High Purity Alumina Market Size, Share, Trends, Industry Analysis Report

: By Product (4N, 5N, and 6N), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1509

- Base Year: 2024

- Historical Data: 2020-2023

High Purity Alumina Market Overview

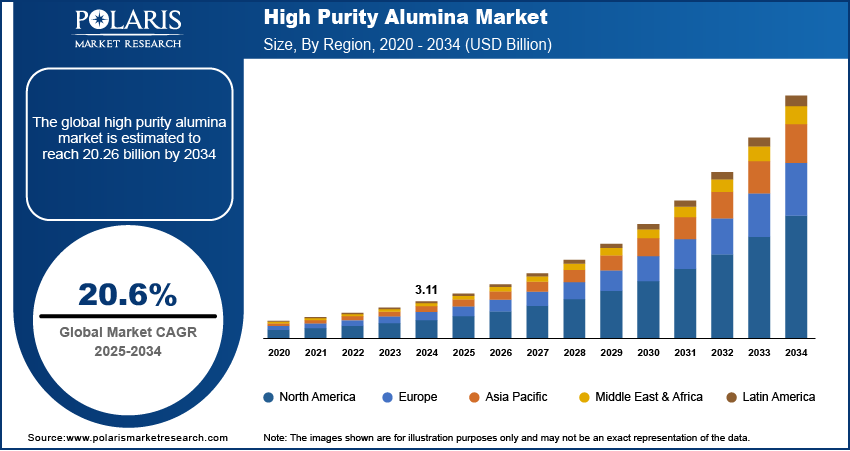

The global high purity alumina market size was valued at USD 3.11 billion in 2024. The market is projected to grow from USD 3.75 billion in 2025 to USD 20.26 billion by 2034. It is projected to exhibit a CAGR of 20.6% from 2025 to 2034.

Aluminum oxide or alumina is the primary raw material used in the production of metallic aluminum. High purity alumina is one of the purest forms of aluminum oxide. Several methods are used to produce high-purity alumina, including vapor phase oxidation, thermal decomposition of ammonium alum, aluminum alkoxide hydrolysis, and underwater spark discharge with aluminum. The hydrolysis of aluminum alkoxide is the most common and widely used method for high purity alumina production. High purity alumina is extensively used in industries such as LED and semiconductor manufacturing worldwide.

To Understand More About this Research: Request a Free Sample Report

The rising emphasis on reducing electricity consumption and the growing adoption of micro LED technology are among the primary factors driving the high purity alumina market demand. The growing electric vehicle (EV) industry, which requires high purity alumina for the production of lithium-ion batteries, further supports market development.

Rising product innovations and increasing investments in research and development (R&D) initiatives are anticipated to drive the high purity alumina market growth in the coming years. The increasing use of high purity alumina in the production of scratch-resistant glasses for watches and smartphones is projected to provide lucrative high purity alumina market opportunities during the forecast period.

High Purity Alumina Market Dynamics

Rising Use in Production of Synthetic Sapphire and Batteries

Synthetic sapphire and lithium-ion batteries are the two major consumers of high purity alumina. High purity alumina is used in the production of solid pucks for lithium-ion batteries that are 99.99% pure (4N grade). Also, it is used to make solid pucks for synthetic sapphire that are 99.9999% pure (5N grade). In batteries, the use of high-purity alumina increases its thermal capacity, reduces the risk of thermal runaway, and lowers the chances of infrequent burns. Thus, the rising use of high purity alumina in the production of batteries and synthetic sapphire drives the high purity alumina market expansion.

Growing Demand for High-Quality Industrial Ceramics

The rising need for efficient and durable components in industries such as chemical processing and mining is driving the demand for high-quality advance ceramics. High purity alumina is used in the production of several high-quality industrial ceramics, such as crucibles for high-purity metals and wear-resistant parts. The use of high purity alumina in these ceramics enables high precision and durability, resulting in greater efficiency and longer lifespan of these products. Thus, the growing demand for high purity alumina for producing high-quality industrial ceramics supports the high purity alumina market development.

High Purity Alumina Market Segment Insights

High Purity Alumina Market Outlook by Product Insights

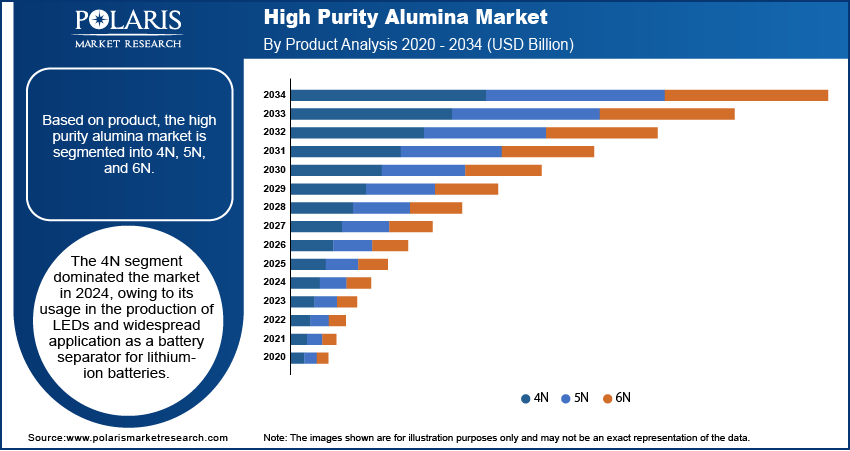

The high purity alumina market, based on product, is segmented into 4N, 5N, and 6N. The 4N segment dominated the market with a revenue share of 43.1% in 2024. The dominance of the 4N segment is primarily attributed to its usage in the production of LEDs. Also, it finds widespread application as a battery separator for lithium-ion batteries. The booming lighting and EV industries globally contribute to the largest share of the 4N segment in the market.

High Purity Alumina Market Assessment by Application Insights

The high purity alumina market, based on application, is segmented into LED, semiconductor, phosphor, sapphire, lithium-ion batteries, and others. The LED segment accounted for the largest market revenue share of 52.70% in 2024. High purity alumina serves as the base material for producing synthetic sapphire crystals, which are then used to make high-brightness LEDs. The increasing adoption of LEDs in various applications, including multimedia displays, mobile phone backlights, and ambient lighting, drives the segment’s robust growth in the market.

High Purity Alumina Market Regional Analysis

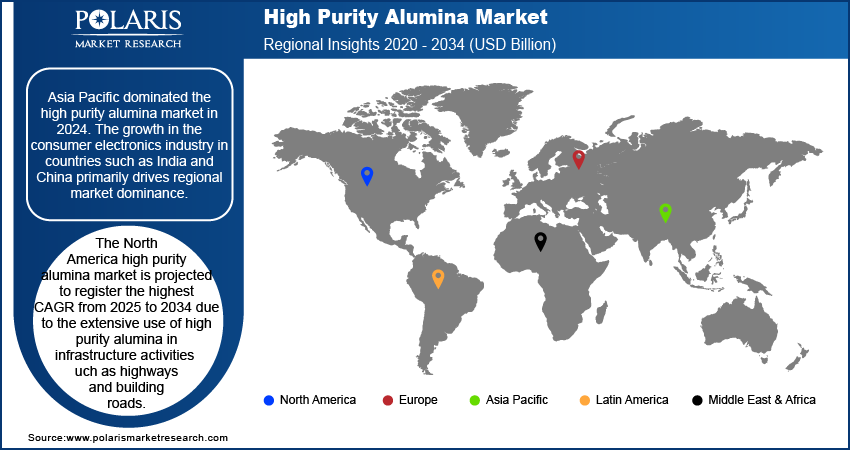

By region, the market report offers high purity alumina market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with an overall revenue share of 74% in 2024. The growth of the consumer electronics industry in countries such as India and China is a major factor contributing to the dominance of the region in the global market. Further, the high demand for LEDs as a more environmentally friendly solution has a positive impact on the regional market expansion.

The North America high purity alumina market is projected to register the highest CAGR from 2025 to 2034 due to the extensive use of high purity alumina in infrastructure activities such as highways and building roads. Also, rising smartphone penetration and the booming automotive industry are anticipated to contribute to the rapid growth of the regional market.

High Purity Alumina Market – Key Players and Competitive Insights

The high purity alumina market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, and strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives and focusing on strategic initiatives such as partnerships, collaborations, and mergers and acquisitions to introduce new solutions that cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly high-purity alumina that comply with stringent government regulations. The high purity alumina market research report offers a market assessment of all the leading players, including Alpha HPA; Baikowski; CoorsTek Inc.; Almatis, Inc.; Altech Chemicals Ltd.; FYI RESOURCES; Orbite Technologies Inc.; Polar Sapphire Ltd.; HONGHE CHEMICAL; Nippon Light Metal Holdings Co., Ltd.; and Sumitomo Chemical Co., Ltd.

List of Key Companies in High Purity Alumina Market

- Alpha HPA

- Baikowski

- CoorsTek Inc.

- Almatis, Inc.

- Altech Chemicals Ltd.

- FYI RESOURCES

- Orbite Technologies Inc.

- Polar Sapphire Ltd.

- HONGHE CHEMICAL

- Nippon Light Metal Holdings Co., Ltd.

- Sumitomo Chemical Co., Ltd.

High Purity Alumina Industry Developments

August 2024: Alpha HPA announced the commencement of the stage 2 construction of its high-purity aluminum materials manufacturing capacity. According to Alpha, the new facility aims to produce high-purity aluminum for sectors such as lithium-ion batteries and semiconductors.

August 2023: Sumitomo Chemical announced the introduction of a new technology for the mass production of ultra-fine α-alumina. The company stated that the ultra-fine α-alumina will mainly be used in industrial products.

High Purity Alumina Market Segmentation

By Product Outlook

- 4N

- 5N

- 6N

By Technology Outlook

- Hydrolysis

- HCL Based

By Application Outlook

- LED

- Semiconductor

- Phosphor

- Sapphire

- Lithium-Ion Batteries

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Purity Alumina Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.11 billion |

|

Market Size Value in 2025 |

USD 3.75 billion |

|

Revenue Forecast by 2034 |

USD 20.26 billion |

|

CAGR |

20.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 3.11 billion in 2024 and is projected to grow to USD 20.26 billion by 2034

The market is projected to register a CAGR of 20.6% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Alpha HPA; Baikowski; CoorsTek Inc.; Almatis, Inc.; Altech Chemicals Ltd.; FYI RESOURCES; Orbite Technologies Inc.; Polar Sapphire Ltd.; HONGHE CHEMICAL; Nippon Light Metal Holdings Co., Ltd.; and Sumitomo Chemical Co., Ltd.

The 4N segment accounted for the largest market share in 2024.

The LED segment accounted for the largest market revenue share in 2024.