Distribution Transformer Market Size, Share, Industry Analysis Report

By Mounting (Pad, Pole, Underground), By Transformer Type, By Power Range, By Insulation, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5208

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

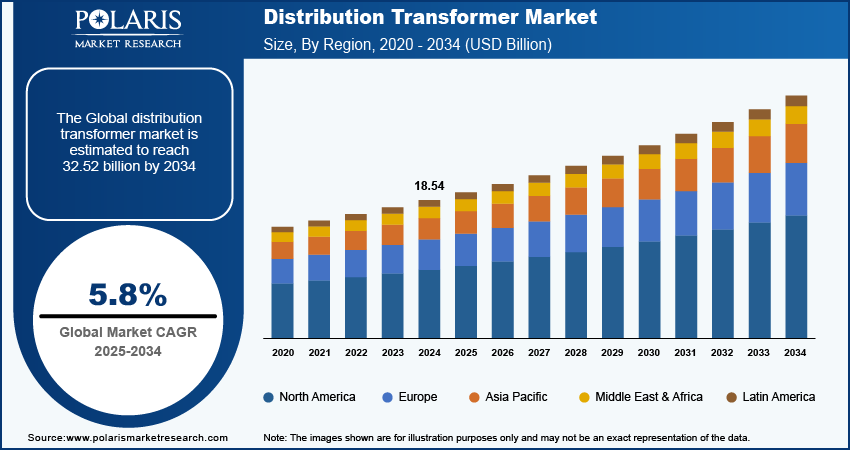

The global distribution transformer market size was valued at USD 19.69 billion in 2024 and is expected to register a CAGR of 5.8% from 2025 to 2034. The increasing demand for reliable and uninterrupted power supply drives the industry growth. Also, the rising focus on renewable energy and grid expansion is expected to boost the growth during the forecast period.

Key Insights

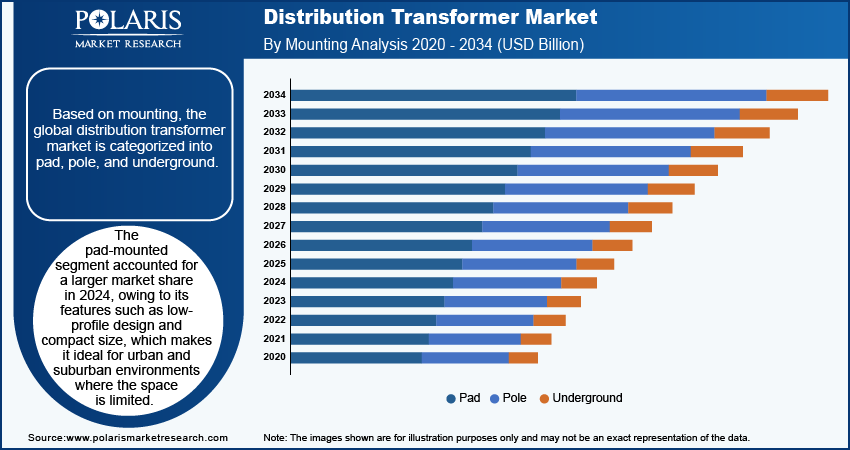

- The pad-mounted transformer segment is projected to register a CAGR of 5.99% during 2025–2034 due to their compact design and ease of maintenance.

- The single-phase transformer segment is projected to reach USD 7.45 billion by 2034. This growth is attributed to the growing focus on smart grids and energy efficiency.

- The 2.5–10 MVA power range segment was valued at USD 3.20 billion in 2024. Distribution transformers in the 2.5–10 MVA range cater to large commercial complexes, where higher power loads are necessary for seamless operations.

- The oil immersed segment dominated the market in 2024. This dominance is propelled by the widely used types in the power distribution network, known for their high efficiency, reliability, and superior cooling capabilities.

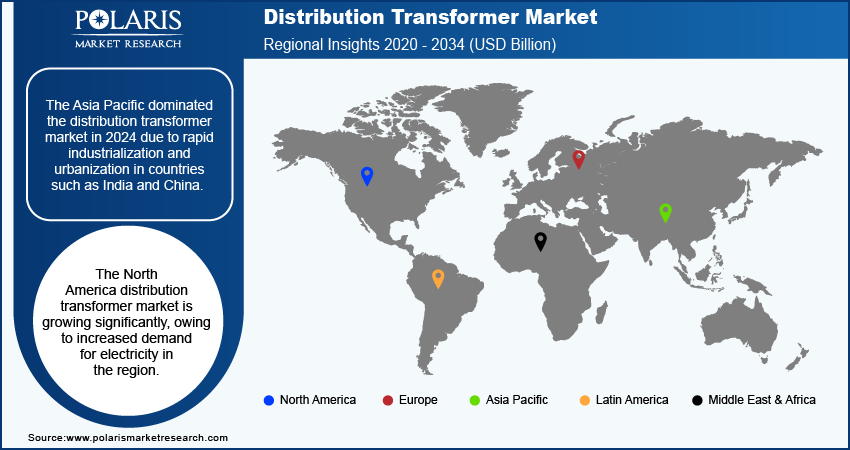

- Asia Pacific accounted for 39.61% of the global market share in 2024. The leadership is driven by the rapid expansion of urban infrastructure and increasing electricity demand.

- The North America industry is expected to register a CAGR of 5.34% during the forecast period. Infrastructure modernization and renewable energy integration boost the industry growth.

Industry Dynamics

- Increasing electricity demand and grid expansion propel the demand for distribution transformers.

- Rising focus on the integration of renewable energy sources fuels the industry expansion.

- Fluctuating prices of raw materials and high investments hinder the market growth.

- Growing demand for distribution transformers, especially in developing countries, is expected to create lucrative opportunities for the market during the forecast period.

Market Statistics

2024 Market Size: USD 19.69 billion

2034 Projected Market Size: USD 31.59 billion

CAGR (2025–2034): 5.8%

Asia Pacific: Largest market in 2024

AI Impact on Distribution Transformer Market

- Artificial intelligence (AI) uses sensor data to predict failures before they happen. It reduces downtime and extends the lifespan of distribution transformers.

- The technology is used to adjust load and voltage levels based on real-time demand. This reduces thermal stress and enhances energy efficiency.

- The use of AI facilitates coordination between transformers and smart grid systems. It supports renewable energy and decentralized power sources.

- Utilities and industrial players adopt AI-based systems to comply with regulatory standards and modernize aging infrastructure.

To Understand More About this Research: Request a Free Sample Report

A distribution transformer is an electrical device used to step down high-voltage electricity to a lower voltage suitable for residential, commercial, or industrial use. It plays a critical role in the final stage of power distribution within the electrical grid. The distribution transformer market has witnessed substantial growth worldwide, with the increasing demand for reliable and uninterrupted power supply. Governments and utility companies are continuously investing in grid modernization and rural electrification projects, further driving expansion. In November 2023, the US Department of Energy allocated USD 3.9 million through its GRIP program to improve transmission infrastructure, streamline energy project interconnections, and deploy advanced technologies such as distributed energy resources. The initiative aims to boost grid reliability and integrate clean electricity nationwide.

Technological advancements in transformer design, such as power transformer, smart transformers and eco-friendly alternatives, are shaping the future of this industry. These transformers minimize energy wastage, ensuring optimal power utilization by stepping down voltage closer to the point of consumption. This contributes to lower electricity costs and improved grid stability, making them an essential component of power distribution networks. Additionally, modern transformers are designed with advanced materials and cooling technologies that extend their lifespan, reducing maintenance costs and improving overall system reliability.

The rising focus on renewable energy integration propels the demand for efficient distribution transformers. According to a February 2025 IEA report, renewables are projected to grow from 30% of global energy generation in 2023 to 46% by 2030, with solar and wind power driving nearly all of this expansion. The need for transformers capable of handling variable loads and bidirectional power flow has increased with the expansion of solar and wind power projects. Smart distribution transformers equipped with monitoring and distribution automation capabilities are gaining traction, allowing real-time performance analysis and fault detection. These innovations contribute to a more resilient and sustainable power grid, aligning with global efforts to reduce carbon emissions and promote green energy solutions.

Industry Dynamics

Increasing Electricity Demand and Grid Expansion

The rising global demand for electricity, driven by rapid urbanization, population growth, and industrialization, is driving growth opportunities. According to a 2024 IEA analysis, worldwide electricity consumption is projected to accelerate in the coming three years, with an anticipated average annual growth rate of 3.4% through 2026. This growth reflects increasing electrification across multiple sectors and regions. There is an increasing requirement for reliable and efficient transformers as countries continue to expand their power distribution networks to meet growing consumption needs. Rural electrification initiatives in developing nations, along with grid modernization efforts in developed economies, are further fueling the demand for advanced distribution transformers. Governments and utilities are investing in high-performance transformer solutions to improve power stability, minimize transmission losses, and ensure uninterrupted electricity supply to end users.

Integration of Renewable Energy Sources

The global shift toward clean and sustainable energy is accelerating the deployment of renewable energy sources such as solar and wind power. This transition requires an efficient distribution infrastructure, with transformers playing a crucial role in integrating renewable energy into the grid, with substantial investments. According to a 2024 IEA report, the US Infrastructure Investment and Jobs Act allocated USD 75 million to clean energy, including USD 21.3 million for grid upgrades. Transformers with bidirectional power flow capabilities and advanced load management features are in high demand as renewable power generation is often decentralized and intermittent. Additionally, microgrid development and distributed generation projects are driving the need for compact and high-efficiency transformers to facilitate smooth energy transmission while reducing dependency on traditional fossil fuel-based power generation.

Segmental Insights

By Mounting Analysis

The segmentation, based on mounting, includes pad, pole, and underground. The pad-mounted transformer segment is projected to grow significantly, reflecting a CAGR of 5.99% during the forecast period, due to their compact design, ease of maintenance, and improved durability. These transformers are designed to withstand harsh environmental conditions, such as extreme temperatures, moisture, and heavy loads, making them ideal for high-density power distribution networks. Regulatory mandates emphasizing the use of energy-efficient transformers are encouraging manufacturers to develop low-loss, high-performance variants. The increasing deployment of underground distribution systems in developed regions such as North America and Europe is further fueling expansion opportunities. Emerging economies are also investing in these transformers to support urban electrification programs and infrastructure modernization, ensuring a stable and efficient power supply.

The underground transformer segment was valued at USD 3.95 billion in 2024, due to the advancements in insulation materials, cooling technologies, and remote monitoring capabilities. Utilities are increasingly investing in underground power infrastructure to reduce transmission losses, improve system reliability, and enhance public safety. Additionally, regulatory policies promoting energy-efficient and environmentally friendly transformer solutions are encouraging the development of compact, high-performance underground transformers. The demand for these transformers is expected to rise as cities expand and underground cabling becomes the norm in high-density areas, making them a vital component of future power distribution networks.

By Transformer Type Analysis

The segmentation, based on transformer type, includes single-phase transformers, and three-phase transformers. The single-phase transformer segment is projected to reach USD 7.45 billion by 2034. This growth is attributed to the growing focus on smart grids and energy efficiency, single-phase distribution transformers are being upgraded with advanced features such as digital monitoring and low-loss core materials. The rise of decentralized power generation, such as rooftop solar panels and small wind turbines, is also increasing the need for flexible and efficient single-phase transformers. The demand for these transformers is expected to remain strong as urbanization and rural development continue, particularly in regions focusing on infrastructure expansion. Manufacturers are investing in innovative designs that enhance energy efficiency and reduce maintenance costs, ensuring that single-phase transformers remain a vital component.

The three-phase transformer segment is projected to experience robust growth during the forecast period, due to the increasing adoption of renewable energy sources, such as wind and solar farms. These transformers are essential for integrating large-scale renewable power into the grid, ensuring smooth power transmission with minimal fluctuations. Advancements in transformer technology, such as improved core materials, enhanced cooling systems, and smart monitoring capabilities, are making three-phase transformers more energy-efficient and reliable. Governments and utility providers are also investing in grid modernization projects, boosting the demand for high-performance three-phase transformers. The global demand for three-phase distribution transformers is expected to witness growth as electrification expands into emerging economies and infrastructure development accelerates.

By Power Range Analysis

The segmentation, based on power range, includes up to 0.5 MVA, 0.5–2.5 MVA, 2.5–10 MVA, and above 10 MVA. The 2.5–10 MVA power range segment was valued at USD 3.20 billion in 2024. Distribution transformers in the 2.5–10 MVA range cater to large commercial complexes, industrial zones, and utility substations, where higher power loads are necessary for seamless operations. These transformers are essential for heavy-duty applications such as large-scale manufacturing units, high-rise buildings, and transportation hubs, ensuring a stable power supply for mission-critical operations. The rising adoption of grid automation and smart substations is expected to further propel the demand for 2.5–10 MVA distribution transformers.

The above 10 MVA power range segment accounted for 7.33% of share in 2024 due to the push for smart grid technology and high-voltage distribution networks, which is boosting demand for transformers above 10 MVA. Advanced features such as automated load balancing, IoT-enabled diagnostics, and high-efficiency cooling systems are being incorporated into these transformers to enhance performance and longevity. Additionally, as countries worldwide focus on renewable energy integration, high-capacity transformers are playing a crucial role in transmitting power from large-scale wind farms, hydroelectric stations, and nuclear plants to distribution networks. With continuous technological advancements and government policies favoring grid modernization, the above 10 MVA transformer segment is poised for sustained growth in the coming years.

By Insulation Analysis

The global segmentation, based on insulation, includes oil immersed and dry. The oil immersed segment dominated the market and was valued at USD 12.07 billion in 2024. This dominance is attributed to widely used types in the power distribution network, known for their high efficiency, reliability, and superior cooling capabilities. These transformers are filled with insulating oil, which serves a dual purpose of cooling and electrical insulation, ensuring smooth operation under varying load conditions. They are commonly used in industrial zones, commercial establishments, and utility substations where large power loads need to be managed efficiently. The growing demand for grid expansion, coupled with the rising adoption of renewable energy sources, has fueled the need for oil-immersed transformers in both urban and rural electrification projects.

The dry-type transformer segment is projected to register a CAGR of 7.01% during the forecast period. Dry-type distribution transformers offer a safer and more environmentally friendly alternative to oil-immersed transformers, making them an ideal choice for indoor applications and areas where fire safety is a priority. These transformers use air or resin as an insulating medium instead of oil, eliminating the risk of leakage and environmental contamination. Their ability to withstand harsh conditions without requiring extensive maintenance makes them suitable for commercial buildings, hospitals, data centers, and underground power distribution networks. The increasing adoption of dry-type transformers in densely populated urban areas, where space constraints and safety regulations are major considerations for growth opportunities.

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America distribution transformer market is expected to register a CAGR of 5.34% due to infrastructure modernization, renewable energy integration, and electrification initiatives. The regulatory framework for distribution transformers in North America is primarily governed by agencies such as the US Department of Energy (DOE), the Federal Energy Regulatory Commission (FERC), and the Canadian Standards Association (CSA). The DOE has established stringent energy efficiency standards for transformers under the Energy Policy and Conservation Act (EPCA), which mandates minimum efficiency levels to reduce energy losses and enhance grid performance. These regulations are periodically updated to align with technological advancements and sustainability goals, placing additional compliance burdens on manufacturers. Furthermore, regional utilities and state-level agencies often implement supplementary requirements, creating a complex, multi-layered compliance landscape. Participants also adhere to international standards such as IEEE C57.12.00 for safety and performance, assuring interoperability across North America's aging grid infrastructure.

The US distribution transformer market accounted for 78.10% regional share in 2024, primarily due to its vast and aging power grid infrastructure requiring frequent upgrades. Strict federal energy efficiency regulations, such as DOE’s updated efficiency standards, force utilities to adopt advanced transformer technologies, driving consistent demand. Additionally, the country’s focus on grid modernization, renewable energy integration, and resilience against extreme weather conditions further accelerates growth.

The Asia Pacific distribution transformer market accounted for 39.61% of market share in 2024 primarily due to the rapid expansion of urban infrastructure, increasing electricity demand, and continued investments in power grid modernization. In May 2025, GE Vernova made an investment of USD 16 million in India to expand manufacturing and engineering capabilities for advanced grid technologies with new production lines in Chennai and Noida, improving capacity for next-gen transmission equipment. The region’s large-scale rural electrification initiatives and robust industrial growth have driven the need for reliable and efficient power distribution systems. Additionally, government-backed renewable energy integration efforts and expanding smart grid projects have accelerated the deployment of advanced distribution transformers across utilities and commercial sectors. The rising focus on reducing transmission losses and improving energy efficiency has further supported the demand for technologically advanced transformers, strengthening the region's leadership.

The China distribution transformer market was valued at USD 2.07 billion in 2024 due to its rapid industrialization and urbanization, necessitating large-scale power infrastructure expansion. The government’s aggressive investments in renewable energy projects, such as wind and solar farms, have greatly boosted demand for efficient distribution transformers. Furthermore, China’s focus on domestic manufacturing capabilities and cost-competitive production has strengthened its position in both local and global sectors. The push toward electrification in rural areas and smart grid initiatives highlights the country’s high valuation.

The Europe distribution transformer market is projected to witness substantial growth during the forecast period, propelled by the region's aggressive de-carbonization goals and focus on energy transition. Investments in upgrading aging grid infrastructure and integrating distributed energy resources, such as solar and wind, have increased the need for modern, flexible transformer systems. According to a May 2025 EU parliament report, the EU's Connecting Europe Facility (CEF) has allocated USD 6.26 million between 2021 and 2027 to advance clean energy transition and energy union goals. Funding prioritizes cross-border renewable projects and grid interoperability to modernize and digitalize EU energy systems under the TEN-E policy framework. The push for electrification across transportation and heating sectors, alongside the growing adoption of digital grid technologies, is increasing the need for transformers with advanced monitoring and control features. Additionally, strict energy efficiency regulations and sustainability mandates are influencing utilities and industries to replace legacy transformers with high-performance, eco-efficient alternatives, driving consistent expansion across Europe.

The UK distribution transformer market is expected to register a CAGR of 5.87% during the forecast period, driven by the country’s transition toward a decarbonized energy system and increasing renewable energy capacity. Policies promoting offshore wind farms and grid upgrades to support distributed energy resources are major growth factors. Additionally, the replacement of aging transformer fleets and the integration of smart grid technologies contribute to sustained demand. The UK’s focus on energy security and reducing transmission losses ensures a favorable outlook for expansion opportunities.

Key Players and Competitive Analysis

The distribution transformer industry is witnessing competition driven by strategic investments, emerging markets, and technological advancements. Players such as Hitachi Energy, Siemens, and Schneider Electric are leveraging competitive intelligence to capitalize on revenue opportunities, particularly in developed markets where grid modernization is a priority. Meanwhile, emerging market segments present expansion opportunities due to rising electrification needs. Disruptions and trends such as renewable energy integration and smart grids are reshaping future development strategies, pushing vendors to innovate in efficiency and sustainability. Companies are also exploring joint ventures and mergers and acquisitions to strengthen their regional footprint and address supply chain disruptions. Revenue growth is further fueled by latent demand in small and medium-sized businesses, while economic and geopolitical shifts influence pricing insights and vendor strategies. Firms are focusing on sustainable value chains and expert insights to navigate macroeconomic trends and industry-leading competitive intelligence to maintain competitive positioning. This dynamic landscape highlights the importance of strategic alliances and business transformation to secure long-term growth.

A few key players are CG Power & Industrial Solutions Ltd; Eaton; GE Grid Solutions, LLC; Hammond Power Solutions; HD Hyundai Electric Co., Ltd.; Hitachi Energy Ltd; HYOSUNG HEAVY INDUSTRIES; Kirloskar Electric Company; Ormazabal; Padmavahini Transformers Private Limited; Schneider Electric; SGB SMIT; Siemens; Transformer India; Voltamp Transformers; and WILSON POWER AND DISTRIBUTION TECHNOLOGIES PVT. LTD.

Key Players

- CG Power & Industrial Solutions Ltd

- Eaton

- GE Grid Solutions, LLC

- Hammond Power Solutions

- HD Hyundai Electric Co., Ltd.

- Hitachi Energy Ltd

- HYOSUNG HEAVY INDUSTRIES

- Kirloskar Electric Company

- Ormazabal.

- Padmavahini Transformers Private Limited

- Schneider Electric.

- SGB SMIT

- Siemens

- Transformer India

- Voltamp Transformers

- WILSON POWER AND DISTRIBUTION TECHNOLOGIES PVT. LTD

Industry Developments

May 2025: HPS launched an EV charging distribution transformer, addressing high harmonic currents and overheating risks in fast-charging installations. It features k-factor and harmonic mitigation, with low-temperature rise options for warmer climates.

January 2025: Efacec signed a 5-year framework agreement with Germany’s EnBW to supply over 2,600 distribution transformers from 2024 to 2028. The contract, valued at tens of millions of euros, covers transformer deliveries.

April 2024: Hitachi Industrial Equipment Systems and Mitsubishi Electric agreed to transfer Mitsubishi’s Nagoya Works distribution transformer business (excluding Ako Factory transformers) to Hitachi.

Distribution Transformer Market Segmentation

By Mounting Outlook (Revenue, USD Billion, 2020–2034)

- Pad

- Pole

- Underground

By Transformer Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-phase Transformers

- Three-phase Transformers

By Power Range Outlook (Revenue, USD Billion, 2020–2034)

- Up to 0.5 MVA

- 0.5–2.5 MVA

- 2.5–10 MVA

- Above 10 MVA

By Insulation Outlook (Revenue, USD Billion, 2020–2034)

- Oil Immersed

- Dry

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Power Utilities

- Residential & Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Distribution Transformer Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.69 billion |

|

Market Size in 2025 |

USD 20.88 billion |

|

Revenue Forecast by 2034 |

USD 31.59 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.69 billion in 2024 and is projected to grow to USD 31.59 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are CG Power & Industrial Solutions Ltd; Eaton; GE Grid Solutions, LLC; Hammond Power Solutions; HD Hyundai Electric Co., Ltd.; Hitachi Energy Ltd; HYOSUNG HEAVY INDUSTRIES; Kirloskar Electric Company; Ormazabal; Padmavahini Transformers Private Limited; Schneider Electric; SGB SMIT; Siemens; Transformer India; Voltamp Transformers; and WILSON POWER AND DISTRIBUTION TECHNOLOGIES PVT. LTD.

The oil immersed segment dominated the market in 2024.

The above 10 MVA segment is expected to witness the fastest growth during the forecast period.