Germany Vapor Recovery Units Market Size, Share, Trends, Industry Analysis Report

By Technology (Absorption, Condensation, Membrane Separation, Adsorption, Others), By Application, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6323

- Base Year: 2024

- Historical Data: 2020-2023

Overview

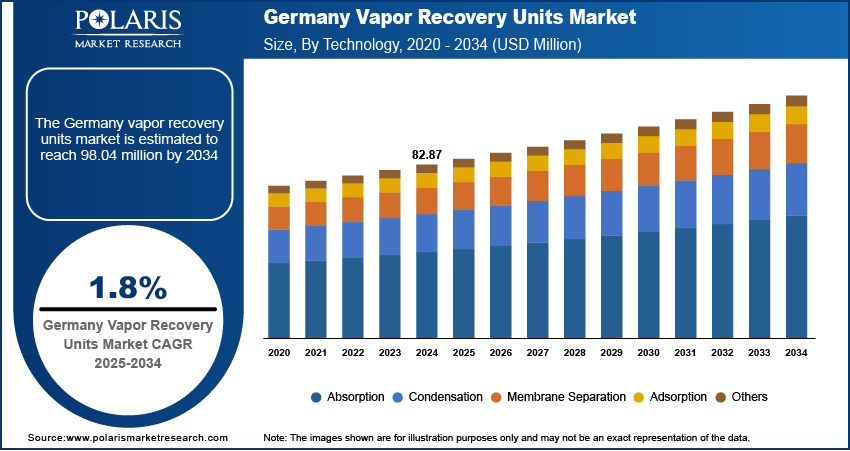

The Germany vapor recovery units (VRUs) market size was valued at USD 82.87 million in 2024, growing at a CAGR of 1.8% from 2025 to 2034. Strict environmental regulations aimed at reducing VOC emissions from storage and distribution facilities boost the market growth. Additionally, the rising focus on sustainable industrial practices and energy efficiency is encouraging industries to adopt advanced vapor recovery technologies.

Key Insights

- The absorption segment accounted for USD 28.38 million in revenue in 2024 due to its high efficiency in capturing volatile organic compounds (VOCs) and compliance with the country’s strict environmental emission standards.

- The transportation segment is projected to register a CAGR of 2.3% during the forecast period, due to increasing fuel distribution activities and the rising need for vapor recovery systems at loading and unloading terminals to meet environmental compliance.

- The oil & gas segment accounted for USD 51.16 million in revenue in 2024. The growth is attributed to the growing focus on emission control and the widespread adoption of vapor recovery units across Germany’s upstream and downstream operations.

Industry Dynamics

- Stringent environmental regulations are driving the demand for vapor recovery units in Germany.

- Rising adoption of energy-efficient solutions in storage and distribution facilities supports growth.

- High installation and maintenance costs act as a major restraint for smaller operators in the Germany VRUs market.

- Expanding investments in sustainable fuel infrastructure are expected to present significant opportunities for advanced technologies during the forecast period.

Market Statistics

- 2024 Market Size: USD 82.87 million

- 2034 Projected Market Size: USD 98.04 million

- CAGR (2025–2034): 1.8%

AI Impact on Germany Vapor Recovery Units Market

- AI-driven predictive maintenance is enhancing the reliability and uptime of vapor recovery units (VRUs) in Germany, reducing operational downtime and maintenance costs.

- Advanced analytics and machine learning are enabling real-time monitoring of emissions, ensuring compliance with Germany’s stringent environmental regulations.

- AI-optimized process control is improving hydrocarbon recovery efficiency, lowering energy consumption, and maximizing return on investment for operators.

- Integration of AI with IoT-enabled VRUs is fostering data-driven decision-making, helping German industries transition toward more sustainable and automated vapor recovery operations.

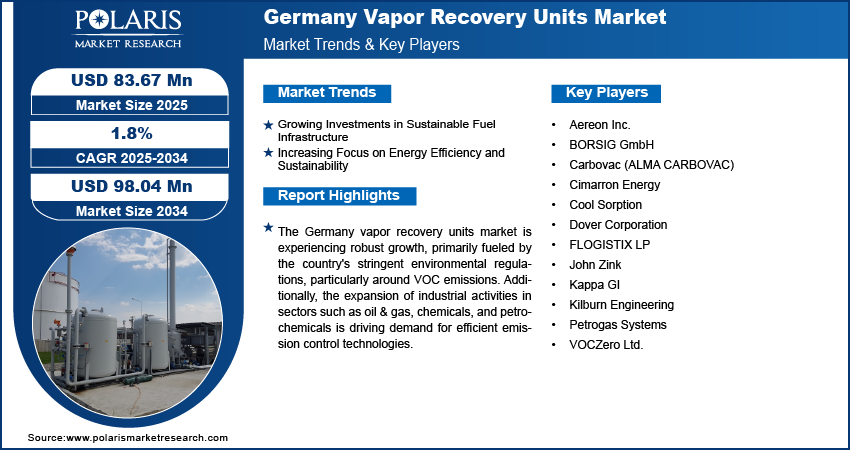

The Germany vapor recovery units sector is evolving rapidly, propelled by a robust regulatory framework and a growing corporate commitment to environmental stewardship. There is a rising imposition of stringent national and European Union mandates aimed at reducing volatile organic compound (VOC) emissions across fuel storage and distribution infrastructure. These regulations, such as the Industrial Emissions Directive (IED) and the Mobile Machinery Vapor Recovery requirements, compel operators to adopt technologies that minimize harmful vapor release, making vapor recovery units beneficial and mandatory.

In Germany’s industrial landscape, the oil and gas sector remains the dominant end user of VRUs. Major fuel terminal operators retrofit older facilities and newer developments integrating recovery systems from the outset. Beyond the traditional oil & gas domain, chemical processing plants, coastal ports handling oil tankers, and large logistics hubs are increasingly embracing vapor recovery solutions. Regulatory compliance and improved resource efficiency propel the industry expansion. VRUs enable the capture and return of vapors into the product system, effectively reducing losses, enhancing economic value, and lowering carbon footprint an important advantage for companies placing sustainability at the center of their operations.

Technological innovation enhances the landscape. Modern VRUs come equipped with advanced features such as automated pressure control, real‑time emissions monitoring, and integration with digital management systems. These additions support predictive maintenance, optimize performance, and facilitate data-driven environmental reporting an attractive proposition for companies under pressure to demonstrate compliance and reduce operational risk. Additionally, growing focus on clean fuel infrastructure creates palpable opportunities. Germany’s green hydrogen initiatives and progressive bio‑fuel blending strategies, along with anticipated shifts toward compressed natural gas (CNG) and liquefied natural gas (LNG) distribution, all call for compatible vapor recovery solutions to ensure environmental safety and system efficiency. As both government and private sectors invest more in eco-friendly fuel networks, especially at fueling stations and storage facilities, equipment providers are well positioned to meet the growing demand.

Drivers & Opportunities

Increasing Focus on Energy Efficiency and Sustainability: A rising focus on energy efficiency and sustainability within Germany’s industrial landscape is emerging as a key driver for the market. As part of the country’s broader Energiewende energy transition, industries are under pressure to reduce emissions, improve resource utilization, and adopt cleaner operational practices. VRUs align perfectly with these goals as they capture vapors released during the storage or transfer of fuels and convert them back into usable hydrocarbons. This process prevents harmful volatile organic compounds (VOCs) from entering the atmosphere and recovers valuable product, effectively turning potential waste into economic gain. For industrial operators, the adoption of VRUs represents a dual advantage compliance with environmental regulations and improved operational efficiency. Modern VRUs are designed with energy‑saving components such as variable‑speed compressors, automated pressure controls, and integrated monitoring systems that optimize performance while reducing power consumption. By minimizing the energy required for vapor recovery and enhancing system efficiency, these technologies support companies in lowering their carbon footprint while meeting corporate sustainability commitments.

Growing Investments in Sustainable Fuel Infrastructure: The growing investments in sustainable fuel infrastructure, including biofuel, liquefied natural gas (LNG), and compressed natural gas (CNG) facilities would presents a significant opportunity for the Germany VRU market during the forecast period. As the country accelerates its transition to cleaner energy sources, the expansion of alternative fuel networks requires storage, transportation, and distribution systems that comply with stringent environmental standards. Sustainable fuels such as Sustainable Aviation Fuel (SAF), while reducing greenhouse gas emissions during combustion, still release vapors during handling and storage that can contribute to air pollution and product loss if not properly managed. This is where advanced VRUs come into play, offering an efficient solution to capture and recycle these vapors, ensuring both environmental protection and operational efficiency. The development of biofuel blending facilities, including those processing algae biofuel, along with LNG/CNG refueling stations, creates a direct demand for vapor recovery technologies that are compatible with these evolving energy networks. For example, LNG and CNG stations experience boil‑off gases and pressure variations that require specialized recovery systems to prevent atmospheric emissions and energy loss. Similarly, biofuel storage can emit organic vapors that need to be captured to comply with Germany’s strict VOC emission regulations. By providing VRUs tailored for these applications, equipment manufacturers can position themselves as essential partners in the sustainable energy ecosystem.

Segmental Insights

Technology Analysis

Based on technology, the Germany vapor recovery units market segmentation includes absorption, condensation, membrane separation, adsorption, and others. The absorption technology segment held the largest revenue share in 2024 due to its high efficiency, cost-effectiveness, and wide applicability across various industrial processes. This technology is especially favored for its ability to recover a broad range of VOCs with minimal energy consumption, making it an environmentally and economically attractive solution. Industries such as oil and gas, petrochemicals, and chemical manufacturing prefer absorption systems as they can be integrated easily into existing infrastructure and deliver consistent performance under different operating conditions. Additionally, advancements in solvent materials and system design have further enhanced the operational efficiency of absorption units.

The membrane separation segment is projected to grow at a substantial pace in the coming years due to its low energy requirements and minimal environmental impact. It offers a compact, modular design that is easy to install and scale, making it ideal for both new and retrofit applications. Additionally, the technology provides high selectivity and efficiency in separating and recovering specific vapors, which aligns well with stricter emission control regulations in Germany.

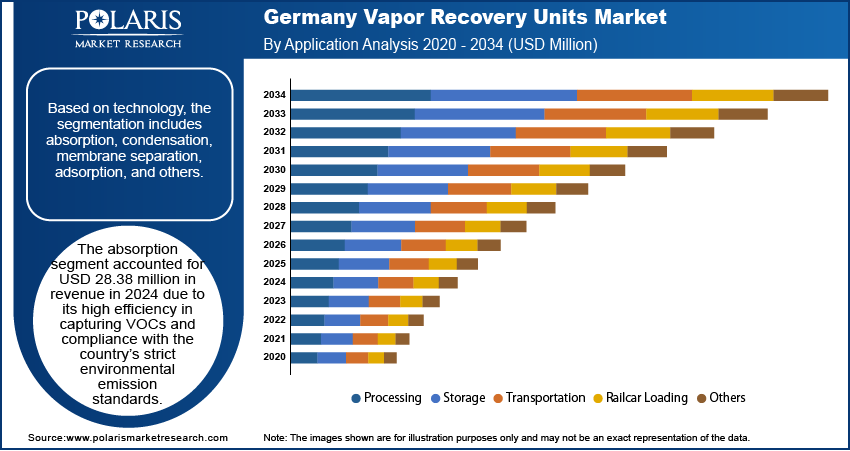

Application Analysis

In terms of application, the Germany vapor recovery units market segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment held 31.7% share of the market in 2024. Storage tanks frequently generate vapors because of temperature fluctuations and liquid movement, making them a consistent source of emissions that require effective control. Vapor recovery units help reduce product loss by capturing valuable vapors, offering significant cost savings to operators. Safety is another major driver, as the accumulation of flammable vapors in storage tanks poses explosion and fire hazards, which VRUs help mitigate. Furthermore, the modernization of aging storage infrastructure across Germany has led to increased adoption of advanced vapor recovery technologies. The proximity of many storage facilities to urban or environmentally sensitive areas has also intensified the need for effective vapor control solutions.

The transportation segment is projected to register a CAGR of 2.3% during the forecast period due to the increasing movement of volatile fuels and chemicals across the country. As stricter environmental regulations target emissions during fuel loading and unloading, the demand for mobile and efficient vapor recovery systems in trucks, tankers, and pipelines is rising. Additionally, the growing focus on minimizing product loss during transit and ensuring worker and environmental safety supports the adoption of VRUs in transportation. Technological advancements are also enabling compact, high-performance systems suitable for mobile operations.

End User Analysis

The Germany vapor recovery units market segmentation, based on end user, includes into oil & gas, chemicals & petrochemicals, landfills, and others. The oil & gas segment accounted for USD 53.97 million revenue share in 2024, due to the sector’s expansive infrastructure and continuous operations that release significant volumes of vapors. With the growing push toward decarbonization and industry-wide sustainability targets, companies are prioritizing the adoption of vapor recovery units to align with environmental goals. The oil & gas industry also faces increasing pressure to enhance energy efficiency and reduce waste across the value chain. As a result, VRUs are being integrated into facility designs to meet regulations and support long-term resource optimization and corporate environmental responsibility initiatives.

The landfills segment is projected to capture 7.3% share of the market by 2034 due to its increasing role in controlling greenhouse gas emissions and improving environmental safety. Landfill gas releases significant amounts of methane and other volatile organic compounds (VOCs), which contribute to air pollution and climate change. As Germany strengthens its climate policies and waste management regulations, there is growing demand for vapor recovery systems to capture and treat these emissions.

Key Players & Competitive Analysis

The Germany vapor recovery units market is experiencing growing competition, fueled by the steady growth of key sectors such as oil & gas, chemicals, and renewable energy. Leading domestic and international players are adopting strategic initiatives to strengthen their foothold, including collaborations with German industrial firms, investments in R&D focused on compliance with EU and national environmental standards, and the localization of manufacturing and service capabilities. Companies are prioritizing the development of next-generation VRUs equipped with automation, real-time emissions monitoring, and modular configurations to address Germany’s strict air quality and VOC emission regulations. There is also a strong push to enhance energy efficiency, lower lifecycle costs, and provide customized solutions for applications in fuel depots, chemical storage sites, and biogas plants. Additionally, the emergence of German tech startups specializing in digital emissions control and smart monitoring systems is intensifying market competition, encouraging established players to continuously innovate and adapt to the country’s sustainability-driven industrial landscape.

A few key players such as Aereon Inc., BORSIG GmbH, Carbovac (ALMA CARBOVAC), Cimarron Energy, Cool Sorption, Dover Corporation, FLOGISTIX LP, John Zink, Kappa GI, Kilburn Engineering, Petrogas Systems, and VOCZero Ltd. dominate the market through their extensive fleets and nationwide service networks.

Key Players

- Aereon Inc.

- BORSIG GmbH

- Carbovac (ALMA CARBOVAC)

- Cimarron Energy

- Cool Sorption

- Dover Corporation

- FLOGISTIX LP

- John Zink

- Kappa GI

- Kilburn Engineering

- Petrogas Systems

- VOCZero Ltd.

Germany Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2020–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

Germany Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 82.87 Million |

|

Market Size in 2025 |

USD 83.67 Million |

|

Revenue Forecast by 2034 |

USD 98.04 Million |

|

CAGR |

1.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 82.87 million in 2024 and is projected to grow to USD 98.04 million by 2034.

The market is projected to register a CAGR of 1.8% during the forecast period.

A few of the key players in the market are Aereon Inc., BORSIG GmbH, Carbovac (ALMA CARBOVAC), Cimarron Energy, Cool Sorption, Dover Corporation, FLOGISTIX LP, John Zink, Kappa GI, Kilburn Engineering, Petrogas Systems, and VOCZero Ltd.

The absorption segment accounted for USD 28.38 million in revenue in 2024.

The transportation segment is projected to register a CAGR of 2.3% during the forecast period.