Healthcare Interoperability Solutions Market Share, Size, Trends, Industry Analysis Report

By Offering (Solutions, Services); By Level; By Deployment; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4695

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

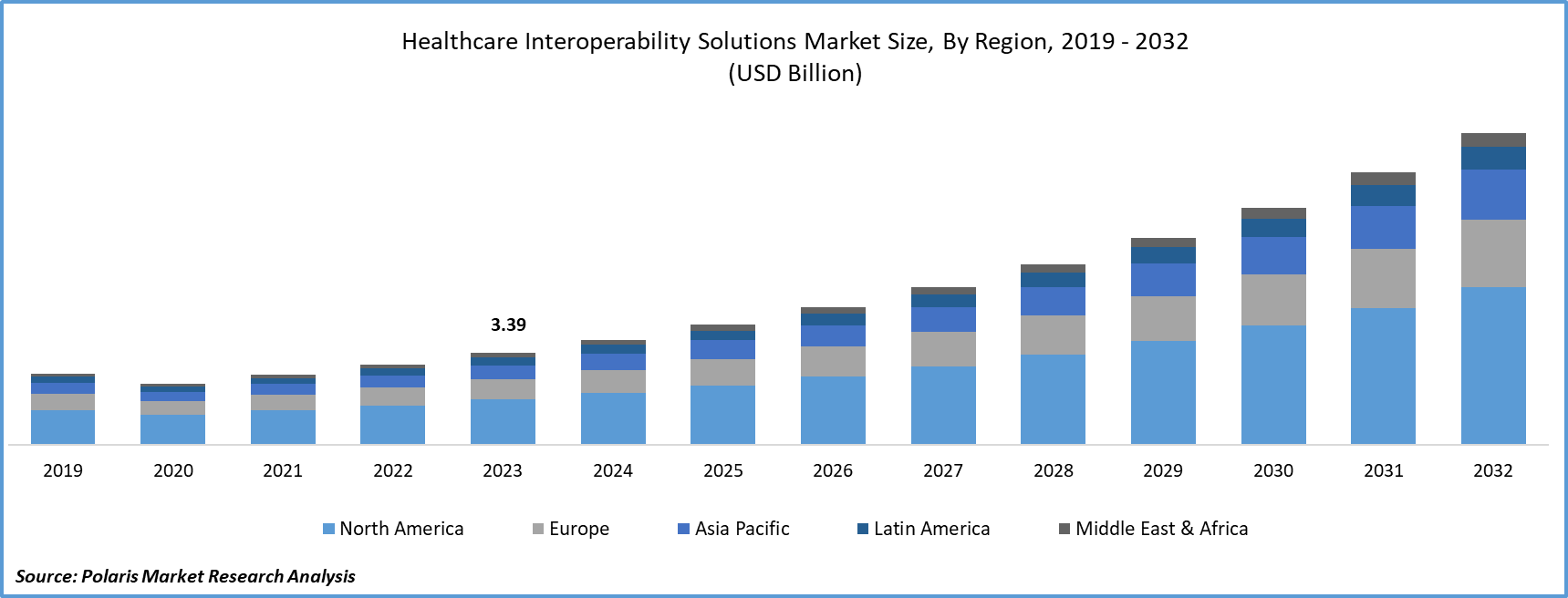

- Global healthcare interoperability solutions Market size was valued at USD 3.39 billion in 2023.

- The market is anticipated to grow from USD 3.88 billion in 2024 to USD 11.52 billion by 2032, exhibiting the CAGR of 14.6% during the forecast period.

Market Introduction

The healthcare interoperability solutions market share is driven by the increasing demand for seamless data exchange across healthcare systems. As patient care becomes more complex, interoperability solutions play a crucial role in facilitating the exchange of health information between different platforms and providers. This ensures continuity of care, improves clinical decision-making, and supports population health management and research efforts. With a focus on value-based care and patient-centric approaches, healthcare organizations recognize the importance of interoperability in enhancing care coordination and outcomes. Consequently, there is a growing investment in interoperability solutions to bridge the gap between disparate systems, promoting efficient data exchange.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are entering partnerships and collaborations to expand market reach and strengthen their presence.

- For instance, in February 2023, Redox and Google Cloud teamed up to streamline the sharing of medical data, enabling organizations to enhance their decision-making processes swiftly and effectively. Through seamless integration of health data from outdated systems into Google Cloud solutions such as Healthcare Data Engine and Healthcare API, entities can construct comprehensive perspectives to cater more effectively to their patients and members.

With the continuous evolution of digital healthcare systems, interoperability solutions are increasingly vital for seamless data exchange among disparate IT systems and applications. Innovations such as Application Programming Interfaces (APIs), cloud computing, and blockchain are transforming healthcare interoperability, enabling secure and standardized data exchange across organizations, platforms, and devices. These advancements empower healthcare providers with real-time access to comprehensive patient information, enhancing clinical decision-making and care coordination. Additionally, interoperability solutions streamline workflows and optimize efficiency by integrating electronic health records, telehealth platforms, and medical device.

Industry Growth Drivers

Government initiatives and mandates are projected to spur the product demand

Government initiatives and mandates play a pivotal role in fueling the healthcare interoperability solutions market size. Recognizing the significance of interoperability in enhancing patient care and reducing costs, governments worldwide are implementing policies and regulations to promote its adoption. Initiatives like the 21st Century Cures Act in the United States and the European Interoperability Framework in Europe aim to facilitate a seamless exchange of health information among stakeholders. These efforts, alongside regulations such as the GDPR, create an environment conducive to interoperability solutions adoption, driving market growth globally.

Growing adoption of electronic health records is expected to drive healthcare interoperability solutions market growth

The market is propelled by the growing adoption of electronic health records (EHRs). EHR systems streamline clinical workflows and patient care coordination by electronically storing and managing health information. However, interoperability challenges arise when different EHR systems cannot communicate seamlessly. Healthcare interoperability solutions address this issue by facilitating data exchange across disparate systems, ensuring comprehensive patient records accessibility. As healthcare organizations prioritize interoperability to enhance care delivery and patient outcomes, the demand for interoperability solutions increases. Government initiatives like the Meaningful Use program in the United States further boost adoption, driving market growth.

Industry Challenges

Data privacy and security concerns are likely to impede the market growth

Data privacy and security concerns present obstacles to the growth of the healthcare interoperability solutions market growth. As sensitive patient health information is exchanged across various systems, the risk of data breaches and unauthorized access escalates. Healthcare organizations and patients are increasingly focused on protecting confidential medical records, adhering to strict data protection regulations like HIPAA and GDPR. Additionally, interoperability solutions involve sharing large volumes of data, heightening privacy and security risks. These concerns impede the adoption of interoperability solutions as providers prioritize data privacy and security.

Report Segmentation

The healthcare interoperability solutions market analysis is primarily segmented based on offering, level, deployment, end user, and region.

|

By Offering |

By Level |

By Deployment |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

Services segment held significant revenue share in 2023

The services segment held a significant revenue share in 2023 due to its critical role in supporting solution implementation, training, and technical assistance. Service providers offer expertise in configuring and customizing solutions, ensuring seamless integration with existing systems. Comprehensive training programs enhance user adoption and utilization rates. Ongoing technical support guarantees solution reliability and performance optimization. Additionally, consultancy services assist organizations in assessing needs and developing interoperability strategies. Data migration and integration services facilitate seamless transition and data compatibility.

By Level Analysis

Structural segment held significant revenue share in 2023

The structural segment held a significant revenue share in 2023. Healthcare systems are complex, consisting of diverse components like electronic health records and laboratory information systems, necessitating structural interoperability solutions for seamless integration. These solutions adhere to standardized data formats, facilitating interoperability across different healthcare IT systems. They enable data exchange between healthcare facilities, supporting care coordination and patient referrals. Additionally, structural interoperability solutions often integrate with emerging technologies like AI and blockchain, enhancing data interoperability and driving adoption. Government regulations, such as the 21st Century Cures Act, further emphasize the importance of structural interoperability, fueling demand for solutions that enable seamless data exchange and integration within the healthcare sector.

By Deployment Analysis

Cloud based segment is expected to experience significant growth during the forecast period

The cloud-based segment is expected to experience significant growth during the forecast period. Cloud solutions offer scalability and flexibility, accommodating evolving interoperability needs without extensive infrastructure investments. They are cost-effective, eliminating on-premises hardware and maintenance expenses and particularly beneficial for smaller healthcare facilities. Cloud solutions offer faster implementation times, facilitating quicker deployment of interoperability solutions. Additionally, they enable remote access and collaboration among healthcare professionals, enhancing care coordination and telemedicine. With robust security measures and compliance certifications, cloud solutions ensure data protection and regulatory adherence.

By End User Analysis

Healthcare providers segment held significant revenue share in 2023

The healthcare providers segment held a significant revenue share in 2023. Healthcare providers directly manage patient data stored in electronic health records, necessitating interoperability solutions tailored to their needs. Solutions that seamlessly integrate with clinical workflows are highly valued for optimizing efficiency. Regulatory mandates like HIPAA require secure and interoperable data exchange, driving investment in interoperability solutions. Additionally, the shift towards patient-centered care models and collaborative partnerships further boosts demand among healthcare providers.

Regional Insights

North America region accounted for a significant market share in 2023

In 2023, the North American region accounted for a significant market share due to its advanced healthcare infrastructure, government initiatives like the Meaningful Use program, and widespread adoption of electronic health records. The region is home to key market players and enforces stringent data privacy regulations such as HIPAA, fostering secure data exchange. Additionally, North America's focus on research and development drives innovation in interoperability solutions.

Asia-Pacific is expected to experience significant growth during the forecast period. Rapid healthcare digitization, including the adoption of electronic health records and telemedicine, creates a favorable environment for interoperability solutions. Increased healthcare expenditure and government initiatives prioritize interoperability for improved healthcare delivery. The region faces a rising burden of chronic diseases, driving demand for better data management and care coordination. Moreover, government regulations and incentives promote interoperability, further stimulating market growth.

Key Market Players & Competitive Insights

The healthcare interoperability solutions market players comprise a variety of participants, and the anticipated entry of new competitors is set to increase competition. Established leaders consistently upgrade their technologies to retain a competitive edge, focusing on efficacy, dependability, and safety. These companies prioritize strategic initiatives like forming partnerships, enhancing product offerings, and engaging in collaborative efforts. Their goal is to surpass rivals in the industry, capturing a market share.

Some of the major players operating in the global healthcare interoperability solutions market include:

- Allscripts Healthcare Solutions, Inc.

- Cerner Corporation

- Change Healthcare

- Epic Systems Corporation

- GE Healthcare

- InterSystems Corporation

- Jitterbit

- Koch Industries, Inc

- Meditech

- NextGen Healthcare, Inc.

- Orion Health

- OSP Labs

- Philips Healthcare

- Veradigm Inc.

- Virtusa Corpopration

Recent Developments

- In January 2024, Axxess introduced, Axxess Connect, an interoperability solution. This product offers to enhance the connectivity and data-sharing experience for Axxess users with healthcare providers and specialists. It aims to bolster care coordination, elevate patient outcomes by facilitating new care models and value-based care initiatives.

- In July 2021, Infor unveiled its FHIR Server to assist healthcare organizations in optimizing data utilization and analysis. This new solution enables organizations to expand their Fast Healthcare Interoperability Resource (FHIR) and application programming interface (API) capabilities beyond current constraints, enhancing care coordination by delivering essential information to providers and patients.

- In October 2023, Productive Edge revealed a strategic alliance with Redox, targeting the resolution of critical issues in the industry concerning health data fragmentation, real-time analytics, and compliance. This partnership is geared towards delivering inventive solutions for enhancing healthcare interoperability.

Report Coverage

The healthcare interoperability solutions market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offerings, levels, deployments, end users, and their futuristic growth opportunities.

Healthcare Interoperability Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.88 billion |

|

Revenue forecast in 2032 |

USD 11.52 billion |

|

CAGR |

14.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Healthcare Interoperability Solutions Market report covering key segments are offering, level, deployment, end user, and region.

Healthcare Interoperability Solutions Market Size Worth $11.52 Billion By 2032

Global healthcare interoperability solutions market exhibiting the CAGR of 14.6% during the forecast period.

North America is leading the global market

key driving factors in Healthcare Interoperability Solutions Market are Growing adoption of electronic health records