Emollients Market Size, Share, Trends, Industry Analysis Report

By Form (Solid, Liquid), By Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5840

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

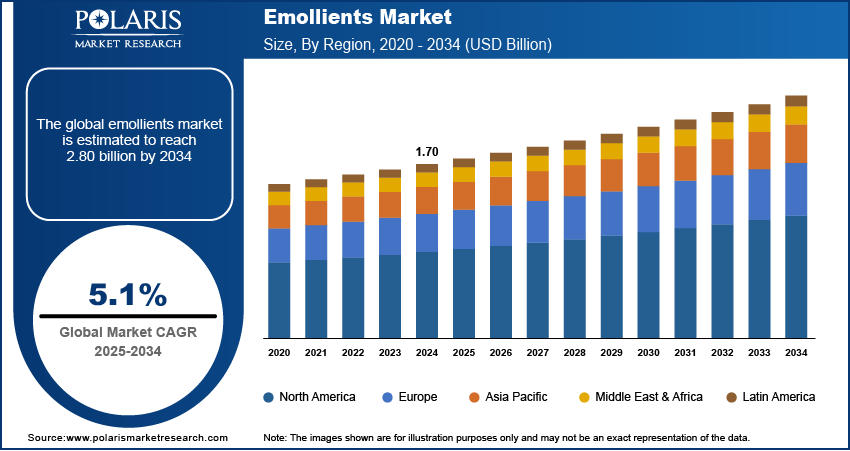

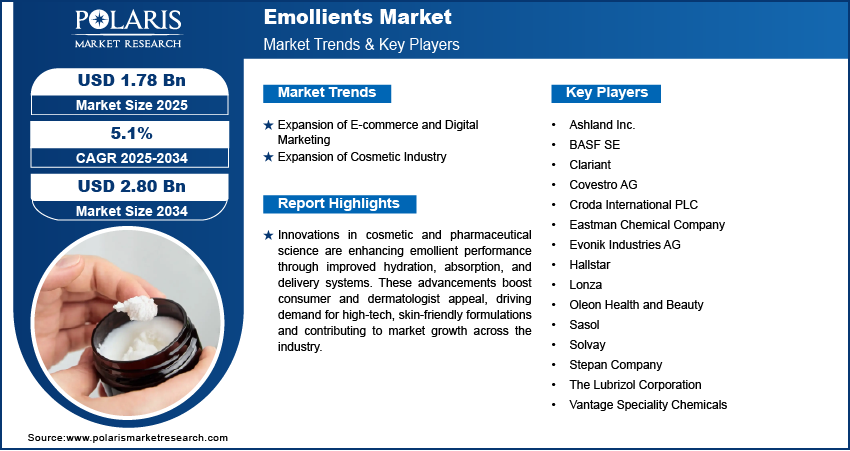

The global emollients market size was valued at USD 1.70 billion in 2024, growing at a CAGR of 5.1% from 2025 to 2034. The demand is driven by the growth of e-commerce and digital marketing, and the expansion of the cosmetics industry.

Emollients are ingredients used in skincare and cosmetic products to soften, smooth, and hydrate the skin by forming a protective barrier that prevents moisture loss. They help improve skin texture and are commonly found in lotions, creams, and ointments.

Consumers are increasingly seeking skincare and personal care products that contain natural and organic ingredients. This shift is driven by health concerns, environmental awareness, and a preference for "clean beauty" products. Natural emollients such as shea butter, coconut oil, and almond oil are being favored over synthetic alternatives. Companies are responding to this trend by reformulating products with plant-based and biodegradable ingredients. This rising preference for greener products benefits the environment and promotes healthier skin, which appeals to eco-conscious and health-focused consumers, thereby driving growth.

To Understand More About this Research: Request a Free Sample Report

Innovations in cosmetic and pharmaceutical science are enabling the development of more advanced and effective emollient products. Companies are investing in research to develop emollients that offer improved hydration, faster absorption, and better skin compatibility. Advanced delivery systems, such as nanoemulsions and encapsulated ingredients, are helping emollients work more efficiently and last longer. These advancements make products more appealing to both consumers and dermatologists. Demand for high-tech emollient formulations is rising as the industry prioritizes performance and skin-friendly solutions, attracting end users and manufacturers, thereby driving the growth.

Industry Dynamics

Growth of E-commerce and Digital Marketing

The e-commerce sector is expanding worldwide. According to the United States Census Bureau, retail sales through e-commerce platforms were worth USD 300,226 million in the U.S. in the first quarter of 2025. The rise in the penetration of e-commerce and online beauty platforms has made skincare and cosmetic products more accessible to a global consumer, driving the accessibility of emollient products. Additionally, online reviews, tutorials, and influencer marketing significantly shape consumer preferences and drive purchases. Digital platforms allow brands to target niche regions, offer product education, and showcase the benefits of emollients effectively. Moreover, the convenience of online shopping, micro-subscription services, and personalized skincare recommendations has led to more frequent buying patterns, further increasing the demand for products that rely heavily on emollients, thereby driving the industry growth.

Expansion of Cosmetic Industry

The cosmetic industry is expanding globally due to rising beauty trends, frequent product innovations, and increasing male interest in grooming. According to Cosmetics Europe, the retail sales of cosmetics in Europe alone were USD 119.771 billion or €104 billion in 2024. Emollients are a major ingredient in various cosmetic products, including foundations, primers, and lipsticks. They improve product texture and provide a silky, smooth finish that consumers prefer. Natural emollients are in greater demand due to the emergence of newer formulations and the rise of organic and herbal cosmetic lines. Moreover, brands are continually developing products for sensitive and dry skin, making emollients increasingly crucial. The need for multifunctional emollient ingredients rises as the cosmetic market grows, thereby driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on type, includes esters, fatty alcohols, fatty acids, ethers, silicones, and others. In 2024, the esters segment dominated with the largest share due to their excellent skin-softening properties, stability, and smooth texture. They are widely used in cosmetics and personal care products such as creams, lotions, sunscreens, and makeup. Esters blend well with other ingredients, helping improve the feel and spread of products. Their light, non-greasy nature makes them ideal for use in a wide range of skincare formulations. In addition, the growing popularity of premium and dermatologically-tested products contributed to the demand for esters, especially in regions with a high demand for advanced personal care, thereby driving the segment growth.

The fatty acids segment is expected to witness significant growth during the forecast period, due to rising consumer demand for natural and skin-nourishing ingredients. These compounds are derived from plant or animal sources and are known for their moisturizing and barrier-repairing abilities. They are increasingly used in formulations for dry and sensitive skin, as well as in antiaging and therapeutic skincare products. The shift toward clean-label and organic ingredients is further prompting manufacturers to include fatty acids such as linoleic and oleic acid in their product lines. Fatty acids are becoming a preferred emollient type as awareness of their skin health benefits grows, thereby driving the segment growth.

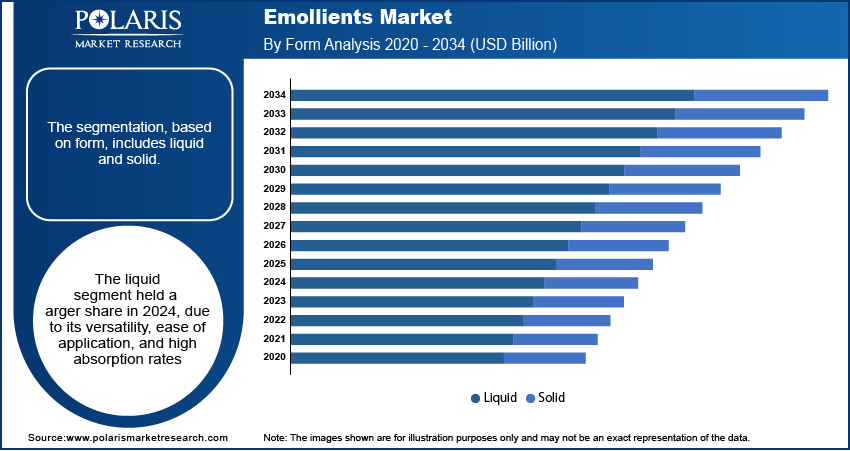

Form Analysis

The segmentation, based on form, includes liquid and solid. The liquid segment held a larger share in 2024, due to its versatility, ease of application, and high absorption rates. They are commonly used in lotions, serums, and oils that cater to various skin types and needs. Liquid emollients offer smoother texture and better spread, making them ideal for daily use and mass-market products. Their compatibility with other ingredients further supports the development of diverse formulations across cosmetics, haircare, and dermatological segments. The convenience and comfort of applying liquid products, combined with their effectiveness in hydrating the skin, drove their widespread adoption, especially among consumers seeking lightweight and non-greasy skincare options.

The solid segment is expected to record significant growth due to rising interest in sustainable and waterless beauty products. These include balm sticks, solid moisturizers, and bars that are travel-friendly and generate less packaging waste. Solid forms often feature natural butters and waxes such as shea butter and beeswax, which appeal to eco-conscious consumers. Solid emollients are becoming more attractive as brands shift toward minimalistic, zero-waste, and plastic-free packaging trends. Additionally, solid formats tend to last longer than liquids, offering better value and shelf stability. This growing appeal is expected to boost segment growth.

Regional Analysis

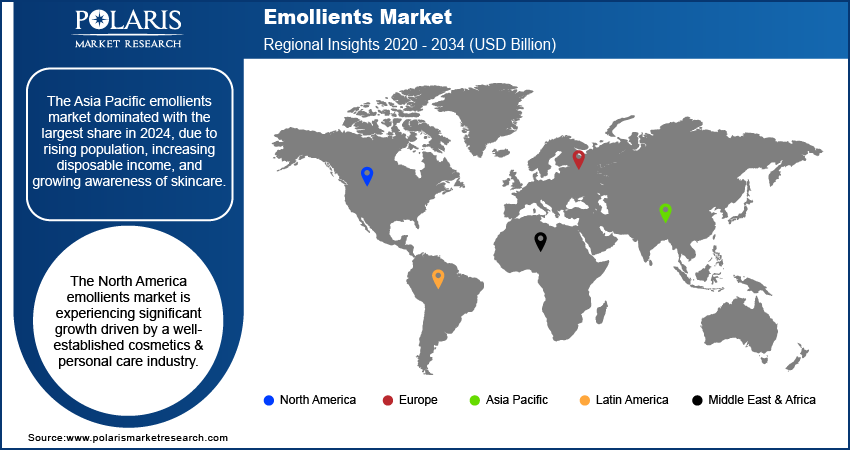

Asia Pacific Emollients Market Trends

Asia Pacific dominated with the largest share in 2024, due to rising population, increasing disposable income, and growing awareness of skincare. Consumers in countries such as India, Japan, South Korea, and Southeast Asia are becoming more conscious about personal grooming, driving demand for moisturizers, sunscreens, and cosmetic products that contain emollients. The booming e-commerce sector and popularity of K-beauty trends are further contributing to the demand. Additionally, rising urbanization and pollution levels have made skincare routines more essential, further boosting the demand for emollient-based products across diverse and rapidly developing Asian countries.

China Emollients Market Assessment

The market in China is expected to witness significant growth during the forecast period. The country has seen a sharp rise in skincare and beauty product consumption, driven by a beauty-conscious young population and a strong influence from social media platforms. Domestic and international brands are investing heavily in China, launching innovative products with advanced ingredients such as esters and fatty acids. Moreover, the rise of natural and herbal personal care products has made plant-based emollients more popular. China’s expanding middle class and increasing demand for high-quality, premium skincare are fueling the industry growth in China.

North America Emollients Market Overview

The market in North America is projected to witness substantial growth during the forecast period, driven by the well-established cosmetics & personal care industry. The region experiences consistent demand for skincare, haircare, and therapeutic dermatology products that contain moisturizing ingredients. Consumers in the U.S. and Canada prefer high-performance, science-backed products, and are increasingly seeking natural and sustainable options. Regulatory support for safe and skin-friendly ingredients has encouraged manufacturers to include quality emollients. Additionally, the rise of wellness trends and increased awareness of skin-related health issues continue to sustain the region's need for effective and multifunctional emollient-based formulations, thereby driving the growth in North America.

U.S. Emollients Market Outlook

The U.S. market is expected to experience significant growth in the coming years, due to the highly advanced beauty & skincare industry. Consumers in the country are increasingly investing in personal care routines and prefer products that offer hydration, antiaging, and sensitivity solutions, all of which require emollients. The growing popularity of clean beauty and dermatologically approved products is pushing brands to use safe, effective emollients such as esters and fatty acids. Strong online retail platform networks and influencer marketing platforms have played a major role in promoting skincare brands. Innovation and consumer preference for premium skincare boost the demand in the U.S.

Europe Emollients Market Insights

Europe emollients market is expected to experience significant growth in the future, driven by a strong demand for high-quality personal care and cosmetic products. Consumers in the region are highly conscious of ingredient safety, sustainability, and product performance. European regulations, such as those by the European Chemicals Agency (ECHA), encourage the use of skin-safe and eco-friendly ingredients, pushing brands to incorporate natural emollients. The popularity of organic, vegan, and cruelty-free cosmetics is on the rise, especially in countries such as France, the UK, and Italy, driving the demand in the region.

Germany Emollients Market Analysis

The market in Germany is expected to experience significant growth during the forecast period. The country is known for its preference toward high-quality, dermatologist-recommended skincare products. It has a large base of health-conscious and environmentally aware consumers who value products that are both effective and sustainable. German skincare brands focus on minimal, clean formulations, making emollients such as esters and fatty acids highly desirable. The pharmaceutical and cosmeceutical segments are also strong in Germany, further boosting demand for therapeutic skincare items. Moreover, growing interest in natural beauty and a tradition of herbal care products drive the growth in Germany.

Key Players and Competitive Analysis

The field of emollients is highly competitive and characterized by the presence of both global chemical giants and specialized ingredient manufacturers. Key players such as BASF SE, Clariant, Eastman Chemical Company, and The Lubrizol Corporation lead the market with extensive product portfolios, strong global reach, and robust R&D capabilities. Companies such as Evonik Industries AG, Croda International PLC, and Ashland Inc. are focused on innovation and sustainable formulations, particularly plant-based or biodegradable emollients, to meet the growing demand for eco-friendly personal care products among consumers. Niche firms such as Hallstar, Vantage Specialty Chemicals, and Oleon Health and Beauty offer customized and specialty emollients for premium applications. Meanwhile, Sasol, Lonza, Stepan Company, and Solvay are expanding through strategic partnerships, technological advancements, and new product launches. The market is seeing a shift toward natural and sustainable solutions, prompting companies to invest in green chemistry, certification programs, and bio-based feedstocks to strengthen their competitive edge.

Key Players

- Ashland Inc.

- BASF SE

- Clariant

- Covestro AG

- Croda International PLC

- Eastman Chemical Company

- Evonik Industries AG

- Hallstar

- Lonza

- Oleon Health and Beauty

- Sasol

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Vantage Speciality Chemicals.

Industry Developments

In February 2025, LBB Specialties joined forces with Kerry Group to distribute Kerry’s emollients, emulsifiers, and fermentation-based actives across the U.S. and Canada for applications in skincare, personal care, and cosmetics.

In July 2024, OQ Chemicals launched OxBalance NPG Diheptanoate, a biomass-balanced light emollient ester for cosmetics. Certified under ISCC PLUS, it replaced D5 silicones, offering eco-friendly, high-performance benefits in skincare, sun care, and color cosmetics applications.

In September 2024, Evonik inaugurated a new production plant for sustainable cosmetic emollients in Steinau, Germany. The facility, built with a double-digit million-euro investment, has significantly expanded capacity and reduced its climate footprint through enzymatic esterification and the use of renewable energy.

Emollients Market Segmentation

By Type Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- Esters

- Fatty Alcohols

- Fatty Acids

- Ethers

- Silicones

- Others

By Form Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- Solid

- Liquid

By Application Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- Skin Care

- Hair Care

- Deodorants

- Oral Care

- Others

By Regional Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Emollients Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.70 Billion |

|

Market Size in 2025 |

USD 1.78 Billion |

|

Revenue Forecast by 2034 |

USD 2.80 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.70 billion in 2024 and is projected to grow to USD 2.80 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are BASF SE, Clariant, Eastman Chemical Company, The Lubrizol Corporation, Covestro AG, Evonik Industries AG, Hallstar, Croda International PLC, Ashland Inc., Sasol, Lonza, Stepan Company, Oleon Health and Beauty, Solvay, and Vantage Specialty Chemicals.

The esters segment dominated the market share in 2024.

The solid segment is expected to witness the significant growth during the forecast period.