Healthcare Staffing and Scheduling Software Market Size, Share, Trends, Industry Analysis Report

By Product Type, By Deployment Model, By Specialty, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6313

- Base Year: 2024

- Historical Data: 2020-2023

Overview

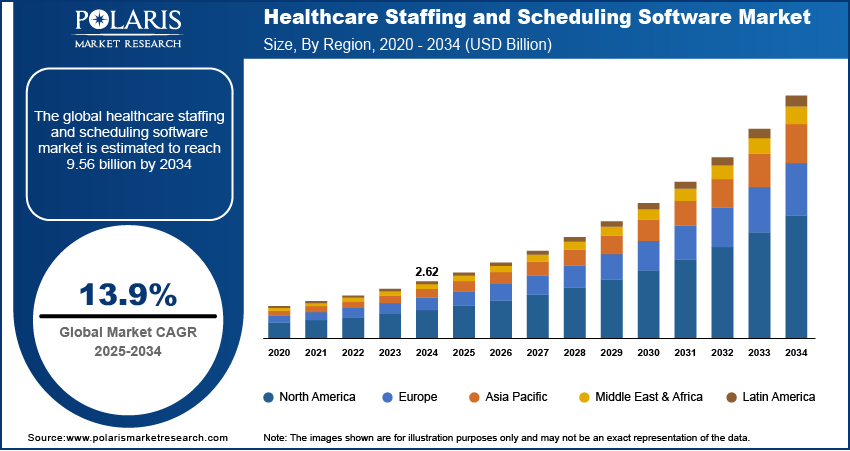

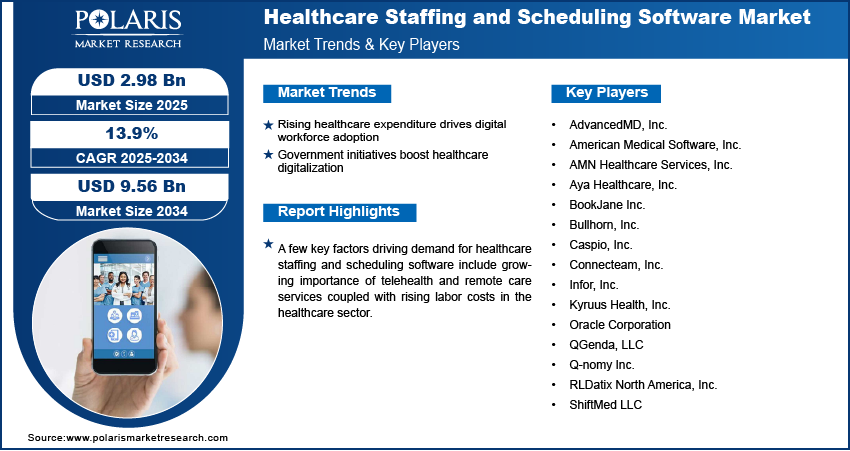

The global healthcare staffing and scheduling software market size was valued at USD 2.62 billion in 2024, growing at a CAGR of 13.9% from 2025 to 2034. Key factors driving demand for healthcare staffing and scheduling software include rising healthcare expenditure in developed and emerging economies along with government initiatives promoting healthcare digitalization and adoption of workforce management platforms.

Key Insights

- The care provider scheduling segment held the largest market share in 2024, driven by growing demand for efficient workforce allocation, shift management, and overtime tracking across hospitals and healthcare systems.

- The behavioral and mental health segment accounted for the highest CAGR, fueled by rising awareness of mental health care, expansion of specialized facilities.

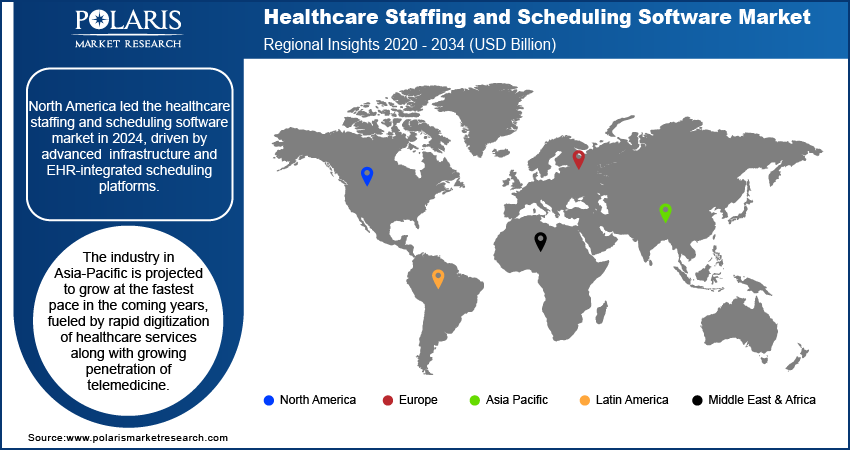

- The North America healthcare staffing and scheduling software market dominated the market in 2024. This dominance is driven by advanced healthcare infrastructure coupled with increasing integration of scheduling platforms with electronic health records (EHR) systems.

- The U.S. held the largest revenue share in the North America healthcare staffing and scheduling software landscape in 2024, driven by rising healthcare expenditure and the growing focus on operational efficiency across healthcare facilities.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, fueled by rapid digitization of healthcare services along with growing penetration of telemedicine.

- India is emerging as a key growth hub, fueled by rapid growth of healthcare infrastructure and rising investments in digital health technologies.

Industry Dynamics

- Rising healthcare expenditure in developed and emerging economies is supporting the adoption of digital workforce management platforms, enabling healthcare organizations to improve efficiency, streamline operations, and optimize staff allocation.

- Government initiatives promoting healthcare digitalization are accelerating the deployment of workforce management platforms across hospitals, diagnostic centers, and clinics to enhance compliance, improve patient care delivery, and ensure optimal utilization of resources.

- Integration of AI-driven predictive analytics is creating market opportunities, supporting accurate staffing, automate scheduling processes, and enhance workforce flexibility while reducing administrative burden.

- High initial implementation and integration costs is restraining the adoption, among smaller healthcare facilities where budgetary limitations restrict investment in advanced digital scheduling solutions.

Market Statistics

- 2024 Market Size: USD 2.62 Billion

- 2034 Projected Market Size: USD 9.56 Billion

- CAGR (2025–2034): 13.9%

- North America: Largest Market Share

AI Impact on Healthcare Staffing and Scheduling Software Market

- AI analyzes historical data, patient flow, and staff availability to forecast demand and automate shift planning, reducing scheduling errors, cutting overtime costs, and easing administrative workload for healthcare managers.

- It enables real-time shift adjustments, allowing healthcare facilities to adapt quickly to staff absences or patient surges, improving operational agility, continuity of care, and overall resource efficiency.

- Personalized scheduling algorithms consider staff preferences, fatigue, and workload balance, helping reduce burnout, boost job satisfaction, and support better retention in high-pressure healthcare environments.

- AI-driven systems ensure compliance with labor laws, credentialing, and staffing policies, while identifying risks such as skill shortages or overworked staff, enhancing both workforce safety and patient outcomes.

The healthcare staffing and scheduling software market comprises advanced digital platforms designed to optimize workforce management, streamline staff allocation, and enhance operational efficiency across healthcare facilities. These solutions are widely adopted by hospitals, clinics, long-term care centers, and other healthcare organizations to ensure accurate shift scheduling, reduce administrative burden, and maintain compliance with labor regulations. Integration of artificial intelligence, cloud-based deployment, and mobile accessibility improved the scalability, flexibility, and real-time responsiveness of these systems. Enabling effective resource utilization supports patient care delivery, minimizes staffing shortages, and enhances overall productivity within healthcare institutions.

The adoption of healthcare staffing and scheduling software is rising due to the growing importance of telehealth and remote care services that require flexible and adaptive workforce management. The expansion of virtual consultations, remote patient monitoring, and digital healthcare delivery models is driving demand for intelligent scheduling platforms capable of managing complex staffing patterns. These solutions integrate predictive analytics, cloud-based access, and mobile applications to improve workforce allocation, reduce scheduling conflicts, and ensure timely care delivery. Increasing reliance on digital health ecosystems continues to strengthen the need for advanced staffing tools across hospitals, outpatient clinics, and telehealth providers.

Rising labor costs in the healthcare sector are further accelerating the demand for cost-efficient staffing and scheduling solutions. Healthcare organizations face pressure to optimize resource utilization while maintaining quality patient care. Intelligent workforce management platforms support labor cost reduction by automating scheduling, improving staff productivity, and minimizing overtime expenses. According to the American Hospital Association, hospital labor costs grew by more than 20% per patient between 2019 and 2022, highlighting the urgency for healthcare providers to adopt technology-driven scheduling systems. This trend is fueling the demand for advanced staffing software in enhancing operational efficiency and supporting financial sustainability within healthcare institutions.

Drivers & Opportunities

Rising Healthcare Expenditure in Developed and Emerging Economies Supporting Digital Workforce Management Adoption: Increasing healthcare spending worldwide is driving demand for technology-driven workforce optimization solutions. Hospitals and healthcare systems are investing in advanced staffing and scheduling platforms to improve operational efficiency, reduce administrative overheads, and allocate resources effectively. According to KFF, a U.S.-based health policy organization, total health spending is expected to reach USD 5.6 trillion by 2025, with hospitals accounting for the largest portion at approximately USD 1.8 trillion. This surge in expenditure is boosting demand for digital workforce management solutions that streamline scheduling and address staff shortages.

Government Initiatives Promoting Healthcare Digitalization and Adoption of Workforce Management Platforms: Public sector initiatives aimed at strengthening healthcare infrastructure and digital transformation are accelerating the adoption of advanced staffing and scheduling solutions. For instance, in October 2024, Singapore’s Ministry of Health unveiled a USD 150 million, five-year initiative to advance the adoption of artificial intelligence technologies, aimed at driving large-scale integration across national healthcare system projects through a centralized approach. Governments across regions are pushing hospitals and clinics to implement electronic workforce systems to enhance productivity, reduce inefficiencies, and improve patient care delivery. These initiatives are creating favorable conditions for software providers to expand reach and deliver innovative scheduling platforms that meet with regulatory requirements and healthcare digitalization goals.

Segmental Insights

By Product Type

Based on product type, the healthcare staffing and scheduling software market is segmented into patient scheduling, care provider scheduling, and others. The care provider scheduling segment accounted for the largest share in 2024, driven by growing demand for efficient workforce allocation, shift management, and overtime tracking across hospitals and healthcare systems. These solutions streamline staff utilization, reduce administrative burden, and improve care delivery outcomes.

The patient scheduling segment is projected to witness the fastest growth during the forecast period, supported by rising demand for digital appointment booking, integration with telehealth platforms, and patient-centric care models. This segment enables efficient appointment coordination, reduces no-shows, and enhances patient satisfaction across hospitals, clinics, and telehealth providers.

By Deployment Model

Based on deployment model, the market is categorized into cloud-based, on-premise, and hybrid solutions. The cloud-based segment dominated the market in 2024, driven by scalability, lower upfront investment, and ease of integration with electronic health record (EHR) systems and telehealth platforms. Healthcare providers are increasingly adopting cloud-based scheduling tools to ensure real-time access, multi-location support, and seamless data sharing.

The hybrid deployment model is expected to register significant growth during the forecast period, due to its balance between data security of on-premise systems and flexibility of cloud platforms. This model is gaining traction among mid- to large-scale healthcare organizations aiming to optimize costs while maintaining compliance with strict regulatory requirements.

By Specialty

Based on specialty, the healthcare staffing and scheduling software market is segmented into primary care, dentistry, behavioral and mental health, and others. The primary care segment held the largest share in 2024, supported by high patient volumes, need for efficient appointment coordination, and workforce optimization in general healthcare services.

The behavioral and mental health segment is projected to experience robust growth during the forecast period, fueled by rising awareness of mental health care, expansion of specialized facilities, and increasing adoption of digital scheduling solutions to manage therapy sessions and care provider availability.

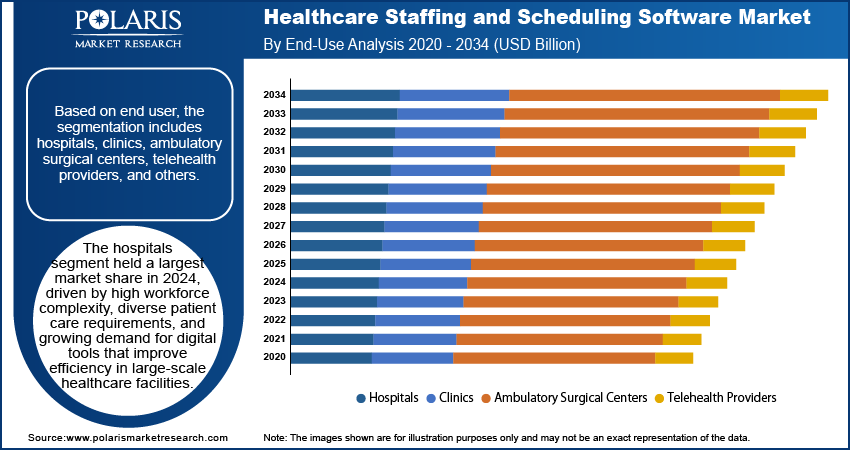

By End User

Based on end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, telehealth providers, and others. The hospitals segment accounted for the largest share in 2024, driven by high workforce complexity, diverse patient care requirements, and growing demand for digital tools that improve efficiency in large-scale healthcare facilities.

The telehealth providers segment is expected to grow at the fastest pace over the forecast period, supported by the rising adoption of virtual care models, remote consultations, and patient-centric scheduling platforms. These solutions enable seamless appointment booking, real-time coordination, and scalability, making them integral to modern digital healthcare ecosystems.

Regional Analysis

The North America healthcare staffing and scheduling software market accounted for the largest revenue share in 2024, driven by advanced healthcare infrastructure coupled with increasing integration of scheduling platforms with electronic health records (EHR) systems. The region faces persistent physician shortages and nursing workforce challenges, creating strong demand for flexible and automated scheduling solutions. Hospitals, clinics, and ambulatory centers are increasingly investing in cloud-based workforce management platforms to optimize labor allocation, reduce administrative burden, and improve patient care delivery.

The U.S. Healthcare Staffing and Scheduling Software Market Insights

The U.S. held the dominant share of the North America market in 2024, driven by rising healthcare expenditure and the growing focus on operational efficiency across healthcare facilities. The country’s strong presence of software providers offering advanced solutions for workforce scheduling, time tracking, and real-time analytics is increasing the demand for healthcare staffing and scheduling software solutions. According to the Centers for Medicare & Medicaid Services, the U.S. healthcare spending increased by 7.5% in 2023 compared to the previous year, reaching USD 4.9 trillion. Healthcare expenditures represented 17.6% of the nation’s Gross Domestic Product (GDP). This trend is fueling demand for healthcare staffing and scheduling software that enhances productivity, reduces costs, and ensures compliance with labor regulations across hospitals, clinics, and telehealth providers.

Asia Pacific Healthcare Staffing and Scheduling Software Market Trends

The Asia Pacific market is projected to witness the fastest CAGR through 2034, fueled by rapid digitization of healthcare services along with growing penetration of telemedicine. Countries in the region are adopting digital workforce management systems to handle rising patient loads and modernize healthcare delivery. Increasing government initiatives to promote eHealth adoption, coupled with foreign investments and strategic collaborations in healthcare IT, are further accelerating market growth. Rising emphasis on flexible workforce scheduling to meet diverse patient demands is driving adoption across hospitals, ambulatory surgical centers, and emerging telehealth platforms.

India Healthcare Staffing and Scheduling Software Market Overview

India is emerging as one of the most promising markets, fueled by rapid growth of healthcare infrastructure and rising investments in digital health technologies. The Indian government’s initiatives under the Ayushman Bharat Digital Mission and expanding telemedicine services are boosting adoption of cloud-based workforce management platforms. Growing demand for streamlined scheduling in hospitals, diagnostic centers, and clinics is driving healthcare providers to adopt advanced digital solutions that enhance efficiency, optimize workforce management, and support compliance with staffing standards.

Europe Healthcare Staffing and Scheduling Software Market Assessment

The Europe market holds a significant share of the global industry, due to the strong regulatory emphasis on efficient healthcare resource management and workforce planning. The European Union’s eHealth strategies and national digitization programs are driving adoption of healthcare IT solutions across hospitals and clinics. Widespread digitization of healthcare services, growing demand for patient-centered care, and emphasis on reducing administrative inefficiencies are accelerating the use of advanced scheduling platforms. Countries such as Germany, France, and the UK are leading in adopting cloud-based and hybrid deployment models, ensuring seamless workforce allocation and compliance with labor laws while improving patient care delivery.

Key Players & Competitive Analysis

The global healthcare staffing and scheduling software market is highly competitive, with key players such as AdvancedMD, Inc., AMN Healthcare Services, Inc., and Oracle Corporation driving growth through innovative workforce management platforms, integration with hospital information systems, and large-scale digital transformation initiatives. Oracle Corporation focuses on enhancing cloud-based healthcare workforce solutions integrated with enterprise resource planning (ERP) and electronic health record (EHR) systems, improving scheduling accuracy and operational efficiency. AMN Healthcare Services, Inc. emphasizes advanced digital staffing platforms and mobile-enabled scheduling tools to address nurse shortages and optimize workforce utilization, while AdvancedMD, Inc. strengthens its presence by offering cloud-based practice management and workforce solutions tailored for clinics, hospitals, and ambulatory care centers.

The market is witnessing strong adoption of digital scheduling and workforce optimization platforms across hospitals, specialty clinics, and nursing agencies, driven by the growing need to improve staff productivity, reduce administrative burden, and ensure compliance with healthcare regulations. Companies are developing AI-driven predictive scheduling tools, mobile-first workforce applications, and cloud-based integration with EHR systems to improve operational efficiency and patient outcomes. Strategic collaborations with healthcare providers, telemedicine companies, and technology firms are expanding the adoption of these solutions, while investments in analytics, automation, and real-time monitoring are further strengthening the capabilities of workforce management platforms.

Prominent companies operating in the healthcare staffing and scheduling software market include AdvancedMD, Inc., American Medical Software, Inc., AMN Healthcare Services, Inc., Aya Healthcare, Inc., BookJane Inc., Bullhorn, Inc., Caspio, Inc., Connecteam, Inc., Infor, Inc., Kyruus Health, Inc., Oracle Corporation, QGenda, LLC, Q-nomy Inc., RLDatix North America, Inc., and ShiftMed LLC.

Key Players

- AdvancedMD, Inc.

- American Medical Software, Inc.

- AMN Healthcare Services, Inc.

- Aya Healthcare, Inc.

- BookJane Inc.

- Bullhorn, Inc.

- Caspio, Inc.

- Connecteam, Inc.

- Infor, Inc.

- Kyruus Health, Inc.

- Oracle Corporation

- QGenda, LLC

- Q-nomy Inc.

- RLDatix North America, Inc.

- ShiftMed LLC

Healthcare Staffing and Scheduling Software Industry Developments

In June 2025: Aya Healthcare, a leading U.S. healthcare staffing firm, acquired UK-based Locum’s Nest, enhancing global workforce solutions. The deal boosts mobile-first shift management, enabling flexible staffing and cross-border innovation in healthcare through efficient, app-based hospital-professional connectivity.

In August 2024: Care Systems partnered with Harris OnPoint, granting them the right to distribute CareWare, a workforce scheduling suite, as part of Harris OnPoint’s healthcare technology offerings. This partnership exemplifies the healthcare staffing and scheduling software market’s trend toward integrated platforms that unite scheduling, acuity-based staffing, credentialing, and analytics empowering healthcare systems to better manage staff resources and enhance patient care delivery.

Healthcare Staffing and Scheduling Software Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Patient Scheduling

- Care Provider Scheduling

- Others

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premise

- Hybrid

By Specialty Outlook (Revenue, USD Billion, 2020–2034)

- Primary Care

- Dentistry

- Behavioral and Mental Health

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Telehealth Providers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Healthcare Staffing and Scheduling Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.62 Billion |

|

Market Size in 2025 |

USD 2.98 Billion |

|

Revenue Forecast by 2034 |

USD 9.56 Billion |

|

CAGR |

13.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.62 billion in 2024 and is projected to grow to USD 9.56 billion by 2034.

The global market is projected to register a CAGR of 13.9% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are AdvancedMD, Inc., American Medical Software, Inc., AMN Healthcare Services, Inc., Aya Healthcare, Inc., BookJane Inc., Bullhorn, Inc., Caspio, Inc., Connecteam, Inc., Infor, Inc., Kyruus Health, Inc., Oracle Corporation, QGenda, LLC, Q-nomy Inc., RLDatix North America, Inc., and ShiftMed LLC.

The care provider scheduling segment dominated the market revenue share in 2024.

The hybrid deployment segment is projected to witness the fastest growth during the forecast period.