High Level Disinfection Services Market Size, Share, Trends, Industry Analysis Report

: By Services (In house and Outsource), Compound, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM5648

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview:

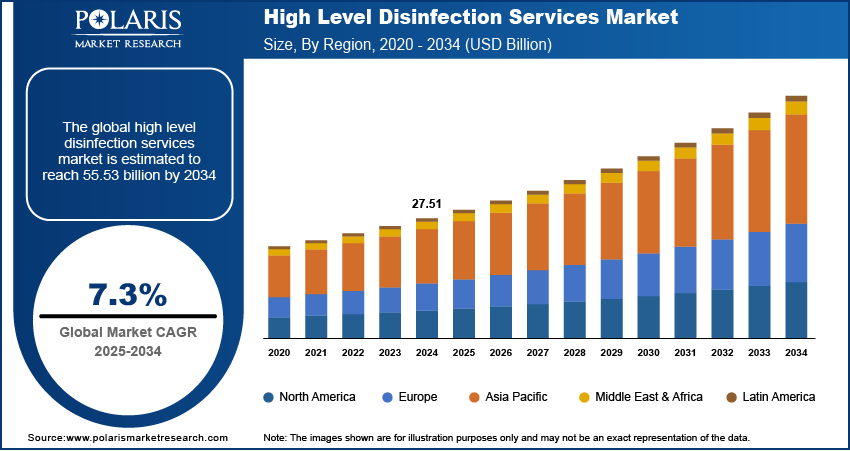

The high level disinfection services market size was valued at USD 27.51 billion in 2024, exhibiting a CAGR of 7.3% during 2025–2034. The market is driven by rising healthcare-associated infections, increasing surgical and endoscopic procedures, strict regulatory compliance, outsourcing trends, and growing global healthcare infrastructure investment.

Key Insights

Outsourcing services is preferred due to lower cost, compliance assurance, and access to advanced disinfection expertise not available in-house.

Hydrogen peroxide sees the highest growth due to safety, eco-friendliness, and adoption of vaporized systems for sensitive devices.

Hospitals and clinics hold the largest share because of high procedure volumes and strict infection prevention regulations.

North America leads the market with strong infrastructure, regulatory enforcement, and widespread use of reusable instruments.

Asia Pacific grows fastest due to increased healthcare investments, aging population, more surgeries, and rising hygiene standards.

Industry Dynamics

Rising global surgical and endoscopic procedure volumes increase the need for disinfection to prevent cross-contamination and the spread of infection.

There is a growing demand for automated disinfection systems and robotics in hospitals to improve efficiency and standardization of sterilization procedures.

Stricter regulatory compliance standards push healthcare providers toward outsourcing to ensure validated, traceable disinfection protocols and audits.

Expansion of healthcare infrastructure in emerging economies increases demand for professional HLD services and standardized sterilization support.

High costs of advanced disinfection equipment and recurring service charges hinder widespread adoption in small or rural healthcare facilities.

Market Statistics

2024 Market Size: USD 27.51 billion

2034 Projected Market Size: USD 55.53 billion

CAGR (2025–2034): 7.3%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The High Level Disinfection (HLD) Services market is defined by the provision of specialized processes aimed at eliminating all microorganisms from reusable medical devices, with the exception of a small number of bacterial spores. These services are crucial in healthcare settings to prevent the transmission of infections associated with the reuse of semi-critical medical equipment, which comes into contact with mucous membranes or non-intact skin. The demand for these services, which now include disinfection robots is significantly influenced by evolving healthcare regulations and a heightened focus on patient safety. Ensuring proper sterility of medical devices through effective disinfection protocols is a fundamental requirement, directly driving the market drive for HLD services.

Several factors contribute to the growth of the high level disinfection services market. A primary market drive is the increasing awareness and concern regarding Hospital-Acquired Infections (HAIs). The rise in surgical procedures globally also necessitates stringent disinfection practices to minimize infection risks, thereby fueling market demand. Furthermore, the expansion of healthcare infrastructure, particularly in emerging economies, coupled with stricter regulatory guidelines pertaining to hygiene and sanitation standards, are significant market growth factors. The trend of outsourcing disinfection services to specialized providers allows healthcare facilities to focus on core operations while ensuring compliance with rigorous disinfection protocols, further contributing to market development and increasing the market potential for specialized service providers.

Market Dynamics:

Heightened Focus on Infection Prevention and Control

The escalating emphasis on infection prevention and control within healthcare facilities is a significant market drive for High Level Disinfection (HLD) Services. Healthcare-associated infections (HAIs) pose a substantial threat to patient safety, increase healthcare costs, and prolong hospital stays. In the U.S. alone, HAIs account for an estimated 1.7 million infections and 99,000 associated deaths each year. Globally, hundreds of millions of patients are affected by HAIs annually. Effective disinfection practices, including high-level disinfection, are crucial in preventing these infections

For instance, a study published on the National Center for Biotechnology Information (NCBI) website in 2023, titled "Burden of healthcare-associated infections in India: A systematic review and meta-analysis," highlights the significant prevalence of HAIs in Indian healthcare settings, emphasizing the urgent need for robust infection control measures, including effective medical device disinfection. These guidelines, regularly reviewed and updated based on the latest scientific evidence, set a benchmark for infection control practices globally.

Increasing Volume of Endoscopic Procedures

The rising number of endoscopic procedures performed worldwide is another significant market drive for high level disinfection services. Endoscopy is a minimally invasive diagnostic and therapeutic procedure that involves inserting a flexible tube with a camera attached into the body to visualize internal organs and tissues. A research article published on PubMed in 2022, titled "Global trends in gastrointestinal endoscopy: a systematic review," documented a significant increase in the utilization of endoscopic procedures globally over the past few decades. The study highlighted the advancements in endoscopic techniques and their expanding applications, leading to a higher volume of procedures being performed in both inpatient and outpatient settings. Each endoscopic procedure necessitates thorough high-level disinfection to prevent the transmission of infectious agents between patients. Inadequate disinfection can lead to serious and even fatal infections.

Stringent Regulatory Landscape and Compliance Requirements

The increasingly stringent regulatory landscape governing the reprocessing of medical devices is a crucial market drive for high level disinfection services. Regulatory bodies worldwide are implementing and enforcing more rigorous standards for the disinfection and sterilization equipment to safeguard patient health. For example, the Food and Drug Administration (FDA) in the United States has established stringent guidelines for the reprocessing of reusable medical devices, including endoscopes. These guidelines outline specific steps and validation procedures that healthcare facilities must adhere to ensure effective disinfection. Non-compliance can result in severe penalties, including fines, legal action, and damage to the facility's reputation. Similarly, various government health organizations and international bodies issue recommendations and standards for infection control practices, emphasizing the importance of proper device reprocessing. A guidance document published by the World Health Organization (WHO) in 2023, titled "Decontamination and reprocessing of medical devices for health-care facilities," provides comprehensive recommendations on the appropriate methods for cleaning, disinfection, and sterilization of medical devices, highlighting the critical role of HLD for semi-critical instruments.

Segment Insights:

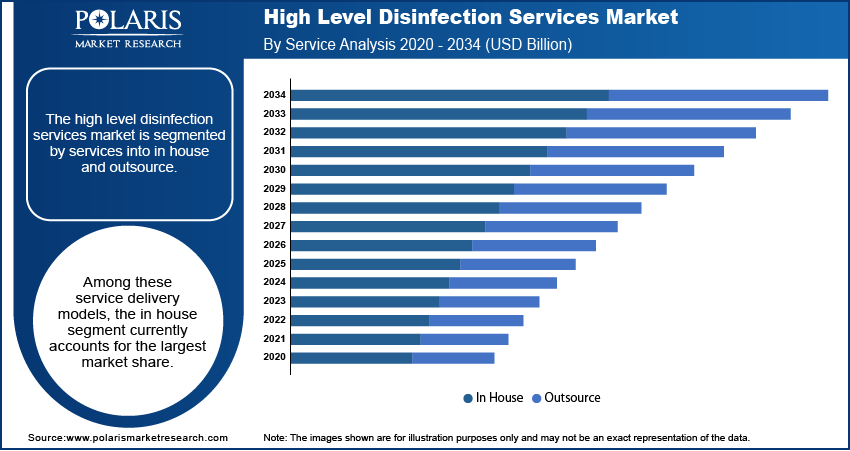

Market Assessment – By Service

The high level disinfection services market is segmented by services into in house and outsource. Among these service delivery models, the outsource segment currently accounts for the largest market share. This dominance can be attributed several compelling factors. Healthcare facilities, facing increasing pressures to optimize operational efficiency and reduce costs, are recognizing the benefits of entrusting specialized disinfection companies with their HLD needs. Outsourcing provides access to expertise, advanced technologies, and standardized processes that may not be readily available or cost-effective to implement in house. Moreover, the complexities of evolving regulatory requirements and the need for meticulous documentation and quality assurance make outsourcing an attractive option for ensuring compliance and mitigating potential liabilities.

The in house segment is exhibiting the highest growth rate within the high level disinfection services market. This accelerated growth is driven by to the historical preference of larger healthcare institutions to maintain direct control over critical processes like medical device disinfection. By performing HLD in house, hospitals and large clinics aim to ensure adherence to their specific protocols, maintain immediate oversight of quality control, and integrate disinfection processes seamlessly within their existing operational workflows. The established infrastructure and trained personnel within these facilities have historically supported the prevalence of in house HLD services. Furthermore, the perception of greater cost-effectiveness and the desire to manage potential risks directly have contributed to the significant market penetration of this segment.

Market Evaluation– By Compound

The high level disinfection services market is segmented by compound into formaldehyde, glutaraldehyde, ortho-phthalaldehyde, hydrogen peroxide, peracetic acid, and others. Among these chemical compounds utilized in HLD processes, glutaraldehyde currently commands the largest market share. This significant share can be attributed to its long-standing history of effective broad-spectrum antimicrobial activity and its compatibility with a wide range of medical devices. Glutaraldehyde-based disinfectants have been a mainstay in healthcare settings for decades, providing a reliable and relatively cost-effective solution for high-level disinfection. The established protocols and familiarity among healthcare professionals with glutaraldehyde-based HLD processes have contributed to its continued widespread adoption and thus, its dominant market penetration.

The hydrogen peroxide segment is experiencing the highest growth rate within the high level disinfection services market. This rapid expansion is fueled by increasing concerns regarding the potential toxicity and environmental impact associated with traditional disinfectants like glutaraldehyde. Hydrogen peroxide offers a more environmentally friendly alternative, breaking down into water and oxygen. Furthermore, advancements in hydrogen peroxide-based disinfection technologies, such as vaporized hydrogen peroxide systems, are enhancing their efficacy and broadening their application scope, particularly for sterilizing heat-sensitive equipment and enclosed spaces. The growing emphasis on worker safety and environmental sustainability, coupled with the development of innovative hydrogen peroxide-based disinfection methods, is significantly contributing to the accelerated market development and increasing market potential of this compound segment within the high level disinfection services market.

Market Evaluation– By End Use

The high level disinfection services market is segmented by end use into hospitals & clinics, diagnostic laboratories, pharmaceutical & biotechnology companies, academic & research institutes, and others. Currently, the hospitals & clinics segment accounts for the largest share of the high level disinfection services market. This dominance is primarily driven by the high volume of surgical and diagnostic procedures performed in these settings, which necessitate the frequent reprocessing of semi-critical medical devices. The stringent infection control protocols mandated in hospitals and clinics, such as using ultrasound probe disinfection methods coupled with the sheer number of reusable instruments requiring high-level disinfection on a daily basis, contribute significantly to the substantial market penetration of HLD services within this end-use segment. The established infrastructure and the critical need to prevent healthcare-associated infections in these primary healthcare delivery points solidify the leading position of hospitals & clinics in the overall market demand.

The pharmaceutical & biotechnology companies segment is exhibiting the highest growth rate within the high level disinfection services market. This rapid growth is fueled by the increasing focus on sterile manufacturing processes and the stringent regulatory requirements governing the production of pharmaceutical and biological products. The need to prevent contamination in research, development, and manufacturing environments within this sector is paramount. High-level disinfection and sterilization play a crucial role in ensuring the integrity and safety of pharmaceutical and biotechnology products. The expanding activities in drug discovery, clinical trials, and biopharmaceutical manufacturing are driving a greater demand for specialized HLD services that can meet the rigorous standards of this industry. The increasing investments in research and development within the pharmaceutical and biotechnology sectors, coupled with the growing emphasis on product quality and safety, are significant market growth factors contributing to the accelerated development of the HLD services market within this end-use segment.

Regional Footprint

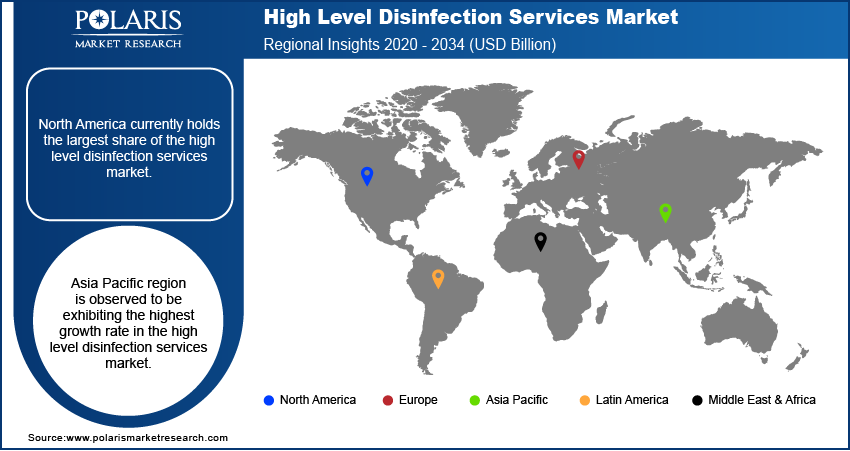

Referring to available industry reports, a general overview of the regional landscape for the high level disinfection services market reveals a global presence with varying degrees of market maturity and growth potential across different geographies. North America and Europe have historically represented significant markets, characterized by well-established healthcare infrastructures and stringent regulatory frameworks emphasizing infection prevention. The Asia Pacific region is recognized as a high-growth area, driven by expanding healthcare access, increasing healthcare expenditure, and a growing awareness of infection control measures. Latin America and the Middle East & Africa represent markets with considerable potential, witnessing increasing investments in healthcare infrastructure and a rising focus on improving hygiene standards, although their current market size is comparatively smaller.

Among the regions analyzed, North America currently holds the largest share of the high level disinfection services market. This dominance can be attributed to several factors, including the presence of a sophisticated and well-established healthcare system, stringent regulatory guidelines regarding medical device reprocessing, and a high awareness of healthcare-associated infections. The significant volume of surgical procedures and diagnostic tests performed annually in North American healthcare facilities generates a substantial and consistent demand for reliable high-level disinfection services. Furthermore, the presence of major healthcare providers and a strong emphasis on patient safety contribute to the leading market position of North America.

Conversely, the Asia Pacific region is observed to be exhibiting the highest growth rate in the high level disinfection services market. This rapid expansion is fueled by a confluence of factors, including the increasing investments in healthcare infrastructure across developing economies within the region, a growing geriatric population susceptible to infections, and a rising awareness of the importance of infection prevention and control. The expanding healthcare expenditure and the implementation of more stringent hygiene standards by governments in countries like China and India are creating significant market opportunities for HLD service providers. The increasing number of hospitals and clinics, coupled with a growing emphasis on quality healthcare services, is driving the accelerated market development and enhancing the market potential of the Asia Pacific region.

Key Players and Competitive Insights

The high level disinfection services market includes several prominent players actively providing crucial services. These include STERIS Corporation, ASP Global Manufacturing GmbH (Fortive Corporation), Cantel Medical Corp. (now part of STERIS Corporation but mentioning it as a reference point for historical context), Getinge AB, Ecolab Inc., Metrex Research, LLC (Envista Holdings Corporation), Advanced Sterilization Products (ASP) (Fortive Corporation), Ruhof Corporation, 3M Company, and Wassenburg Medical B.V. These entities offer a range of solutions and services aimed at ensuring the effective high-level disinfection of medical devices across various healthcare settings.

The competitive landscape of the high level disinfection services market is characterized by a mix of well-established global players and smaller, specialized regional providers. Competition is driven by factors such as service quality, technological advancements in disinfection methods, cost-effectiveness, compliance with stringent regulatory standards, and the breadth of service offerings. Market insights suggest a growing trend towards outsourcing of HLD services, creating opportunities for companies that can provide efficient, reliable, and compliant solutions. Key competitive strategies include expanding service portfolios, strengthening geographical presence, and forming strategic partnerships with healthcare facilities to enhance market penetration and address evolving market demand trends.

STERIS Corporation, headquartered in Dublin, Ohio, United States, offers a comprehensive suite of infection prevention and control products and services, including high-level disinfection for medical devices. Their offerings encompass automated endoscope reprocessors, a wide range of high-level disinfectants, and instrument processing services, making them a significant entity in ensuring the safety and sterility of reusable medical equipment.

Getinge AB, based in Gothenburg, Sweden, provides a broad spectrum of solutions for healthcare and life sciences, including advanced systems for disinfection and sterilization. Their portfolio relevant to the high level disinfection services market includes automated reprocessors for endoscopes and other medical instruments, as well as a variety of disinfectant chemistries, playing a vital role in supporting infection control practices in healthcare facilities globally.

List of Key Companies

- 3M Company

- Advanced Sterilization Products (ASP) (Fortive Corporation)

- Cantel Medical Corp. (now part of STERIS Corporation)

- Ecolab Inc.

- Getinge AB

- Metrex Research, LLC (Envista Holdings Corporation)

- Ruhof Corporation

- STERIS Corporation

- Wassenburg Medical B.V.

High Level Disinfection Services Industry Developments

- July 2024: STERIS, a provider of infection prevention solutions, announced the launch of a new ethylene oxide (EO) processing facility in Singapore. This development is intended to enhance medical device manufacturing capabilities across Asia by expanding EO processing capacity in the region.

- June 2024: Metall Zug and Miele completed the formation of a joint venture, uniting their subsidiaries—Belimed Infection Control, Belimed Life Science, and Steelco—under a new brand name: SteelcoBelimed. This strategic collaboration is designed to establish a leading player in the Infection Control and Life Science markets by leveraging the combined expertise and resources of both companies.

High Level Disinfection Services Market Segmentation

By Service Outlook (Revenue-USD Billion, 2020–2034)

- In house

- Outsource

By Compound Outlook (Revenue-USD Billion, 2020–2034)

- Formaldehyde

- Glutaraldehyde

- Ortho-phthalaldehyde

- Hydrogen Peroxide

- Peracetic Acid

- Others

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 27.51 billion |

|

Market Size Value in 2025 |

USD 29.45 billion |

|

Revenue Forecast by 2034 |

USD 55.53 billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The high level disinfection services market has been segmented into detailed segments of service, compound, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth strategies within the high level disinfection services market are increasingly focused on expanding service portfolios to include a wider range of disinfection solutions and technologies. Market penetration is being enhanced through strategic partnerships with healthcare facilities, offering customized and cost-effective outsourcing options. Marketing efforts emphasize the critical role of proper disinfection in preventing healthcare-associated infections and ensuring patient safety, highlighting compliance with stringent regulatory standards. Educational initiatives targeting healthcare professionals underscore the benefits of utilizing specialized HLD services. Furthermore, companies are focusing on technological advancements and environmentally friendly disinfection methods to cater to evolving market demand trends and sustainability concerns, thereby driving market development and increasing their market share.

FAQ's

The high level disinfection services market size was valued at USD 27.51 billion in 2024 and is projected to grow to USD 55.53 billion by 2034.

The market is projected to register a CAGR of 7.3% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the high level disinfection services market include STERIS Corporation, ASP Global Manufacturing GmbH (Fortive Corporation), Cantel Medical Corp. (now part of STERIS Corporation but mentioning it as a reference point for historical context), Getinge AB, Ecolab Inc., Metrex Research, LLC (Envista Holdings Corporation), Advanced Sterilization Products (ASP) (Fortive Corporation), Ruhof Corporation, 3M Company, and Wassenburg Medical B.V.

The hospitals & clinics segment accounted for the larger share of the market in 2024.

High Level Disinfection (HLD) Services refer to the specialized processes used in healthcare settings to eliminate all microorganisms from reusable medical devices, with the exception of a small number of bacterial spores. These services are crucial for semi-critical devices, which come into contact with mucous membranes or non-intact skin, as they significantly reduce the risk of healthcare-associated infections (HAIs). HLD aims to render these devices safe for patient use by inactivating bacteria, viruses, fungi, and mycobacteria. While HLD does not achieve the sterility of sterilization processes (which eliminates all microorganisms, including bacterial spores), it provides a necessary level of safety for devices that cannot withstand sterilization methods, such as certain heat-sensitive instruments.