Heart Pump Device Market Size, Share, & Trends, Analysis Report

: By Type (Implanted Heart Pump Devices and Extracorporeal Heart Pump Devices), By Product, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5714

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

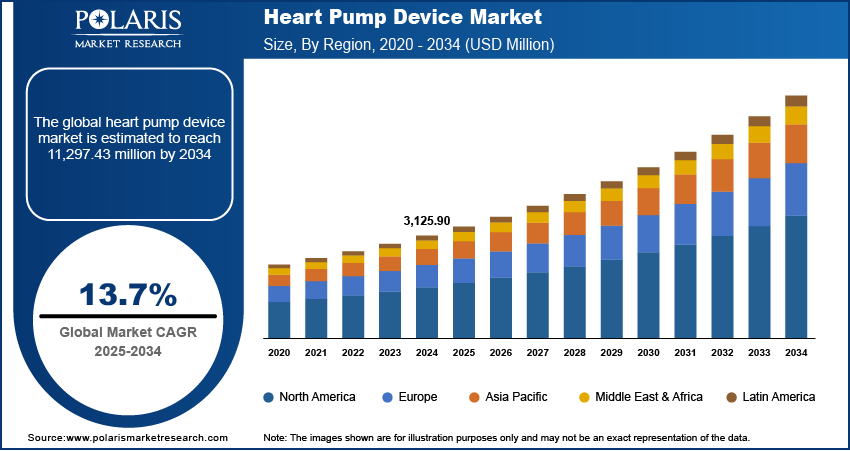

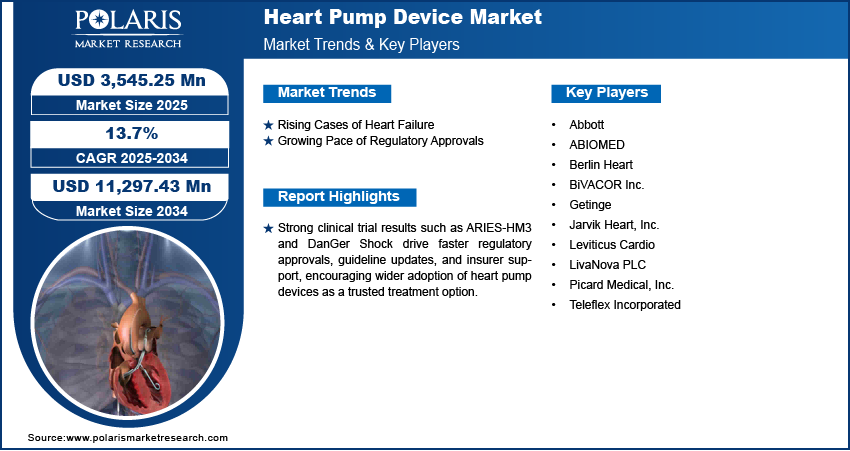

The global heart pump device market size was valued at USD 3,125.90 million in 2024, growing at a CAGR of 13.7% during 2025–2034. The growth is driven by the rising cases of heart failure and fast-track clinical trials and approvals by major regulatory bodies.

A heart pump device is a mechanical device that helps the heart circulate blood when it is too weak to do so on its own. It is commonly used in patients affected by severe heart failure or during critical care to support or temporarily replace heart function.

There are far more people waiting for a heart transplant than there are donor hearts available. Because of this shortage, heart pump devices are being used as a “bridge to transplant,” keeping patients alive until a heart donor becomes available. In some cases, these devices are used as long-term solutions when a transplant isn’t possible. This unmet need for alternatives is pushing hospitals to rely more heavily on heart pump technology, increasing the demand for these devices.

To Understand More About this Research: Request a Free Sample Report

Technology is rapidly improving the functions of heart pumps. Modern pumps are smaller, more durable, and easier to implant, making them safer and more comfortable for patients. Newer models also cause less damage to blood cells and reduce the risk of complications such as infection or bleeding. Innovations such as wireless power systems, real-time monitoring, and fully implantable devices are attracting attention from both doctors and patients. These advancements have improved survival rates and enhanced the quality of life, which helps drive demand for the latest heart pump technologies.

Industry Dynamics

Rising Cases of Heart Failure

Heart failure is becoming more common due to aging populations, poor lifestyle habits, and chronic diseases such as diabetes and high blood pressure. According to the Heart Failure Society of America, about 6.7 million Americans aged 20 and above have heart failure, with the number projected to increase to 8.7 million by 2030 and 10.3 million by 2040. The need for life-saving devices such as heart pumps grows as more people suffer from weakened hearts. These pumps help the heart circulate blood, especially when medicines or surgery aren't enough. Hospitals and doctors are turning to advanced heart pump devices to support or replace heart function, with millions affected worldwide. Therefore, the rising cases of heart failure drive the demand for these devices.

Growing Pace of Regulatory Approvals

Many heart pump devices are receiving regulatory approvals faster because of strong clinical trial results showing they are effective and safe. Trials such as ARIES-HM3 and DanGer Shock provided major data that influenced updated treatment guidelines and wider use of specific pumps. These strong clinical trials are driving the adoption of these devices as doctors and hospitals see clear evidence that a device works well. Additionally, Regulatory support further boosts confidence in insurers, helping with reimbursement. These positive developments push more healthcare providers to adopt heart pumps as a standard treatment option.

Segmental Insights

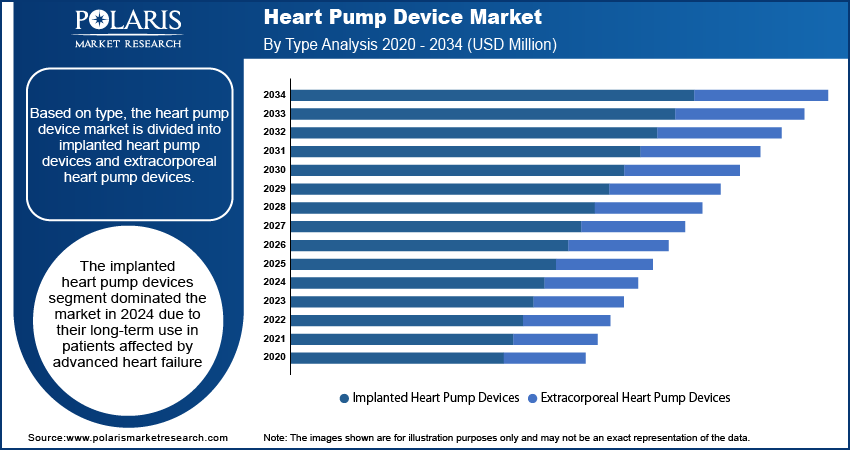

By Type Analysis

The implanted heart pump devices segment dominated with a larger share in 2024 due to their long-term use in patients affected by advanced heart failure. These devices, such as Left Ventricular Assist Devices (LVADs), are surgically implanted to help the heart pump blood more efficiently. They are often used as a "bridge to transplant" or even as a permanent solution for patients who are not eligible for a heart transplant. Their proven effectiveness in improving survival rates and quality of life, along with growing clinical evidence, has made them the preferred option in chronic heart failure care, leading to segmental dominance.

By Product Type Analysis

The extracorporeal membrane oxygenation (ECMO) segment is expected to experience the fastest growth during the forecast period. ECMO systems temporarily take over the function of the heart and lungs during severe illness or surgery, giving these organs time to rest and heal. These systems have become critical in emergency care, especially for patients suffering from cardiac or respiratory failure. ECMO use surged during the COVID-19 pandemic and continues to expand in intensive care settings. Their flexibility, portability, and increased use in both adult and pediatric care have made ECMO systems a rapidly growing and vital part of the heart pump device landscape.

By End Use Analysis

The hospitals segment dominated with the largest market share as they have the necessary infrastructure, specialists, and critical care units required to implant and manage these devices. Most heart pump procedures, including LVAD implantations and ECMO support, are performed in hospital settings where continuous monitoring and emergency interventions are available. Hospitals are investing in heart pump devices due to the growing burden of heart failure cases and increasing adoption of advanced cardiac care technologies, driving their segmental dominance.

The cardiac centers segment is expected to record significant growth during the forecast period due to its major role in the follow-up care and specialized treatment. These centers focus on treating heart diseases exclusively and often work in partnership with hospitals for procedures and post-operative care. Cardiac centers are increasingly equipped with technologies such as heart pumps to offer targeted treatment as congestive heart failure, and heart failure management becomes more complex. Their ability to provide personalized care, manage device complications, and conduct regular monitoring makes them an essential facility, thereby driving the segmental growth.

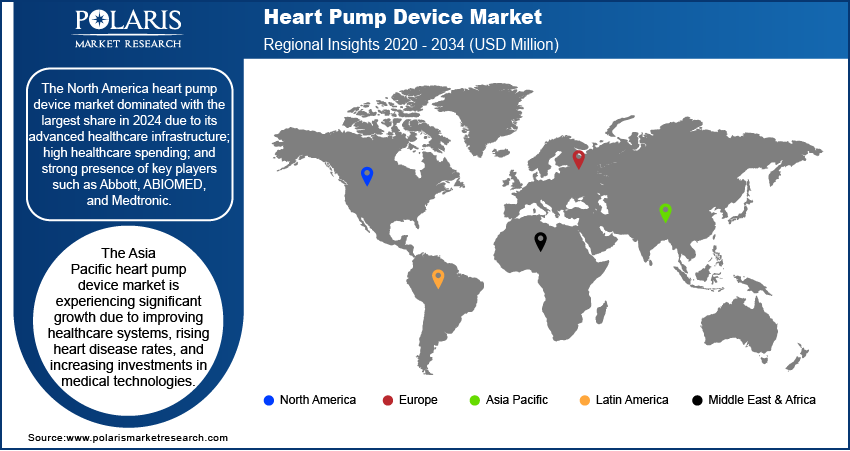

Regional Analysis

The North America heart pump device market dominated with the largest share due to its advanced healthcare infrastructure; high healthcare spending; and strong presence of key players such as Abbott, ABIOMED, and Medtronic. The US heart pump device market leads the region with a growing number of heart failure cases, favorable reimbursement policies, and rapid adoption of advanced devices such as LVADs and ECMO. Fast-track clinical trials and FDA approvals in this region further drive the growth. Additionally, awareness among patients and physicians is high, and the demand for both emergency and chronic heart care is rising. These factors collectively are driving the growth of the regional market.

The Asia Pacific heart pump device market is expected to witness significant growth during the forecast period due to improving healthcare systems, rising heart disease rates, and increasing investments in medical technologies. Countries such as China, Japan, and South Korea are leading in adopting modern cardiac care tools, including ECMO and implantable pumps. Urbanization, aging populations, and lifestyle-related diseases are driving demand for better heart failure solutions. Governments are supporting healthcare infrastructure upgrades, and awareness about heart pump devices is increasing, thereby driving the growth of the market in the region.

The India heart pump device market is driven by a growing population with heart failure and a rising demand for advanced cardiac treatments. The awareness among doctors and patients is increasing, especially in metro cities. Private hospitals are leading in the adoption of devices such as ECMO and LVADs, while government efforts to upgrade healthcare infrastructure are helping expand access. The demand in India is growing, with medical tourism and partnerships with global device manufacturers growing.

The Europe heart pump device market is driven by strong regulatory frameworks, well-equipped hospitals, and a high number of advanced cardiac centers. Countries such as Germany, the UK, and France are leading in the adoption of both implanted heart pumps and ECMO systems. The region benefits from government-funded healthcare, high awareness, and skilled healthcare professionals. Additionally, recent clinical studies from European institutions support the effectiveness of devices such as HeartMate 3 and Impella, encouraging broader usage. Europe's aging population and the rising burden of heart disease are further fueling the industry growth in the region.

Key Players and Competitive Analysis Report

The heart pump device market is highly competitive, with key players driving innovation in mechanical circulatory support. Abbott leads with its HeartMate 3 LVAD, recently approved for aspirin-free management. ABIOMED, now part of Johnson & Johnson, dominates the short-term support segment with Impella devices. Berlin Heart specializes in pediatric heart pumps, while BiVACOR pioneers total artificial hearts. Getinge and LivaNova offer integrated cardiac support systems. Jarvik Heart and Leviticus Cardio focus on compact, wireless-powered implants. Picard Medical develops advanced pump technologies, and Teleflex enhances support through cannulation and perfusion tools. Together, these companies shape a dynamic, rapidly evolving heart pump landscape.

Abbott develops, produces, and markets a wide range of medical products. It functions through the following divisions: pharmaceutical, diagnostic, pharmaceutical, and medical device products. Pharmaceutical products include a series of branded generic pharmaceutical medicines sold internationally. The Nutritional Products section serves the global sales of adult and pediatric nutritional products. Additionally, Abbott's nutrition business develops specialized products for infants, children, and adults, catering to specific health requirements. The diagnostic products division sells diagnostic systems and procedures, including blood banks, hospitals, commercial laboratories, and alternative-care testing facilities. In the medical devices sector, Abbott offers advanced technologies for cardiovascular devices, diabetes devices, neuromodulation, and other specialties, enhancing patient outcomes and quality of life. The diagnostics division provides various diagnostic solutions, including laboratory and point-of-care diagnostics and testing systems, aiding in accurate disease detection and management. The company is based in Abbott Park, Illinois, US, and was founded in 1888. Abbott generates most of its revenue by selling a wide range of healthcare products through short-term receivables. Around 70% of its revenue comes from markets outside of the US, with 50% generated in faster-growing regions where healthcare spending is increasing faster than the growth of gross domestic product (GDP). The company provides HeartMate 3 Left Ventricular Assist Device, which is an implantable mechanical pump for advanced heart failure patients, featuring fully magnetically levitated technology to provide short- or long-term circulatory support while minimizing blood damage and hemocompatibility-related complications.

Berlin Heart GmbH is a medical technology company based in Berlin, Germany, established in 1996. The company develops, manufactures, and distributes ventricular assist devices (VADs) that provide mechanical circulatory support for patients having severe heart failure. Berlin Heart’s product range includes both implantable and external (paracorporeal) VAD systems. The EXCOR system, available in both adult and pediatric versions, is used as a bridge to heart transplantation or recovery for patients of all ages, including infants and children. This device is notable for being one of the few VADs with approval for pediatric use. The INCOR system is an implantable VAD intended for adults and is used in cases where long-term circulatory support is required. Berlin Heart divides its business into product segments based on patient age and device type, with a focus on pediatric and adult heart failure support. The company also provides mobile driving units, such as the EXCOR Active, which allow for increased patient mobility during treatment. These devices are used in hospitals and specialized cardiac centers as part of advanced heart failure management protocols. The company operates internationally, supplying its products to hospitals and clinics in Europe, North America, Asia, and other regions. Berlin Heart has a subsidiary in the US, Berlin Heart Inc., located in Texas, which supports customers in the US, Canada, and Mexico. The company collaborates with several leading cardiac centers for product development, clinical research, and training.

Key Players

- Abbott

- ABIOMED

- Berlin Heart

- BiVACOR Inc.

- Getinge

- Jarvik Heart, Inc.

- Leviticus Cardio

- LivaNova PLC

- Picard Medical, Inc.

- Teleflex Incorporated.

Industry Developments

In March 2025, Johnson & Johnson MedTech showcased the upgraded Impella heart pump at ACC.25, following its reclassification to Class 2a in ACC/AHA guidelines, highlighting significant survival benefits for STEMI patients with cardiogenic shock, based on the DanGer Shock trial results.

In September 2024, Medtronic launched the VitalFlow ECMO system, integrating performance and simplicity for bedside and intra-hospital transport, following its acquisition of MC3 Cardiopulmonary, reinforcing its leadership in cardiac surgery and advancing care for critically ill cardiopulmonary patients.

In August 2024, Abbott announced FDA approval for removing aspirin from the HeartMate 3 LVAD regimen after the ARIES-HM3 trial showed reduced bleeding and hospital stays, marking a major advancement in heart failure management for over 30,000 patients worldwide.

Heart Pump Device Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Implanted Heart Pump Devices

- Extracorporeal Heart Pump Devices

By Product Outlook (Revenue, USD Million, 2020–2034)

- Ventricular Assist Devices (VADs)

- Left Ventricular Assist Devices (LVADs)

- Right Ventricular Assist Devices (RVADs)

- BiVAD Ventricular Assist Devices (BiVADs)

- Percutaneous Ventricular Assist Devices (PVADs)

- Intra-Aortic Balloon Pumps (IABPs)

- Extracorporeal Membrane Oxygenation (ECMO)

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Cardiac Centers

- Research Institute

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Heart Pump Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,125.90 Million |

|

Market Size Value in 2025 |

USD 3,545.25 Million |

|

Revenue Forecast by 2034 |

USD 11,297.43 Million |

|

CAGR |

13.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,125.90 million in 2024 and is projected to grow to USD 11,297.43 million by 2034.

The global market is projected to register a CAGR of 13.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Abbott; ABIOMED; Berlin Heart; BiVACOR Inc.; Getinge; Jarvik Heart, Inc.; Leviticus Cardio; LivaNova PLC; Picard Medical, Inc.; and Teleflex Incorporated.

The implanted heart pump devices segment dominated the market share in 2024.

The cardiac center segment is expected to witness a significant growth during the forecast period.