Face Swiping Payment Market Share, Size, Trends, Industry Analysis Report

By Type (Payment Equipment, Payment System); By Application (Retail, Restaurant, Travel, Others); By Region; And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3498

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

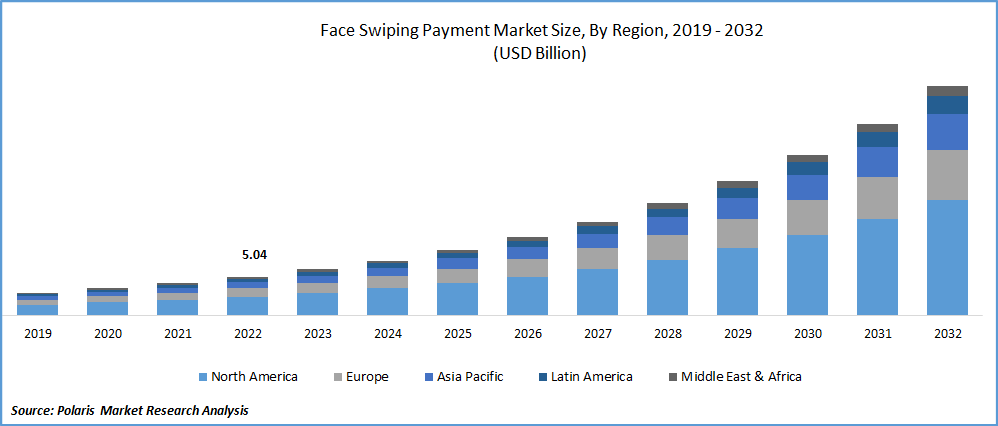

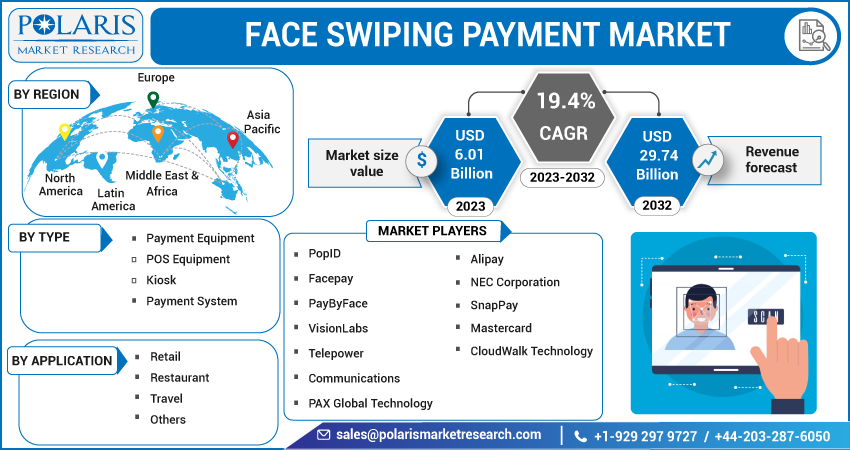

The global face swiping payment market was valued at USD 5.04 billion in 2022 and is expected to grow at a CAGR of 19.4% during the forecast period. Use of facial recognition technology in payment systems is becoming increasingly popular as it offers a fast and secure way of making transactions. It includes facial 3D depth, blink detection, facial motion recognition, and bright pupil effect detection, are all designed to enhance the accuracy and security of facial recognition payments. Facial 3D depth technology enables the system to detect the depth of a person's face, which helps to prevent fraudulent attempts made with 2D images or masks. Blink detection and facial motion recognition can be used to ensure that the person making the payment is a living and active human being, rather than a static image or a video recording. The bright pupil effect detection feature is designed to identify if the person's pupils are reflecting light, which is a key indicator of a real person, rather than a photo or video recording.

To Understand More About this Research: Request a Free Sample Report

Other advanced algorithms, such as average difference detection and optical flow field judgment, can be used to detect any inconsistencies in facial features or movements, which may indicate fraudulent activity. These features can help to prevent identity theft and ensure that payments are made by the authorized user only. Venture capital firms are investing in face-swiping payment technology companies, which is expected to drive industry growth. PopID, an identity verification gateway, aims to raise $50 million to scale its face verification services for payment functions, and has already raised $25 million from CaliBurger holding company, Cali Group.

It significantly reduces transaction time & ease in processing payments. With face-swiping payment technology, transactions can be completed quickly and securely, making it an attractive option for both consumers and merchants. As a result, the industry is experiencing significant growth, and it is expected to continue to expand as more people adopt this technology for their daily transactions. Several governments are implementing face recognition technology to enhance the customer experience for travelers. One of the use cases for this technology is enabling travelers to process payments by swiping their faces. This technology is being implemented in various transportation systems, including airports, train stations, and bus terminals, to make the payment process more convenient and efficient for travelers. With face-swiping payment technology, travelers can quickly and securely make payments without the need for cash or physical payment cards.

COVID-19 pandemic has had a positive impact on the growth of the face-swiping payment industry. The pandemic has resulted in increased demand for touchless payment options due to social distancing norms and regulations. This has created a significant opportunity for companies offering face-swiping technology as it provides a safe and convenient way for consumers to make payments without the need for physical contact with payment terminals or other devices.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Facial recognition technology used in face-swiping payment systems offers a high level of security compared to other digital payment methods that use PINs and passcodes. Unlike PINs and passcodes, which can be easily forgotten or hacked, facial recognition technology relies on a unique physical characteristic that cannot be easily replicated or stolen.

Additionally, the advanced features such as facial 3D depth, blink detection, and facial motion recognition, which are used in face-swiping payment systems, enhance the accuracy and security of the technology, making it a safe and secure way to make transactions. As a result, many consumers and merchants are adopting this technology for their daily transactions, driving the growth of the face swiping payment market.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Payment equipment segment holds the largest share in 2022

Payment equipment segment garnered the largest revenue share, and is expected to dominate over the study period. This is primarily due to growing popularity of cashier-fewer ordering kiosks in several fast-food restaurants. These kiosks are designed to streamline the ordering process, allowing customers to place their orders quickly and easily without the need for human interaction. Customers can browse menus, customize their orders, and pay using touchscreens, providing a fast and convenient way to order food. Cashier-less ordering kiosks not only improve the customer experience but also help to reduce wait times and increase efficiency for restaurants.

For instance, CaliBurger, have installed self-ordering kiosks with facial recognition technology and artificial intelligence to enhance their customer experience. These kiosks use facial recognition technology to identify customers, allowing them to place their orders quickly and easily without the need for physical interaction with restaurant staff. In addition, the use of artificial intelligence enables these kiosks to provide personalized recommendations to customers based on their previous orders and preferences.

Payment system segment projected to register robust growth over the study period. The deployment of payment systems with biometric sensors for face recognition within point of sale (POS) terminals is propelling the growth of the face-swiping payment segment. These systems enable customers to make payments quickly and easily by simply swiping their faces in front of the POS terminal, without the need for physical contact with payment devices or cards. The use of biometric sensors for face recognition ensures the security of transactions, making face-swiping payments more secure than traditional payment methods such as cards or cash.

Retail segment expected to witness higher growth rate

Retail segment is projected to experience higher growth in the study period. Businesses are adopting face-swiping payments to streamline their operations & to increase the customer experience. The use of face-swiping payments helps to reduce transaction times, increase efficiency, and improve the overall customer experience by providing a fast, secure, and convenient payment option. Many businesses, including restaurants, supermarkets, and transportation companies, have already implemented face-swiping payment systems, and the adoption of this technology is expected to continue to grow in the future.

Travel segment registered steady growth. Many travelers are now looking for contactless payment options that allow them to make payments quickly and easily without having to touch any surfaces or handle cash. As a result, many transportation companies, including airlines, buses, and trains, have started to offer touchless payment options such as face-swiping payments to their customers. These touchless payment options not only help to reduce the risk of infection but also provide a more convenient and efficient payment method for travelers.

APAC registered with the highest growth rate in the study period

APAC is projected to witness a higher growth rate over the forecast period. The governments in the region are recognizing the potential benefits of this technology in terms of reducing fraud and improving security, as well as enhancing the overall customer experience. For example, in January 2023, the Indian government allowed banks to verify individual transactions using facial recognition technology as a means of lowering fraud.

North America garnered largest revenue share. Region’s growth is primarily due to increasing adoption of touch-less payment options. For instance, in May 2022, Mastercard introduced new face detection platform, "Smile to Pay," allowing people to do payments using their faces. It is designed to reduce transaction times, shorten queues, enhance security, & to improve hygiene, all of which are key benefits in the post-pandemic world.

Competitive Insight

Some of the major players operating in the global market include PopID, Facepay, PayByFace, VisionLabs, Telepower Communications, PAX Global Technology, Alipay, NEC Corporation, SnapPay, Mastercard, and CloudWalk Technology.

Recent Developments

- In January 2023, QNB Group introduced biometric payment solution in Qatar for the small and medium scale merchants. By this customer have enhanced security & convenience.

- In April 2022, PopID signed a partnership agreement with the Visa Inc. This partnership introduced to enable facial verification module for its client in the Middle East.

Face Swiping Payment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.01 billion |

|

Revenue forecast in 2032 |

USD 29.74 billion |

|

CAGR |

19.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

PopID, Facepay, PayByFace, VisionLabs, Telepower Communications, PAX Global Technology, Alipay, NEC Corporation, SnapPay, Mastercard, and CloudWalk Technology. |

Explore the landscape of Face Swiping Payment Market in 2023 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The global face swiping payment market size is expected to reach USD 29.74 billion by 2032.

Key players in the face swiping payment market are PopID, Facepay, PayByFace, VisionLabs, Telepower Communications, PAX Global Technology, Alipay.

Asia Pacific contribute notably towards the global face swiping payment market.

The global face swiping payment market is expected to grow at a CAGR of 19.4% during the forecast period.

The face swiping payment market report covering key segments are type, application, and region.