Fitness Equipment Market Share, Size, Trends, Industry Analysis Report

By Type, By End Use, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4098

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

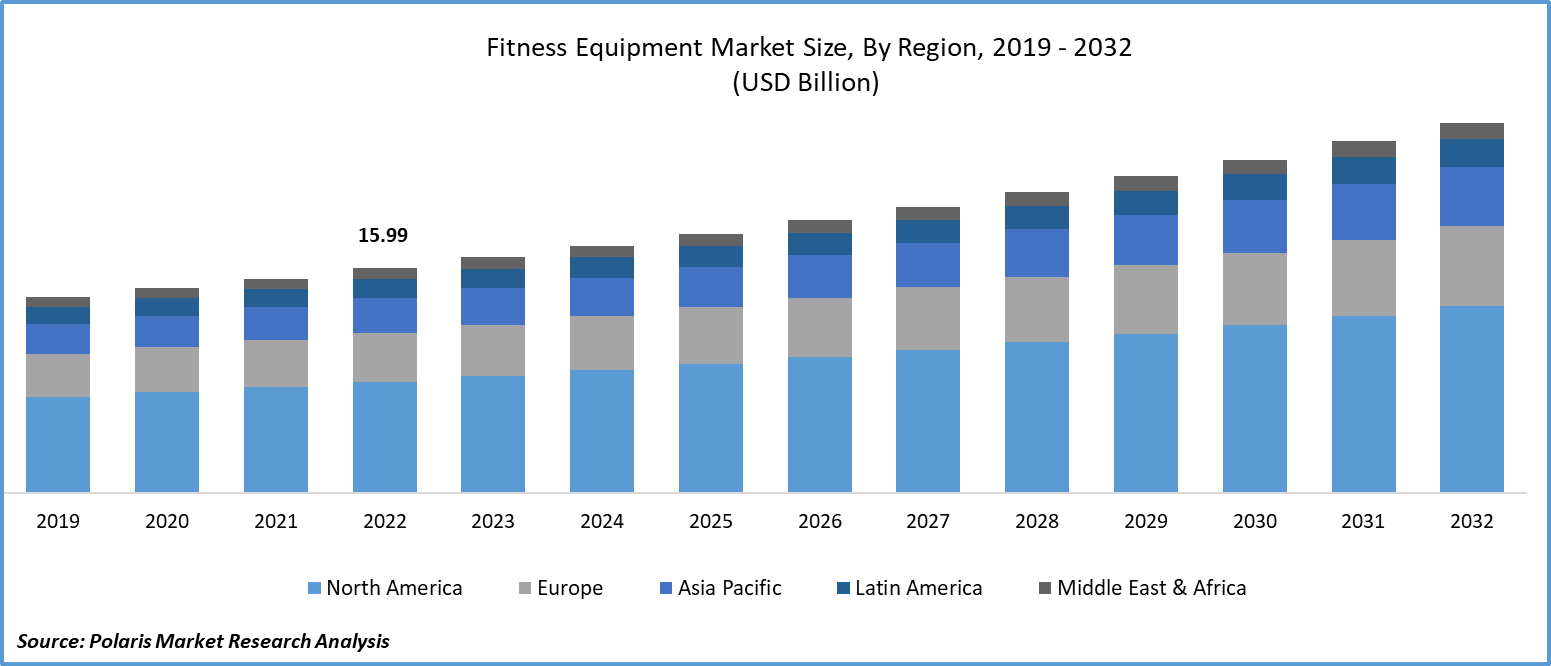

The global fitness equipment market was valued at USD 16.76 billion in 2023 and is expected to grow at a CAGR of 5.2% during the forecast period.

The market has witnessed substantial expansion in recent times, primarily attributed to the increasing emphasis on personal health, growing recognition of the significance of regular physical activity for overall wellness, and the augmentation of disposable incomes. Fitness equipment plays a pivotal role in facilitating exercises aimed at enhancing physical fitness, managing weight, and boosting muscular strength and endurance. The proliferation of obesity, a burgeoning young demographic, and escalating health consciousness stand out as key drivers propelling the growth of the global industry. This market encompasses a diverse array of products tailored for both residential and commercial usage, catering to individuals, fitness facilities, gyms, and sports clubs.

With regards to fitness equipment there are innumerable varied brands, types, and techniques of equipment. From treadmills and rowing contrivances to adaptable dumbbells and kettlebells a fitness business regularly requires a lot of varied kinds of equipment to generate superior affiliate experience. The ever-growing fitness equipment market and the growing demand for fitness indicate there is a broad gamut of fitness instruments obtainable on the market. Engrossment in home fitness equipment proceeds to surge, and the demand for Bluetooth-linked, smart, and exceptional equipment is clear.

With soaring fitness equipment costs, used equipment is usually obtainable at a much more cost-effective price. But it is not as easy as purchasing contemporary equipment for an economical price and abandoning it there. Occasionally utilized equipment can end up costlier in the long run as it has had considerably more wear and tear. The fitness equipment market size is expanding as one is also required to contemplate cleanliness issues, how effortlessly one can acquire parts of mending, and probable renovation prices.

To Understand More About this Research: Request a Free Sample Report

In order to bolster corporate wellness endeavors, manufacturers frequently engage in partnerships with companies to deliver tailored fitness solutions. These collaborations entail the development of wellness programs and the provision of discounted or tailor-made fitness equipment designed for corporate fitness facilities. These synergies formed between businesses and manufacturers play a pivotal role in propelling market expansion.

The shift towards remote work, notably during the COVID-19 pandemic, has amplified the demand for home gym equipment. Businesses have recognized this evolving trend and are now offering provisions for employees to establish home gyms or acquire fitness equipment. This focus on corporate well-being extends beyond traditional office spaces, consequently driving sales in the home fitness equipment sector.

Industry Dynamics

Growth Drivers

- Smart fitness trackers with real-time health monitoring

The Fitness Equipment Market is undergoing a transformative shift with the integration of smart fitness trackers featuring real-time health monitoring capabilities. These innovative devices have become indispensable tools for individuals seeking a holistic approach to their fitness journey. Smart fitness trackers go beyond traditional activity tracking, offering users a comprehensive insight into various health metrics, including heart rate, sleep patterns, and stress levels. This real-time data empowers users to make informed decisions about their well-being, optimizing their fitness routines for better results.

In today's fast-paced world, the demand for compact and technologically advanced home gym systems is on the rise. The Fitness Equipment Market responds to this trend by offering cutting-edge solutions that cater to the diverse needs of consumers. These systems provide a convenient and efficient way for users to engage in personalized workouts from the comfort of their homes. Furthermore, the incorporation of virtual reality (VR) technology in fitness equipment adds an immersive dimension to exercise, making workouts engaging and enjoyable.

Wearable fitness technology has become a driving force in the market, allowing individuals to monitor their health seamlessly throughout the day. AI-powered fitness apps complement these wearables by offering personalized exercise routines based on the user's unique health data. This convergence of technology and fitness reflects a dynamic industry poised to revolutionize the way individuals approach and achieve their health and wellness goals.

Report Segmentation

The market is primarily segmented based on type, end-use, distribution channel, and region.

|

By Type |

By End Use |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The cardiovascular training segment held the largest share in 2023.

The cardiovascular segment garnered the largest share. This segment encompasses a diverse array of machines, including treadmills, stationary cycles, elliptical trainers, and others. The integration of cutting-edge features and technological advancements within these machines is a key driving force behind the expansion of the market. Moreover, the increasing adoption of wearable devices and fitness apps has generated a need for cardiovascular training fitness equipment seamlessly integrated with cutting-edge technologies such as Internet of Things (IoT) devices, cloud computing, and mobile applications.

Incorporating strength training into one's daily fitness regimen is essential for enhancing muscle mass and overall strength. This form of training centers on engaging muscles using weights or weight machines. In the market, industry participants are integrating intelligent strength technology into strength training equipment. This technology serves to monitor progress and performance, offer guidance on proper form, customize workout plans, and elevate the overall workout experience.

For instance, PRIME Fitness USA has introduced SmartStrength technology, revolutionizing the approach to strength training. This innovative solution facilitates targeted muscle engagement in shortened, medial, or lengthened positions. Its applications extend to athletes, fitness enthusiasts, and individuals aspiring to achieve optimal results from their exercise routines.

By End-Use Analysis

- The home consumers segment dominated the market in 2023.

Home consumers held the largest share. The demand for Internet of Things (IoT)-enabled fitness equipment is notably high, as it empowers users to monitor their progress and find motivation in their fitness journey. Alongside these trends, the concept of functional fitness, which centers on exercises that enhance everyday activities, is rapidly gaining popularity. This approach appeals to individuals seeking comprehensive health enhancement through targeted physical conditioning.

Several significant trends fuel the surge in demand for home gym equipment among consumers. These trends encompass the growing prevalence of interconnected home devices, coupled with an enhanced emphasis on health and wellness. Additionally, the proliferation of online fitness platforms has gained momentum, delivered diverse workout options, and facilitated connections among individuals passionate about fitness.

The gym segment is expected to have faster growth. From corporate wellness initiatives that prioritize employee health to hotels and resorts aiming to provide fitness amenities for their guests, and from rehabilitation centers facilitating recovery through exercise to educational institutions promoting active lifestyles among students, fitness equipment plays a pivotal role. Moreover, this equipment is also essential in military and law enforcement training programs as well as in senior living communities where well-being remains a paramount concern.

It addresses the varied requirements of individuals, fostering their physical fitness and enhancing both their quality of life and general well-being. For instance, in January 2022, NordicTrack introduced the NordicTrack iSelect Adjustable Dumbbells. These dumbbells, which are voice-controlled and designed to collaborate with Alexa, offer users the ability to electronically modify the weight from 5 to 50 pounds using voice commands via Alexa-enabled devices. This functionality guarantees a seamless and user-friendly workout encounter.

By Distribution Channel Analysis

- The offline segment dominated the market in 2023.

The offline segment held the largest share. Offline fitness outlets are becoming increasingly favored by consumers who value individualized shopping interactions, benefiting from an extensive product range and expert guidance. The trend towards omnichannel retail is growing, granting customers the flexibility to make purchases either online or in-store or utilizing both options for enhanced convenience and broader accessibility. Additionally, traditional fitness distribution channels and in-person fitness experiences remained crucial. Many individuals opt to attend gyms and fitness centers due to reasons like access to specialized equipment, social engagement, and personalized coaching.

Online channels are expected to grow at a rapid pace. The widespread availability of high-speed internet empowers individuals to effortlessly access live and on-demand fitness classes from the comfort of their homes. Furthermore, the escalating expenses associated with traditional gym memberships drive many individuals towards the more cost-effective option of online fitness solutions. The prevalence of wearable technology assists in monitoring fitness advancements and sustaining motivation.

Regional Analysis

- North America registered the largest revenue share in 2023.

North America garnered the largest revenue share for the market. This supremacy is attributed to the heightened health consciousness of consumers in the region and their growing embrace of a wholesome lifestyle that underscores weight management, physical well-being, enhanced body endurance, and muscular strength. The prevalence of a considerable obese or overweight population in the region further propels the demand for fitness equipment.

Asia Pacific is expected to grow at a rapid pace. This region has observed a surge in gym memberships, attributed to the adoption of Western cultural influences and an escalating aspiration to enhance one's overall appearance. Moreover, the region has witnessed a notable rise in disposable income overall. The adoption of fitness products in this geographical area is expected to gather momentum, driven by the rapid urbanization occurring in developing economies, the upswing in the youthful population, and the concurrent increase in per capita disposable income.

Competitive Insight

The fitness equipment market is expected to have higher competition owing to the increasing evolution of companies with the latest innovations in the marketplace. The rising product innovations, partnerships, collaborations, mergers, and acquisitions among the market players are expanding the growth potential and contributing to the market's outreach to a wider population.

Some of the major players operating in the global market include:

- Core Health & Fitness

- Icon Health & Fitness

- Impulse Health Technology

- Johnson HealthTech

- Life Fitness

- Nautilus

- Precor

- Technogym

- Torque Fitness

- TRUE

Recent Developments

- In March 2023, Core Health & Fitness entered a strategic partnership with CRANK, a boutique fitness studio situated in the UAE. This collaboration aims to amplify the reach of CRANK's operations not only within the Gulf Cooperation Council (GCC) region but also across wider geographical horizons.

- In October 2021, CieloIT, a distinguished managed services provider (MSP) focusing on Cloud IP technology solutions, partnered with Perfect Gym Solutions to merge both online and offline fitness approaches.

Fitness Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.58 billion |

|

Revenue Forecast in 2032 |

USD 26.31 billion |

|

CAGR |

5.2% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Equipment Type, By End Use, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |