking, driving their adoption across highly regulated sectors such as finance and healthcare.

Artificial intelligence and machine learning integration in risk platforms enhances predictive modeling and real-time risk scoring. This enables businesses to proactively identify vulnerabilities, optimize risk strategies, and improve accuracy in decision-making, fueling market demand for intelligent risk solutions. Moreover, global supply chains, remote workforces, and digital transformation are creating layered risk environments. Enterprises are increasingly deploying comprehensive risk management systems to evaluate operational dependencies and ensure business continuity across dynamic scenarios.

Drivers & Opportunities

Adoption in Fintech and Healthcare Sectors: Fintech and healthcare sectors are witnessing rapid transformation through digital technologies, which has significantly increased the level of operational and compliance risks. According to the U.S. Department of Health and Human Services, in 2024, healthcare data breaches affected over 52 million individuals. Fintech companies are dealing with large volumes of sensitive financial data and must adhere to strict regulatory standards, making risk oversight essential. Similarly, in healthcare, the growing use of digital health platforms and personalized treatment has created vulnerabilities around data security and patient safety. To address these challenges, companies are adopting advanced risk management solutions that can monitor, predict, and mitigate potential risks. These tools help ensure regulatory compliance while allowing continued innovation and secure service delivery.

Rising Cybersecurity Threats: Cyberattacks have become more frequent and sophisticated, targeting businesses of all sizes across different industries. Ransomware, phishing, and data theft are causing serious financial and reputational damage. According to the Cybersecurity and Infrastructure Security Agency, ransomware incidents across various sectors surged over 70% from 2022 to 2023. In response, companies are turning to risk management platforms that can identify threats early, assess their impact, and support coordinated response plans. These systems provide real-time monitoring, alerting, and simulation tools that improve an organization’s ability to prevent and respond to attacks. The growing awareness around cybersecurity, combined with the financial consequences of breaches, is driving strong demand for robust risk management frameworks to protect digital infrastructure and maintain business trust.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solution and service. The solution segment dominated the market with ~65% of the revenue share in 2024 due to the growing preference for integrated platforms that streamline risk identification, evaluation, and mitigation across enterprise functions. Organizations are increasingly investing in advanced software tools offering predictive analytics, automation, and real-time dashboards to monitor various risk categories. These solutions help reduce manual efforts, improve response time, and maintain compliance with evolving regulations. Demand is particularly high among large enterprises where multi-level risk visibility and centralized management are critical. Vendors are also introducing modular features tailored to specific industry needs, further supporting the segment’s strong market position.

The service segment is expected to register the highest CAGR of 14.9% from 2025 to 2034 due to rising demand for customization, technical support, and regulatory consulting. Companies are seeking expert guidance to integrate risk management frameworks into their existing workflows and to train internal teams for long-term efficiency. Ongoing changes in compliance rules and cybersecurity standards are also pushing businesses to rely on managed services for timely updates and accurate reporting. Service providers are offering continuous monitoring, auditing, and assessment packages that add value beyond software. This personalized and ongoing support is becoming essential, especially for small and mid-sized enterprises lacking internal expertise.

Deployment Analysis

In terms of deployment, the segmentation includes on-premises and cloud-based. The cloud-based segment held the largest revenue share in 2024 due to the scalability, remote accessibility, and low infrastructure cost of cloud-based risk management platforms. Businesses prefer cloud deployments to support real-time monitoring and multi-site coordination without the need for significant hardware investments. Integration with third-party tools and automated updates are also easier in the cloud, making it more adaptable to evolving risk environments. Large enterprises and startups alike are deploying these solutions to gain immediate visibility into financial, compliance, and cyber threats. The cloud also simplifies backup, data recovery, and security patching, which strengthens its position as the preferred deployment model.

The on-premises segment is expected to register a significant CAGR from 2025 to 2034. Data-sensitive sectors such as defense, government, and manufacturing continue to prioritize on-premises deployments for strong control and regulatory compliance. The expected growth of this segment is driven by the need to manage proprietary data internally and ensure security in highly regulated environments. Organizations operating in regions with strict data residency laws are also investing in on-premises systems to avoid cloud-related legal complications. Advances in edge computing and local infrastructure capabilities are making these deployments more cost-effective. Customization and integration with legacy systems are easier to manage on-premises, appealing to businesses with complex operational setups.

Risk Type Analysis

In terms of risk type, the segmentation includes financial risk, compliance risk, cybersecurity risk, enterprise risk, operational risk, and others. The financial risk segment held the largest revenue share in 2024 due to increased volatility in global markets, interest rate shifts, and stringent financial regulations. Organizations are actively managing risks tied to credit, liquidity, and capital allocation to ensure financial stability. The growing use of derivatives, complex asset portfolios, and cross-border transactions also demands sophisticated tools to assess potential exposure. Financial institutions and large enterprises are deploying risk modeling and forecasting tools to mitigate potential disruptions. The emphasis on maintaining investor confidence and protecting shareholder value continues to strengthen demand for financial risk management solutions.

The cybersecurity risk segment is expected to register the highest CAGR from 2025 to 2034, driven by increasing focus on regenerative therapies for chronic heart conditions. due to the growing number and complexity of digital threats facing businesses. Increasing reliance on connected systems, cloud applications, and remote work models has widened the attack surface for malicious actors. Enterprises are investing in cyber risk platforms that offer real-time monitoring, threat intelligence integration, and incident response planning. Regulatory mandates such as GDPR and sector-specific guidelines are also compelling organizations to enhance cybersecurity risk oversight. Tailored frameworks that map vulnerabilities and ensure business continuity are becoming a top priority, especially in data-driven industries.

End Use Analysis

In terms of end use, the segmentation includes BFSI, IT & telecom, government, defense, and aerospace, healthcare & life science, retail & consumer goods, manufacturing, energy & utilities, and others. The BFSI segment held the largest revenue share in 2024 due to its high exposure to financial, regulatory, and cybersecurity risks. The complexity of financial products, digital transactions, and customer data handling has pushed banks and insurers to implement comprehensive risk strategies. Institutions are leveraging platforms that combine fraud detection, regulatory compliance tracking, and portfolio risk analysis in a unified interface. Continued pressure from global regulators and the need to maintain customer trust are compelling BFSI firms to adopt real-time risk intelligence. Their heavy investments in digital transformation further fuel the adoption of advanced risk management systems.

The IT & telecom segment is expected to register a significant CAGR during 2025–2034 driven by the rapid evolution of network technologies and digital services is increasing risk complexity for IT and telecom firms. Risks related to data privacy, system outages, and service-level failures are prompting investment in advanced risk platforms. Cloud migrations, 5G rollouts, and software-defined infrastructures are adding new layers of vulnerability that need continuous monitoring. Telecom providers are focusing on tools that offer predictive analytics, real-time alerts, and automated risk reporting to ensure service reliability. Additionally, increased collaboration with external vendors and ecosystem partners is intensifying the need for comprehensive risk oversight to protect business continuity.

Regional Analysis

The North America risk management market accounted for ~43% of the revenue share in 2024 due to strong regulatory frameworks, rising corporate compliance requirements, and widespread adoption of advanced digital technologies across sectors. Organizations across industries are focusing more on integrated risk platforms to streamline governance, monitor emerging risks, and meet stringent reporting mandates. Enterprises are investing heavily in analytics-powered tools to align operations with real-time risk insights and ensure continuity in volatile business environments. The presence of mature financial institutions, healthcare providers, and critical infrastructure firms has fueled the demand for scalable and automated solutions that offer better visibility into enterprise-wide risk exposure.

U.S. Risk Management Market Insights

The U.S. market is expected to register a CAGR of 13.3% from 2025 to 2034, driven by the increasing reliance on digital infrastructure, the emergence of fintech ecosystems, and growing cybersecurity concerns. The shift toward digitized operations across sectors has created demand for adaptive and predictive risk management solutions that can assess complex threats and ensure regulatory alignment. Enterprises are emphasizing risk as a strategic function, embedding it into business decisions rather than limiting it to compliance checklists. The U.S. is also witnessing increased venture capital investments in risk tech startups, which is accelerating innovation and enabling access to AI-enabled, cloud-native platforms across both large and mid-sized businesses.

Asia Pacific Risk Management Market Trends

The market in Asia Pacific is expected to register a significant CAGR from 2025 to 2034 due to rising digital adoption, evolving regulatory environments, and the fast-paced growth of financial services and manufacturing sectors. In 2024, the Asian Development Bank reported that digital adoption in Asia Pacific surged by 28% year-on-year, with over 1.3 billion people now using digital financial services, driving regulatory reforms and risk management investments across the region. Businesses are transitioning from reactive to proactive risk strategies as they face challenges from cyber threats, global supply chain disruptions, and data localization policies. Countries across the region are modernizing their governance frameworks, pushing organizations to invest in platforms that allow real-time monitoring and cross-functional risk collaboration. Rapid urbanization and the growth of cross-border e-commerce are also influencing firms to deploy multi-domain risk solutions that can scale with business complexity and ensure compliance across jurisdictions.

China Risk Management Market Overview

The industry in China held a significant revenue share in Asia Pacific in 2024, due to rapid industrialization, expansion of fintech, and strong governmental emphasis on data security and corporate governance. Enterprises in sectors such as banking, healthcare, and smart manufacturing are increasingly adopting advanced risk management platforms to ensure compliance with evolving regulations such as the Data Security Law and Cybersecurity Law. Digital transformation across state-owned and private companies has made real-time risk visibility critical. Local software vendors are also forming partnerships with global risk tech firms to enhance capabilities, improve automation, and enable AI-driven risk prediction models suited for China’s regulatory and business landscape.

Europe Risk Management Market Analysis

The market in Europe is expanding steadily due to continuous regulatory developments such as GDPR, MiFID II, and the Digital Operational Resilience Act (DORA), which have pushed organizations to integrate risk management more deeply into their governance frameworks. Enterprises are implementing advanced risk assessment tools that can manage multi-layered compliance across different jurisdictions. There is also a growing trend toward ESG-related risk assessment, particularly in industries such as energy, finance, and consumer goods. Risk professionals in Europe are emphasizing transparency, traceability, and ethical risk modeling, which is encouraging demand for configurable, real-time platforms that support both strategic risk evaluation and operational oversight in a dynamic regulatory climate.

Key Players and Competitive Analysis

The competitive landscape of the risk management market is marked by dynamic shifts driven by technology advancements, regulatory evolution, and increasing enterprise demand for integrated platforms. Industry analysis reveals a sharp focus on market expansion strategies, including joint ventures and strategic alliances aimed at enhancing geographic reach and product offerings. Mergers and acquisitions continue to play a vital role, enabling firms to acquire niche capabilities and strengthen vertical-specific portfolios. Post-merger integration efforts are increasingly geared toward harmonizing data architectures and accelerating innovation pipelines.

Players are leveraging artificial intelligence, predictive analytics, and cloud-native solutions to offer real-time, customizable risk intelligence. In a fragmented ecosystem, competition is intensifying around scalability, automation, and regulatory compliance capabilities. Companies are also investing in customer-centric interfaces and cross-functional integration features to meet the evolving needs of risk and compliance teams. Strategic positioning is influenced by the ability to deliver comprehensive, adaptable platforms that align with global risk governance frameworks.

Key Players

- BitSight

- FIS Global

- Fiserv

- IBM Corporation

- LogicGate, Inc.

- MetricStream

- Microsoft Corporation

- Moody's Corporation

- NAVEX Global

- Oracle Corporation

- Qualys, Inc.

- Riskonnect, Inc.

- SAS Institute Inc.

- ServiceNow

Risk Management Industry Developments

April 2025: FIS Global launched the Treasury and Risk Manager Quantum Cloud Edition, a cloud-native platform offering real-time cash visibility, risk analysis, and enterprise integration for corporate treasury functions.

December 2024: NAVEX Global released its first Risk Resilience Guide, offering a practical framework for proactive risk management, covering regulatory changes, third-party risks, and strategies for building organizational resilience.

Risk Management Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Risk Assessment & Analysis

- Risk Control & Monitoring

- Risk Reporting & Analytics

- Others

- Services

- Professional Services

- Managed Services

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud-Based

By Risk Type Outlook (Revenue, USD Billion, 2020–2034)

- Financial Risk

- Compliance Risk

- Cybersecurity Risk

- Enterprise Risk

- Operational Risk

- Others

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-Sized Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT & Telecom

- Government, Defense, and Aerospace

- Healthcare & Life Science

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Risk Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.37 billion |

|

Market Size in 2025 |

USD 17.57 billion |

|

Revenue Forecast by 2034 |

USD 58.95 billion |

|

CAGR |

14.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.37 billion in 2024 and is projected to grow to USD 58.95 billion by 2034.

The global market is projected to register a CAGR of 14.4% during the forecast period.

The North America risk management market accounted for ~43% of the revenue share in 2024 due to strong regulatory frameworks, heightened corporate compliance requirements, and widespread adoption of advanced digital technologies across sectors.

A few of the key players in the market are BitSight; FIS Global; Fiserv; IBM Corporation; LogicGate, Inc.; MetricStream; Microsoft Corporation; Moody's Corporation; NAVEX Global; Oracle Corporation; Qualys, Inc.; Riskonnect, Inc.; SAS Institute Inc.; and ServiceNow.

The solution segment dominated the market in 2024 with ~65% of the revenue share due to the growing preference for integrated platforms that streamline risk identification, evaluation, and mitigation across enterprise functions.

The cloud-based segment held the largest revenue share in 2024 due to the scalability, remote accessibility, and low infrastructure cost of cloud-based risk management platforms.