Food Lyophilization Equipment Market Size, Share, Trends, Industry Analysis Report

By Type (Tray-style Freeze Dryers, Manifold Freeze Dryers, Rotary Freeze Dryers), By Operation Scale, By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5829

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

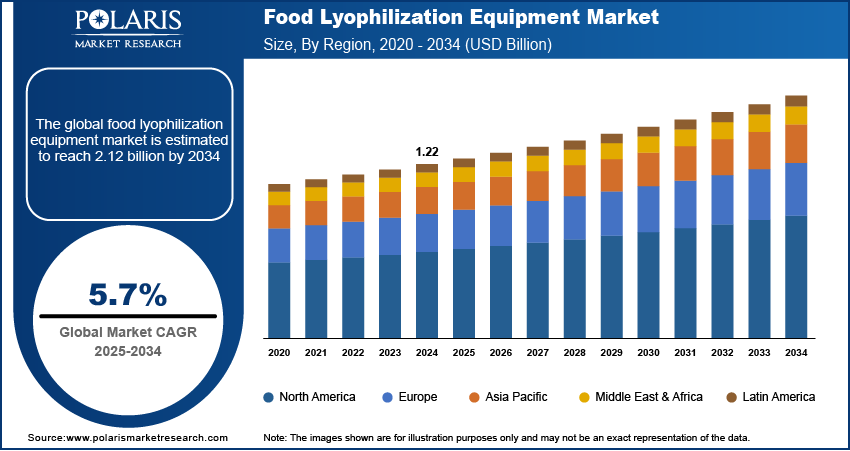

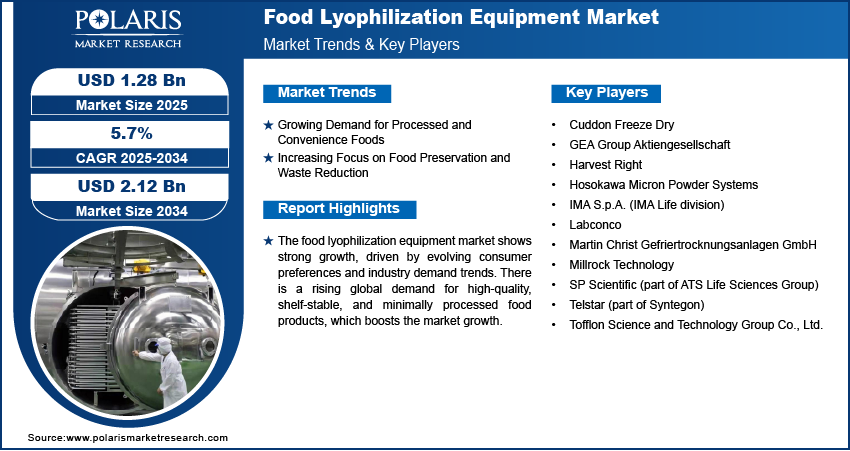

The global food lyophilization equipment market size was valued at USD 1.22 billion in 2024 and is anticipated to register a CAGR of 5.7% from 2025 to 2034. The market growth is driven by the growing demand for high-quality, shelf-stable, and additive-free food products and increasing focus on food preservation and waste reduction. Consumers are increasingly looking for convenient foods that keep their natural taste and nutrients for longer.

The food lyophilization equipment market involves machinery and systems used to freeze-dry food products. This process, also known as freeze-drying, removes moisture from frozen food through sublimation, which helps preserve its quality, nutrients, and extends its shelf life without refrigeration.

A key driver for this market is the increasing demand for high-quality, long-lasting, and healthy food items. Consumers are more aware of what they consume and are seeking natural products with fewer artificial ingredients. Freeze-drying helps food keep its original taste, texture, and nutritional value, making it popular for snacks, ready meals, and specialized ingredients. Another important factor boosting this market is the rising need for convenient and portable food options, driven by busy lifestyles and a growing interest in outdoor activities such as camping and hiking.

Increasing focus on food preservation and waste reduction boosts the demand for food lyophilization equipment. Traditional food preservation methods can sometimes lead to loss of nutrients or changes in food quality. Freeze-drying, however, is a gentler method that locks in freshness. The United States Department of Agriculture (USDA) provides information on various food preservation techniques, emphasizing methods that maintain food safety and quality over time. Freeze-drying significantly extends the shelf life of perishable goods, which can help reduce food waste from spoilage. By removing nearly all moisture, it greatly slows down the processes, such as microbial growth and enzymatic reactions, which can damage the food items.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Demand for Processed and Convenience Foods

The increasing global demand for processed and convenience foods is a significant driver. Modern lifestyles, including busy schedules and a desire for quick meal solutions, have led more consumers to prefer foods that are easy to prepare and consume. Freeze-drying plays a crucial role here by allowing manufacturers to create lightweight, ready-to-eat products that maintain their quality and flavor without needing refrigeration.

This trend is evident in various regions. For instance, the Indian Council for Research on International Economic Relations (ICRIER) stated in a 2023 policy brief titled “The growth of ultra-processed foods in India” that retail sales of ultra-processed foods in India experienced a CAGR of 13.37% in sales value from 2011–2021. This strong increase highlights a shift in dietary patterns toward processed and convenience foods. As more consumers seek out such easy and portable food options, the demand for equipment capable of producing high-quality, shelf-stable ingredients and finished products like those made through lyophilization continues to rise.

Increasing Focus on Food Preservation and Waste Reduction

There is a growing global emphasis on food preservation and the urgent need to reduce food waste. A significant portion of food produced worldwide is lost or wasted, leading to economic and environmental problems. Freeze-drying offers an effective solution by greatly extending the shelf life of perishable foods while keeping their nutritional value and sensory qualities. This method helps prevent spoilage and contributes to more sustainable food systems.

Efforts to reduce food waste are gaining momentum globally. According to insights published by the World Resources Institute (WRI) in an article from April 20, 2023, titled "The Global Benefits of Reducing Food Loss and Waste, and How to Do It," roughly one-third of all food produced globally, by weight, is lost or wasted between the farm and the consumer. This amounts to over 1 billion tonnes of food going uneaten. Technologies such as freeze-drying are vital in addressing this issue by turning highly perishable products into stable forms. By making food last longer without spoilage, freeze-drying equipment directly helps in reducing significant food loss and waste, thereby driving the adoption of lyophilization equipment in the food processing industry.

Segmental Insights

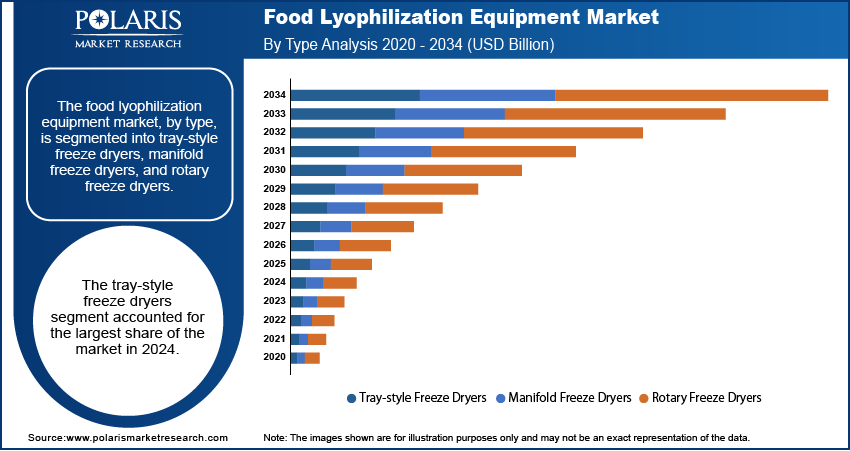

Type Analysis

The tray-style freeze dryers held the largest share in 2024. This dominance is attributed to their ability to provide precise temperature control and uniform drying, which are essential for maintaining the quality, flavor, and nutritional value of food products. They are also highly scalable and suitable for large-scale production across many food segments, including fruits, vegetables, dairy, meat, and ready-to-eat meals.

The Tray-style freeze dryers segment is also anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing consumer demand for healthy, convenient, and additive-free food products with a long shelf life. As food companies invest more in automation and advanced process controls, these systems become even more efficient and cost-effective, which further boosts their adoption.

Operation Scale Analysis

The laboratory-scale lyophilization segment held the largest share in 2024. This is mainly due to its critical role in research, testing, and new product development within the food industry. Before committing to large-scale production, food manufacturers and research institutions heavily rely on these smaller units to develop new formulations, optimize drying cycles, and ensure product quality.

The industrial-scale lyophilization segment is anticipated to register the highest growth rate during the forecast period. This strong expansion is attributed to the increasing global demand for high-volume, efficiently produced freeze-dried food products. As consumer preferences shift toward natural, minimally processed, and convenient food options, food manufacturers are scaling up their production capacities. Industrial-scale units offer the high throughput, automation, and consistent product quality needed to meet these large-scale commercial and export demands.

Technology Analysis

The conventional freeze dryers segment held the largest share in 2024. These systems have been widely adopted across the food industry for a long time due to their proven effectiveness in preserving food products. Their robust design and established operational procedures make them a foundational choice for many manufacturers, particularly for high-volume production of staple freeze-dried items.

The smart freeze dryers segment is anticipated to register the highest growth rate during the forecast period. This strong growth is driven by the increasing demand for automation, precision, and real-time monitoring in food processing operations. Smart systems use advanced sensors, digital controls, and data analytics to optimize the drying process, leading to improved energy efficiency, reduced processing times, and consistent product quality. As food companies increasingly invest in modern manufacturing techniques and look to minimize human error, the adoption of smart freeze dryers is rising.

Application Analysis

The fruits and vegetables segment held the largest share in 2024, due to the significant advantages freeze-drying offers in preserving the nutritional content, vibrant color, and natural flavor of produce. Freeze-dried fruits and vegetables are widely used in a variety of applications, including healthy snacks, breakfast cereals, and as ingredients in other processed foods, appealing to health-conscious consumers.

The pet food segment is anticipated to grow at the highest growth rate during the forecast period. This robust growth is fueled by the ongoing humanization of pets, where owners are increasingly seeking premium, natural, and minimally processed food options for their animals. Freeze-dried pet food, particularly for dogs, offers superior nutritional integrity and palatability compared to traditional kibble, making it a popular choice for health-conscious pet owners.

Regional Overview

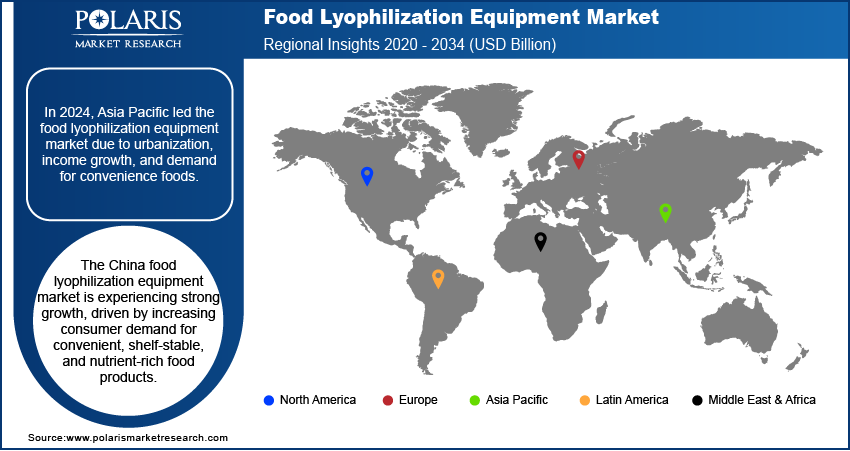

The Asia Pacific food lyophilization equipment market held the largest share in 2024 and is expected to show considerable development in the coming years. This growth is fueled by rapid urbanization, changing dietary habits, and increasing disposable incomes, which are leading to a higher consumption of processed and convenient food items. Countries within this region are investing significantly in upgrading their food processing infrastructure and adopting modern preservation technologies to meet the escalating domestic and export demands.

The China food lyophilization equipment market is experiencing strong growth, driven by increasing consumer demand for convenient, shelf-stable, and nutrient-rich food products. The rising popularity of freeze-dried fruits, vegetables, dairy, and ready-to-eat meals is encouraging food manufacturers to invest in advanced lyophilization technology. Government initiatives to modernize food processing infrastructure and improve food safety standards are also supporting market expansion. Domestic manufacturers are enhancing their technological capabilities to meet growing industry needs, while global players are entering the market through partnerships and localized production. The market is further supported by the rising trend of clean-label and additive-free products, which aligns well with freeze-drying’s ability to preserve natural taste, texture, and nutrition. Industrial automation is also improving process efficiency and scalability.

North America Food Lyophilization Equipment Market Insight

North America represents a significant region for the food lyophilization equipment market. This is largely driven by a strong consumer demand for convenient, high-quality, and natural food products, including various types of snacks and ready-to-eat meals. The region also benefits from well-established food processing infrastructure and a high adoption rate of advanced food preservation technologies. Innovation in product development and a focus on reducing food waste are also key factors influencing the market here.

US Food Lyophilization Equipment Market Analysis

In North America, the US dominates the field of food lyophilization equipment, due to the country's large and diverse food sector, coupled with consumers' increasing preference for clean-label, nutritious, and shelf-stable options. The push for new product development in areas such as specialty ingredients, healthy snacks, and premium pet food also contributes to the demand for efficient freeze-drying solutions across the country.

Europe Food Lyophilization Equipment Market Overview

Europe is a crucial region in the global market, characterized by its mature food processing industry and strong focus on food quality and safety standards. There is a growing emphasis on sustainable food production and waste reduction, driving the adoption of advanced preservation techniques such as freeze-drying. Furthermore, the increasing consumer interest in natural and organic food products, along with the rising popularity of outdoor and adventure foods, contributes to the demand for this equipment across the region. In Europe, the Germany food lyophilization equipment market holds a major revenue share. The country has a highly developed food and beverage sector known for its technological advancements and high production standards. The country's strong research and development activities in food science and engineering, combined with its focus on industrial efficiency and export-oriented food production, contribute significantly to the adoption and innovation of food processing technologies, including lyophilization equipment.

Key Players and Competitive Insights

The competitive landscape of the food lyophilization equipment market is characterized by a mix of established global players and specialized regional manufacturers. Companies compete on factors such as technological innovation, equipment reliability, energy efficiency, customization capabilities, and the provision of comprehensive after-sales services.

A few prominent companies in the industry include GEA Group Aktiengesellschaft; Hosokawa Micron Powder Systems; Tofflon Science and Technology Group Co., Ltd.; Martin Christ Gefriertrocknungsanlagen GmbH; SP Scientific (part of ATS Life Sciences Group); IMA S.p.A. (IMA Life division); Millrock Technology; Cuddon Freeze Dry; Labconco; and Telstar (part of Syntegon).

Key Players

- Cuddon Freeze Dry

- GEA Group Aktiengesellschaft

- Harvest Right

- Hosokawa Micron Powder Systems

- IMA S.p.A. (IMA Life division)

- Labconco

- Martin Christ Gefriertrocknungsanlagen GmbH

- Millrock Technology

- SP Scientific (part of ATS Life Sciences Group)

- Telstar (part of Syntegon)

- Tofflon Science and Technology Group Co., Ltd.

Industry Development

October 2024: GEA launched its new GEA RAY® Plus freeze dryer series. This flexible and energy-efficient system targets various foods, offering optimal performance through advanced vacuum and vapor flow technology, aiming for high-capacity and user-friendly functionality.

Food Lyophilization Equipment Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Tray-style Freeze Dryers

- Manifold Freeze Dryers

- Rotary Freeze Dryers

By Operation Scale Outlook (Revenue – USD Billion, 2020–2034)

- Industrial-Scale Lyophilization

- Pilot-Scale Lyophilization

- Laboratory-Scale Lyophilization

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Conventional Freeze Dryers

- Smart Freeze Dryers

- Hybrid Lyophilizers

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Fruits & Vegetables

- Meat & Seafood

- Beverages

- Prepared Meals

- Dairy Products

- Pet Food

- Probiotics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food Lyophilization Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.22 billion |

|

Market Size in 2025 |

USD 1.28 billion |

|

Revenue Forecast by 2034 |

USD 2.12 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.22 billion in 2024 and is projected to grow to USD 2.12 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include GEA Group Aktiengesellschaft; Hosokawa Micron Powder Systems; Tofflon Science and Technology Group Co., Ltd.; Martin Christ Gefriertrocknungsanlagen GmbH; SP Scientific (part of ATS Life Sciences Group); IMA S.p.A. (IMA Life division); Millrock Technology; Cuddon Freeze Dry; Labconco; and Telstar (part of Syntegon).

The tray-style freeze dryers segment accounted for the largest share of the market in 2024.

The tray-style freeze dryers segment is expected to witness the fastest growth during the forecast period.