Hand Truck and Dolly Market Size, Share, Trends, & Industry Analysis Report

By Product (Hand Trucks and Dolly), By Material, By End Use, By Sales Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5793

- Base Year: 2024

- Historical Data: 2020-2023

Overview

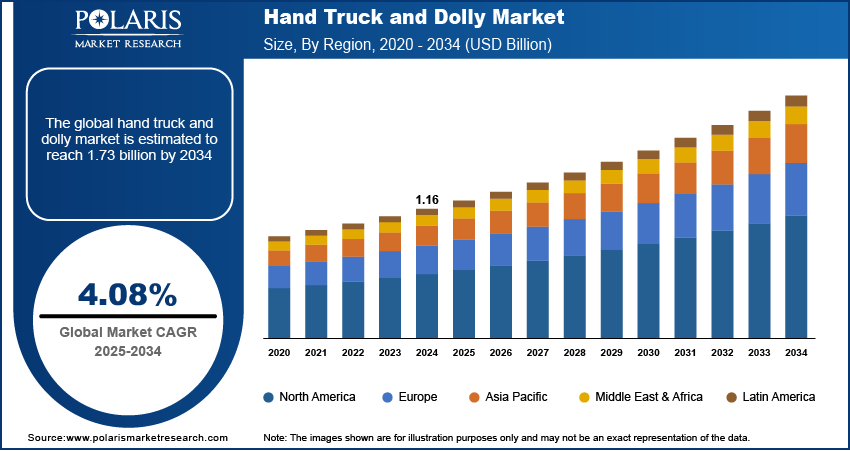

The global hand truck and dolly market size was valued at USD 1.16 billion in 2024, growing at a CAGR of 4.08% during 2025–2034. Key factors driving the market demand include the expanding e-commerce sector, growing urbanization, expanding industrialization, and the growing food & beverages sector globally.

A hand truck, also known as a hand trolley, sack truck, or two-wheeler, features an L-shaped vertical frame with two large wheels at the base and handles at the top. The user tilts the hand truck backward, balancing the load over the wheels, which makes it easier to move heavy or bulky objects such as boxes, appliances, or furniture. Hand trucks are especially useful for moving stacked items or tall, narrow loads and are highly maneuverable in tight spaces such as doorways, hallways, or stairs. A dolly, in contrast, is a flat, raised platform on four wheels, designed to carry heavy or bulky items that are placed on top of it. Dollies provide a stable base and are ideal for transporting large, irregularly-shaped, or very heavy items such as furniture, pianos, or appliances. Hand trucks are best for smaller, heavier items or multiple stacked boxes that need to be moved through tight spaces, while dollies are preferred for larger, bulkier items that require a stable, flat base for transport.

The expanding e-commerce sector globally is driving the market growth. Hand trucks and dollies are widely used in the e-commerce sector as they enable workers to transport heavy or multiple items with minimal effort, improving productivity and reducing physical strain. Additionally, the rise of small and medium-sized e-commerce businesses is expanding the customer base for hand trucks and dollies, as these affordable tools help startups and sellers manage inventory without heavy machinery. Therefore, as the e-commerce sector grows globally, the demand for hand trucks and dollies also increases.

To Understand More About this Research: Request a Free Sample Report

The hand truck and dolly demand is driven by the growing urbanization globally. World Bank, in its report, stated that the urban population is expected to more than double by 2050. Delivery services, moving companies, and construction firms in urban areas rely heavily on hand trucks and dollies to transport goods quickly through narrow hallways, staircases, and crowded streets. Urban retail stores and quick service restaurants also use these tools to manage frequent stock deliveries in spaces with limited storage. Additionally, urbanization leads to the development of high-rise apartments and office buildings, which increases demand for hand trucks, as workers and movers need to transport heavy items without elevators or across multiple floors. Hence, as urbanization expands, the adoption of hand trucks and dollies also increases.

Industry Dynamics

Expanding Industrialization Worldwide

Hand trucks and dollies help workers in industries to transport heavy loads quickly, reducing manual labor and improving workflow efficiency in busy industrial environments. The rise of large-scale production facilities and automated warehouses is further driving demand, as these tools complement machinery by enabling flexible movement of goods in tight spaces. Additionally, developing economies are investing heavily in industrial infrastructure, which is increasing the adoption of hand trucks and dollies as affordable alternatives to expensive equipment. Therefore, the expanding industrialization worldwide is fueling the market growth.

Growing Food & Beverages Sector Globally

Restaurants, supermarkets, and food distributors rely on hand trucks and dollies to move large quantities of packaged foods, beverages, and ingredients quickly while minimizing product damage and worker strain. The expansion of food delivery services and online grocery shopping is further increasing demand, as warehouses and fulfillment centers use hand trucks and dollies to streamline order picking and loading processes. Additionally, breweries, bottling plants, and dairy producers depend on these tools to transport crates, kegs, and pallets safely across production and storage facilities. Therefore, the growing food & beverages sector globally propels the adoption of hand trucks and dollies.

Segmental Insights

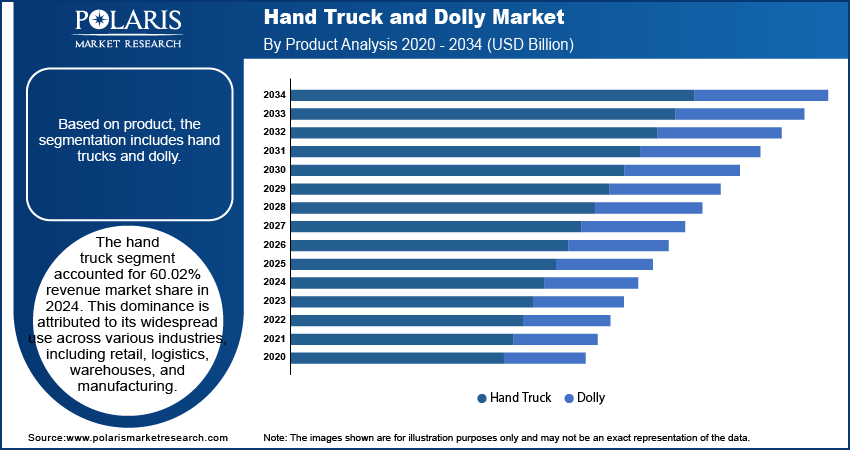

By Product Analysis

Based on product, the segmentation includes hand trucks and dolly. The hand truck segment accounted for 60.02% revenue market share in 2024. This dominance is attributed to its widespread use across various industries, including retail, logistics, warehouses, and manufacturing. Companies preferred hand trucks owing to their simplicity, cost-effectiveness, and ability to transport heavy or bulky goods with minimal manual effort. The rising demand for e-commerce and last-mile delivery services also contributed to the dominance of the segment. Moreover, the growing trend of do-it-yourself (DIY) projects in residential spaces supported product demand among consumers who required a compact and efficient tool for moving appliances, boxes, and furniture.

By Material Analysis

In terms of material, the segmentation includes steel, aluminum, plastics, and others. The steel segment dominated the market share in 2024 due to its exceptional strength, durability, and high load-bearing capacity. Industrial and commercial sectors favored steel-based equipment for their ability to withstand heavy usage in warehouses, factories, and construction sites. Businesses choose steel for its resilience against wear and tear, especially when handling bulky or abrasive materials. Additionally, steel variants offered a longer service life and better stability, which appealed to companies seeking long-term value and minimal maintenance. The availability of advanced coatings and rust-resistant finishes further enhanced the appeal of steel products, making them suitable for both indoor and outdoor operations.

By End Use Analysis

In terms of end use, the segmentation includes retail & e-commerce, manufacturing & industrial, construction, food & beverage, residential/home use, and others. The retail & e-commerce segment held the largest market share in 2024 due to the rapid expansion of online shopping and the growing need for efficient material handling solutions in warehouses and fulfillment centers. E-commerce giants and retailers heavily invested in logistics infrastructure to meet rising consumer demand and ensure timely deliveries. Warehouse personnel relied on hand trucks to move packages quickly and safely, reducing physical strain and enhancing productivity. The constant inflow and outflow of inventory in distribution hubs, along with the increasing adoption of omnichannel retail models, created consistent demand for hand trucks and dollies. Additionally, the seasonal spikes in order volumes during events such as Black Friday and festive sales contributed to higher adoption of hand trucks by retailers aiming to streamline operations.

By Sales Channel Analysis

In terms of sales channel, the segmentation includes online and offline. The offline segment accounted for a major market share in 2024 due to the preference of commercial and industrial buyers to purchase material handling equipment through physical stores, distributors, and specialty retailers. Buyers valued the ability offered by the offline sales channel to inspect products in person, assess build quality, and receive personalized recommendations from sales representatives. Commercial customers, such as those in construction, retail, and manufacturing, usually maintain long-term relationships with local suppliers, which allows them to negotiate better deals and ensure timely product availability. Additionally, many bulk buyers opted for offline channels to take advantage of tailored services, including product demonstrations, installation support, and after-sales maintenance.

The online segment is projected to grow at a robust pace in the coming years, as it offers convenience, broader product selection, and competitive pricing. Online marketplaces and manufacturers are offering easy access to customer reviews, detailed product specifications, and comparison tools to help buyers make informed decisions without visiting a store. The increasing penetration of smartphones, internet access, and secure digital payment systems, particularly in emerging regions, is projected to fuel the growth of the segment.

Regional Analysis

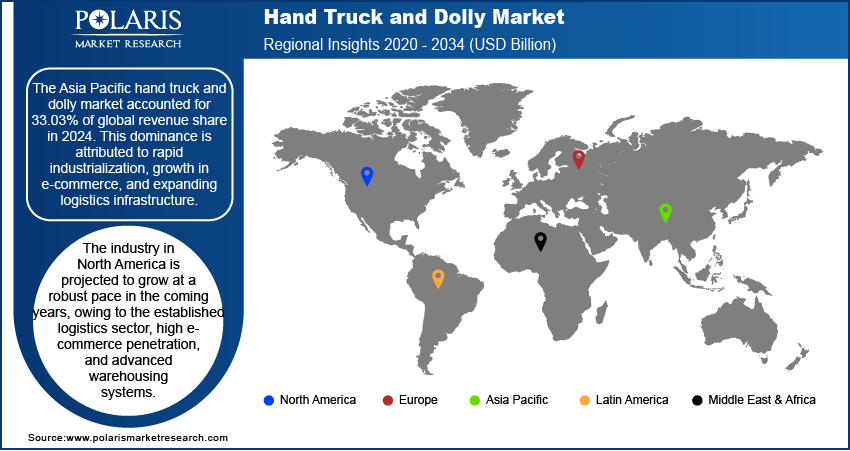

The Asia Pacific hand truck and dolly market accounted for approximately 33.03% of global revenue share in 2024. This dominance is attributed to rapid industrialization, growth in e-commerce, and expanding logistics infrastructure. Countries such as China, Japan, and South Korea witnessed increased manufacturing activities, which necessitated the use of efficient material handling equipment such as hand trucks and dollies. Additionally, the rise of warehousing and retail sectors, along with government investments in infrastructure projects, further fueled demand for hand trucks in the region. The growing adoption of lightweight and foldable hand trucks in urban areas for last-mile deliveries also contributed to market expansion in Asia Pacific.

India Hand Truck and Dolly Market Insight

India accounted for 24.32% revenue market share in 2024 in the Asia Pacific hand truck and dolly market due to the expansion of the e-commerce sector and retail chains, and growth in the manufacturing and construction industries. Government initiatives such as “Make in India” and investments in logistics infrastructure propelled the need for material handling equipment, leading to market growth. Small and medium-sized enterprises (SMEs) in the country increasingly adopted hand trucks for cost-effective transportation of goods. Additionally, expanding urbanization and the rise of hyperlocal delivery services boosted demand for compact and durable dollies in the country in 2024. For instance, World Bank, in its report, stated that India’s urban population is expected to reach 40% by 2036.

North America Hand Truck and Dolly Market

The industry in North America is projected to grow at a robust pace in the coming years, owing to the established logistics sector, high e-commerce penetration, and advanced warehousing systems. The US and Canada, with a large number of retail stores, distribution centers, and manufacturing units, are driving the adoption of hand trucks in the region. The rising trend toward automation in warehouses is also leading to innovations in heavy-duty hand trucks. Furthermore, the growing food & beverage and pharmaceutical industries, which require frequent movement of goods, are supporting the demand for hand trucks and dollies in the region.

US Hand Truck and Dolly Market Overview

In the US, the demand for hand trucks and dollies is driven by high consumer spending and the presence of e-commerce giants such as Amazon and Walmart. The need for efficient last-mile delivery solutions in the country is increasing the adoption of lightweight and multi-functional hand trucks. Additionally, the rise of DIY culture and home improvement projects in the US is spurring the sales of hand trucks in the retail segment.

Europe Hand Truck and Dolly Market

The market in Europe is projected to grow at a substantial pace in the coming years, owing to the stringent workplace safety regulations and the emphasis on ergonomic material handling solutions. The region's strong manufacturing base, particularly in Germany and France, along with a developed logistics sector, is supporting the market growth. The growth of online retail and the need for efficient warehouse operations in countries such as the UK and the Netherlands is further boosting demand for dollies and hand trucks.

Key Players and Competitive Analysis Report

The global hand truck and dolly industry is highly competitive, characterized by the presence of both established players and emerging manufacturers competing to capture revenue share through innovation, pricing strategies, and distribution networks. Key industry leaders such as Magliner, Milwaukee Hand Trucks, Harper Trucks, Inc., and Wesco Industrial Products dominate the industry, leveraging strong brand recognition, extensive product portfolios, and long-standing customer relationships. These companies focus on durability, load capacity, and ergonomic designs to cater to numerous industries such as warehousing, retail, and logistics. Innovation remains a critical differentiator, with companies investing in advanced materials and customizable features such as stair-climbing mechanisms and convertible designs. The rise of e-commerce has further intensified competition, as demand for efficient material handling equipment grows. Online retail platforms such as Amazon and specialized industrial suppliers have expanded industry accessibility, enabling smaller brands to compete with established names.

A few major companies operating in the hand truck and dolly market include B&P Manufacturing; BIL Group; Cosco Home & Office Products; Harper Trucks, Inc.; Magline, Inc.; Milwaukee Hand Trucks; Shunhe; The Hand Truck Company; Wesco Industrial Products, LLC.; and WOODEVER INDUSTRIAL CO., LTD.

Key Players

- B&P Manufacturing

- BIL Group

- Cosco Home & Office Products

- Harper Trucks, Inc.

- Magline, Inc.

- Milwaukee Hand Trucks

- Shunhe

- The Hand Truck Company

- Wesco Industrial Products, LLC.

- WOODEVER INDUSTRIAL CO., LTD.

Hand Truck and Dolly Industry Development

January 2024: Magline, Inc., a manufacturer of durable, heavy-duty hand trucks, carts, and dollies, announced plans to expand operations in Standish, Michigan.

Hand Truck and Dolly Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Hand Trucks

- Dolly

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Steel

- Aluminum

- Plastics

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Retail & E-Commerce

- Manufacturing & Industrial

- Construction

- Food & Beverage

- Residential/Home Use

- Others

By Sales Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hand Truck and Dolly Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.16 Billion |

|

Market Size in 2025 |

USD 1.20 Billion |

|

Revenue Forecast by 2034 |

USD 1.73 Billion |

|

CAGR |

4.08% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.16 billion in 2024 and is projected to grow to USD 1.73 billion by 2034.

The global market is projected to register a CAGR of 4.08% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are B&P Manufacturing; BIL Group; Cosco Home & Office Products; Harper Trucks, Inc.; Magline, Inc.; Milwaukee Hand Trucks; Shunhe; The Hand Truck Company; Wesco Industrial Products, LLC.; and WOODEVER INDUSTRIAL CO., LTD.

The hand truck segment dominated the market share in 2024.

The online segment is expected to witness the fastest growth during the forecast period.