Gynecology Surgical Instrument Market Size, Share, Trends, Industry Analysis Report

By Type (Forceps, Scissors, Trocars, Needle Holders), By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5926

- Base Year: 2024

- Historical Data: 2020-2023

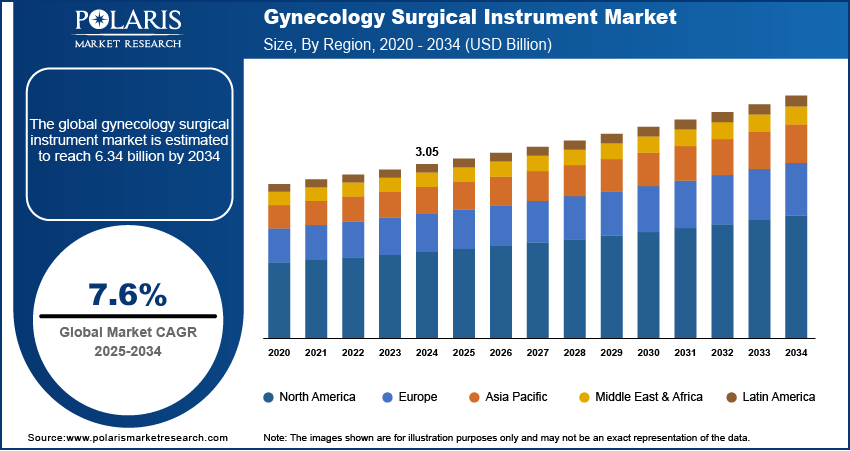

The global gynecology surgical instrument market size was valued at USD 3.05 billion in 2024, growing at a CAGR of 7.6% from 2025 to 2034. The growth is driven by growing female population and the rising prevalence of gynecological disorders.

Market Overview

Gynecology surgical instruments are specialized tools used by healthcare professionals to diagnose and treat conditions related to the female reproductive system. These instruments include forceps, scissors, retractors, speculums, curettes, and laparoscopic devices, tailored for procedures such as hysterectomy, dilation and curettage (D&C), and laparoscopic surgeries. Designed for precision and patient safety, these tools support both open and minimally invasive gynecological procedures.

Many developing countries are investing in healthcare infrastructure, including new hospitals, clinics, and surgical centers. This expansion is increasing access to gynecological care in regions where services were previously limited. The need for surgical instruments rises as more facilities open and more healthcare professionals are trained. Governments and private healthcare providers are equipping these centers with modern tools to meet international standards. The growth of medical tourism in countries such as India, Thailand, and Turkey further contributes to the demand for quality gynecological services and instruments. Moreover, global health organizations are supporting programs to improve women’s health in underserved areas. This includes funding and distributing essential surgical instruments. More women in these regions are screened, diagnosed, and treated for gynecological conditions as healthcare access improves, driving the surgical instrument demand.

Technology has significantly changed how gynecological surgeries are performed. New materials, better ergonomics, and improved precision have made instruments safer and more efficient. Innovations such as disposable hysteroscopes, advanced bipolar energy devices, and fluid management systems improve both patient outcomes and surgical workflow. Additionally, the integration of digital features, such as image-guided systems and automated fluid tracking, helps surgeons perform with greater precision. These developments are adopted by large hospitals, smaller clinics, and outpatient centers. The quality and variety of surgical tools improve as manufacturers continue to invest in research and development. Over time, this also leads to updated safety standards and new product offerings that replace older instruments. This ongoing innovation fuels demand for the latest gynecological instruments and reshapes how procedures are delivered across different healthcare settings.

Industry Dynamics

Growing Female Population

The global population of women, especially those over 35, is increasing, which contributes to the rising need for gynecological care. According to the United States Census Bureau, in the U.S. alone, 0.65% of the total population was female aged 40 years in 2024. Many gynecological conditions, such as fibroids and menopause-related disorders, become more common with age. Older women are also more likely to undergo surgical procedures for both diagnostic and therapeutic reasons. More women require long-term gynecological care, including surgeries as life expectancy increases. This fuels the demand for instruments used in a variety of procedures, from routine exams to complex operations. Additionally, in both developed and developing regions, access to healthcare for women has improved, leading to earlier diagnoses and more proactive treatment strategies. Healthcare providers need a consistent supply of specialized gynecological surgical instruments as more women are seeking care and undergoing procedures at different stages of life, thereby driving the growth.

Rising Prevalence of Gynecological Disorders

The increasing number of women diagnosed with gynecological conditions such as fibroids, endometriosis, abnormal uterine bleeding, and ovarian cysts is a major factor driving demand for gynecological surgical instruments. According to the John Hopkin Medicine, approx. 20% to 50% of women in the U.S. have fibroids. These conditions require diagnostic or surgical interventions, especially when symptoms become severe or persistent. Hospitals and clinics need reliable surgical tools to perform procedures effectively as more women seek treatment. The rise in these cases is partly due to better awareness, more frequent screenings, and improved access to healthcare. Additionally, lifestyle factors, hormonal imbalances, and aging contribute to the growing burden of gynecological disorders. The need for specialized instruments used in minimally invasive or traditional surgeries becomes more important as healthcare systems work to manage these conditions. This steady rise in clinical cases ensures ongoing demand for instruments used in both routine and complex gynecological procedures, thereby driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on type, include forceps, scissors, trocars, needle holders, vaginal speculums, dilators, and other surgical instruments. In 2024, the forceps segment dominated with the largest share as these instruments are routinely used in a wide range of procedures, including tissue handling, suturing, and delivery assistance. Their utility in both open and minimally invasive surgeries has made them a staple in gynecological practice. Forceps are available in various forms, such as tissue forceps, dressing forceps, and obstetric forceps, each serving a specific surgical need. Their widespread use across both hospital and outpatient settings contributes to their demand. Additionally, forceps are considered relatively low-cost and durable, making them accessible for smaller clinics and high-volume centers. Despite increasing automation in some areas of surgery, forceps remain essential for manual manipulation during procedures, thereby driving the segment growth.

The scissors segment is expected to experience significant growth during the forecast period due to the increasing adoption of minimally invasive surgical techniques. Scissors are used for various tasks such as cutting tissue, sutures, and membranes during procedures, including laparoscopy, hysterectomy, and myomectomy. Their design allows for precise cutting with minimal tissue damage, which is critical in surgeries where visualization is limited. The need for highly specialized scissors, such as curved, dissecting, or micro-scissors is rising as surgical procedures become more refined and tailored to patient comfort. The push toward outpatient and office-based procedures has further increased the demand for compact and disposable variants. Advancements in scissor materials and designs that offer better control and ergonomic handling further contribute to segment growth.

Application Analysis

The segmentation, based on application, includes laparoscopy, hysteroscopy, dilation and curettage, colposcopy, and other applications. The colposcopy segment is expected to experience significant growth due to increased awareness and screening for cervical cancer and other abnormal cervical conditions. Colposcopy is a common diagnostic procedure where gynecologists use a colposcope and supporting instruments to closely examine the cervix, vagina, and vulva for signs of disease. More women are undergoing colposcopy as part of routine gynecological care with the rising incidences of HPV-related abnormalities and the growing emphasis on early detection. Additionally, national and international health agencies are expanding cervical screening programs, especially in low- and middle-income countries. This increases the need for instruments such as biopsy forceps, endocervical curettes, and acetic acid applicators used during the procedure. Additionally, technological improvements in colposcopes, coupled with better training for healthcare professionals, are making the procedure more accessible. As a result, supporting surgical instruments are also in higher demand, particularly in ambulatory and outpatient settings, thereby driving the segment growth.

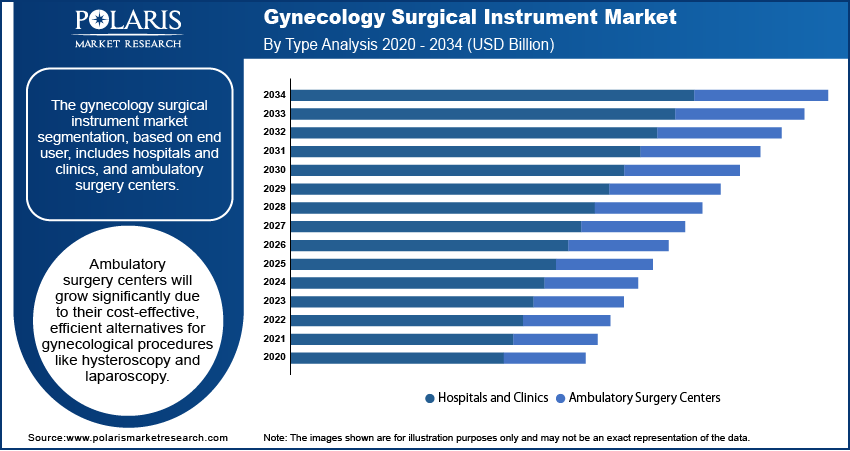

End User Analysis

The segmentation, based on end user, includes hospitals and clinics, and ambulatory surgery centers. The ambulatory surgery centers segment is expected to experience significant growth during the forecast period as these centers offer a cost-effective and efficient alternative to traditional hospitals for many gynecological procedures, including diagnostic hysteroscopy, uterine polyp removal, and minor laparoscopic surgeries. Ambulatory care services are designed for outpatient care, which means shorter procedure times, quicker recovery, and reduced hospital stay factors that align well with current healthcare priorities. The shift of gynecologic care to outpatient settings is further driven by payer and policy changes, as well as patient preference for less invasive, same-day procedures. Consequently, ASCs are increasingly equipped with advanced gynecologic instruments, including disposable and minimally invasive tools. The growing number of ASCs, especially in urban and semi-urban areas, is boosting demand for compact, efficient surgical instruments, thereby driving the growth.

Regional Analysis

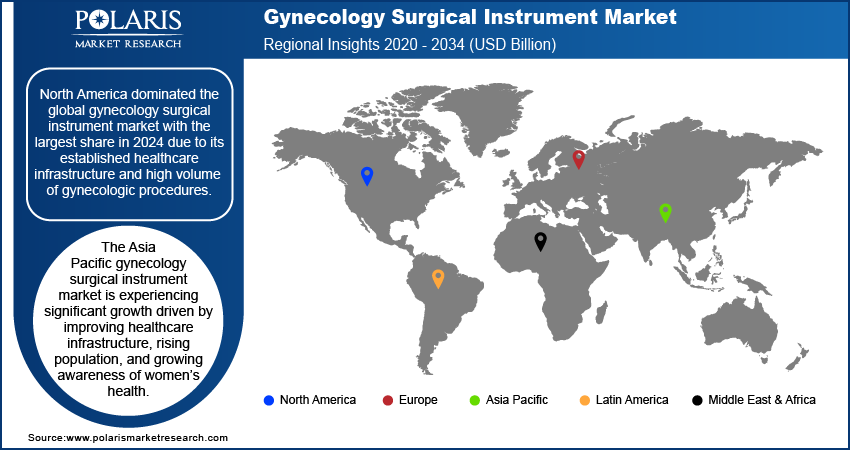

North America Gynecology Surgical Instrument Market Trend

The market in North America dominated with the largest share in 2024, due to its established healthcare infrastructure and high volume of gynecologic procedures. The region has widespread access to both routine and advanced surgical care, which drives the demand for specialized surgical instruments. Aging populations, rising awareness about women’s health, and a focus on minimally invasive procedures have further supported the growth. Additionally, strong regulatory frameworks, reimbursement systems, and the presence of major industry players encourage continuous adoption of new technologies. Moreover, the trend of performing gynecologic procedures in outpatient settings, such as ambulatory surgical centers, is particularly prominent in North America. This has led to an increased need for portable, cost-effective, and single-use surgical instruments. Furthermore, ongoing investments in training, digital surgery, and improved diagnostics continue to influence the development and procurement of surgical tools, thereby driving the industry growth.

U.S. Gynecology Surgical Instrument Market Insight

The U.S. market is expected to witness significant growth during the forecast period, driven by the country's high volume of gynecologic surgeries, including hysterectomies, laparoscopies, and endometrial ablations, performed in hospitals and outpatient settings. The U.S. healthcare system supports innovation through favorable regulatory pathways and reimbursement options, which accelerates the adoption of new surgical tools. Additionally, increasing focus on early diagnosis of uterine and cervical conditions has expanded the use of diagnostic instruments such as hysteroscopes and colposcopy tools. The presence of advanced medical facilities and well-established surgical training programs contributes to the high demand for precision instruments. The shift toward minimally invasive and office-based procedures is further encouraging the use of single-use or disposable tools that reduce infection risks and simplify logistics. Furthermore, private investment in women’s health startups and device companies is strengthening the supply and variety of instruments available across the U.S. healthcare systems, thereby driving the growth.

Asia Pacific Gynecology Surgical Instrument Market Analysis

The market growth in Asia Pacific is driven by improving healthcare infrastructure, rising population, and growing awareness of women’s health. Countries such as India, Japan, South Korea, and Australia are witnessing an increase in demand for gynecologic surgeries, particularly in urban centers. In many parts of Asia Pacific, public and private health initiatives are promoting access to early diagnosis and treatment of reproductive health conditions, such as abnormal uterine bleeding and cervical abnormalities. Consequently, surgical instruments for diagnostic and therapeutic procedures are increasingly required. There is further a shift toward minimally invasive and outpatient gynecologic care in both public and private hospitals. Nonetheless, foreign investments, local manufacturing, and government support for healthcare expansion are expected to fuel the region’s growth during the forecast period.

China Gynecology Surgical Instrument Market Outlook

The market in China is witnessing growth as the country’s large population and growing demand for specialized women’s healthcare services are driving the demand. China has increased investments in healthcare infrastructure, resulting in more hospitals and surgical centers equipped for gynecological procedures. Rising awareness of reproductive health issues, combined with public health campaigns for cervical cancer screening, has led to a higher number of diagnostic and surgical interventions. Domestic medical device manufacturing is further expanding, offering cost-competitive instruments that are widely adopted by local facilities. Moreover, imported instruments are used in high-end hospitals and tertiary care centers. The government’s focus on expanding minimally invasive surgery, including robotic and laparoscopic approaches, is further driving the demand for advanced gynecology instruments and thereby driving the growth.

Europe Gynecology Surgical Instrument Market Insights

The market in Europe is expected to experience significant growth driven by well-established healthcare systems, a high standard of surgical care, and strong regulatory oversight. Countries such as Germany, France, the UK, and Italy have long integrated advanced gynecologic techniques in both inpatient and outpatient settings. The European focus on early detection of reproductive health conditions such as uterine fibroids, endometriosis, and abnormal uterine bleeding boost the demand for diagnostic and surgical tools. Moreover, growing adoption of minimally invasive procedures has driven the need for precision instruments, such as laparoscopic scissors, forceps, and hysteroscopic systems. Europe’s emphasis on patient safety and cost control further supports the shift toward reusable or hybrid surgical instruments in some settings. Additionally, the presence of leading medical device manufacturers in the region facilitates ongoing innovation and training, thereby driving the market growth.

Germany Gynecology Surgical Instrument Market Trends

The Germany gynecology surgical instrument market is expected to experience rapid growth due to its advanced hospital infrastructure, strong public healthcare system, and well-trained surgical workforce. The country has a high volume of gynecologic surgeries, particularly hysterectomies, laparoscopies, and diagnostic procedures, performed in both public hospitals and private clinics. Germany is further home to several global surgical instrument manufacturers, which improves local access to high-quality and specialized tools. The healthcare system supports both reusable and disposable instruments, depending on cost-efficiency and procedural type. Additionally, Germany invests in surgical training and academic research, contributing to the early adoption of minimally invasive surgery techniques. Demand for gynecologic instruments is expected to rise further as the population ages and the incidence of gynecological disorders increases. Digital integration, data-driven diagnostics, and robotics are emerging areas of interest in surgical care, thereby driving the adoption of advanced gynecology surgical instruments in the country.

Key Players and Competitive Analysis

The gynecology surgical instrument market is highly competitive, with key players leveraging innovation, global reach, and strategic partnerships to maintain market share. B. Braun Melsungen AG and Ethicon, Inc. (a Johnson & Johnson company) are leaders with comprehensive portfolios and strong brand recognition. Olympus Corporation and KARL STORZ GmbH & Co. KG offer advanced endoscopic and imaging solutions, while Richard WOLF GmbH focuses on precision instrumentation. CooperSurgical Inc. and MedGyn Products target women’s health with specialized devices, emphasizing office-based procedures. KLS Martin Group and Sklar Surgical Instruments supply a broad range of reusable and specialty tools. Tetra Surgical, emerging from Pakistan, competes on cost-effectiveness and growing regional presence. Companies compete through product innovation, ergonomic design, surgical efficiency, and strategic collaborations with hospitals and surgical centers. As minimally invasive techniques gain traction, players increasingly invest in research and development to align with trends in robotics, single-use instruments, and enhanced safety systems in gynecologic surgery.

Key Players

- B. Braun Melsungen AG

- CooperSurgical Inc.

- Ethicon, Inc.

- KARL STORZ GmbH & Co. KG

- KLS Martin Group

- MedGyn Products

- Olympus Corporation

- Richard WOLF GmbH

- Sklar Surgical Instruments

- Tetra Surgical

Industry Developments

In May 2025, Minerva Surgical launched the HERizon Hysto-Kit, a single-use, pre-assembled hysteroscopy kit designed to streamline office-based procedures, improve setup efficiency, and support OB/GYNs in delivering consistent, high-quality care with reduced preparation time and inventory management.

In April 2024, Moon Surgical and the Franche-Comté Polyclinic introduced the Maestro System for gynecological laparoscopic procedures, enabling eight surgeons to complete hysterectomy, cystectomy, adnexectomy, and ovariectomy cases after a one-hour training, expanding Maestro’s clinical use in France.

In September 2022, Olympus launched the Guardenia Contained Extraction System, enhancing safety in gynecological procedures. Designed to protect the incision and prevent cell escape during manual morcellation, the device delivered superior retraction and stability without requiring additional surgical training.

Gynecology Surgical Instrument Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Forceps

- Scissors

- Trocars

- Needle Holders

- Vaginal Speculums

- Dilators

- Other Surgical Instruments

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Laparoscopy

- Hysteroscopy

- Dilation and Curettage

- Colposcopy

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Ambulatory Surgery Centers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Gynecology Surgical Instrument Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.05 Billion |

|

Market Size in 2025 |

USD 3.28 Billion |

|

Revenue Forecast by 2034 |

USD 6.34 Billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.05 billion in 2024 and is projected to grow to USD 6.34 billion by 2034

The global market is projected to register a CAGR of 7.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are B. Braun Melsungen AG; CooperSurgical Inc.; Ethicon, Inc.; KARL STORZ GmbH & Co. KG; KLS Martin Group; MedGyn Products; Olympus Corporation; Richard WOLF GmbH; Sklar Surgical Instruments; and Tetra Surgical.

The forceps segment dominated the market share in 2024.

The ambulatory surgical centers segment is expected to witness the significant growth during the forecast period.