Micro-Subscription Services Market Size, Share, Trends, Industry Analysis Report

: By Type of Service (Content Streaming, Newsletters & Blogs, E-Learning & Micro Learning, Health & Fitness, Gaming, and Others), Revenue Model, Platform, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5589

- Base Year: 2024

- Historical Data: 2020-2023

Micro-Subscription Services Market Overview

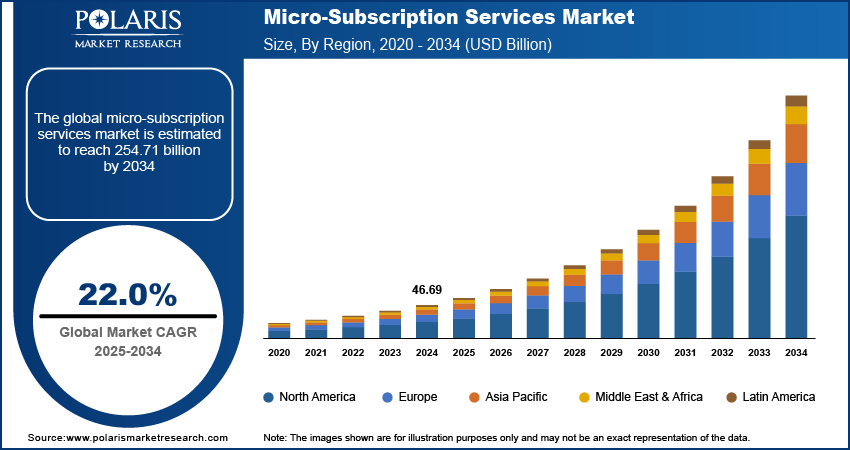

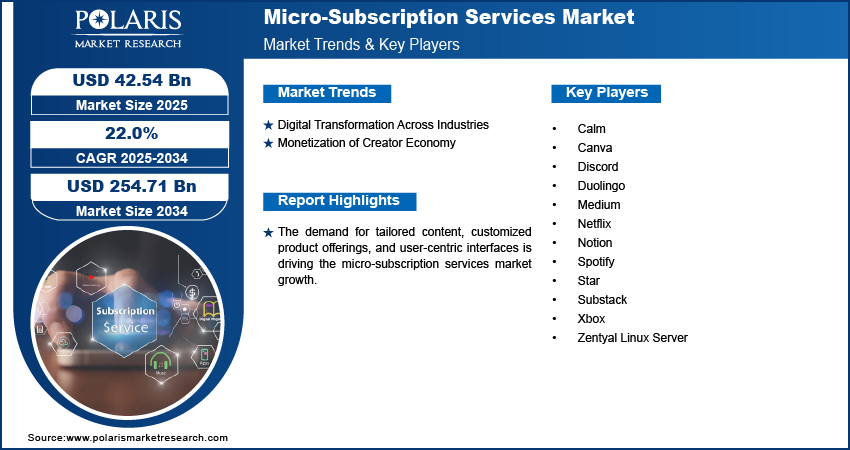

The global micro-subscription services market size was valued at USD 35.01 billion in 2024 and is expected to reach USD 42.54 billion by 2025 and USD 254.71 billion by 2034, exhibiting a CAGR of 22.0% during 2025–2034.

The micro-subscription services market refers to a business model where consumers pay small, recurring fees (often weekly or monthly) for access to digital content, apps, software, or premium features. These subscriptions are low-cost and cater to niche demands, such as streaming, gaming, productivity tools, or exclusive content. The rising demand for tailored content, customized product offerings, and user-centric interfaces is driving the micro-subscription services market growth. These platforms leverage AI-driven personalization to enhance engagement. For instance, Spotify's 2023 Investor Report indicates that AI-generated playlists, such as Discover Weekly, account for 30% of overall user engagement. This significant contribution plays a crucial role in enhancing user retention, particularly within its premium subscription segment.

To Understand More About this Research: Request a Free Sample Report

Micro-subscription models offer affordable pricing, micro-payments, and budget-friendly options, making premium content and services more accessible to price-sensitive users and expanding the customer base. Additionally, modern users prefer flexibility, on-demand access, and cancel-anytime models, driving the shift away from traditional, long-term subscription commitments to short-term services.

Micro-Subscription Services Market Dynamics

Digital Transformation Across Industries

Digital transformation across various industries fuels the micro-subscription services market demand. The widespread integration of digital platforms, mobile-first user interfaces, and cloud computing is redefining consumers access and interaction with content and services. Businesses across entertainment, e-learning, gaming, and fitness are leveraging scalable, agile technologies to deliver frictionless, on-demand experiences. This shift toward digital convenience fuels consumer expectations for flexibility and real-time access, supporting the proliferation of low-cost, recurring billing models. Enhanced data analytics and automation capabilities further enable providers to personalize offerings, improve customer retention, and expand their reach across previously underserved markets.

Monetization of Creator Economy

Monetization of the creator economy is significantly accelerating the adoption of micro-subscription models. Independent creators now utilize platforms such as Substack, Patreon, and OnlyFans to deliver exclusive, recurring content directly to their audiences, bypassing traditional intermediaries. This direct-to-consumer approach enhances creator autonomy and revenue diversification while raising deeper community engagement. For instance, in 2023, OnlyFans reported more than 3 million creators and more than 250 million registered users, with payouts exceeding USD 10 billion since 2016. Increased digital content consumption, combined with growing consumer willingness to pay for niche or premium offerings, supports micro-subscription services market development.

Micro-Subscription Services Market Segment Insights

Micro-Subscription Services Market Assessment by Type of Service Outlook

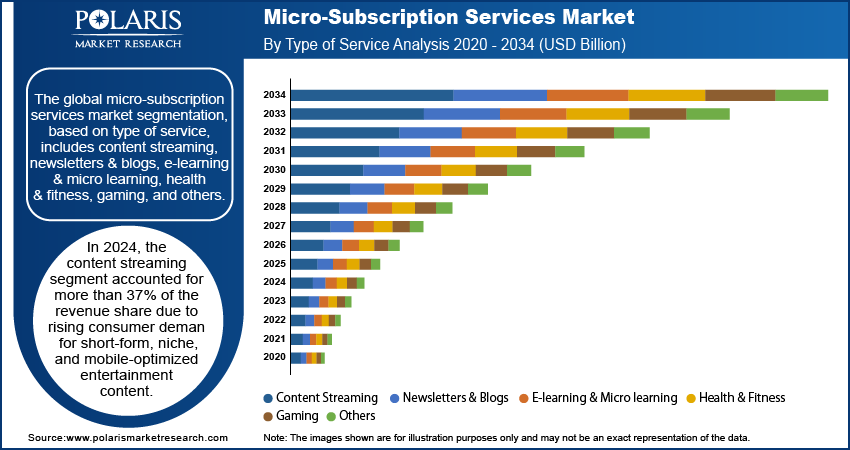

The global micro-subscription services market segmentation, based on type of service, includes content streaming, newsletters & blogs, e-learning & micro learning, health & fitness, gaming, and others. In 2024, the content streaming segment held more than 37% of the micro-subscription services market revenue share due to rising consumer demand for short-form, niche, and mobile-optimized entertainment content. Streaming platforms are increasingly integrating micro-subscription tiers that offer specific access to curated shows, premium videos, or creator channels without full-platform subscriptions. Major players are leveraging AI-based recommendation engines and flexible billing models to segment audiences and enhance monetization strategies. The segment’s ability to drive high user retention through exclusive, regularly updated content supports its leadership in market share.

The e-learning & micro learning segment is expected to register the highest CAGR over the forecast period due to increasing preference for bite-sized, skill-specific content among professionals and students. Platforms offering modular educational experiences are gaining traction, particularly those targeting upskilling in coding, design, finance, and language learning. These services cater to time-constrained users seeking flexibility, and they monetize through low-cost, high-frequency subscription models. Corporate adoption is also rising as companies integrate micro learning into continuous learning and employee development strategies.

Micro-Subscription Services Market Evaluation by End User Outlook

The global micro-subscription services market segmentation, based on end user, includes individual consumers, freelancers & creators, startups & micro-enterprises, educational institutions, and others. According to the micro-subscription services market statistics, the individual consumers segment accounted for more than 45% of the revenue share in 2024 due to the high adoption of micro-subscription models among digital-native consumers, particularly Gen Z and Millennials. These users actively seek personalized, on-demand content and services that align with specific lifestyle interests such as wellness, entertainment, finance, and productivity. The low-cost and cancellable nature of micro-subscriptions enhances affordability while minimizing long-term commitment, making it a preferred consumption model. Continuous engagement through algorithmically tailored experiences ensures low mix and recurring revenue. The segment benefits from widespread smartphone usage, increased app-based service penetration, and direct integration of payment processing solutions enabling seamless onboarding and transaction flow.

The freelancers & creators segment is expected to register the highest CAGR over the forecast period due to the monetization needs of independent content creators, educators, and digital entrepreneurs. Tools that enable pay walled access to niche content such as writing, coaching, music, or templates are empowering creators to launch micro-subscription-based businesses with minimal overhead. This segment’s growth is further driven by the availability of creator-focused platforms that offer analytics, CRM capabilities, and community-building tools, streamlining subscription management. Increasing consumer willingness to support independent creators and the global expansion of the creator economy ecosystem are expected to amplify growth. Venture capital investment in creator-focused infrastructure is also supporting momentum.

Micro-Subscription Services Market Regional Analysis

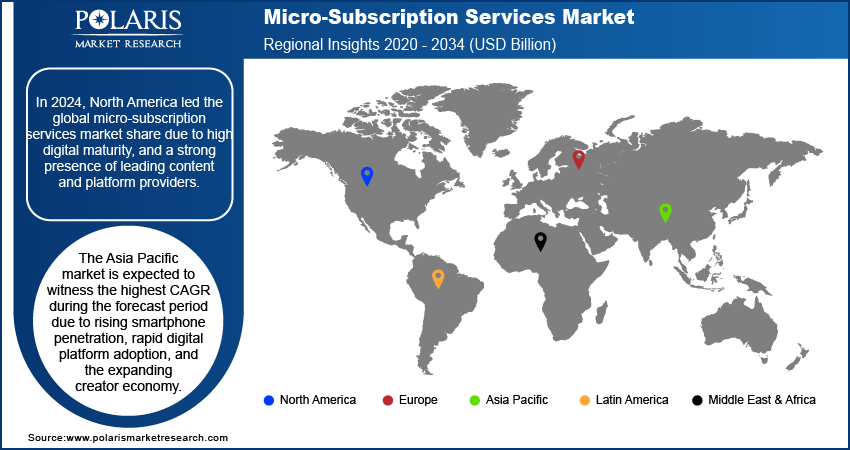

By region, the study provides micro-subscription services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the global micro-subscription services market share. This is due to high digital maturity, next-gen wireless infrastructure, and a strong presence of leading content and platform providers positioned North America as the dominant region in the market. Snapchat has gained over 2 million subscribers and generated around USD 28 million in revenue, providing a robust buffer against ad revenue fluctuations since launching its subscription service in June 2022. Consumers in the US and Canada exhibit high engagement levels with niche content through platforms such as Patreon, Substack, and streaming services offering micro-tier plans. The region also benefits from early adoption of monetization tools, integrated payment systems, and creator-focused SaaS platforms. Moreover, the proliferation of direct-to-consumer models across sectors ranging from entertainment to wellness has led to a substantial concentration of revenue generation within the North American market.

The Asia Pacific micro-subscription services market is expected to witness the highest CAGR during the forecast period due to rising smartphone penetration, rapid digital platform adoption, and the expanding creator economy. According to projections from the Global System for Mobile Communications, mobile penetration in Asia Pacific is anticipated to hit 70% by 2030. Notably, Northeast Asia is expected to achieve a penetration rate of 82%, while Oceania is projected at 79%, positioning these subregions at the forefront of mobile connectivity advancements. Consumers across countries such as India, Indonesia, and the Philippines are increasingly engaging with mobile-first, vernacular content and localized learning modules delivered through low-cost micro-subscriptions. The region's vast population base and growing appetite for niche digital content especially in gaming, education, and wellness create significant monetization opportunities. Strategic moves by global platforms to localize offerings and invest in regional partnerships are expected to further accelerate the micro-subscription services market expansion in Asia Pacific.

Micro-Subscription Services Market – Key Players & Competitive Analysis Report

The micro-subscription services market exhibits a competitive landscape shaped by rapid technological advancements and value chains, enabling bundled offerings and cross-platform synergies. The influx of venture capital into niche verticals highlights the shift from mass-market plays to precision-targeted micro-communities, with ARPU optimization now eclipsing raw subscriber growth as the key metric. Regulatory scrutiny around auto-renewals and data monetization further complicates the path to profitability in this fragmented yet high-potential sector.

Netflix, is an American company engaged in providing subscription-based video-on-demand streaming services. Specializing in original and acquired films and television series, Netflix has transformed the entertainment industry by offering a vast library of content across multiple genres. The company is headquartered in California, US. Netflix product portfolio includes Netflix Originals, licensed content, and mobile games. Services provided by the company encompass streaming video content and limited gaming options through its platform. Netflix operates in over 190 countries.

Xbox is a gaming brand owned by Microsoft Corporation, launched in 2001. The company is engaged in the development of gaming consoles, software services, and related accessories. The brand specializes in providing immersive gaming experiences through its hardware products such as the Xbox Series X|S consoles and services such as Xbox Game Pass (a subscription model offering access to a vast library of games). Xbox's product portfolio includes gaming consoles, controllers, online services such as Xbox Live for multiplayer gaming, and cloud gaming solutions through Xbox Cloud Gaming. Services provided by Xbox extend to game development tools for creators and a digital marketplace for purchasing games and add-ons. Xbox has a global presence with a strong market share in regions such as North America, Europe, and Asia Pacific.

List of Key Companies in Micro-Subscription Services Market

- Calm

- Canva

- Discord

- Duolingo

- Medium

- Netflix

- Notion

- Spotify

- Star

- Substack

- Xbox

- Zentyal Linux Server

Micro-Subscription Services Industry Developments

In February 2025, Canva expanded its affordable subscription options after experiencing strong success in India. The introduction of a daily plan priced at USD 0.79 has resulted in higher user engagement, leading the company to aim for further growth in other Asian and Latin American markets.

In January 2025, Hilton entered a strategic partnership with Calm to meet the increasing demand for wellness solutions among travelers. This collaboration focuses on delivering advanced mindfulness and sleep enhancement resources designed to elevate the guest experience.

Micro-Subscription Services Market Segmentation

By Type of Service Outlook (Revenue – USD Billion, 2020–2034)

- Content Streaming

- Newsletters & Blogs

- E-learning & Micro Learning

- Health & Fitness

- Gaming

- Others

By Revenue Model Outlook (Revenue – USD Billion, 2020–2034)

- Recurring Micro-Payments

- Freemium and Tiered Upgrades

- Pay-per-use with Subscription Perks

- Others

By Platform Outlook (Revenue – USD Billion, 2020–2034)

- Web-Based Services

- Mobile Applications

- Cross-Platform Ecosystems

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Individual Consumers

- Freelancers & Creators

- Startups & Micro-enterprises

- Educational Institutions

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Micro-Subscription Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 35.01 billion |

|

Market Size Value in 2025 |

USD 42.54 billion |

|

Revenue Forecast in 2034 |

USD 254.71 billion |

|

CAGR |

22.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global micro-subscription services market size was valued at USD 35.01 billion in 2024 and is projected to grow to USD 254.71 billion by 2034.

The global market is projected to register a CAGR of 22.0% during the forecast period.

In 2024, North America accounted for the largest market share. This is due to high digital maturity, and a strong presence of leading content and platform providers.

• A few of the key players in the market are Calm, Canva, Discord, Star, Duolingo, Medium, Netflix, Notion, Spotify, Substack, Xbox, and Zentyal Linux Server.

In 2024, the content streaming segment accounted for more than 37% of the micro-subscription services market revenue share due to rising consumer demand for short-form, niche, and mobile-optimized entertainment content.

In 2024, the individual consumers segment accounted for more than 45% of the revenue share due to the high adoption of micro-subscription models among digital-native consumers.