Europe Oral Care Market Share, Size, Trends, Industry Analysis Report

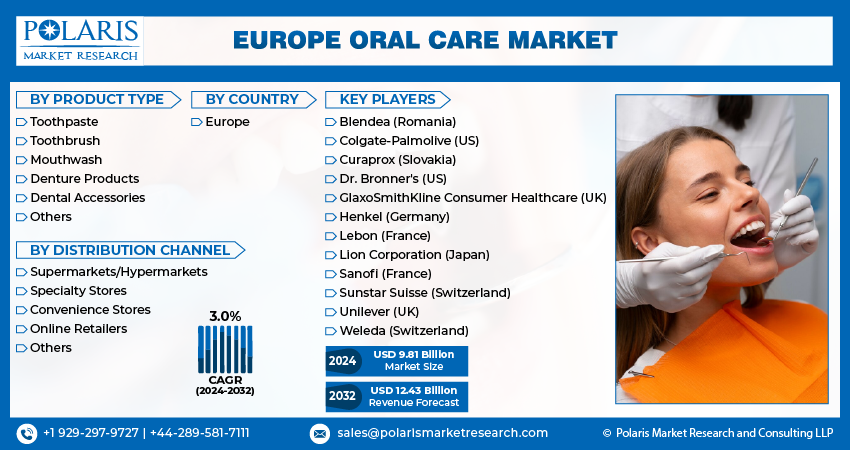

By Product Type (Toothpaste, Toothbrush, Mouthwash, Denture Products, Dental Accessories, Others); By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: PDF

- Report ID: PM4797

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

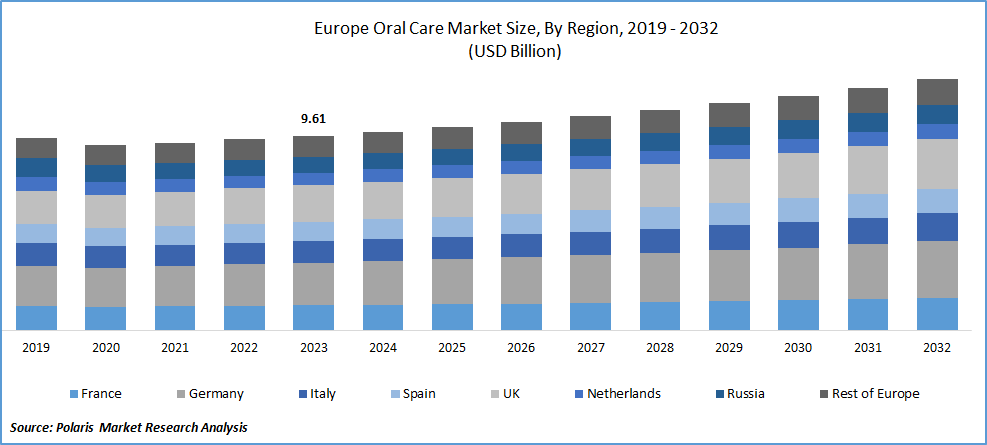

Europe oral care market size was valued at USD 9.61 billion in 2023. The market is anticipated to grow from USD 9.81 billion in 2024 to USD 12.43 billion by 2032, exhibiting the CAGR of 3.0% during the forecast period.

Market Overview

The growth of the European oral care market is highly influenced by the increasing number of people approaching dental tourism and the enhanced accessibility to information with the internet's availability for a wider consumer base. The rising sustainability concerns in the European region are empowering major firms to produce eco-friendly packaging products to gain consumers attention in the market. For instance, Colgate used PET-designed packaging for its Colgate Elixir, which was introduced in North America and Europe.

To Understand More About this Research:Request a Free Sample Report

The rising new product innovations in the oral care industry are expected to create optimal growth opportunities for the oral care market during the study timeframe.

For instance, in January 2024, Dr. Dento announced the launch of its new oral care product line, aiming to combine technology and nature together. This product line range includes aloe grass mouthwash, watermelon mint mouthwash, cucumber mint mouthwash, vanilla icey mint toothpaste, and matcha green tea hemp seed oil toothpaste.

Moreover, the need for superior and effective oral care toothpaste, mouthwash, and other products to meet the needs of consumers is motivating companies to innovate new products in the marketplace. Based on a study, around 75% of the people revealed their concerns about plaque bacteria. For instance, in March 2023, Colgate unveiled the launch of Colgate Total Plaque Pro-Release, providing 24-hour anti-bacterial protection that is proven to safeguard against plaque bacteria.

However, the potential risks associated with the oral care products, mainly tooth whitening pastes, are likely to lower market demand in the next few years. The rising awareness about the hazards of oral care products with the incorporation of chemicals is anticipated to lower market expansion.

Growth Drivers

The Rising Prevalence of Unhealthy Dietary Habits

The rising number of people working in cities and limited time for eating is causing the necessity for prominent oral care products like mouthwash, antimicrobial toothpastes, and more to promote oral health. The increasing concern about lifestyle management is promoting individuals to focus on their bodies, leading to the consumption of conscious oral care products.

The ongoing progress in research and development activities in the oral care segment is optimally driving market growth. For instance, in January 2024, Science Direct introduced a new International Dental Journal focused on exploring the potential of mouthwash in oral care.

Growing Oral Health Awareness Campaigns

The ongoing strategies by the major oral market players, primarily awareness campaigns, are facilitating the need for oral health care in the marketplace. For instance, Colgate-Palmolive announced the launch of the OQ Campaign to promote oral health quotients, as it affects half of the population, including Europeans. As more people become involved in these programmes, there will be a significant number of people who detect their oral abnormalities, contributing to the demand for oral health care in the long run.

Restraining Factors

Consumer Shifts Towards Traditional Oral Care Products Are Likely to Impede Market Growth

The European population is witnessing a rapid transformation in consumption of health products in the marketplace, with increased access to information causing people to prefer traditional remedies and oral care products to modern chemical products. This trend is likely to limit the European oral care market in the long run.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, and region.

|

By Product Type |

By Distribution Channel |

By Countries |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Type Analysis

Toothpaste Segment Is Expected to Witness the Highest Growth During the Forecast Period

The toothpaste segment will grow rapidly, mainly driven by innovations in the toothpaste production process and growing research activities exploring the creation of reliable toothpaste. The evolution of certain toothpastes offering bacterial resilience is positively boosting oral care market growth in Europe.

The dental accessories segment led the market with a substantial revenue share in 2023, largely attributable to its ability to provide effective tooth whitening, which can build confidence among people at professional and other gatherings. The increasing concerns about enhancing smiles in the consumer base are driving enormous demand for cosmetic tooth whitening products in the marketplace.

The toothbrush segment is gaining traction nowadays with the rising development of sustainable and effective oral care products in the marketplace, leading to a higher rate of adoption among the consumer base in the region.

By Distribution Channel Analysis

Online Retailers Segment Accounted For the Largest Market Share in 2023

The online retailer segment held the largest share. This is attributable to the increased access to oral care products among the larger consumer base compared to the traditional distribution channels. The ability to offer convenience and lower transaction costs is gaining wider adoption in online shopping. The growing e-commerce platforms in the European region are positively driving the demand for oral products.

The supermarkets and hypermarkets segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for consumption of multiple household and consumer goods at one place and time. The rising employment opportunities are encouraging consumers to purchase all the required goods, including oral care products, at one time on monthly basis propelling the demand for oral care products.

Regional Insights

Germany Region Registered the Largest Share of the Market in 2023

The Germany region dominated the market. Region’s growth can be largely attributed to rising consumer investments in grooming, and hygiene products, including oral care. The significant rise in the proportion of people opting for mouthwash and dental accessories is a major contributing factor contributing to the larger share in the European oral care market.

The UK region will grow at the rapid pace, owing to the growing consumption of oral care products. According to the British Dental Association, several oral care patients in the UK are opting for treatment in foreign countries, driven by lower healthcare costs. The prevalence of health problems after dental treatment is rising demand for the home oral care market, as about 76% of the respondents in the survey witnessed pain. These health concerns are intended to fuel government initiatives promoting oral health care in the region, contributing to the region’s growth.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The Europe oral care market is consolidated in nature with the existence of several small and large market players in the marketplace, along with rising expansion activities, primarily acquisitions and partnerships in the region. For instance, in May 2023, Akebia Therapeutics joined forces with the Medice Arzneimittel Putter in Europe to develop the oral anemia drug Vafseo for chronic diseases.

Some of the major players operating in the market include:

- Blendea (Romania)

- Colgate-Palmolive (US)

- Curaprox (Slovakia)

- Dr. Bronner's (US)

- GlaxoSmithKline Consumer Healthcare (UK)

- Henkel (Germany)

- Lebon (France)

- Lion Corporation (Japan)

- Sanofi (France)

- Sunstar Suisse (Switzerland)

- Unilever (UK)

- Weleda (Switzerland)

Recent Developments in the Industry

- In March 2023, Lehvoss, a producer of nutrition, entered a partnership with the Unigen, an ingredient supplier, to sell patented products related to joint, oral, and respiratory health in the European region.

Report Coverage

The Europe oral care market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, distribution channel, and their futuristic growth opportunities.

Europe Oral Care Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.81 billion |

|

Revenue forecast in 2032 |

USD 12.43 billion |

|

CAGR |

3.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Europe Oral Care Market Size Worth $ 12.43 Billion By 2032.

The top market players in Europe Oral Care Market include Blendea, Colgate-Palmolive, Curaprox, Dr. Bronner's, GlaxoSmithKline Consumer Healthcare

Europe oral care market exhibiting the CAGR of 3.0% during the forecast period.

Europe Oral Care Market report covering key segments are product type, distribution channel and region.

The key driving factors in Europe Oral Care Market are the rising prevalence of unhealthy dietary habits