Heat Resistant Polymer Market Size, Share, & Industry Analysis Report

: By Type (Fluoropolymer, Polyphenylene Sulfide, Polyimides, Polyether Ether Ketone, and Others), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5701

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

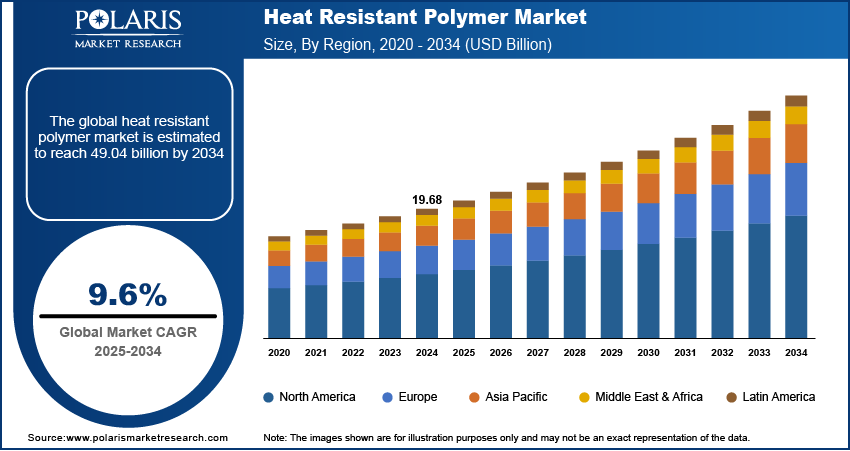

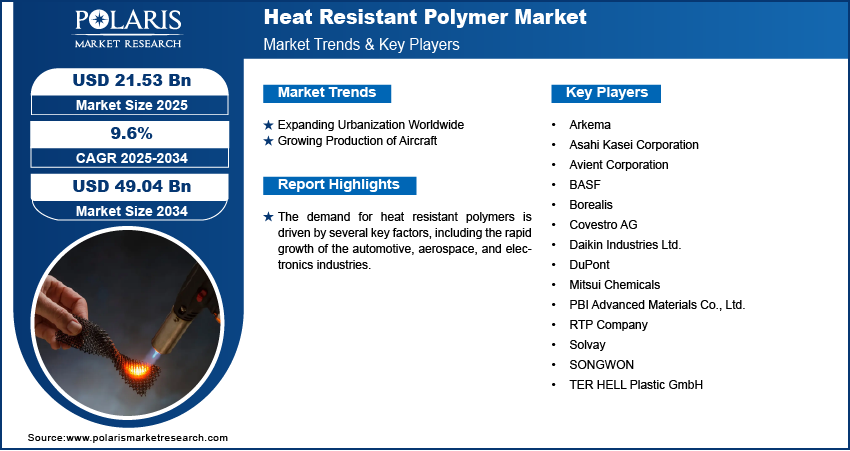

The global heat resistant polymer market size was valued at USD 19.68 billion in 2024, growing at a CAGR of 9.6 % during 2025–2034. The demand for heat resistant polymers is driven by several key factors, including the rapid growth of the automotive, aerospace, and electronics industries, where these materials are essential for components exposed to high temperatures.

Heat resistant polymer is a type of polymeric material specifically made to maintain its structural integrity, mechanical strength, and functional properties when exposed to high temperatures. These polymers achieve their thermal stability primarily through their chemical structure. Heat resistant polymers can be categorized as thermoplastics, which soften and re-solidify upon heating and cooling, or thermosets. The application of heat resistant polymers is broad and critical across numerous industries due to their unique combination of thermal stability and functional versatility. In the automotive sector, these polymers are used for under-the-hood components, such as intake manifolds, fuel system parts, and electrical connectors, where exposure to engine heat and aggressive fluids demands materials that do not deform or degrade. Aerospace manufacturers rely on these polymers for lightweight structural parts, insulation, cable sheathing, and interior components.

The growing adoption of electronic devices such as smartphones, laptops, smartwatches, and others is driving the demand for heat resistant polymers. According to the Groupe Speciale Mobile (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population owns a smartphone. Manufacturers of electric devices such as smartphones and laptops require materials that can maintain dimensional stability, electrical insulation, and mechanical strength at high temperatures. Heat resistant polymers fulfill these requirements, making them essential for use in smartphone and laptop components such as connectors, sockets, printed circuit boards (PCBs), and internal casings. High resistant polymers' resistance to thermal degradation further ensures long-term reliability and safety of electronic devices, thereby increasing their adoption in the manufacturing of smartphones, laptops, smartwatches, and others.

To Understand More About this Research: Request a Free Sample Report

The heat resistant polymer demand is attributed to the growing sales of electric vehicles globally. According to the International Energy Agency, in 2024, a total of 17.1 million electric vehicles (EVs) were sold globally, marking a 25% increase compared to the previous year. High resistance polymers are widely used in electric vehicle components such as high-voltage systems, powerful batteries, and compact electric drivetrains to enhance performance reliability under high temperatures. Moreover, automakers are using high resistance polymers in the manufacturing of EVS to reduce vehicle weight, thereby increasing driving range and energy efficiency. Therefore, the demand for high resistant polymers is increasing rapidly with the growing sales of electric vehicles globally.

Market Dynamics

Expanding Urbanization Worldwide

Urbanization leads to a surge in building activities, including residential, commercial, and industrial projects, driving demand for high resistant polymers. Heat resistant polymers are used in construction materials such as pipes, insulation, roofing, and flooring due to their ability to resist corrosion, moisture, and extreme temperatures. In addition, expanding urbanization is fueling the adoption of heat resistant polymers in power distribution and public transportation systems due to their ability to withstand high temperatures, harsh chemicals, and mechanical wear. For instance, the United Nations Development Programme, in its report, stated that Africa’s urban population is projected to reach 56% by 2050, and Asia’s to 64%. Therefore, as urbanization across the globe increases, the demand for high resistant polymers also spurs.

Growing Production of Aircraft

High-resistant polymers, such as carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced polymers (GFRP), are essential in modern aircraft design. These polymers offer numerous advantages, including lightweight nature, high strength-to-weight ratio, corrosion resistance, and the ability to withstand harsh temperatures and climatic conditions, making them crucial in aircraft manufacturing. High resistant polymers are increasingly used in critical components of aircraft such as engine parts, wiring insulation, cabin interiors, ducting systems, and brackets. They resist heat and maintain mechanical properties of aircraft at high altitudes and under thermal cycling, ensuring passenger safety and operational reliability. Hence, the growing production of aircraft worldwide is driving the demand for high resistant polymers.

Segmental Insights

By Type Analysis

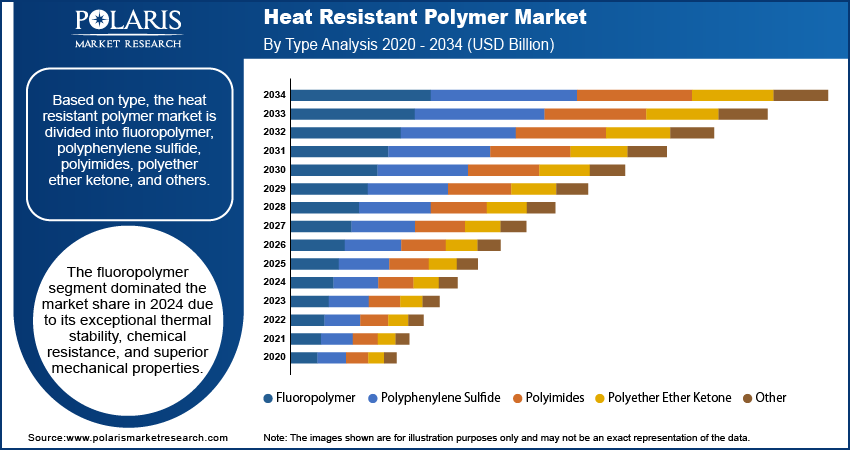

Based on type, the market is divided into fluoropolymer, polyphenylene sulfide, polyimides, polyether ether ketone, and others. The fluoropolymer segment dominated the heat resistant polymer market share in 2024 due to its exceptional thermal stability, chemical resistance, and superior mechanical properties. Industries such as automotive, aerospace, and electronics heavily rely on fluoropolymers for components exposed to high temperatures and corrosive environments. The non-stick and low-friction characteristics of fluoropolymers also support their use in specialized industrial applications. The increasing shift toward electric vehicles (EVs) further boosted fluoropolymer demand, as fluoropolymers are essential in thermal management systems and battery components.

By End Use Analysis

In terms of end use, the heat resistant polymer market is divided into automotive, aerospace & defense, electrical & electronics, industrial, marine, and others. The electrical and electronics segment captured the largest share due to the rising demand for high-performance materials capable of withstanding extreme temperatures in compact and high-density devices. Manufacturers in this sector increasingly incorporate advanced polymers in circuit boards, connectors, insulators, and wire coatings to enhance safety and reliability. The ongoing miniaturization of electronic components and the widespread adoption of 5G technology accelerated the need for polymers that maintain dimensional stability and dielectric properties under thermal stress. Additionally, consumer electronics and semiconductor industries in Asia Pacific, especially in China, South Korea, and Japan, drove significant demand for heat resistant polymers as these regions continued to lead in electronics manufacturing.

The automotive sector is expected to grow at a robust pace in the coming years, owing to the global shift toward electric and hybrid vehicles. Automakers are increasingly integrating high-performance polymers in battery housings, motor insulation, under-the-hood applications, and powertrain components. These materials withstand elevated temperatures and contribute to weight reduction, improving overall vehicle efficiency and range. Stringent emissions regulations and the push for fuel efficiency have led manufacturers to replace metal parts with advanced polymers that offer the required thermal and mechanical performance. Furthermore, the rapid expansion of EV charging infrastructure and increased investments in autonomous vehicle technologies are projected to boost heat resistant polymer adoption in the segment.

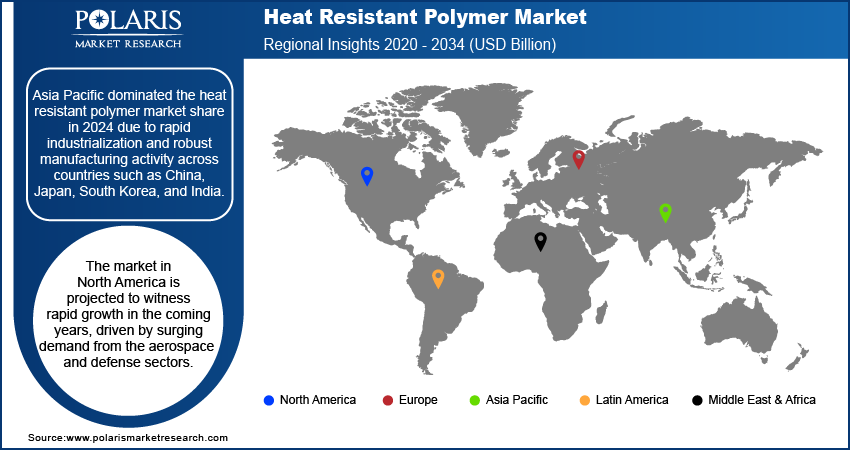

Regional Analysis

By region, the heat resistant polymer market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the industry share in 2024 due to rapid industrialization and robust manufacturing activity across countries such as China, Japan, South Korea, and India. China led the regional market, fueled by its dominance in electronics manufacturing, automotive production, and industrial equipment sectors. The country’s focus on expanding EV production and its well-established supply chain for high-performance materials contributed significantly to market growth. Additionally, favorable government policies, growing investments in semiconductor fabrication, and the presence of a large consumer electronics base propelled regional consumption of heat resistant polymers. The availability of low-cost labor and raw materials further supported large-scale production and export activities, strengthening Asia Pacific’s dominant position.

The North America heat resistant polymer market is projected to witness rapid growth in the coming years, driven by surging demand from the aerospace and defense sectors. The US is estimated to lead this growth due to increasing investments in next-generation aircraft, space exploration programs, and military technologies. American aircraft manufacturers are further prioritizing lightweight and thermally stable materials to enhance fuel efficiency and performance in extreme environments, making high resistant polymers an ideal choice. The automotive sector’s transition toward electric mobility and the growing adoption of advanced electronics in vehicles are also contributing to the rising demand for high resistant polymers in the region.

The Europe high resistant polymers market is projected to witness substantial growth due to the strong presence of automotive manufacturers such as BMW, Volkswagen, and Mercedes-Benz. These manufacturers drove substantial demand for high-performance polymers used in engine components, powertrains, and electric vehicle systems. Additionally, the region's aerospace industry, led by companies such as Airbus and Safran, is driving the adoption of advanced polymers capable of performing under high thermal and mechanical stress. Strict environmental regulations and the European Union’s push toward sustainable mobility are also encouraging manufacturers to adopt lightweight and thermally resilient alternatives to metals, further boosting industry growth.

Key Players and Competitive Analysis

The global heat resistant polymer market is highly competitive, with key players leveraging product portfolios, strategic expansions, partnerships, and mergers & acquisitions (M&A) to strengthen their market position. Major companies such as DuPont, Solvay, and BASF dominate the industry, focusing on innovation and diversification to meet growing demand from the aerospace, automotive, electronics, and industrial sectors. These players are continuously enhancing their product offerings to cater to high-performance applications. Companies are further investing in production expansions, particularly in Asia Pacific, to meet rising demand. Emerging nations such as India and Southeast Asia are witnessing increased investments due to growing automotive and electronics manufacturing.

A few prominent companies in the heat resistant polymer market are Arkema; Asahi Kasei Corporation; Avient Corporation; BASF; Borealis; Covestro AG; Daikin Industries Ltd.; DuPont; Mitsui Chemicals; PBI Advanced Materials Co., Ltd.; RTP Company; Solvay; SONGWON; and TER HELL Plastic GmbH.

Arkema is a global specialty materials company headquartered in Colombes, France, with a significant presence in over 55 countries and employing more than 21,000 people worldwide. The company was established in 2004 as part of the restructuring of Total’s chemicals business and became fully independent in 2006 after being listed on the Paris stock exchange. Arkema has strategically evolved into a major player in the specialty materials sector, focusing on innovation and sustainable development. Arkema’s business is organized into four main segments: Adhesive Solutions, Advanced Materials, Coating Solutions, and Intermediates. The company’s global reach and balanced geographical sales split across Europe, North America, and Asia. A significant area of expertise for Arkema is the development and production of heat-resistant polymers, particularly within its specialty polyamides portfolio. Arkema is recognized as a global leader in bio-based polyamides, with its flagship Rilsan Polyamide 11 (PA11) series known for over 70 years.

DuPont, is a prominent American multinational corporation with a rich legacy in the chemicals, materials, and biotechnology sectors. Founded in 1802 by Éleuthère Irénée du Pont in Delaware, the company initially specialized in the production of black powder and explosives, quickly establishing itself as a major industrial force in the US. Over the centuries, DuPont diversified its portfolio, becoming a global leader in the development of synthetic fibers, industrial chemicals, and advanced materials. The company operates a vast network of plants, subsidiaries, and affiliates worldwide, employing approximately 24,000 people. One of DuPont’s most renowned heat resistant polymers is Nomex, an aramid fiber introduced in the 1960s. Nomex is known for its exceptional thermal stability, flame resistance, and mechanical strength.

List of Key Players in Heat Resistant Polymer Market

- Arkema

- Asahi Kasei Corporation

- Avient Corporation

- BASF

- Borealis

- Covestro AG

- Daikin Industries Ltd.

- DuPont

- Mitsui Chemicals

- PBI Advanced Materials Co., Ltd.

- RTP Company

- Solvay

- SONGWON

- TER HELL Plastic GmbH

Heat Resistant Polymer Industry Developments

January 2024: Covestro is one of the world’s leading manufacturers of high-quality polymer materials and their components, announced the launch of Apec 2045, a copolycarbonate with the highest heat resistance, enabling molders and medical OEMs to slash production time and cost.

May 2023: Borealis, one of the world’s leading providers of advanced and circular polyolefin solutions, announced the launch of Stelora, a polymer offering increased strength and durability in heat-resistance capability.

March 2023: Solvay, a global market company in specialty materials, announced the introduction of high-heat and flame-retardant polymer for EV battery components.

Heat Resistant Polymer Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Fluoropolymer

- Polyphenylene Sulfide

- Polyimides

- Polyether Ether Ketone

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace & Defense

- Electrical & Electronics

- Industrial

- Marine

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heat Resistant Polymer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.68 billion |

|

Market Size Value in 2025 |

USD 21.53 billion |

|

Revenue Forecast by 2034 |

USD 49.04 billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.68 billion in 2024 and is projected to grow to USD 49.04 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

• A few of the key players in the market are Arkema; Asahi Kasei Corporation; Avient Corporation; BASF; Borealis; Covestro AG; Daikin Industries Ltd.; DuPont; Mitsui Chemicals; PBI Advanced Materials Co., Ltd.; RTP Company; Solvay; SONGWON; and TER HELL Plastic GmbH.

The fluoropolymer segment dominated the market share in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.