Feed Acidulants Market Share, Size, Trends, Industry Analysis Report

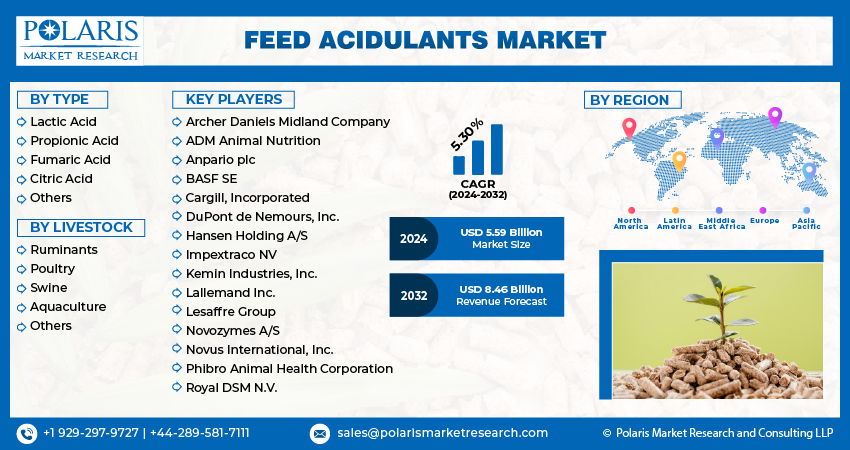

By Type (Lactic Acid, Propionic Acid, Fumaric Acid, Citric Acid, Others); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3921

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

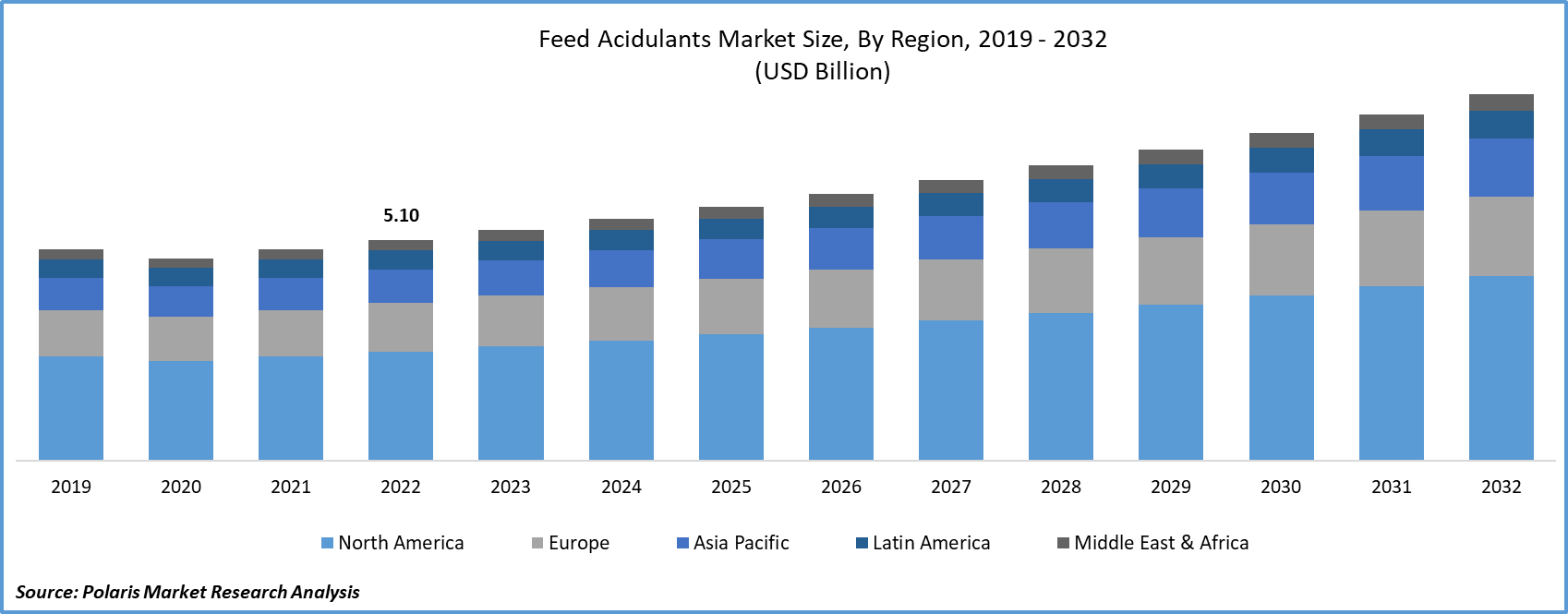

The global feed acidulants market was valued at USD 5.34 billion in 2023 and is expected to grow at a CAGR of 5.30% during the forecast period.

Feed acidulants, which may also be referred to as animal feed acidifiers or acidifiers designed for livestock feed, serve as supplements incorporated into animal nutrition with the aim of enhancing feed quality and fostering the well-being and productivity of livestock. Their primary functions encompass the prevention of bacterial proliferation, enhancement of digestive processes, and the overall maintenance of animal health. These acidulants are offered in a variety of formulations, including salts, blends, and organic acids.

To Understand More About this Research: Request a Free Sample Report

Feed acidulants are becoming increasingly popular in the global market due to their growing utilization. They serve as crucial preservatives in the food and beverage industry, adding both flavor and texture to various food items such as jams and candies. Moreover, they help in maintaining the pH and acidity levels in beverages. The combination of these beneficial features is expected to drive the demand for feed acidulants in the global market.

Feed acidulants come in a variety of formats, including powders, gases, liquids, and more. Among manufacturers, powdered feed acidulants are the preferred choice due to their ease of storage. This preference for the dry form of feed acidulants is expected to be a major factor in driving the global feed acidulants market.

The adoption of intensive animal farming practices and the increasing demand for high-quality meat products have made it essential to enhance animal nutrition. This heightened need for nutritional improvement has led to a growing demand for feed acidulants. These additives play a crucial role in promoting animal well-being by reducing stomach pH levels and creating a favorable environment for beneficial bacteria to thrive. This, in turn, results in improved overall animal health, increased digestion efficiency, and enhanced productivity.

The increasing focus on animal well-being and the necessity to reduce antibiotic usage in animal nutrition are additional driving forces in the market. Feed acidulants play a vital role in mitigating the risk of bacterial infections in animals and fostering a healthy gut microbiome, making them a recognized and dependable substitute for antibiotics. Consequently, there has been a surge in the demand for feed acidulants, especially in regions with stringent regulations on antibiotic use in animal nutrition.

The COVID-19 pandemic has had a significant impact on the feed acidulants market. Feed acidulants are additives used in animal nutrition to improve feed efficiency and health. The pandemic's disruptions in supply chains and logistical challenges have caused fluctuations in the availability, distribution, and pricing of feed acidulants. Additionally, the economic downturn resulting from the pandemic led some farmers to reassess their spending, which has led to a temporary decrease in demand for such additives.

However, there has been an increasing awareness of the importance of animal health and immunity during the pandemic. This has driven interest in feed acidulants as they enhance animal immunity and gut health. Furthermore, ongoing research and development in the field may lead to more advanced feed acidulants that are better equipped to address emerging challenges in animal nutrition.

Industry Dynamics

Growth Drivers

- Increasing demand for high-quality animal product will Facilitate Market Growth

The market growth of feed acidulants during the forecast period is primarily driven by the increasing demand for high-quality animal product. There has been a notable shift in consumer preferences toward the consumption of high-quality and safe animal-derived products. This growing recognition of the importance of product quality and safety has sparked a renewed and heightened interest in the use of feed acidulants within the livestock and animal agriculture industry. These additives have emerged as essential tools in improving the edibility and nutritional value of animal feed, which, in turn, has a direct impact on the production of premium eggs, high-quality meat, and milk.

The surging emphasis on quality and safety in animal-derived products has led to an increased interest in feed acidulants within the livestock and animal agriculture industry. These additives serve as indispensable tools for enhancing both the nutritional content and edibility of animal feed, resulting in the production of premium eggs, high-quality meat, and milk. As consumers continue to prioritize the quality and safety of the products they consume, the role of feed acidulants in ensuring the highest standards in animal agriculture becomes increasingly significant.

Report Segmentation

The market is primarily segmented based on type, livestock and region.

|

By Type |

By Livestock |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Propionic acid segment held the largest revenue share in 2022

In 2022, the propionic acid segment held the largest revenue share. The primary factors fueling the demand for propionic acid in the animal feed acidulants market are the increasing need for animal protein and the quest to enhance feed quality. Propionic acid offers numerous benefits, such as improved nutritional absorption in animals, reduced bacterial proliferation, and enhanced gastrointestinal well-being. Furthermore, it is a common choice for mold prevention in animal feed and has demonstrated effectiveness in reducing mycotoxins within the feed.

On the other hand, the fumaric acid segment is anticipated to witness significant growth throughout the forecast period. The rise in demand for fumaric acid within the acidulants market can be attributed to the increasing need for meat and meat-related products, alongside the growing emphasis on enhancing animal performance. Fumaric acid, widely renowned for its potent antibacterial properties, finds extensive utility in animal feed to enhance the overall growth efficiency of livestock. Furthermore, its cost-effectiveness in comparison to antibiotics and growth promoters is a significant factor fueling its surging popularity in the feed acidulants market.

By Livestock Analysis

- The swine segment accounted for the highest market share during the forecast period

The swine segment accounted for the highest market share during the forecast period. The global increase in the consumption of pork, particularly premium pork, along with the need for more effective disease prevention and control methods in swine farming, are driving factors behind this growth. Incorporating feed acidulants into swine diets offers benefits such as improved nutrient absorption, enhanced gut health, and a reduced risk of diseases like swine dysentery and post-weaning diarrhea.

By improving nutrient digestibility and creating an unfavorable environment for harmful bacteria within the pig's digestive system, feed acidulants contribute to better growth, reduced disease risk, and enhanced overall well-being in swine. The swine industry's reliance on feed acidulants underscores their significance in ensuring the success and sustainability of swine production practices.

On the other hand, aquaculture segment is anticipated to experience significant growth throughout the forecast period. Acidulants play a pivotal role in aquaculture by helping to regulate pH levels in water and enhance the digestibility of feed. These additives also contribute to disease prevention and the maintenance of water quality by reducing toxic compound accumulation. The versatility of acidulants allows for species-specific applications, catering to the unique pH requirements of various aquatic species. As global demand for seafood continues to rise, the aquaculture industry expands, driving increased demand for effective solutions to ensure water quality and optimize feed performance.

Regional Insights

- North America accounted for the largest market share during the forecast period

In 2022, North America accounted for the largest market contributor in the feed acidulants market, due to there is a consistent and robust demand for meat and dairy products throughout the region, and this enduring consumer interest serves as a cornerstone for the continual expansion of the industry. Secondly, the sector's dynamics are notably influenced by strict and comprehensive regulations that pertain to animal feed quality and animal welfare. These regulations are not only a testament to North America's dedication to upholding the highest standards in animal care and food quality but also function as a driving force that shapes the industry's practices and standards.

The adoption of coronary stents in the Asia-Pacific (APAC) region is accounted for the fastest growth. The increase in knowledge and awareness about animal nutrition and health in the region has resulted in a rise in demand for feed acidulants. This has also helped to enhance the quality of life of livestock and poultry by optimizing their nutritional intake. China, Japan, and India are some of the leading countries producing feed acidulants. The high demand for animal-derived products in these densely populated regions is a significant driving force for this industry. Therefore, the need for these essential additives has become more significant in the livestock and poultry sectors.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Archer Daniels Midland Company

- ADM Animal Nutrition

- Anpario plc

- BASF SE

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Hansen Holding A/S

- Impextraco NV

- Kemin Industries, Inc.

- Lallemand Inc.

- Lesaffre Group

- Novozymes A/S

- Novus International, Inc.

- Phibro Animal Health Corporation

- Royal DSM N.V.

- Tate & Lyle Plc

Recent Developments

- In 2021, KPS Capital Partners, an American investment company specializing in industrial starches, acidulants, and various other products, acquired a majority share in Tate & Lyle for a total of $1.7 billion. This strategic purchase affords KPS Capital Partners operational dominance of Tate & Lyle's primary operations in Latin America and North America, facilitating their expansion and increased market influence in these regions.

- In 2021, Tate & Lyle Plc. unveiled plans to install a state-of-the-art biomass boiler at its acidulants facility located in Santa Rosa, Brazil. This initiative is designed to achieve a dual purpose: mitigating greenhouse gas emissions and enhancing the operational efficiency of the plant.

Feed Acidulants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.59 billion |

|

Revenue forecast in 2032 |

USD 8.46 billion |

|

CAGR |

5.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Livestock, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |