Forage Market Size, Share, & Industry Analysis Report

: By Crop Type (Cereals, Legumes, and Grasses), Product Type, Animal Type, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3513

- Base Year: 2024

- Historical Data: 2020-2023

Forage Market Overview

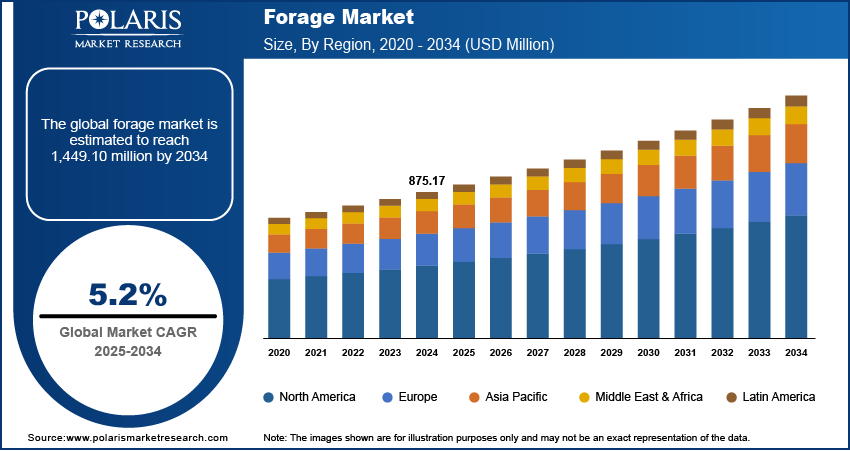

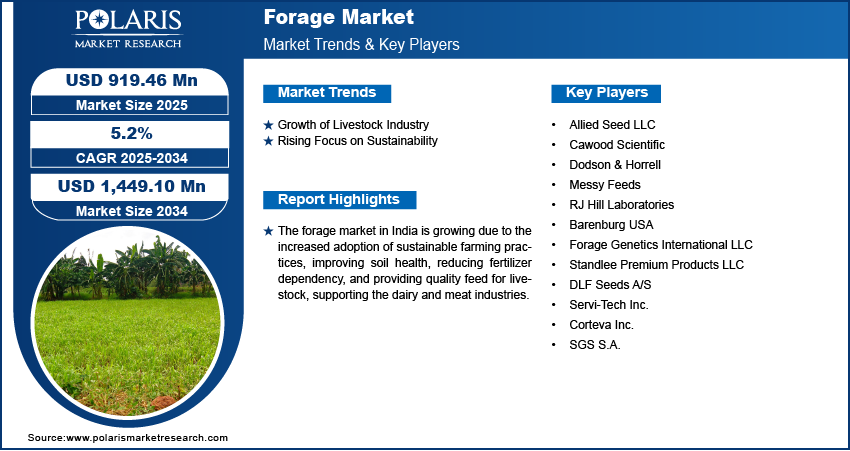

Forage market size was valued at USD 875.17 million in 2024, exhibiting a CAGR of 5.2% during the forecast period. The market is driven by rising demand for high‑quality livestock feed amid expanding meat and dairy consumption, advancements in precision agriculture and seed breeding, increasing focus on sustainable farming practices and organic forage adoption, and growth in the global livestock industry.

Key Insights

- The legumes segment is projected to grow the fastest due to its high protein content and benefits in improving soil fertility, making it an ideal source of sustainable livestock feed.

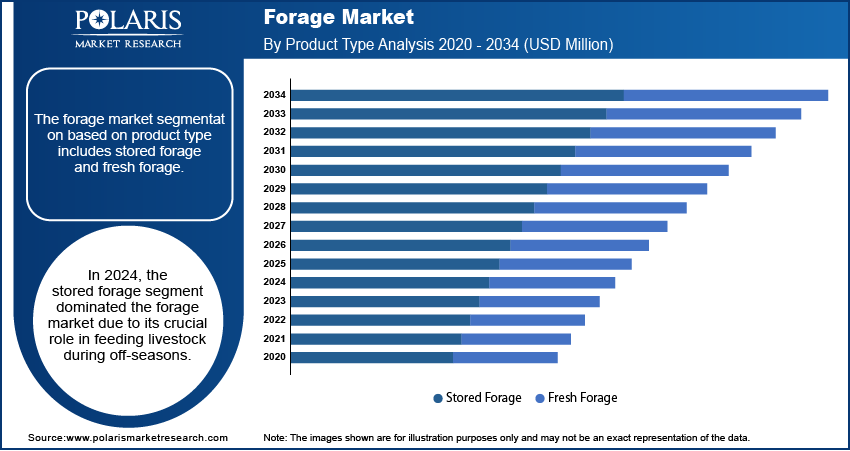

- The stored forage segment led the market in 2024, as it ensures a reliable feed source during off-seasons when fresh forage is scarce.

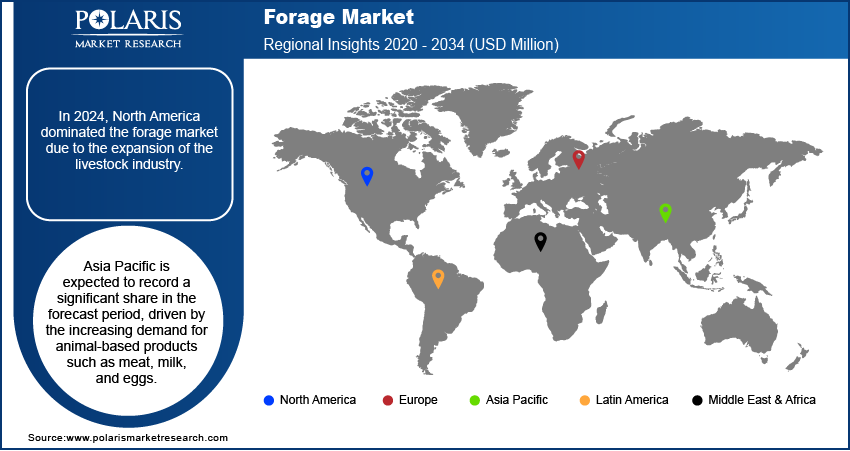

- North America dominated the market in 2024, supported by the expansion of the livestock industry and increasing demand for high-quality feed.

- The Asia Pacific region is expected to gain a significant market share, driven by rising consumption of animal-based products like meat, milk, and eggs.

- India is witnessing notable growth due to a growing emphasis on sustainable agriculture and improving livestock productivity through enhanced forage solutions.

Industry Dynamics

- Rising demand for high-quality animal nutrition and increased livestock farming are driving growth in the forage market.

- Expansion of the dairy and meat industries globally further boosts forage consumption.

- Fluctuating weather conditions and limited arable land affect consistent forage production.

- Innovations in forage seed development and preservation techniques offer strong growth potential.

Market Statistics

- 2024 Market Size: USD 875.17 million

- 2034 Projected Market Size: USD 1,449.10 million

- CAGR (2025-2034): 5.2%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Forage refers to plant material, such as grass, legumes, or other vegetation, that is grown and harvested primarily for animal feed. It provides essential nutrients for livestock and can be used as hay, silage, or grazing.

The global population growth has led to an increased demand for animal-based products such as meat, dairy, and eggs. This rise in consumption creates a higher need for quality animal feed, and forage plays a crucial role in providing that. Forage crops, such as grasses and legumes, are rich in nutrients essential for livestock growth, health, and productivity. Additionally, the demand for high-quality, cost-effective forage has surged as farmers and producers are striving to feed their animals more efficiently to meet the growing need for animal products, thereby driving the industry's growth.

Continuous research and development in the agriculture sector have led to the creation of new, improved forage crop varieties. These innovations focus on improving the nutritional value, yield, and resilience of forages. New varieties of grasses and legumes are being developed to offer higher protein content, better drought resistance, and greater disease resistance. Such progress helps farmers improve animal health and productivity while managing costs more effectively. The adoption of these advanced forage crops is increasing among farmers, driving the demand for these varieties and contributing to the market expansion.

Market Dynamics

Growth of Livestock Industry

The global livestock industry is expanding, particularly in developing countries, as income levels rise and dietary habits shift. For instance, according to the Indian Ministry of Electronics and Information Technology, India alone employs 20.5 million people in the livestock industry, showcasing the expansion of the livestock industry. This growth increases the need for reliable, nutritious feed sources for cattle, poultry, and other animals. This intensive livestock farming is driving farmers to seek higher-quality forages that can support animals throughout the year.

Rising Focus on Sustainability

A growing emphasis on sustainable agricultural practices is being placed to combat environmental degradation and climate change. Forage crops play a significant role in sustainable farming, helping to improve soil health, prevent erosion, and reduce the need for chemical inputs such as fertilizers. Well-managed forage systems also sequester carbon, contributing to the reduction of greenhouse gas emissions. Both farmers and governments are focusing on sustainability, leading to increasing demand for forage crops that support eco-friendly practices.

Segment Analysis

By Crop Type

The forage market segmentation, based on crop type, includes cereals, legumes, and grasses. The legumes segment is expected to witness the fastest growth during the forecast period. Legumes such as clover, alfalfa, and beans are highly valued for their protein-rich content and ability to improve soil health through nitrogen fixation. These forages are crucial for livestock feed, supporting animal growth and overall well-being. Additionally, legumes offer environmental benefits, such as reducing the need for synthetic fertilizers, due to which farmers are increasingly turning to legume-based forages to improve both animal nutrition and sustainability, thereby driving the segmental growth in the market.

By Product Type

The forage market segmentation, based on product type, includes stored forage and fresh forage. The stored forage segment dominated the market in 2024 due to its crucial role in feeding livestock during off-seasons, especially when fresh forage is not available. Stored forages, such as hay, silage, and haylage, provide a reliable source of nutrition for animals throughout the year. These products are harvested and preserved at their peak nutritional value, ensuring that livestock receive the necessary nutrients for growth and productivity during winter or periods of drought. Additionally, the demand for stored forages is driven by the need for a consistent and stable feed supply.

Regional Analysis

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the expansion of the livestock industry. Increased demand for meat, dairy, and other animal-based products has led to a higher need for quality forage to feed livestock. Regions including the US have large-scale livestock operations and rely heavily on forage crops such as alfalfa and clover to support their herds. For instance, according to the US Department of Agriculture, in 2021, 10.4% of the US total employment is in agriculture and related sectors. These growing livestock farming industries and the focus on improving animal nutrition and health are driving the growth of the forage market in North America.

Asia Pacific is expected to record a significant share during the forecast period, driven by the increasing demand for animal-based products such as meat, milk, and eggs. Countries including China, India, and Australia are seeing significant growth in their livestock industries, which creates a higher demand for quality forage crops to feed livestock. In particular, the rise of intensive livestock farming and the need for better animal nutrition are boosting the forage market growth in Asia Pacific.

India is experiencing substantial market growth due to the rising focus on sustainable farming practices. Farmers in the country are increasingly adopting forage crops to improve soil health, reduce dependency on chemical fertilizers, and improve the overall sustainability of their farming systems. Additionally, these crops provide high-quality feed for livestock, supporting the dairy and meat industries. The growing awareness of environmental sustainability and the need for eco-friendly farming practices are driving the demand for forage crops, thereby driving the growth of the forage market in India.

Key Players & Competitive Analysis Report

The market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the market include Allied Seed LLC, Cawood Scientific, Dodson & Horrell, Messy Feeds, RJ Hill Laboratories, Barenburg USA, Forage Genetics International LLC, Standlee Premium Products LLC, DLF Seeds A/S, Servi-Tech Inc., Corteva Inc., and SGS S.A.

Allied Seed LLC, founded in 2000 and based in Nampa, Idaho, operates in the seed industry, focusing on forage, turfgrass, and cover crop seeds. The company utilizes several brands, including Farm Science Genetics for forage legumes and grasses, Turf Science Genetics for turfgrass varieties, and Conservation Science Genetics for cover crops. Allied Seed provides a range of seed products and services to meet various agricultural requirements. The product offerings can be categorized into three main segments. The forage products segment includes a variety of legumes and grasses that enhance soil health and serve as nutritional feed for livestock. Key products in this segment are clover and alfalfa, which are recognized for their high protein content and digestibility. The turfgrass seeds segment addresses both commercial and residential markets by offering grass seed varieties suitable for lawns, sports fields, and landscaped areas. The cover crops segment is significant for sustainable agriculture, contributing to soil health by preventing erosion and improving fertility. Allied Seed primarily operates in North America, with processing facilities located in Nampa (ID), Albany (OR), and Worland (WY). The company manages over 25,000 acres dedicated to seed production. North America is a key market due to its extensive livestock industry and increasing interest in organic forage products.

Forage Genetics International, LLC (FGI) is a significant player in the forage industry, focusing on the genetic development of alfalfa and other forage crops. Established over 30 years ago, FGI has concentrated on improving traits such as winterhardiness, yield potential, and pest resistance. The company is recognized for its patented traits, including Roundup Ready and HarvXtra, which aim to enhance crop quality by reducing lignin content and improving weed management. FGI also offers disease-resistant varieties through its UltraCut Alfalfa Disease Package, targeting common diseases such as Anthracnose and Aphanomyces. The company evaluates a large number of plants annually across various research facilities, reflecting its commitment to ongoing research and development. FGI primarily operates in North America, particularly in the US and Canada, where it leverages an established agricultural infrastructure and a substantial livestock sector that depends on high-quality forage for animal health.

List of Key Companies

- Allied Seed LLC

- Cawood Scientific

- Dodson & Horrell

- Messy Feeds

- RJ Hill Laboratories

- Barenburg USA

- Forage Genetics International LLC

- Standlee Premium Products LLC

- DLF Seeds A/S

- Servi-Tech Inc.

- Corteva Inc.

- SGS S.A.

Market Developments

October 2024: Renovo Seed launched a new forage mix, OptiHarv, at the 2024 World Dairy Expo. The blend, designed for high-quality feed, offers versatile, season-long grazing and harvesting options.

December 2023: MAS Seeds launched the MAS4 cover crops and forage mixtures portfolio. The new range, developed for France and Italy, was presented at a press conference.

Market Segmentation

By Crop Type Outlook (Revenue USD Million, 2020–2034)

- Cereals

- Legumes

- Grasses

By Product Type Outlook (Revenue USD Million, 2020–2034)

- Stored Forage

- Fresh Forage

By Animal Type Outlook (Revenue USD Million, 2020–2034)

- Ruminants

- Swine

- Poultry

- Cattle

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 875.17 million |

|

Market Size Value in 2025 |

USD 919.46 million |

|

Revenue Forecast in 2034 |

USD 1,449.10 million |

|

CAGR |

5.2% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The forage market size was valued at USD 875.17 million in 2024 and is projected to grow to USD 1,449.10 million by 2034.

The global market is projected to register a CAGR of 5.2% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Allied Seed LLC, Cawood Scientific, Dodson & Horrell, Messy Feeds, RJ Hill Laboratories, Barenburg USA, Forage Genetics International LLC, Standlee Premium Products LLC, DLF Seeds A/S, Servi-Tech Inc., Corteva Inc., and SGS S.A.

The stored forage segment dominated the forage market in 2024 due to its crucial role in feeding livestock during off-seasons.

The legumes segment is expected to witness the fastest growth during the forecast period due to their protein-rich content and ability to improve soil health through nitrogen fixation.