Gallium Market Size, Share, Trends, Industry Analysis Report

By Product Type (Transistors, Diodes, Rectifiers, Power ICs, and Others), By End-user Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6289

- Base Year: 2024

- Historical Data: 2020-2023

Overview

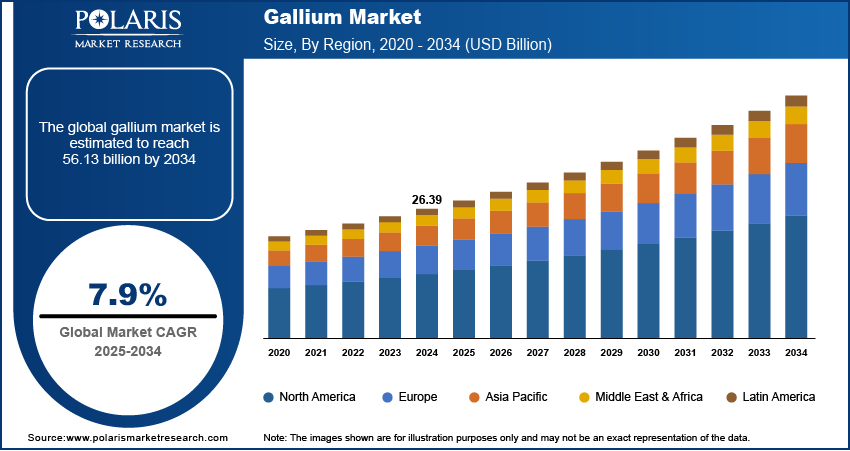

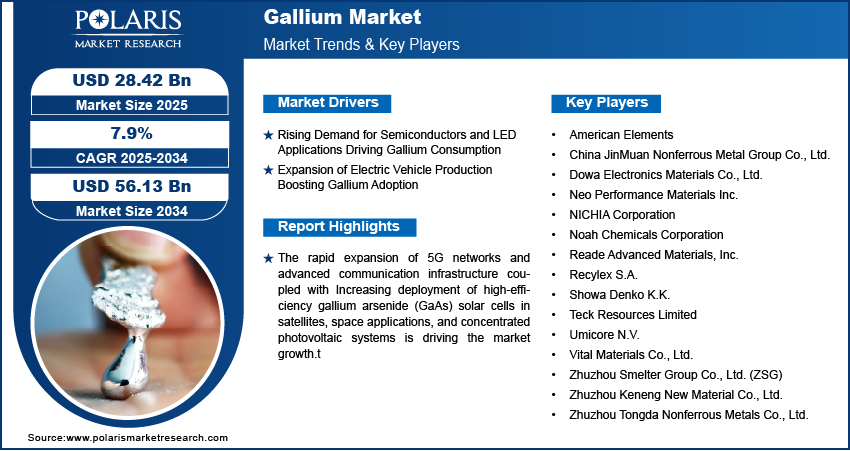

The gallium market size was valued at USD 26.39 billion in 2024, growing at a CAGR of 7.9% from 2025 to 2034. Key factors driving demand for gallium include rising demand for semiconductors and led applications driving gallium consumption coupled with expansion of electric vehicle production boosting gallium adoption.

Key Insights

- The diodes segment dominated the market share in 2024.

- The automotive segment is projected to grow at a rapid pace in the coming years, due to the increasing use of electric vehicles, hybrid systems, and intelligent driver-assistance technologies.

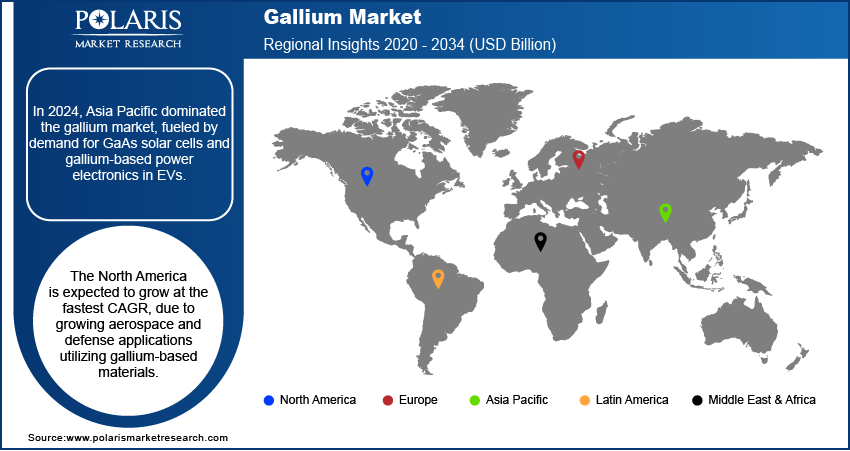

- Asia Pacific dominated the global gallium market share in 2024.

- China gallium market is growing fueled by the rapid expansion of electronics manufacturing and consumer electronic industries.

- North America is expected to grow at the fastest CAGR, driven by aerospace and defense applications using gallium-based materials.

- The market in the U.S. is growing rapidly, due to the aggressive deployment of 5G infrastructure and high-frequency RF parts.

Industry Dynamics

- Growing demand for semiconductors and LED use is driving gallium market growth due to its pivotal contribution to high-end electronic devices, optoelectronics, and energy-efficient lighting solutions.

- Increasing electric vehicle manufacturing is fueling gallium demand, with GaN-based devices enhancing power efficiency and thermal management in EV power electronics and charging systems.

- Surging research into advanced GaAs (Gallium Arsenide) components are creating new profitable opportunities in high-frequency communication systems, satellite technology, and future 5G networks.

- High production costs and limited availability of primary gallium sources restrain market growth, creating barriers for small-scale manufacturers and new entrants.

Market Statistics

- 2024 Market Size: USD 26.39 Billion

- 2034 Projected Market Size: USD 56.13 Billion

- CAGR (2025–2034): 7.9%

- Asia Pacific: Largest Market Share

AI Impact on Gallium Market

- AI promotes performance optimization of the gallium market by examining extraction efficiencies, refining processes, and demand patterns to provide high-purity output and lower operational expenses for semiconductor and optoelectronic industries.

- Implementation of AI facilitates adaptive process control, dynamically modifying temperature, chemical inputs, and flow rates of gallium production based on real-time quality monitoring and resource availability.

- Analytics based on AI help in the early detection of equipment wear, impurity accumulation, or supply chain interruption and support predictive maintenance and stable material quality in high-tech production.

- AI enhances operator interaction through automated process adjustment, real-time data visualization, and smart forecasting, enhanced decision-making and throughput performance in gallium extraction and refining processes.

The gallium industry encompasses production and supply of high-purity gallium metal and compounds for electronics, semiconductors, and optoelectronics applications. Primary applications are LEDs, solar cells, integrated circuits, and performance alloys. Gallium's low melting point, conductivity, and semiconductor material compatibility make it crucial in electronics, renewable energy, aerospace, and defense.

The deployment of 5G networks is driving the demand for gallium-based high-frequency devices. The 5G America reported that worldwide 5G connections increased to 2.25 billion in 2024 from 1.76 billion in 2023. This is driving gallium demand in semiconductors, amplifiers, and other future communication components.

Efficient gallium arsenide (GaAs) solar cells are increasingly adopted in satellites, space missions, and concentrated photovoltaic applications. GaAs cells give better energy conversion, longevity, and performance in harsh environments and are the go-to choice for advanced aerospace and clean energy projects. Clean energy and space technologies investments also drive gallium utilization in next-generation solar applications.

Drivers & Opportunities

Growing Demand for Semiconductors and LED Uses Fueling Gallium Consumption: Rising demand for semiconductors and LED technologies is increasing consumption of gallium compounds such as gallium arsenide (GaAs) and gallium nitride (GaN). As per the Semiconductor Industry Association, sales of semiconductor products worldwide achieved USD 627.6 billion in 2024, an increase of 19.1% compared to 2023, with gallium's increasing application in consumer electronics, communications, and industrial use.

Growth of Electric Vehicle Manufacturing Fueling Gallium Demand: Growing EV manufacturing is driving the demand for gallium-based semiconductors in power electronics, energy management, and charging systems. According to the International Energy Agency, approximately 17.3 million electric vehicles were produced in 2024, a 25% jump from 2023, and this offers robust growth prospects for gallium in high-efficiency automotive products.

Segmental Insights

Product Type Analysis

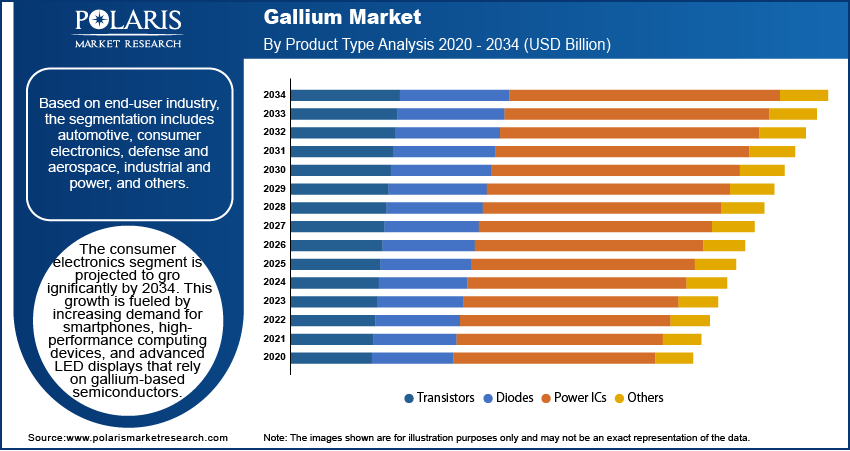

By product type, the gallium market is segmented into transistors, diodes, rectifiers, power ICs, and others. Diodes held the largest market share in 2024 due to its extensive applications in telecom, LED lighting, and electronics. High-efficiency, superior thermal performance, and rapid switching are provided by gallium-based GaN diodes.

Power ICs are expected to grow at a fast pase, driven by adoption in EVs, renewable energy, and energy management. These products use gallium for increased power density, lower losses, and higher reliability.

End-User Industry Analysis

Based on end-user industry, the gallium market is categorized into automotive, consumer electronics, defense and aerospace, industrial and power, and others. The consumer electronics accounted for the largest market share in 2024 due to smartphones, high-performance computing, and LED displays.

Automotive is projected to increase most rapidly, driven by EV adoption, hybrid technology, and advanced driver-assistance solutions. Gallium-based devices enhance power electronics efficiency, battery life, and system dependability. Defense and aerospace are also driving demand through applications in radar, satellites, and high-frequency communications.

Regional Analysis

Asia Pacific held the largest market share in 2024, driven by increasing demand for solar energy solutions using gallium arsenide (GaAs) solar cells and the increasing use of electric vehicles that need gallium-based power electronics. Booming industrialization, increasing renewable energy initiatives, and government incentives to clean technologies are leading to aggressive adoption throughout the region.

China Gallium Market Insights

China holds a major share of the Asia Pacific market, fueled by the robust growth of electronics and consumer sectors. The government has committed more than USD 150 billion for increasing domestic production of semiconductors and curbing imports between 2014 to 2030. It is fueling the use of gallium in semiconductors, LEDs, EVs, and 5G infrastructure.

North America Gallium Market Trends

North America is set to grow at the fastest pace, driven by the aerospace and defense industry domination across the region. Government initiatives, R&D expenditures, and optoelectronic technology adoption boosts the market. The region has a developed semiconductor foundation, high-end manufacturing, and emphasis on high-frequency and energy-efficient devices.

U.S. Gallium Market Analysis

The U.S. plays a key role in North America’s growth. This is due to the accelerating 5G deployment and high-frequency RF component demand. According to 5G Americas, North America registered 289 million 5G connections in 2024, an increase of 67% from 196 million in 2023. This increase sustains gallium demand in telecom, computing, and advanced electronics.

Europe Gallium Market Assessment

Europe holds a significant global share due to growing emphasis on renewable energy and efficiency-oriented solar technologies. Favorable EU policies, such as the European Green Deal, promote gallium application in power electronics, photovoltaics, and optoelectronics. Germany, France, and the U.K. are top adopters in clean energy and industrial applications, solidifying Europe's position in the market.

Key Players & Competitive Analysis

The market for gallium is highly competitive and dominated by major players such as American Elements, China JinMuan Nonferrous Metal Group Co., Ltd., Dowa Electronics Materials Co., Ltd., Keneng New Material Co., Ltd., and Zhuzhou Tongda Nonferrous Metals Co., Ltd. The industry is led by these players through technology, partnerships, and expansions in capacity. These firms specialize in the manufacture of high-purity gallium, gallium compounds, and specialty materials for use in semiconductors, optoelectronics, solar cells, and power electronics. Competitive forces are also influenced by increasing investments in R&D, technological advancements in high-efficiency GaN and GaAs devices, and joint ventures to extend global supply chains and product offerings.

Some of the key players in the gallium market are American Elements, China JinMuan Nonferrous Metal Group Co., Ltd., Dowa Electronics Materials Co., Ltd., Neo Performance Materials Inc., NICHIA Corporation, Noah Chemicals Corporation, Reade Advanced Materials, Inc., Recylex S.A., Showa Denko K.K., Teck Resources Limited, Umicore N.V., Vital Materials Co., Ltd., Zhuzhou Smelter Group Co., Ltd. (ZSG), Zhuzhou Keneng New Material Co., Ltd., and Zhuzhou Tongda Nonferrous Metals Co., Ltd.

Key Players

- American Elements

- China JinMuan Nonferrous Metal Group Co., Ltd.

- Dowa Electronics Materials Co., Ltd.

- Neo Performance Materials Inc.

- NICHIA Corporation

- Noah Chemicals Corporation

- Reade Advanced Materials, Inc.

- Recylex S.A.

- Showa Denko K.K.

- Teck Resources Limited

- Umicore N.V.

- Vital Materials Co., Ltd.

- Zhuzhou Smelter Group Co., Ltd. (ZSG)

- Zhuzhou Keneng New Material Co., Ltd.

- Zhuzhou Tongda Nonferrous Metals Co., Ltd.

Gallium Industry Developments

In December 2024, American Elements publicized a significant expansion of its Salt Lake City manufacturing facilities to boost the production of gallium, germanium, and antimony in multiple forms, such as alloys, oxides, chlorides, nitrates, nanoparticles, and thin-film coating compounds. This was prompted by increasing demand for high-purity materials in the wake of tightening global supply in the wake of China's export ban on gallium and germanium.

In November 2024, MACOM Technology Solutions Holdings, Inc. completed the acquisition of ENGIN-IC, Inc., with its offices in Plano, Texas, and San Diego, California. ENGIN-IC's advanced design strengths, such as GaN monolithic microwave integrated circuits (MMICs) design, are anticipated to complement MACOM's technology portfolio and enhance its industry position in target markets.

Gallium Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Transistors

- Diodes

- Rectifiers

- Power ICs

- Others

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Consumer Electronics

- Defense and Aerospace

- Industrial and Power

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gallium Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.39 Billion |

|

Market Size in 2025 |

USD 28.42 Billion |

|

Revenue Forecast by 2034 |

USD 56.13 Billion |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Gallium market size was valued at USD 26.39 billion in 2024 and is projected to grow to USD 56.13 billion by 2034.

The Gallium market is projected to register a CAGR of 7.9% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are American Elements, China JinMuan Nonferrous Metal Group Co., Ltd., Dowa Electronics Materials Co., Ltd., Neo Performance Materials Inc., NICHIA Corporation, Noah Chemicals Corporation, Reade Advanced Materials, Inc., Recylex S.A., Showa Denko K.K., Teck Resources Limited, Umicore N.V., Vital Materials Co., Ltd., Zhuzhou Smelter Group Co., Ltd. (ZSG), Zhuzhou Keneng New Material Co., Ltd., and Zhuzhou Tongda Nonferrous Metals Co., Ltd.

The diodes segment dominated the market revenue share in 2024, driven by widespread deployment in high-frequency, high-efficiency circuits across telecommunications, LED lighting, and consumer electronics.

The automotive segment is projected to witness the fastest growth during the forecast period driven by the growing adoption of electric vehicles, hybrid systems, and advanced driver-assistance technologies.