Edge Security Market Size, Share, Trends, & Industry Analysis Report

By (Solutions and Services), By Deployment Mode, By Organization Size, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5972

- Base Year: 2024

- Historical Data: 2020-2023

Overview

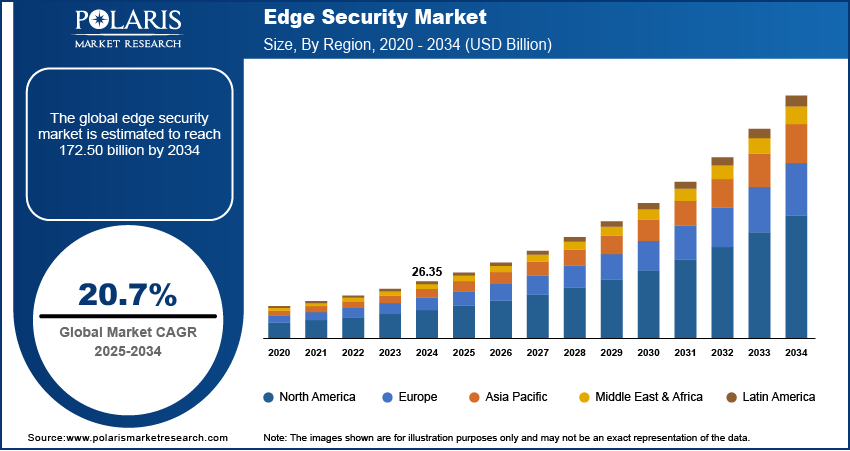

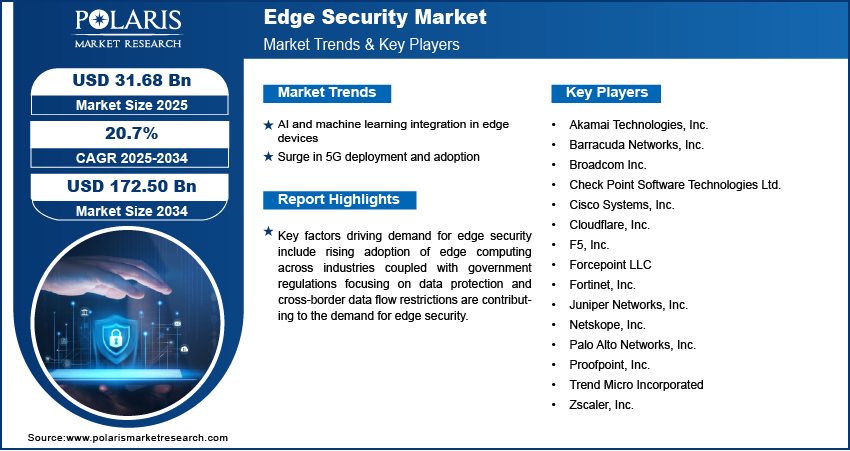

The global edge security market size was valued at USD 26.35 billion in 2024, growing at a CAGR of 20.7% from 2025–2034. Key factors driving demand for edge security include the rising artificial intelligence (AI) and machine learning integration in edge devices coupled with surge in 5G deployment and adoption.

Key Insights

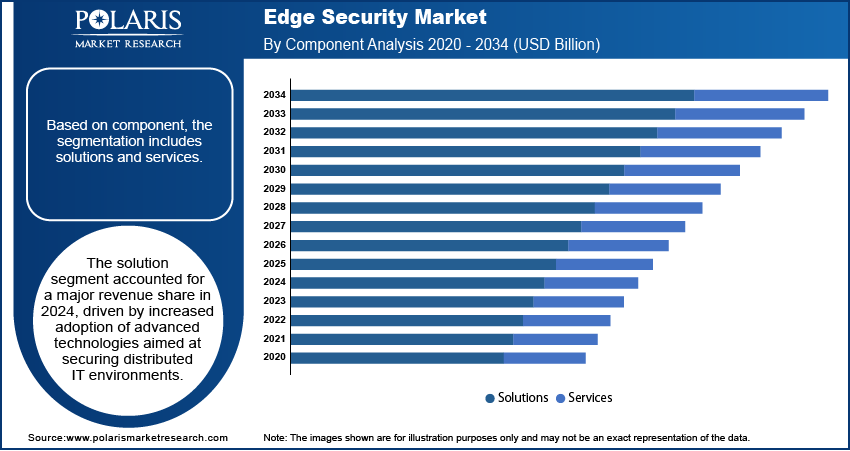

- The solution segment accounted for largest revenue share in 2024.

- The on-premises segment is projected to grow at a rapid pace in the coming years, attributed to rising demand for internal control, regulatory compliance, and data security across critical sectors.

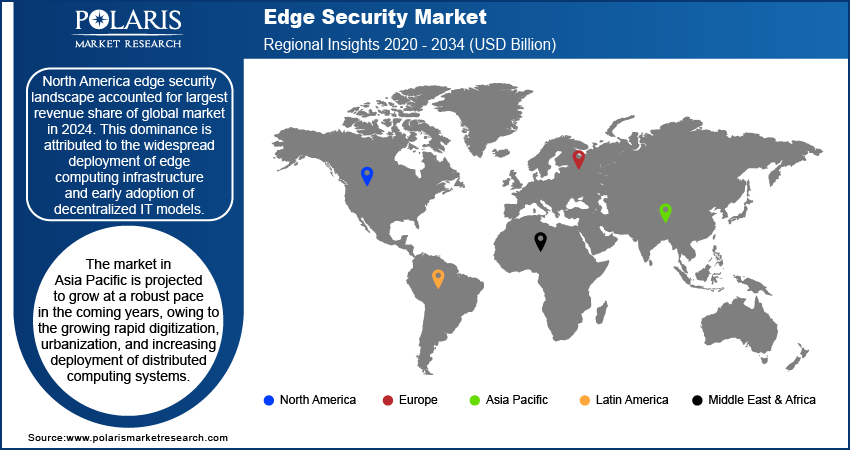

- North America accounted for largest revenue share of the global market in 2024, driver by early adoption of decentralized IT models and widespread edge infrastructure deployment.

- The US held largest regional market share in North America in 2024, owing to a strong digital ecosystem, significant enterprise IT spending, and ongoing cybersecurity modernization efforts.

- Asia Pacific is projected to grow at the fastest pace from 2025 to 2034, owing to rapid digitization, urbanization and rising deployment of distributed computing systems.

- The market in China is expanding rapidly due to increasing investments and technological advancements in edge computing infrastructure.

Edge security solutions are designed to protect data, devices, and applications at or near the point of data generation, using technologies such as secure access service edge (SASE), zero trust architecture, and threat detection at the edge. These solutions help minimize latency, reduce bandwidth usage, and enhance real-time threat mitigation by processing security functions closer to the user or device. Edge security ensures robust protection without compromising performance or user experience, making it ideal for industries with distributed networks such as manufacturing, healthcare, retail, and transportation. Along with improving threat response times, edge security enhances data privacy, supports compliance requirements, and reduces dependence on centralized infrastructure.

To Understand More About this Research: Request a Free Sample Report

Rising adoption of edge computing across industries such as manufacturing, healthcare, telecommunications, and smart infrastructure is fueling the demand for robust edge security frameworks. Enterprises are seeking solutions that enforce real-time threat detection, policy enforcement, and access control without relying solely on centralized security models. According to the Eclipse Foundation's 2023 report, edge computing adoption is growing, with 53% of organizations already using or planning to implement edge technologies within the next 12 months. Additionally, 20% are actively assessing the potential of edge deployments. This shift is compelling security vendors to offer tailored solutions capable of protecting data-in-motion and enforcing consistent protection across highly distributed IT environments.

Government regulations focusing on data protection and cross-border data flow restrictions are further contributing to the demand for edge security. Regulations such as the General Data Protection Regulation (GDPR) and sector-specific mandates in North America and Asia Pacific are pushing enterprises to secure localized data and ensure compliance with regional laws. For instance, in August 2023, the Government of India announced the Digital Personal Data Protection Act, 2023 (DPDP Act), establishing the country’s regulatory framework for personal data protection. The Act outlines key compliance requirements related to the collection, processing, storage, and transfer of digital personal data. These regulatory requirements are pushing companies to redesign their cybersecurity strategies around decentralized processing environments.

Industry Dynamics

- The growing use of artificial intelligence and machine learning in edge devices is increasing the need for localized security models to detect and mitigate threats in real time.

- Rising integration of 5G networks with edge computing is expanding the volume of endpoints, leading to increased demand for security solutions tailored for ultra-low latency environments.

- Integration of artificial intelligence (AI) in edge security solutions creates opportunity for the market to enhance threat analytics and autonomous response capabilities.

- High implementation and integration costs limit adoption among resource-constrained organizations.

AI and Machine Learning Integration in Edge Devices: The increasing deployment of artificial intelligence (AI) and machine learning (ML) capabilities in edge devices is increasing the need for advanced security solutions, therefore fueling the market growth. In June 2025, EU PREVAIL project launched an Edge AI platform that allowed real-time AI workloads to run directly on edge devices reducing latency, conserving bandwidth, and better protecting privacy. The platform provides multi-hub access to advanced chip prototyping including embedded nonvolatile memory, silicon photonics, and 3D integration for developers and researchers. The integration of AI at the edge allows systems to respond independently without relying on cloud-based processing. These use cases demand security frameworks capable of continuous behavioral monitoring, secure firmware validation, and real-time anomaly detection. The growing shift toward localized AI inference and real-time analytics is securing data pipelines and embedded systems at the device level across various industry verticals.

Surge in 5G Deployment and Adoption: The growing adoption of 5G networks is accelerating the expansion of edge computing infrastructure by enabling high-speed connectivity, reduced latency, and near-instantaneous data transmission. According to 5G Americas, global 5G connections surged to 1.5 wireless connections per person, reaching 2.25 billion connections worldwide in 2024. This is facilitating new use cases in autonomous mobility, industrial automation, and smart city deployments, where edge nodes handle data processing closer to the source. Moreover, enterprises implementing 5G-enabled edge environments are focusing on advanced security architectures that include real-time threat detection, granular network segmentation, encrypted traffic flows, and automated incident response. Thus, the ongoing developments in establishing 5G is driving the edge security capabilities due to its role in enabling next-generation network performance.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solutions and services. The solutions segment accounted for largest revenue share in 2024, driven by increased adoption of advanced technologies aimed at securing distributed IT environments. Organizations are implementing comprehensive platforms that include secure access service edge (SASE), next-generation firewalls, intrusion prevention systems, endpoint protection, and zero trust access models. These solutions are used to protect users, data, and applications at remote sites, branch offices, and industrial locations. The need for real-time data protection, consistent policy enforcement, and lower latency threat detection is pushing enterprises to invest in integrated and standalone edge security offerings. Moreover, the increasing frequency of targeted cyberattacks and the operational risk of data breaches accelerated the shift toward edge-focused security infrastructure.

The services segment is expected to grow at the fastest CAGR from 2025 to 2034, driven by rising demand for advisory, implementation, and managed security offerings across diverse industry verticals. Many organizations are turning to specialized service providers to configure and maintain secure edge environments, as network complexity grows. These services include continuous vulnerability scanning, real-time incident response, policy updates, and compliance reporting. Small and medium enterprises are increasingly opting for security-as-a-service models to overcome internal resource limitations and manage cost-effective cybersecurity operations at the edge.

Deployment Mode Analysis

In terms of deployment mode, the segmentation includes on-premises and cloud. The cloud segment dominated the revenue share in 2024, attributed to organizations increasingly embracing scalable, cost-effective, and flexible security models that meet with modern IT environments. Cloud-based edge security solutions enable centralized management of policies, allow faster response to threats, and support integration across multiple sites without the need for heavy infrastructure. Businesses deploying hybrid or remote work environments are relying on cloud-delivered platforms to secure communication flows, user identities, and application access across geographies. Additionally, continuous innovation in cloud-native security tools and greater vendor support for multi-cloud integration contributed to the segment’s dominance. For instance, in October 2023, Darktrace launched a new cloud-native security solution that integrates its Self‑Learning AI to deliver real-time threat visibility across AWS and Azure environments. The platform autonomously detects and responds to misconfigurations, identity anomalies, and emerging cyber threats.

The on-premises segment is anticipated to grow steadily during the forecast period, particularly in industries where regulatory compliance, data localization, or operational control are top priorities. Enterprises in defense, energy, government, and financial services sectors require dedicated hardware, isolated network setups, and custom configurations for security purposes. These organizations are increasingly investing in on-site security appliances and edge-native controls that are fully managed internally. Concerns about third-party access, data leakage, and real-time monitoring have reinforced the appeal of on-premises solutions among large organizations with sensitive data and critical infrastructure.

Organization Size Analysis

Based on organization size, the segmentation includes large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment generated the highest revenue in 2024, due to extensive and distributed IT operations that span across multiple geographies and involve complex data interactions. These enterprises typically face a larger threat surface and a higher frequency of targeted cyber incidents. To mitigate operational risks, large enterprises are deploying multi-layered edge security frameworks that offer granular visibility, network segmentation, and centralized policy control. Industries such as manufacturing, telecom, and energy are leading adopters, where real-time performance and uninterrupted data flow are business-critical. The financial capacity to invest in high-performance hardware, AI-driven analytics, and continuous threat hunting further supporting the adoption.

The SMEs segment is projected to record the fastest CAGR through 2034, owing to the rising digitalization and exposure to cyberattacks, forcing smaller businesses to prioritize cybersecurity investments. SMEs operating in healthcare, logistics, and retail are increasingly adopting cost-effective and simplified edge security solutions to protect local networks, POS systems, and remote workers. Cloud-based delivery models, pay-as-you-go pricing, and pre-configured security packages are helping overcome resource limitations and technical barriers. Additionally, growing compliance mandates and increased awareness around data breaches are contributing to edge security adoption across smaller business environments.

Vertical Analysis

In terms of vertical, the segmentation includes government & defense, BFSI, IT & telecom, healthcare, retail, manufacturing, energy & utilities, and other verticals. The IT & telecom segment led the market in 2024, fueled by rapid digital transformation and the deployment of 5G infrastructure. Telecom providers and hyperscale cloud platforms are expanding edge nodes closer to customers, which requires resilient security to protect data in motion and ensure service availability. High volumes of data traffic, increasing endpoints, and reliance on distributed architectures are creating the need for scalable security tools tailored for edge use. Tools such as micro-segmentation, virtual firewalls, and encrypted tunnels are deployed to maintain integrity and uptime across edge environments.

The healthcare segment is expected to grow at the fastest rate during the forecast period, driven by the increasing use of connected medical devices, telemedicine platforms, and remote diagnostics. Healthcare providers must ensure that patient data remains secure at all endpoints, as medical records and imaging files are transferred between hospitals, labs, and cloud systems. Regulatory compliance requirements such as HIPAA and GDPR further add to the urgency of deploying secure edge frameworks. Edge security solutions are used to secure Internet of Medical Things (IoMT) devices, control access to critical systems, and prevent data tampering in highly sensitive environments.

Regional Analysis

North America edge security market accounted for largest revenue share of global market in 2024. This dominance is attributed to the widespread deployment of edge computing infrastructure and early adoption of decentralized IT models. Enterprises across the region are integrating edge security frameworks to secure distributed applications and users across industries such as telecommunications, financial services, and manufacturing. The region’s well-established technology ecosystem supports edge-native security platforms equipped with features such as micro-segmentation, zero trust enforcement, and real-time threat intelligence. In addition, increasing adoption of hybrid work environments and growing investments in Industry 4.0 technologies are accelerating the demand for advanced edge protection. Also, the region benefits from strong regulatory enforcement of data privacy and cybersecurity compliance, pushing businesses to deploy localized and scalable security tools to maintain operational continuity.

US Edge Security Market Insight

US held largest regional share in North America edge security landscape in 2024, owing to its strong digital ecosystem, robust enterprise IT spending, and emphasis on cybersecurity modernization. For instance, The Federal Information Technology (IT) Budget for fiscal year (FY) 2023 proposed spending USD 65 billion on IT across civilian agencies. This funding aimed to support the delivery of essential public services, enhance the security of sensitive data and systems, and advance the Administration’s goal of building a more effective and efficient government. Moreover, businesses in the US are rapidly deploying edge-based threat detection, identity management, and access control tools to support secure remote operations and reduce the attack surface across connected assets. The proliferation of 5G infrastructure, coupled with increased IoT adoption in sectors such as retail, healthcare and utilities is expanding the footprint of edge nodes, further highlighting the need for localized security solutions. In addition, growing investment by hyperscale cloud providers and telecom operators is boosting the adoption of scalable edge security frameworks designed to secure multi-cloud and hybrid environments.

Asia Pacific Edge Security Market

The market in Asia Pacific is projected to witness fastest CAGR during the forecast period, owing to the growing rapid digitization, urbanization, and increasing deployment of distributed computing systems. Enterprises across countries such as China, Japan, South Korea, Singapore, and Australia are accelerating investments in edge computing infrastructure to support latency-sensitive applications across smart cities, industrial automation, and telecom networks. These developments are increasing the demand for real-time threat mitigation and localized control of sensitive data, making edge security an operational necessity. Additionally, the rise of regional cybersecurity mandates and the presence of a large number of SMEs are boosting the use of cloud-delivered edge protection platforms.

China Edge Security Market Overview

The market in China is expanding due to the increasing investments and rapid technological advancements in edge computing infrastructure. The shift toward decentralized data processing to enable real-time analytics and minimize latency is driving stronger demand for robust security frameworks. In May 2025, China launched 12 satellites as part of the world’s first space-based edge computing network, called the Three-Body Constellation. These satellites were equipped to perform AI-powered data processing directly in orbit, enabling faster, localized analytics and reducing dependence on ground-based infrastructure. This development highlight China’s strategic push to dominate edge computing technologies. Also it emphasizes the growing need for advanced edge security solutions to protect increasingly distributed and mission-critical data environments.

Europe Edge Security Market

The edge security landscape in Europe is projected to hold a substantial share in 2034, due to rising strong regulatory frameworks coupled with advanced data protection initiatives. Data localization mandates and compliance with General Data Protection Regulation (GDPR) are compelling organizations to adopt security models that provide localized threat detection, encrypted communication, and secure data storage. Countries such as Germany, France, and the UK are investing in edge infrastructure to support critical industries and are increasingly integrating edge-native security solutions as part of national cybersecurity resilience strategies. Moreover, the European Union’s focus on digital sovereignty is accelerating the need for regionally managed and auditable edge protection tools.

Key Players & Competitive Analysis Report

The edge security industry is highly competitive, marked by active participation from global cybersecurity vendors, cloud-native solution providers, and network infrastructure companies. Market participants differentiate through advanced capabilities in encrypted traffic inspection, zero trust enforcement, and automated threat response tailored for distributed edge environments. Key players such as Akamai Technologies, Cisco Systems, Palo Alto Networks, and Zscaler are expanding their portfolios with integrated SASE, ZTNA, and FWaaS offerings to secure data, applications, and devices at the network perimeter. Strategic initiatives include strengthening cloud-delivered security architectures, enhancing compatibility with hybrid IT environments, and scaling threat intelligence across latency-sensitive use cases.

Major companies operating in the edge security market include Akamai Technologies, Inc., Barracuda Networks, Inc., Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Cloudflare, Inc., F5, Inc., Forcepoint LLC, Fortinet, Inc., Juniper Networks, Inc., Netskope, Inc., Palo Alto Networks, Inc., Proofpoint, Inc., Trend Micro Incorporated, and Zscaler, Inc.

Key Players

- Akamai Technologies, Inc.

- Barracuda Networks, Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- F5, Inc.

- Forcepoint LLC

- Fortinet, Inc.

- Juniper Networks, Inc.

- Netskope, Inc.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Trend Micro Incorporated

- Zscaler, Inc.

Industry Developments

- May 2025: NetFoundry received USD 12 million in funding to enhance its edge-native networking platform, aiming to replace legacy models with zero trust and AI-optimized security frameworks. The investment supports the development of scalable, software-defined edge security solutions for distributed and AI-driven environments.

- March 2025: CISO Global launched an AI-powered cloud security solution to enhance enterprise cyber resilience at the edge. The platform focuses on securing distributed environments by integrating threat detection, response automation, and policy enforcement across cloud and edge networks.

- January 2024: Kyndryl launched new Edge Security Services to help enterprises protect distributed environments through secure access, threat detection, and policy enforcement at the network edge. The offering integrates zero trust principles with advanced analytics to enhance real-time risk management across edge infrastructure.

Edge Security Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- SMES

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Government & Defense

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Manufacturing

- Energy & Utilities

- Other Verticals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Edge Security Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.35 Billion |

|

Market Size in 2025 |

USD 31.68 Billion |

|

Revenue Forecast by 2034 |

USD 172.50 Billion |

|

CAGR |

20.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.35 billion in 2024 and is projected to grow to USD 172.50 billion by 2034.

The global market is projected to register a CAGR of 20.7% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Akamai Technologies, Inc., Barracuda Networks, Inc., Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Cloudflare, Inc., F5, Inc., Forcepoint LLC, Fortinet, Inc., Juniper Networks, Inc., Netskope, Inc., Palo Alto Networks, Inc., Proofpoint, Inc., Trend Micro Incorporated, and Zscaler, Inc.

The solution segment dominated the market in 2024, due to rising demand for integrated threat prevention and access control tools.

The on-premises segment is expected to witness the fastest growth during the forecast period, due to demand for data control and regulatory compliance.