Pharmacy Automation Market Size, Share, Trends, Industry Analysis Report

: By Product (Automated Medication Dispensing, Automated Packaging, Automated Tabletop Counters, and Others), Automation Mode, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM2802

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

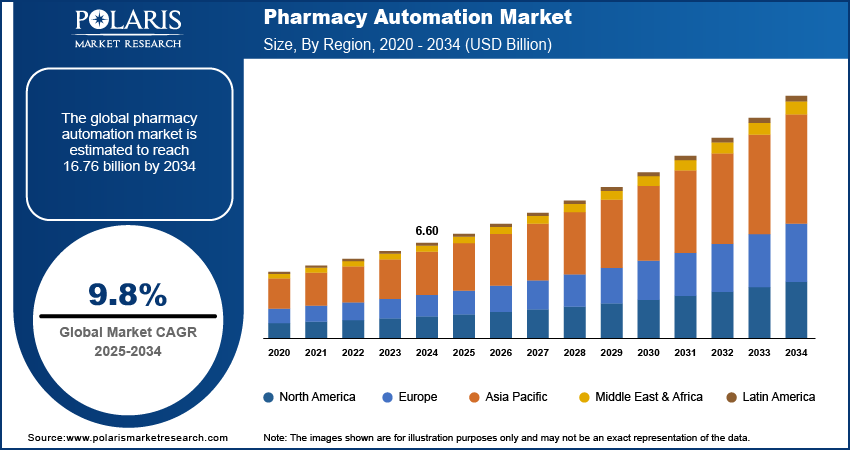

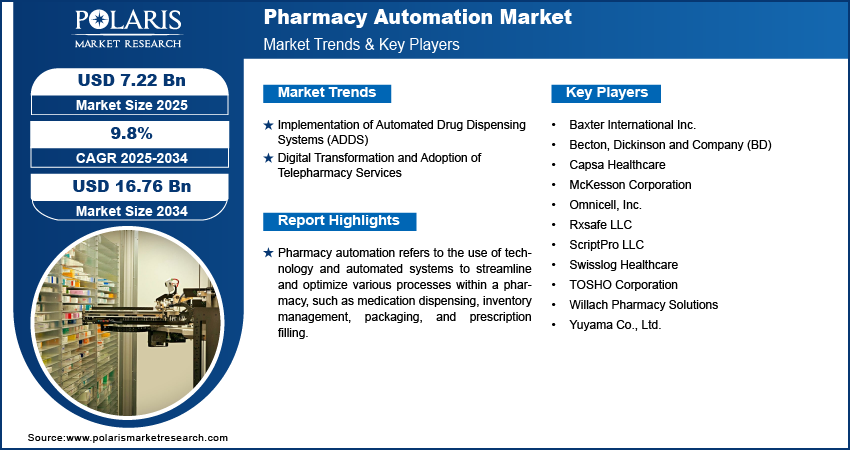

The pharmacy automation market size was valued at USD 6.60 billion in 2024, exhibiting a CAGR of 9.8% during 2025–2034. The pharmacy automation market is boosted by the demand for higher accuracy, efficiency, technology, and the use of automated systems such as ADDS to enhance safety and simplify processes.

Key Insights

- The automated dispensing medication segment dominated the market in 2024 with increasing demand for precise, efficient, and safe medication management within hospitals and retail pharmacies.

- The fully automatic segment commanded a major market share in 2024 due to their capacity to undertake operations with negligible human involvement, thus improving efficiency and precision.

- The biotechnology segment is witnessing the maximum CAGR in the pharmacy automation industry, triggered by progress in biologics, personalized medicine, and gene therapy, which demand specialized automation systems.

- North America dominated the market, powered by its sophisticated healthcare system and extensive use of advanced technologies.

- Asia Pacific is leading the way with the most rapid growth in the pharmacy automation market due to the accelerating development of healthcare in China, India, and Japan with their emphasis on enhancing access and infrastructure.

Industry Dynamics

- The expansion in technology and the uptake of EHR are propelling the adoption of automated systems within pharmacies, increasing Pharmacy Automation market growth as pharmacy chains enhance service and comply with requirements.

- The increase in the adoption of automated drug dispensing systems (ADDS) is a significant growth driver for the market.

- Increased use of advanced technology is increasing the efficiency of pharmacies, leading to growth in the pharmacy automation market by increasing speed, intelligence, and patient friendliness of services.

- High initial investment in using automated systems is a significant restraint in the market, which is a hindrance for small pharmacies and healthcare facilities.

Market Statistics

2024 Market Size: USD 6.60 billion

2034 Projected Market Size: USD 16.76 billion

CAGR (2025-2034): 9.8%

North America: Largest Market Share

AI Impact on Pharmacy Automation Market

AI enhances the accuracy of dispensing medications, minimizing human mistakes and maximizing patient safety.

Technologically enabled systems streamline inventory management by forecasting stock requirements and avoiding shortages.

AI enhances pharmacy operations by streamlining processes, including prescription processing and patient record management.

AI is embedded with EHRs to provide individualized treatment suggestions, enhancing care.

To Understand More About this Research: Request a Free Sample Report

Several factors are contributing to the pharmacy automation market growth. A key driver is the rising demand for enhanced accuracy and efficiency in medication management, which automation systems can deliver. The increasing prevalence of chronic diseases and an aging population are also pushing the need for more efficient pharmacy operations to handle larger volumes of prescriptions. Additionally, advancements in technology and the growing adoption of electronic health records (EHR) are facilitating the integration of automated systems in pharmacies. As pharmacies seek to improve customer service and meet regulatory standards, the market is expected to experience significant growth in the coming years.

Market Dynamics

Implementation of Automated Drug Dispensing Systems (ADDS)

The implementation of automated drug dispensing systems (ADDS) is a key driver of growth in the pharmacy automation market. These systems reduce human errors, improve medication safety, and enhance efficiency in pharmacies and hospitals. By automating the dispensing process, ADDS ensures accurate dosing, minimizes delays, and allows healthcare staff to focus on patient care rather than manual tasks. The rising demand for prescription medications, coupled with the global shortage of pharmacists, further fuels the adoption of these systems. Additionally, stringent government regulations promoting patient safety and the increasing need to curb medication errors are pushing healthcare facilities toward automation. As hospitals and pharmacies aim to streamline operations and cut costs, ADDS adoption is expected to rise, making it a critical component of modern healthcare infrastructure.

Digital Transformation and Adoption of Telepharmacy Services

The pharmacy sector is changing quickly due to digital technology, especially with the rise of telepharmacy. Telepharmacy lets pharmacists help patients remotely, making healthcare more convenient and accessible, especially in areas with few medical services. During the COVID-19 pandemic, online pharmacy platforms grew rapidly, changing how pharmacy services and education work. This digital shift makes it easier for patients to connect with pharmacists and improves how pharmacies operate. By using advanced technology, pharmacies are becoming more efficient, helping the pharmacy automation market grow. In short, digital tools are making pharmacy services faster, smarter, and more patient-friendly.

Segment Insights

Market Assessment by Product

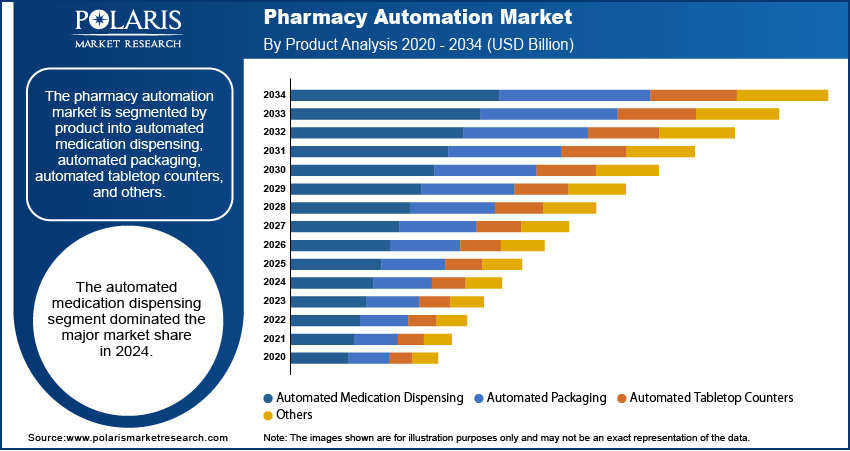

The pharmacy automation market is segmented by product into automated medication dispensing, automated packaging, automated tabletop counters, and others. The automated medication dispensing segment dominated the market in 2024. This is primarily driven by the increasing demand for accurate, efficient, and safe medication management systems in both hospitals and retail pharmacies. Automated medication dispensing systems reduce the risk of human error during the drug dispensing process and optimize inventory management, enabling pharmacies to better manage medication stocks while enhancing patient safety. The widespread adoption of these systems is propelled by the growing focus on improving operational efficiency and patient care, particularly in large healthcare settings where the volume of prescriptions and medications is high. Automated medication dispensing remains the most significant contributor to the market overall share as hospitals and pharmacies continue to prioritize automation for workflow enhancement.

The automated packaging segment is experiencing the fastest pharmacy automation market growth. The demand for automated packaging systems has been rapidly increasing due to the need for more efficient and scalable packaging solutions in the pharmaceutical industry. These systems streamline the process of packaging drugs, ensuring that medications are packaged accurately, securely, and efficiently, which is critical in reducing the risk of errors and improving distribution efficiency. The rise in prescription volume, combined with the need for streamlined production and packaging processes, is pushing the growth of the segment. Automated packaging systems are especially crucial in high-volume production environments, where speed and accuracy are essential. This growth is further driven by technological advancements in packaging machinery, making it a preferred choice for many pharmaceutical manufacturers aiming to meet rising demand with improved operational capabilities.

Market Evaluation by Automation Mode

The pharmacy automation market is segmented by automation mode into fully-automatic and semi-automatic. The fully automatic segment accounted for a major pharmacy automation market share in 2024. Fully automatic systems are increasingly being adopted due to their ability to perform entire tasks with minimal human intervention, offering superior efficiency and accuracy. These systems are particularly beneficial in high-demand settings such as large hospitals and chain pharmacies, where the volume of prescriptions requires rapid and precise processing. Fully-automatic systems streamline various pharmacy operations, including medication dispensing, packaging, and inventory management, significantly reducing the chances of human error and enhancing overall operational efficiency. The continued focus on improving patient safety and reducing labor costs further drives the demand for fully automatic automation modes, making it the dominant segment in the market.

The semi-automatic segment is experiencing the fastest growth rate. Semi-automatic systems provide a balance between automation and manual intervention, making them an attractive option for pharmacies seeking to enhance efficiency without fully relinquishing human oversight. These systems offer flexibility, allowing pharmacists to maintain a certain level of control over the dispensing and packaging processes while still benefiting from automation. As smaller and medium-sized pharmacies look for cost-effective automation solutions, semi-automatic systems are gaining popularity. Additionally, advancements in semi-automatic technology, such as improved user interfaces and increased integration capabilities, have further spurred growth in the segment. The ability of semi-automatic systems to meet the diverse needs of various pharmacy environments, along with their scalability, contributes to the growing demand and rapid expansion of this segment.

Market Outlook by End User

The pharmacy automation market segmentation, based on end user, includes pharmaceutical and biotech. The pharmaceutical segment held the largest market share in 2024. The pharmaceutical industry’s large-scale operations and the need for efficient, precise, and reliable automation systems have made it the leading sector for pharmacy automation solutions. Automation in pharmaceutical manufacturing, packaging, and dispensing is crucial for maintaining high production volumes while ensuring compliance with stringent regulatory standards. Pharmaceutical companies are turning to automation technologies to improve production efficiency, reduce operational costs, and ensure consistent product quality. The ongoing focus on patient safety, reducing medication errors, and optimizing production lines further support the dominant position of the pharmaceutical segment in the market.

The biotech segment is witnessing the highest pharmacy automation market CAGR. The rise in biotechnology advancements, particularly in the development of biologics, personalized medicine, and gene therapies, has increased the need for specialized automation systems. These systems play a vital role in ensuring the accurate handling, storage, and distribution of complex biotech products that often require unique processing conditions. The rapid growth of the biotech sector, driven by continuous innovations and the increasing number of biotech companies, is fueling demand for automation solutions.

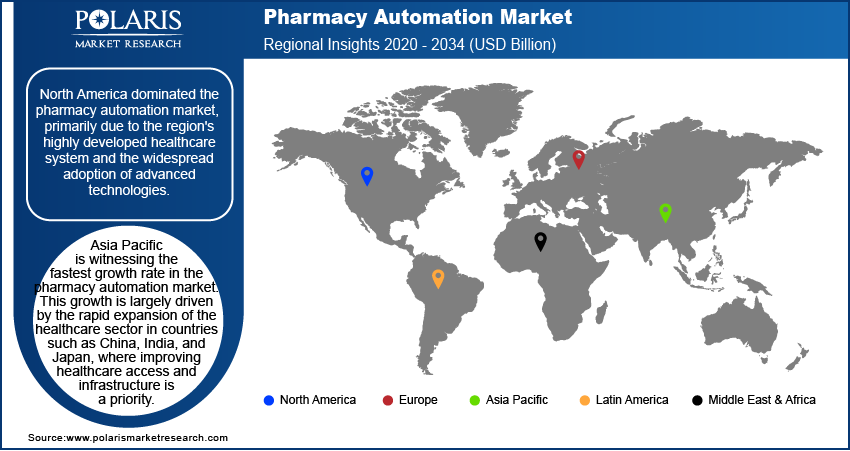

Regional Analysis

By region, the study provides the pharmacy automation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market, primarily due to the region's highly developed healthcare system and the widespread adoption of advanced technologies. The US, in particular, is a leader in the integration of automation within healthcare settings, driven by the need to improve patient safety, reduce medication errors, and enhance operational efficiency in pharmacies. Hospitals and retail pharmacies in the region are increasingly implementing fully automated systems, including medication dispensing and packaging solutions, to streamline their operations. Moreover, government regulations and initiatives aimed at enhancing healthcare delivery and reducing operational costs have further supported the adoption of pharmacy automation in North America. The established presence of key market players and ongoing investments in innovation make North America a dominant region in the pharmacy automation market.

Asia Pacific is witnessing the fastest pharmacy automation market growth rate. This growth is largely driven by the rapid expansion of the healthcare sector in countries such as China, India, and Japan, where improving healthcare access and infrastructure is a priority. The increasing population, rising prevalence of chronic diseases, and growing demand for pharmaceutical products are fueling the need for efficient pharmacy operations in the region. Moreover, governments in several Asia Pacific countries are investing in healthcare technology and automation to address the challenges of scaling up healthcare services for large populations. The adoption of automated pharmacy solutions in both urban and rural settings is expected to continue to rise as countries in the region look to improve their healthcare systems and meet the demands of a growing patient base. This surge in automation adoption positions Asia Pacific as a key region for growth in the pharmacy automation market.

Key Players and Competitive Analysis Report

The pharmacy automation market includes several major players actively contributing to the development and adoption of automation technologies. Some of the key companies in this market are Baxter International Inc.; Becton, Dickinson and Company (BD); Capsa Healthcare; McKesson Corporation; Omnicell, Inc.; Rxsafe LLC; ScriptPro LLC; Swisslog Healthcare; TOSHO Corporation; Willach Pharmacy Solutions; and Yuyama Co., Ltd. These companies are engaged in providing automation solutions such as automated medication dispensing, packaging systems, and pharmacy management software designed to improve efficiency and accuracy in pharmacy operations.

The competitive landscape in the pharmacy automation market is characterized by a high degree of innovation and technological advancements, with key players focusing on developing integrated solutions that streamline pharmacy workflows. Companies are increasingly offering customized solutions to meet the specific needs of various healthcare settings, from small retail pharmacies to large hospital networks. There is also an emphasis on strategic collaborations and acquisitions to enhance product offerings, expand geographic presence, and gain access to cutting-edge technologies. As the demand for automation in the pharmacy industry grows, players are investing heavily in research and development to improve product features and functionality. Additionally, market players are positioning themselves by addressing the ongoing challenges of medication errors, operational inefficiencies, and the need for cost-effective solutions.

Omnicell, Inc., headquartered in Mountain View, California, is a prominent player in the pharmacy automation market. The company provides a wide range of automated medication dispensing systems, packaging solutions, and medication management software. Omnicell's automation solutions are designed to enhance pharmacy workflow, reduce errors, and improve patient safety. With a focus on both hospital and retail pharmacy environments, Omnicell's technology supports pharmacies in managing medication distribution efficiently and accurately. The company is known for its integration of artificial intelligence and robotics into its systems, offering scalability and customization based on the specific needs of healthcare providers.

Baxter International Inc., based in Deerfield, Illinois, is another major player in the market, known for its extensive portfolio of pharmacy automation products. Baxter offers automated medication dispensing systems, as well as solutions for drug preparation and packaging, particularly aimed at improving the safety and efficiency of pharmacy operations. Through its acquisition of Kirby Lester, a key player in the field of medication dispensing, Baxter has strengthened its position in the pharmacy automation sector. Baxter’s technology solutions are crucial for hospitals, outpatient clinics, and retail pharmacies looking to streamline operations, reduce human error, and enhance the quality of patient care. Their commitment to innovation in healthcare technology supports their continued relevance in the growing Pharmacy Automation Market.

List of Key Companies

- Baxter International Inc.

- Becton, Dickinson and Company (BD)

- Capsa Healthcare

- McKesson Corporation

- Omnicell, Inc.

- Rxsafe LLC

- ScriptPro LLC

- Swisslog Healthcare

- TOSHO Corporation

- Willach Pharmacy Solutions

- Yuyama Co., Ltd.

Pharmacy Automation Industry Developments

- October 2024: Malaysia introduced its first automated dispensing medication system (ADMS), i-Pharmabot, at the National Heart Institute (IJN).

- May 2024: Plenful, an AI-powered platform dedicated to automating pharmacy and healthcare workflows, secured USD 17 million in funding. This milestone highlights Plenful’s commitment to transforming pharmacy operations through advanced automation and AI technologies

Pharmacy Automation Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Automated Medication Dispensing

- Automated Packaging

- Automated Tabletop Counters

- Others

By Automation Mode Outlook (Revenue-USD Billion, 2020–2034)

- Fully-Automatic

- Semi-Automatic

By End User Outlook (Revenue-USD Billion, 2020–2034)

- Pharmaceutical

- Biotech

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Pharmacy Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.60 billion |

|

Market Value in 2025 |

USD 7.22 billion |

|

Revenue Forecast by 2034 |

USD 16.76 billion |

|

CAGR |

9.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The pharmacy automation market has been segmented into detailed segments of product, automation mode, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the pharmacy automation market focuses on expanding product offerings, enhancing customer satisfaction, and fostering partnerships with healthcare providers. Companies are investing in research and development to integrate advanced technologies such as artificial intelligence and robotics into their automation solutions, which improves efficiency and reduces medication errors. Additionally, market players are leveraging strategic collaborations, mergers, and acquisitions to broaden their market reach and enhance product portfolios. As the demand for accurate and efficient pharmacy solutions grows, targeted marketing efforts emphasize the benefits of automation in improving patient safety, reducing operational costs, and enhancing workflow in both hospitals and retail pharmacies. These strategies position companies to capture a larger share of the expanding market.

FAQ's

The pharmacy automation market size was valued at USD 6.60 billion in 2024 and is projected to grow to USD 16.76 billion by 2034.

The market is projected to register a CAGR of 9.8% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the pharmacy automation market include Baxter International Inc.; Becton, Dickinson and Company (BD); Capsa Healthcare; McKesson Corporation; Omnicell, Inc.; Rxsafe LLC; ScriptPro LLC; Swisslog Healthcare; TOSHO Corporation; Willach Pharmacy Solutions; and Yuyama Co., Ltd.

The pharmaceutical segment accounted for the largest share of the market in 2024.

Following are some of the pharmacy automation market trends: ? Integration of Artificial Intelligence (AI) and Machine Learning: AI and machine learning are being increasingly incorporated into pharmacy automation systems to enhance decision-making, optimize workflows, and improve medication accuracy. ? Robotics in Medication Dispensing: The use of robotics for dispensing medications is growing, as it improves accuracy, reduces human errors, and speeds up the dispensing process. ? Cloud-Based Pharmacy Management Systems: The adoption of cloud-based platforms is rising, offering real-time data access, remote monitoring, and more efficient management of inventory and medication dispensing.

Pharmacy automation refers to the use of technology and automated systems to streamline and improve various processes within a pharmacy, including medication dispensing, packaging, inventory management, and prescription filling. These automated systems are designed to reduce human errors, increase operational efficiency, and enhance patient safety. Pharmacy automation includes both hardware (such as robotic dispensing machines and automated storage systems) and software (such as pharmacy management software) that work together to assist pharmacists in managing their tasks more efficiently. By integrating these technologies, pharmacies can ensure faster and more accurate medication delivery, optimize workflow, and reduce the risks associated with manual handling of medications.