Drippers Market Size, Share, Trends, Industry Analysis Report

: By Type (Inline and Online), Crop Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3395

- Base Year: 2024

- Historical Data: 2020-2023

Drippers Market Overview

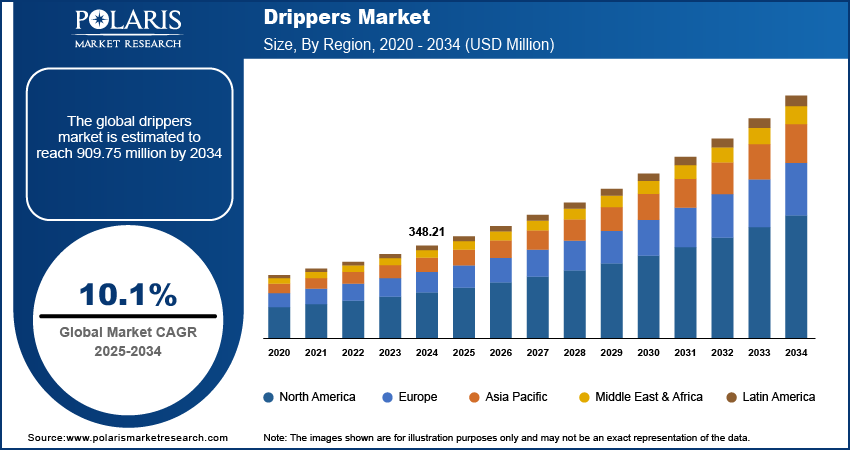

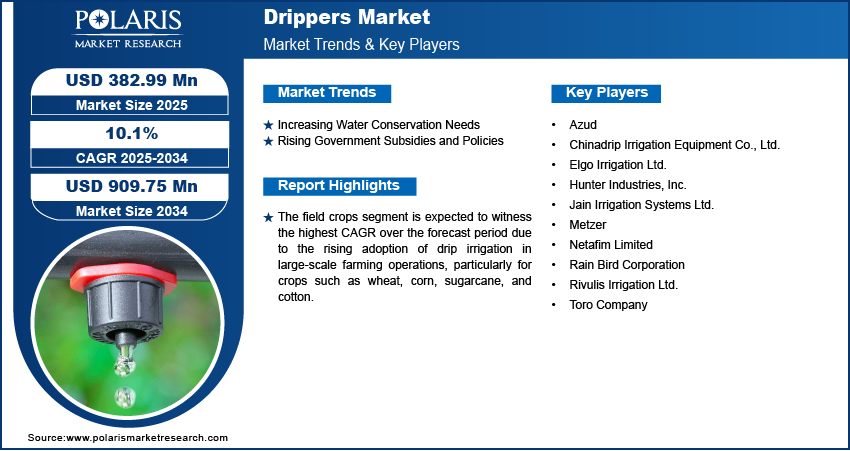

Drippers market size was valued at USD 348.21 million in 2024 and is expected to reach USD 382.99 million by 2025 and 909.75 million by 2034, exhibiting a CAGR of 10.1% during the forecast period.

The drippers market focuses on manufacturing and supplying drip irrigation drippers, which are small devices used in precision irrigation systems to control the slow and steady release of water to plant roots. The need for higher crop yields and efficient irrigation methods is driving the adoption of drippers, especially in regions with limited water resources thereby, contributing to the market growth. Moreover, innovations such as pressure-compensating drippers, clog-resistant designs, and smart irrigation systems enhance efficiency, making drippers more attractive to farmers which is fueling drippers market demand.

To Understand More About this Research: Request a Free Sample Report

The increasing adoption of protected cultivation and commercial horticulture is driving the demand for advanced and efficient irrigation systems, particularly drippers. These precision irrigation solutions help optimize water use, improve crop yields, and ensure consistent moisture levels in controlled environments such as greenhouses and high-tech farms.

Beyond traditional agriculture, drippers are becoming popular in landscaping, sports fields, and home gardening. Their ability to deliver water directly to the root zone minimizes wastage, reduces soil erosion, and promotes healthier plant growth. This expansion into non-agricultural applications is broadening the drippers market, as urban landscapes, golf courses, and residential gardens increasingly adopt water-efficient irrigation systems. As sustainability concerns grow, the demand for drippers is expected to rise across multiple sectors.

Drippers Market Dynamics

Increasing Water Conservation Needs

Water conservation is a critical drippers market driver, as increasing water scarcity and depleting groundwater levels push the agriculture sector toward more efficient irrigation solutions. Traditional irrigation methods, such as flood or sprinkler irrigation, often lead to excessive water consumption, runoff, and evaporation losses. Moreover, in water-stressed regions, such as parts of India, the Middle East, and Africa, the need for efficient irrigation has become even more crucial, driving farmers to invest in drippers as a long-term solution. Additionally, as climate change continues to disrupt rainfall patterns and worsen drought conditions, the demand for precision irrigation systems is expected to rise, further propelling market growth. For instance, in July 2024, global average temperatures reached a record 17.16 °C. This extreme heat caused considerable soil moisture evaporation, increasing the exposure of vegetation and biodiversity and threatening ecological stability across many ecosystems worldwide.

Rising Government Subsidies and Policies

Government subsidies and policies play a crucial role in driving the adoption of micro-irrigation systems, including drippers, as part of broader efforts to promote sustainable and efficient water use in agriculture. Recognizing the urgency of water conservation and the need to enhance agricultural productivity, many governments worldwide are offering financial incentives, grants, and subsidies to encourage farmers to transition from traditional irrigation methods to drip irrigation. Additionally, regulatory measures such as water-use restrictions, agricultural water pricing reforms, and mandatory micro-irrigation adoption in certain regions are further accelerating market growth. For instance, in India, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) offers subsidies covering up to 55-75% of the cost of drip irrigation systems, promoting widespread adoption. These initiatives support resource conservation and contribute to higher crop yields, reduced operational costs, and improved farmer incomes, thereby reinforcing the long-term sustainability of agriculture. Thus, as climate change worsens and water availability declines, governments are likely to boost policies and financial support for micro-irrigation, driving the drippers market expansion.

Drippers Market Segment Insights

Drippers Market Assessment by Type

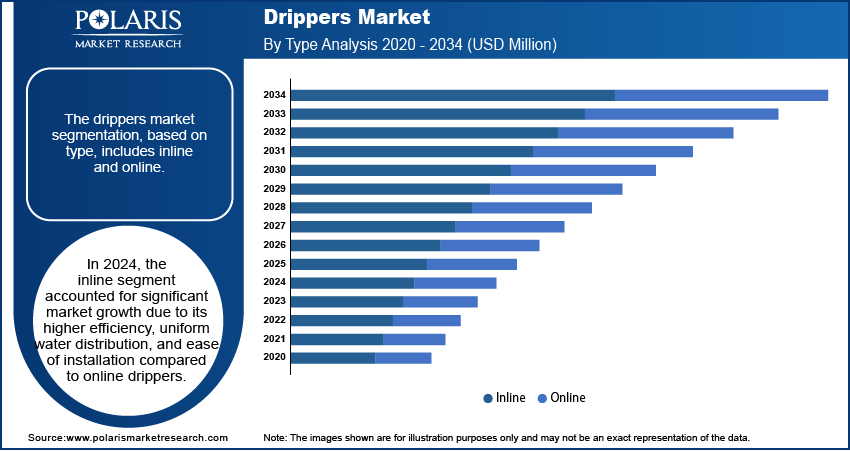

The drippers market segmentation, based on type, includes inline and online. In 2024, the inline segment accounted for significant market growth due to its higher efficiency, uniform water distribution, and ease of installation compared to online drippers. Inline drippers are pre-installed within the lateral irrigation tubing, ensuring consistent water flow to each plant, which is particularly beneficial for row crops, orchards, vineyards, and greenhouse farming. Their design minimizes clogging issues and reduces maintenance requirements, making them a cost-effective and reliable choice for large-scale agricultural applications. Additionally, the growing emphasis on precision agriculture and water conservation has led farmers to adopt inline drippers, as they optimize water usage while ensuring uniform moisture levels in the soil. Moreover, with advancements in pressure-compensating and self-cleaning technologies, inline drippers have developed more efficiently, driving their increasing preference over traditional irrigation methods.

Drippers Market Evaluation by Crop Type

The global drippers market segmentation, based on crop type, includes field crops, fruits & nuts, vegetable crops, and other crops. The field crops segment is expected to witness the highest drippers market CAGR over the forecast period. This growth is due to the rising adoption of drip irrigation in large-scale farming operations, particularly for crops such as wheat, corn, sugarcane, and cotton. Increasing concerns over water scarcity are declining groundwater levels and fluctuating rainfall patterns. Thus, farmers are shifting toward water-efficient irrigation methods to maximize yield while minimizing resource wastage. Technological advancements in pressure-compensating and anti-clogging drippers have further boosted their adoption, allowing farmers to irrigate expansive fields with greater precision and lower operational costs. Global food demand continues to rise, along with the need for sustainable agricultural practices. As a result, the field crops segment is poised for rapid expansion, driving significant growth.

Drippers Market Share by Regional Analysis

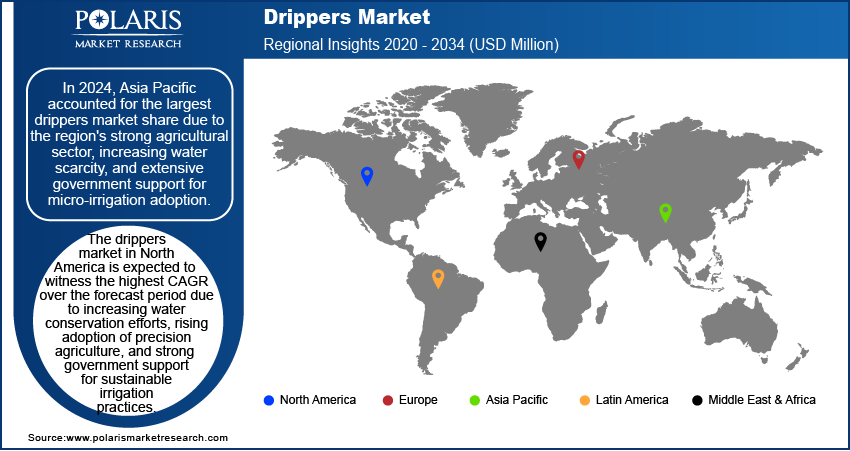

By region, the study provides drippers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's strong agricultural sector, increasing water scarcity, and extensive government support for micro-irrigation adoption. Countries such as India, China, and Australia are witnessing rapid adoption of drip irrigation systems, driven by the need to enhance crop productivity and optimize water usage in the face of irregular monsoons and declining groundwater levels. Government initiatives and subsidies have played a crucial role in accelerating market growth, with programs such as China’s agricultural water conservation policies promoting large-scale deployment of drippers. Additionally, growing investments in precision agriculture, rising awareness among farmers about efficient irrigation methods, and increasing adoption of high-value crops such as fruits, nuts, and vegetables have further fueled demand for drippers in the region. For instance, in October 2024, the Asian Development Bank approved a USD 125 million financing package to enhance year-round irrigation water access in rural Rautahat and Sarlahi districts, Madhesh Province, Nepal. The presence of leading micro-irrigation manufacturers and ongoing technological advancements in pressure-compensating and clog-resistant drippers have also contributed to the drippers market growth in Asia Pacific.

The drippers market in North America is expected to witness the highest CAGR over the forecast period due to increasing water conservation efforts, rising adoption of precision agriculture, and strong government support for sustainable irrigation practices. The growing concerns over water shortages and drought conditions, particularly in regions such as California, Texas, and Arizona, farmers are increasingly shifting toward drip irrigation systems to optimize water usage and enhance crop yields. The adoption of smart irrigation technologies, including IoT-enabled and pressure-compensating drippers, is further accelerating market growth, as these solutions enable real-time monitoring and efficient water distribution. Additionally, government programs and subsidies, such as the US Environmental Quality Incentives Program (EQIP) and state-level agricultural water conservation initiatives, are providing financial incentives for farmers to invest in drip irrigation systems. The expansion of high-value crop cultivation, including fruits, nuts, and vegetables, along with the presence of leading drip irrigation system manufacturers and research institutions, is further driving innovation and market expansion.

Drippers Key Market Players & Competitive Analysis Report

The competitive landscape of the drippers market is characterized by the presence of several global and regional players focused on innovation, product expansion, and strategic collaborations to strengthen their market position. Major companies in the market include Netafim Ltd., Jain Irrigation Systems Ltd., The Toro Company, Hunter Industries, Rain Bird Corporation, and Rivulis Irrigation Ltd., among others. These companies are actively investing in R&D to develop advanced drippers with enhanced clog resistance, pressure compensation, and smart irrigation capabilities. Market players are also adopting strategies such as mergers & acquisitions, partnerships, and geographic expansion to capture a larger customer base. Additionally, government incentives and subsidy programs in regions such as North America, Asia Pacific, and Europe are encouraging new entrants and regional manufacturers to enter the market, intensifying competition. The rising demand for water-efficient irrigation systems, especially in water-scarce regions, is also driving companies to enhance their product portfolios with customized drippers for different crop types and soil conditions.

The Toro Company was established as the "Toro Motor Company" to build tractor engines in 1914. Later, the company transit to manufacturing farm equipment and is credited with developing the first mechanical golf course maintenance tools. The company is engaged in designing, manufacturing, and marketing skilled turf maintenance kits, services, turf irrigation systems, landscaping equipment, and lighting. Toro's product portfolio includes turf and landscape maintenance equipment, snow and ice management equipment, and irrigation systems. The company provides solutions for outdoor environments and is present in over 125 countries. Toro is headquartered in Bloomington, Minnesota, and serves homeowners, professional contractors, golf courses, groundskeepers, rental companies, governments, and educational institutions. Toro purchased an irrigation equipment manufacturer in 1962 and entered the underground irrigation business. The company acquired James Hardie Irrigation in 1996. Toro also offers drip tape such as Aqua-Traxx B-come that combines efficiency and sustainability.

Netafim is engaged in producing drippers, sprinklers, dripper lines, and micro-emitters. The company was established in 1965. Netafim also manufactures and delivers crop management technologies, including dosing systems, monitoring and control systems, and crop management software, as well as services including agronomical advisory, managed irrigation, and operation and maintenance. Netafim is headquartered in Tel Aviv-Yafo, Israel, and maintains 33 subsidiaries and 17 manufacturing plants worldwide. Netafim offers a range of products and services, including micro-irrigation, community irrigation, greenhouses, and digital farming solutions. The company's product portfolio includes drip irrigation systems and other water technologies developed to deliver solutions in control, efficient irrigation, and agronomy for various field crops, orchards, and vineyards grown under diverse conditions worldwide.

Key Companies in Drippers Market

- Azud

- Chinadrip Irrigation Equipment Co., Ltd.

- Elgo Irrigation Ltd.

- Hunter Industries, Inc.

- Jain Irrigation Systems Ltd.

- Metzer

- Netafim Limited

- Rain Bird Corporation

- Rivulis Irrigation Ltd.

- The Toro Company

Drippers Market Developments

September 2024: Rivulis Pte. Ltd. launched the largest micro-irrigation manufacturing facility in North America to boost production capacity, addressing the rising demand for efficient, resource-conserving irrigation technologies.

November 2024: Orbia Advance Corporation’s S.A.B. de C.V. Precision Agriculture division, Netafim, introduced two innovations at EIMA: GrowSphere, a comprehensive irrigation management system, and the Orion PC, the first thin-wall, pressure-compensated dripline, designed for precise water delivery and efficiency.

March 2022: PepsiCo and N-Drip partnered to enhance water efficiency in agriculture across 10,000 hectares (25,000 acres) by 2025. This collaboration focuses on implementing innovative drip irrigation technology to optimize water usage, improve crop yields, and promote sustainability in farming practices worldwide.

Drippers Market Segmentation

By Type Outlook (Revenue USD Million 2020 - 2034)

- Inline

- Online

By Crop Type Outlook (Revenue USD Million 2020 - 2034)

- Field Crops

- Fruits & Nuts

- Vegetable Crops

- Other Crops

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drippers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 348.21 million |

|

Market Size Value in 2025 |

USD 382.99 million |

|

Revenue Forecast in 2034 |

USD 909.75 million |

|

CAGR |

10.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drippers market size was valued at USD 348.21 million in 2024 and is projected to grow to USD 909.75 million by 2034.

The global market is projected to register a CAGR of 10.1% during the forecast period.

In 2024, Asia Pacific accounted for the largest drippers market share due to the region's strong agricultural sector, increasing water scarcity, and extensive government support for micro-irrigation adoption.

Some of the key players in the market are Azud; Chinadrip Irrigation Equipment Co., Ltd.; Elgo Irrigation Ltd.; Hunter Industries, Inc.; Jain Irrigation Systems Ltd.; Metzer; Netafim Limited; Rain Bird Corporation; Rivulis Irrigation Ltd.; and Toro Company.

In 2024, the inline segment accounted for significant market growth due to its higher efficiency, uniform water distribution, and ease of installation compared to online drippers.

The field crops segment is expected to witness the highest CAGR over the forecast period due to the rising adoption of drip irrigation in large-scale farming operations, particularly for crops such as wheat, corn, sugarcane, and cotton.