GPU as a Service Market Size, Share, & Industry Analysis Report

By Component (Solution, Services), By Pricing Model, By Organization Size, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5654

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

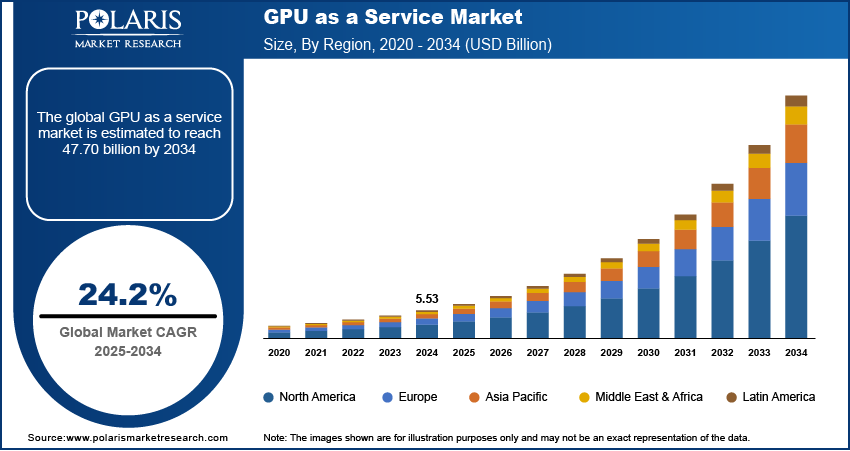

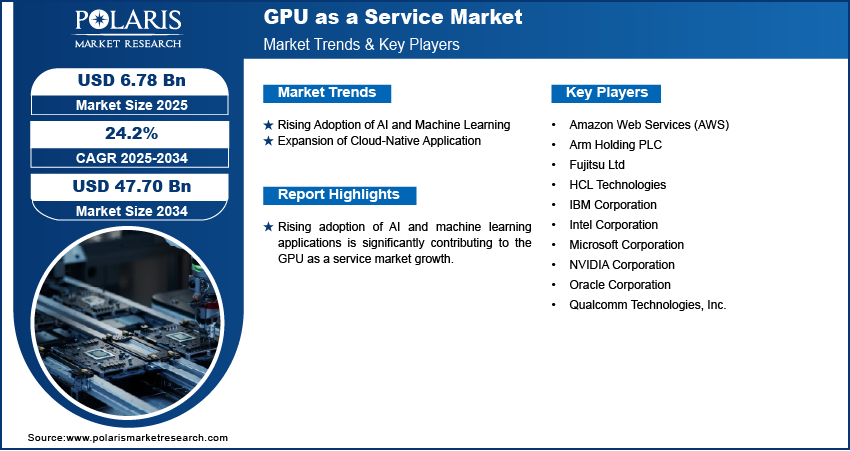

The global GPU as a service market size was valued at USD 3.43 billion in 2024, growing at a CAGR of 19.9% from 2025–2034. The increasing adoption of AI across various industries along with the rising demand for cloud gaming and real-time graphics processing is fueling the growth of GPU as a service.

GPU as a service (GPUaaS) allows organizations to access high-performance computing capabilities through cloud-based infrastructure. These services allow enterprises to run intensive workloads, such as deep learning, data analytics, graphics rendering and scientific simulations without the need for on-premise hardware investments. Cloud-based GPU models support scalability, workload mobility and resource optimization, making it a practical option for businesses handling dynamic computational requirements. Enterprises across sectors are increasingly adopting GPUaaS to streamline operations and reduce time-to-insight for artificial intelligence (AI) and machine learning platforms.

Service providers are developing dedicated GPU clusters and optimized software environments to address growing demands for parallel processing and low-latency execution. Automation in provisioning, usage monitoring and workload orchestration is improving service efficiency, while enhanced virtual GPU support is enabling secure multi-tenant environments. These solutions are advancing productivity in industries such as media and entertainment, autonomous driving, finance and healthcare, where large-scale data processing and inference modeling are essential to core operations.

To Understand More About this Research: Request a Free Sample Report

Rising advancements in deep learning model complexity, simulation workloads and computational science are driving the shift toward high-throughput cloud-based GPU solutions. Enterprises involved in drug discovery, seismic analysis, weather forecasting and 3D content generation require flexible GPU infrastructure to support large-scale iterative processes. In January 2024, WekaIO partnered with NexGen Cloud to support its AI Supercloud and GPU as a service platform with faster and more efficient data technology. This helps deliver affordable, high-speed GPU compute for large-scale AI training and workloads. GPU as a service allows these organizations to access specialized hardware environments without long procurement cycles or capital-intensive infrastructure builds. This utility-based model enables seamless experimentation, rapid deployment and cross-location accessibility for research and engineering teams.

Increasing demand for IT cost optimization and resource scalability is pushing organizations to adopt GPUaaS platforms to manage short-term surges and project-based workloads. Service providers are deploying containerized GPU clusters, high-bandwidth interconnects and dynamic allocation mechanisms to maintain computational performance across diverse user bases. The integration of advanced workload schedulers and usage-based pricing models is improving efficiency, while automated orchestration is reducing provisioning time. These developments are driving GPUaaS across enterprise for agility, infrastructure rationalization and compute-intensive innovation.

Industry Dynamics

Increasing Adoption of AI Across Industries

The growing use of artificial intelligence across industries is driving the demand for GPU as a service. Companies in healthcare, finance, automotive and retail are adopting AI-based tools for applications such as customer targeting, risk analysis, forecasting and autonomous operations. For example, in March 2025, MEF, Infosys, and IronYun introduced a new GPU as a service solution at MWC 2025 in Barcelona. It uses MEF’s standardized APIs to let service providers offer on-demand GPU compute at the network edge for real-time AI applications. These functions require high computing power for training large models, running generative AI and managing deep learning tasks. GPUaaS offers a scalable and flexible solution by providing access to high-performance GPUs through a cloud-based model. This helps organizations manage complex workloads without making large capital investments in hardware. This pay-as-you-go model reduces capital expenditure and offers flexibility to scale resources based on project needs, accelerating AI innovation and adoption across sectors.

Additionally, major cloud service providers are expanding AI infrastructure to support this rising demand for GPUaaS. Platforms such as AWS, Microsoft Azure and Google Cloud are deploying advanced GPUs, including models from NVIDIA to enhance computing capacity. These services help businesses improve operational efficiency and adopt AI at a faster pace. Rising advancements in AI tools are increasing the demand for faster model development and real-time processing, thus boosting the demand for the GPUaaS industry across industries worldwide.

Rising Demand for Cloud Gaming and Real-Time Graphics Processing

The rising demand for cloud gaming and real-time graphics processing is contributing to the growth of the GPU as a service market. According to Newzoo, the cloud gaming industry was valued at around USD 2.4 billion by the end of 2022 and grew to approximately USD 8.2 billion by 2025. Modern gaming applications require powerful GPUs to support high-resolution graphics, realistic lighting and immersive gameplay. Cloud gaming platforms use GPUaaS to deliver these experiences across various devices, allowing users to play graphic-intensive games without investing in high-end hardware. This approach makes premium gaming more accessible by enabling smooth performance and low-latency gameplay on smartphones, laptops and other consumer devices.

In addition, GPUaaS is used in various industries such as media, architecture, product design and virtual collaboration. These sectors rely on real-time rendering, animation and visualization for project development and creative workflows. GPUaaS provides the flexibility to scale resources during high-demand periods, such as major content releases or design revisions. The growing demand for interactive content and advanced visual processing services is propelling the demand for GPUaaS among businesses and creative professionals.

Segmental Insights

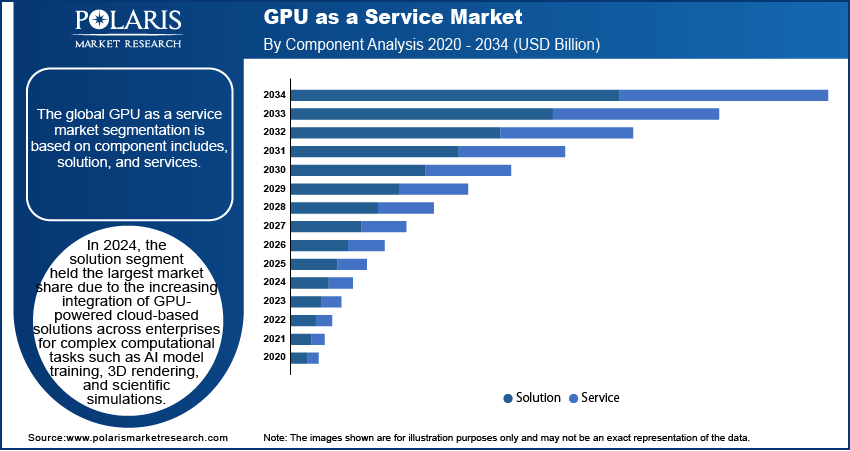

Component Analysis

The segmentation, based on component includes, solution and services. The solution segment dominated the market in 2024. This is driven by growing demand for high-performance infrastructure to support AI, graphics rendering and simulation workloads. In September 2024, Sharon AI partnered with Next DC, Layercake, Grass Valley, and AI‑Media to launch a cloud-based media platform that uses on-demand GPU-as-a-Service infrastructure to automate video production workflows. Enterprises are deploying cloud-based GPU solutions to reduce capital expenditure and increase computational flexibility across key applications such as deep learning, video rendering and virtual modeling. Vendors are offering pre-configured GPU instances with integration capabilities for various AI and analytics frameworks.

The services segment is projected to grow at a robust pace in the coming years, due to rising enterprise needs for system integration, consulting and managed services tailored to GPUaaS environments. Many companies are adopting GPUaaS services to support resource management, handle workloads and smoothly deploy solutions across different cloud platforms. This demand is strong among non-technical businesses and small to medium-sized enterprises that lack dedicated in-house IT infrastructure. The demand for GPUaaS services is increasing due to the high-performance computing by organizations to boost efficiency, scalability and speed.

Pricing Model Analysis

The segmentation, based on pricing model includes, pay-as-you-go, subscription-based. The pay-as-you-go segment accounted for substantial share in 2024, as it offers flexibility and cost control for organizations with fluctuating or project-based workloads. Enterprises engaged in AI research, graphics processing and simulation prefer this model to avoid upfront capital expenses. It enables usage-based billing, allowing businesses to scale compute power based on immediate requirements without overcommitting resources. This approach is beneficial for testing and development phases, where usage are unpredictable. The model is gaining wide acceptance among both SMEs and large enterprises for its efficiency and financial transparency.

The subscription-based segment is projected to grow at a significant pace during the assessment phase, this growth is attributed to the businesses looking for predictable pricing and long-term access to GPU infrastructure. Organizations with continuous AI training, software rendering and simulation workloads are shifting toward monthly or annual subscriptions to ensure consistent access and performance. This model is attractive to companies building long-term digital products or offering GPU-based services, such as AI-driven platforms or media rendering tools. GPUaaS services are growing significantly due to operational stability, bundled services, integrated software tools and dedicated support within subscription tiers.

Organization Size Analysis

The segmentation, based on organization size includes, small & medium enterprises (SMEs) and large enterprises. The large enterprises segment accounted for largest share in 2024, due to ongoing investments in AI, analytics as a service and simulation technologies. These organizations manage complex projects that require significant computing power and high levels of system customization. GPUaaS allows large enterprises to optimize performance while reducing capital expenditures on hardware. Use cases in autonomous systems, real-time forecasting, and enterprise-grade ML applications are driving adoption across sectors such as finance, manufacturing and automotive. For instance, in November 2024, Rackspace Technology expanded its Rackspace Spot platform with a new Silicon Valley data center and launched an on-demand GPU as a service powered by NVIDIA H100 GPUs. Also, strong IT infrastructure and skilled workforce further facilitate integration of GPUaaS into broader digital ecosystems.

The small & medium enterprises (SMEs) segment is estimated to hold a significant market share in 2034, fueled by the rising accessibility of cloud infrastructure and the need for cost-effective computing. SMEs are increasingly engaging in AI model development, product visualization and cloud-based content creation that require GPU capabilities. GPUaaS helps these businesses overcome hardware limitations by offering on-demand scalability and manageable pricing models. The growing availability of pre-built solutions and user-friendly platforms is allowing SMEs to leverage high-performance computing without heavy technical overhead, driving rapid growth in this segment.

End User Analysis

The segmentation, based on end user includes, IT & telecom, BFSI, media and entertainment, gaming, automotive, healthcare, and other end user. The gaming segment accounted for largest share in 2024, driven by demand for high-performance computing to support game development, cloud-based gameplay and immersive user experiences. GPUaaS platforms are enabling real-time rendering, ray tracing and advanced visual effects across multiple devices, without the need for local GPU hardware. Cloud gaming becomes mainstream, developers and platforms rely on GPUaaS to deliver consistent performance and graphical fidelity. Also, the growing demand for scalable infrastructure during game launches and live events continues to strengthen the segment’s dominance.

The healthcare segment is estimated to hold a significant market share in 2034, due to the increasing adoption in medical institutions and research centers for diagnostics, medical imaging and genomics. GPUaaS provides the computing power required to process complex datasets and run deep learning models for pattern recognition and disease detection. Cloud-based GPUs support collaborative research, real-time image rendering and data visualization in telemedicine and personalized treatment planning. GPUaaS is becoming essential for delivering faster insights and supporting innovation across clinical and research functions in the healthcare sector.

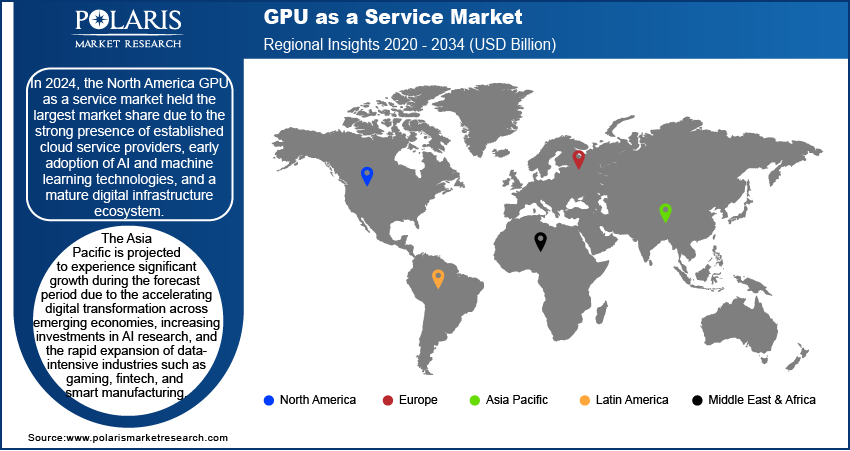

Regional Analysis

North America GPU as a service industry dominated the revenue share in 2024, driven by widespread adoption of cloud infrastructure, coupled with integration of AI tools and significant investments in data centers in the region. The presence of major hyperscalers including AWS, Microsoft Azure and Google Cloud along with leading GPU vendors such as NVIDIA and AMD established a strong ecosystem for delivering on-demand GPU computing. Moreover, enterprises across the US and Canada are utilizing GPUaaS platforms to boost performance in areas such as financial modeling, autonomous systems and healthcare diagnostics. Additionally, the growing shift toward generative AI and large language models is driving the need for high-throughput GPU as a service infrastructure.

US GPU as a Service Market Insight

The US dominated the regional share in 2024, fueled by presence of many cloud providers that are using GPUs across data centers in states such as Virginia, Oregon, and Texas. In May 2025, DigitalOcean launched new GPU Droplets powered by NVIDIA RTX and L40S GPUs, offering scalable, on-demand GPU compute for AI, machine learning, and graphics workloads. This enhances its GPU-as-a-Service capabilities, enabling developers to deploy high-performance workloads with ease. Also, federal initiatives such as the creating helpful incentives to produce semiconductor (CHIPS) and Science Act are promoting domestic technology growth, thus driving the broader adoption of cloud-based GPU services.

Asia Pacific GPU as a Service Market

The Asia Pacific GPU as a service industry is projected to grow with fastest CAGR during the forecast period, owing to the rapid digital transformation and cloud expansion in the region. The contribution by prominent countries such as China, India, Japan and Thailand are witnessing demand for GPU computing in AI development, gaming, and content creation. Regional and global cloud providers are setting up new data centers to support enterprise and public-sector workloads. In March 2025, Thailand Board of Investment (BOI) approved approximately USD 2.7 billion in new investments for data center and cloud service projects across Rayong, Chonburi, and Bangkok including a major 300 MW facility by China’s Beijing Haoyang. This investment strengthens Thailand’s digital infrastructure, attracts global hyperscalers, and boosts Southeast Asia’s GPUaaS growth by expanding high-capacity AI compute hubs. Also, GPUaaS is adopted in sectors including agriculture, education and healthcare to support automation, diagnostics and forecasting tools.

Europe GPU as a Service Market Overview

Europe GPU as a service market accounted for significant revenue share in 2024, due to the strong industrial capabilities and growing investment in AI and high-performance computing. Many countries are investing in local cloud infrastructure to support GPU workloads across automotive, aerospace and healthcare sectors. As an example, in March 2025, Oracle announced to invest USD 5 billion over five years to expand Oracle Cloud Infrastructure (OCI) footprint in the UK to boost AI, sovereign cloud, multicloud and generative AI services. This investment boosts Oracle’s role in the GPUaaS market by expanding GPU capacity, supporting AI growth and increasing competition with major cloud providers. Moreover, businesses are using GPUaaS to run simulations, design models and process complex data securely. The focus on regulatory compliance and energy efficiency is driving the demand for localized and sustainable GPUaaS solutions. Also, rising collaborations between cloud vendors, research institutes and enterprise IT teams are boosting adoption across the region.

Key Players & Competitive Analysis Report

The GPU as a service industry is moderately competitive, driven by rising demand for AI computing, real-time processing, and scalable GPU infrastructure. Key players are expanding GPU clusters and improving virtual GPU support for multi-user environments. Adoption is growing across sectors such as gaming, media, healthcare, and automotive. Companies are investing in containerized GPU platforms and flexible pricing models to meet diverse workload needs. Focus areas include energy-efficient data centers and optimized AI environments to enhance performance and reduce operational costs. Global expansion and partnerships with cloud and semiconductor providers are further strengthening market presence.

Key companies in the GPU as a service industry include Amazon Web Services Inc., Microsoft Corporation, Alphabet Inc., IBM Corporation, Oracle Corporation, Alibaba Group Holding Ltd., NVIDIA Corporation, CoreWeave, Inc., DigitalOcean Holdings, Inc., Tencent Holdings Ltd., Vast Data Inc., and Lambda Labs Inc.

Key Players

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon Web Services Inc.

- CoreWeave, Inc.

- DigitalOcean Holdings, Inc.

- IBM Corporation

- Lambda Labs Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Tencent Holdings Ltd.

- Vast Data Inc.

Industry Developments

May 2025: NVIDIA launched DGX Cloud Lepton, a GPU as a service platform designed to connect developers with NVIDIA’s global compute ecosystem. It enables on-demand access to thousands of NVIDIA GPUs across regional cloud partners, allowing AI developers to easily deploy models, use optimized microservices, and scale workloads efficiently.

May 2025: UAE-based telecom provider du launched a GPU as a service offering to deliver scalable, high-performance AI compute for enterprises and government entities. The service enables rapid deployment of generative AI and advanced analytics without upfront infrastructure costs.

January 2025: SK Telecom launched a GPU as a service platform in Seoul, South Korea, offering flexible access to NVIDIA H100 GPUs for AI workloads. Businesses will be able to subscribe to scalable GPU resources with added features such as dedicated servers and private network lines.

GPU as a Service Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Services

By Pricing Model Outlook (Revenue, USD Billion, 2020–2034)

- Pay-as-you-go

- Subscription-based

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End User Outlook (Revenue, USD Billion, 2020–2034)

- IT & telecom

- BFSI

- Media and Entertainment

- Gaming

- Automotive

- Healthcare

- Other End User

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

GPU as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.43 Billion |

|

Market Size in 2025 |

USD 4.10 Billion |

|

Revenue Forecast by 2034 |

USD 21.02 Billion |

|

CAGR |

19.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.43 billion in 2024 and is projected to grow to USD 21.02 billion by 2034.

The global market is projected to register a CAGR of 19.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amazon Web Services Inc., Microsoft Corporation, Alphabet Inc., IBM Corporation, Oracle Corporation, Alibaba Group Holding Ltd., NVIDIA Corporation, CoreWeave, Inc., DigitalOcean Holdings, Inc., Tencent Holdings Ltd., Vast Data Inc., and Lambda Labs Inc.

The solution segment dominated the market in 2024.

The small & medium enterprises (SMEs) segment is estimated to hold a significant market share in 2034.