Health Information Exchange Market Size, Share, Trends, Industry Analysis Report

: By Setup Type (Private HIE and Public HIE), Solution, Implementation Model, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM4037

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

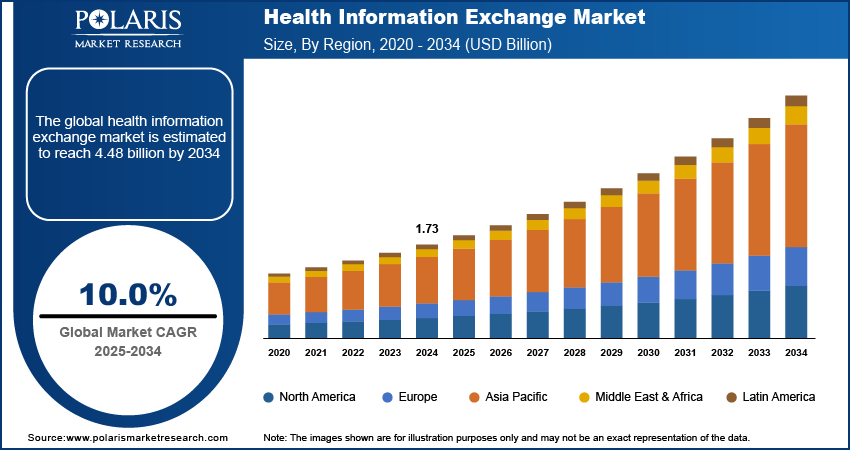

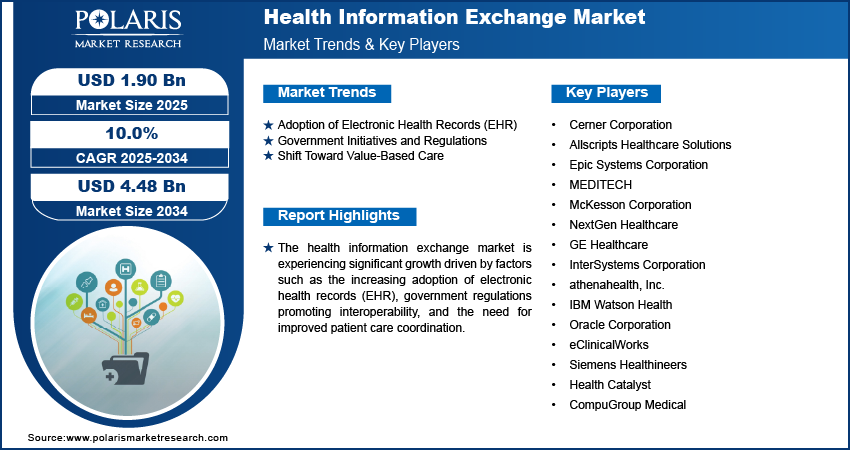

The health information exchange market size was valued at USD 1.73 billion in 2024, exhibiting a CAGR of 10.0% during 2025–2034. The market is driven by rising EHR adoption, government mandates for interoperability, and the global shift toward value based, patient-centered care.

Key Insights

- The private HIE segment leads due to healthcare institutions seeking greater control over patient data, enhancing security and privacy.

- The centralized HIE model holds the largest market share, offering consolidated data repositories and enhanced data control for healthcare providers.

- Workflow management systems are growing fast, optimizing clinical and administrative processes, improving efficiency, and enhancing patient care coordination.

- North America leads the market, supported by advanced infrastructure, strong regulatory frameworks, and widespread EHR adoption promoting HIE systems.

- Europe sees steady growth, influenced by EU initiatives for data interoperability and a focus on improving healthcare quality and care coordination.

Industry Dynamics

- EHR adoption drives HIE growth by enhancing data accuracy and sharing across systems, improving patient care coordination globally.

- Government initiatives such as the HITECH Act promote interoperability, encouraging healthcare providers to adopt HIE solutions for seamless data exchange.

- Healthcare organizations are increasingly seeking solutions that enhance data exchange security, presenting a chance to expand secure HIE platforms.

- Integration of cloud computing in HIE systems can streamline data access, offering opportunities for faster and more flexible healthcare solutions.

- Fragmented regulations across countries can complicate interoperability efforts, slowing down market expansion in regions with varied compliance needs.

Market Statistics

2024 Market Size: USD 1.73 billion

2034 Projected Market Size: USD 4.48 billion

CAGR (2025–2034): 10.0%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The health information exchange (HIE) market refers to the electronic sharing of health-related information across different organizations, such as hospitals, laboratories, and healthcare providers, to improve care coordination and clinical outcomes. The market is driven by factors such as the increasing adoption of electronic health records (EHR), the need for improved patient care, and government initiatives promoting interoperability in healthcare systems.

The rising demand for data-driven healthcare solutions, the shift toward value-based care, and the growing emphasis on patient-centered care are also contributing to the health information exchange market growth. Trends in the market include the integration of advanced technologies such as cloud computing and blockchain for secure data exchange, as well as an increasing focus on data privacy and security.

Market Dynamics

Adoption of Electronic Health Records (EHR)

The widespread adoption of electronic health records (EHR) systems is a key driver of the HIE market. EHR systems facilitate the digital storage and sharing of patient health data, improving efficiency and accuracy in medical record keeping. According to a 2021 report by the Office of the National Coordinator for Health Information Technology (ONC), approximately 96% of hospitals and 86% of office-based physicians in the US adopted EHRs by 2020. As EHR adoption continues to rise globally, healthcare organizations are increasingly turning to HIE solutions to share patient data seamlessly across systems, ensuring comprehensive and up-to-date information is available for patient care. The integration of EHRs with HIEs enhances the ability to coordinate care among multiple providers, improving clinical outcomes.

Government Initiatives and Regulations

Government initiatives promoting the interoperability of healthcare systems have significantly contributed to the health information exchange market growth. In the Us, policies such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the 21st Century Cures Act have incentivized healthcare providers to adopt and use interoperable EHR systems. These regulations mandate that health data must be exchanged in a standardized format to ensure compatibility across different platforms. For example, the 21st Century Cures Act, signed into law in 2016, emphasizes the need for open and accessible health data while preventing information blocking. These government-driven initiatives are driving the demand for advanced HIE solutions that can meet these regulatory requirements, encouraging collaboration across health systems.

Shift Toward Value-Based Care

The healthcare industry's shift from fee-for-service models to value-based care is another major HIE market driver. In value-based care, healthcare providers are incentivized to improve patient outcomes and reduce costs rather than focusing on the volume of services provided. This shift necessitates the seamless exchange of health information to track patient progress and outcomes effectively. According to a 2020 report from the Centers for Medicare and Medicaid Services (CMS), nearly 50% of Medicare beneficiaries were enrolled in value-based care programs by 2020. As healthcare providers seek to optimize patient care and outcomes under value-based care models, the need for reliable, real-time access to comprehensive patient data drives the adoption of HIE technologies. This trend is expected to accelerate as value-based care continues to expand globally.

Segment Insights

Assessment by Setup Type

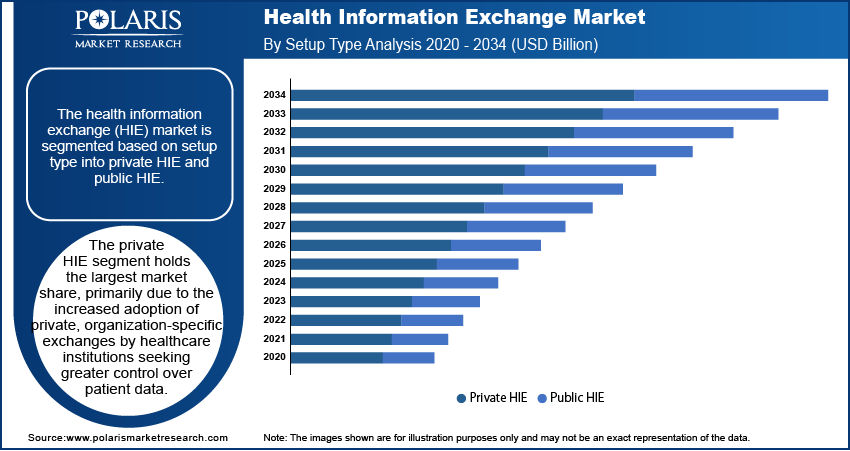

The health information exchange market is segmented based on setup type into private HIE and public HIE. The private HIE segment holds the largest market share, primarily due to the increased adoption of private, organization-specific exchanges by healthcare institutions seeking greater control over patient data. These private networks provide enhanced security and privacy, as they are often used by a single healthcare system or group of providers. The ability to tailor private HIE systems to meet specific organizational needs and regulatory requirements, combined with the demand for seamless care coordination within specific healthcare networks, contributes to the widespread use of private HIEs.

The public HIE segment is also registering the fastest growth, driven by government initiatives and the push for interoperability across healthcare systems. Public HIEs facilitate the exchange of health information across multiple, diverse organizations, including hospitals, clinics, and governmental bodies, creating a more comprehensive data-sharing environment. As national and regional healthcare authorities work to establish universal health data networks, the demand for public HIE platforms has surged. These exchanges support the broader goals of improving patient care, reducing healthcare costs, and meeting regulatory standards, contributing to their rapid growth and increasing adoption among healthcare stakeholders.

Evaluation by Implementation Model

The HIE market is segmented based on implementation model into centralized HIE model, decentralized HIE model, and hybrid HIE model. The centralized HIE model holds the largest market share, as it allows for the consolidation of health data into a central repository, making it easier for healthcare providers to access comprehensive patient information. This model offers enhanced data control, security, and streamlined integration, which are critical for organizations seeking reliable and consistent access to health information. Its widespread adoption is also supported by the simplicity of centralized infrastructure and regulatory support for interoperability in centralized systems.

The hybrid HIE model is also registering the fastest growth due to its ability to combine the benefits of both centralized and decentralized systems. This model allows healthcare organizations to maintain certain data within their own systems while also facilitating secure exchange with external providers through a central hub. The hybrid approach addresses the growing need for flexible, scalable, and secure data-sharing solutions that can adapt to the evolving needs of healthcare providers. As healthcare systems strive for increased interoperability and collaboration across various platforms, the hybrid model is gaining traction for its adaptability and efficiency, contributing to its rapid market expansion.

Outlook by Application

The health information exchange market segmentation, based on application, includes web portal development, internal interfacing, workflow management, and others. The web portal development segment holds the largest health information exchange market share due to the increasing demand for online platforms that facilitate easy access to patient data across different healthcare systems. Web portals offer healthcare providers, patients, and other stakeholders a user-friendly interface to access, share, and update health records in real time, driving the demand for this application. The ability to integrate web portals with EHR and other clinical systems is a significant factor in their widespread adoption, as they improve efficiency in managing and accessing health information.

The workflow management segment is also registering the fastest growth, as healthcare organizations prioritize streamlined operations and enhanced care coordination. Workflow management systems play a crucial role in automating and optimizing clinical and administrative processes, improving the overall efficiency of healthcare delivery. As healthcare providers adopt more complex and integrated systems, the demand for robust workflow management solutions continues to increase. These systems help healthcare organizations minimize errors, reduce costs, and improve patient outcomes by ensuring that tasks are completed efficiently and on time, contributing to their rapid growth in the market.

Regional Insights

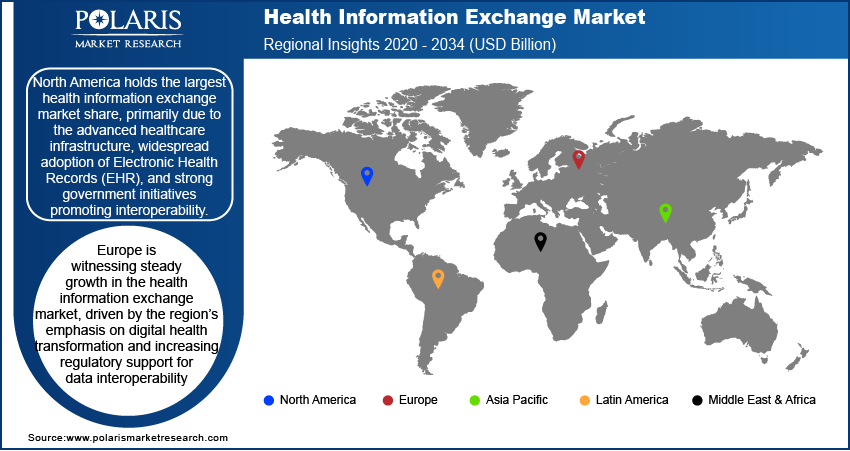

By region, the study provides health information exchange market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the advanced healthcare infrastructure, widespread adoption of EHR, and strong government initiatives promoting interoperability. The US, in particular, has implemented numerous regulations, such as the HITECH Act and the 21st Century Cures Act, which encourage healthcare providers to adopt and use HIE systems. Additionally, North America's healthcare organizations are increasingly adopting data-driven solutions to improve patient outcomes and reduce costs, which further fuels the demand for HIE technologies. The region's robust healthcare framework, combined with regulatory support, makes it the leading market for HIE systems.

Europe is witnessing steady growth in the HIE market, driven by the region’s emphasis on digital health transformation and increasing regulatory support for data interoperability. The European Union's efforts to establish a unified health data infrastructure, through initiatives such as the European Health Data Space (EHDS), are significantly contributing to the adoption of HIE systems across member states. Countries including Germany, the UK, and France are leading the way, implementing policies that encourage secure sharing of health data across borders and healthcare providers. The region's growing focus on improving healthcare quality, reducing inefficiencies, and enhancing patient care coordination is also driving demand for HIE technologies.

The health information exchange market in Asia Pacific is experiencing rapid growth, driven by the increasing digitalization of healthcare systems and the rising demand for efficient and secure data exchange solutions. Countries such as China, Japan, and India are at the forefront of adopting electronic health records and HIE systems, supported by government initiatives aimed at improving healthcare accessibility and quality. In particular, China’s "Healthy China 2030" initiative and India’s push for digital health records are fueling the expansion of HIE in the region. Additionally, the rise of medical tourism and the need for better cross-border healthcare coordination are contributing to the adoption of HIE systems, with an emphasis on improving data sharing across diverse healthcare providers and systems in the region.

Key Players and Competitive Insights

Some of the key players in the HIE market include Cerner Corporation; Allscripts Healthcare Solutions; Epic Systems Corporation; MEDITECH; McKesson Corporation; NextGen Healthcare; GE Healthcare; InterSystems Corporation; athenahealth, Inc.; and IBM Watson Health.

In terms of competitive dynamics, Cerner Corporation and Allscripts Healthcare Solutions are two of the most influential players in the HIE industry, both vying for dominance through their extensive offerings and ongoing innovation. While Cerner Corporation focuses heavily on enhancing its cloud-based services and patient record sharing capabilities, Allscripts Healthcare Solutions emphasizes integrated solutions that support comprehensive patient care management. Both companies are deeply invested in ensuring their platforms meet the growing demand for data interoperability and improved healthcare outcomes. Their competitive edge lies in their ability to continuously adapt to regulatory changes and technological advancements, positioning themselves as key players in the HIE space.

Oracle Corporation is a provider of health information exchange (HIE) solutions, offering a comprehensive portfolio designed to enhance interoperability, data sharing, and healthcare efficiency. Through Oracle Health (formerly Cerner), the company provides advanced HIE platforms that enable secure and seamless exchange of patient data across healthcare systems. Key offerings include Oracle Health Data Intelligence, Oracle Health Interoperability, and Oracle Cloud Infrastructure for healthcare data management. These solutions support electronic health records (EHR) integration, real-time data exchange, and population health analytics, improving care coordination and patient outcomes. Oracle’s HIE products comply with industry standards such as HL7 FHIR, ensuring compatibility across various healthcare IT systems, while its AI-driven analytics enhance clinical decision-making and operational efficiency.

Allscripts Healthcare Solutions is another significant HIE market player. It is known for its software that facilitates the exchange of healthcare data between various institutions. Allscripts’ solutions are designed to help providers manage patient information across different platforms, streamlining processes for better care delivery.

List of Key Companies

- Cerner Corporation

- Allscripts Healthcare Solutions

- Epic Systems Corporation

- MEDITECH

- McKesson Corporation

- NextGen Healthcare

- GE Healthcare

- InterSystems Corporation

- athenahealth, Inc.

- IBM Watson Health

- Oracle Corporation

- eClinicalWorks

- Siemens Healthineers

- Health Catalyst

- CompuGroup Medical

Health Information Exchange Industry Developments

- February 2024: Cerner introduced new features aimed at improving the integration of health records across multiple systems, marking another step toward enhancing data sharing and accessibility for healthcare professionals.

- January 2025: Allscripts unveiled an upgraded platform to improve the sharing of patient data and the management of care, further advancing its focus on integrated solutions that promote collaboration across healthcare systems.

Health Information Exchange Market Segmentation

By Setup Type Outlook (Revenue-USD Billion, 2020–2034)

- Private HIE

- Public HIE

By Solution

- Platform-Centric

- Portal-Centric

- Messaging-Centric

By Implementation Model Outlook (Revenue-USD Billion, 2020–2034)

- Centralized HIE Model

- Decentralized HIE Model

- Hybrid HIE Model

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Web Portal Development

- Internal Interfacing

- Work flow Management

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Health Information Exchange Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.73 billion |

|

Market Size Value in 2025 |

USD 1.90 billion |

|

Revenue Forecast by 2034 |

USD 4.48 billion |

|

CAGR |

10.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The health information exchange market size was valued at USD 1.73 billion in 2024 and is projected to grow to USD 4.48 billion by 2034.

The market is projected to register a CAGR of 10.0% during the forecast period, 2025-2034.

North America had the largest share of the market.

The health information exchange market key players are Cerner Corporation; Allscripts Healthcare Solutions; Epic Systems Corporation; MEDITECH; McKesson Corporation; NextGen Healthcare; GE Healthcare; InterSystems Corporation; athenahealth, Inc.; and IBM Watson Health.

The private HIE segment accounted for the larger share of the market in 2024.

Health information exchange (HIE) refers to the electronic sharing of health-related information between different healthcare organizations, such as hospitals, physicians, and laboratories, to improve patient care. The goal of HIE is to provide authorized healthcare providers with access to complete, up-to-date patient information, regardless of where the data was originally recorded. This enables better coordination of care, reduces the risk of errors, and helps improve healthcare outcomes by allowing providers to make more informed decisions. HIE systems can support various types of data sharing, including patient health records, lab results, medications, and treatment histories.

A few key trends in the market are described below: