High Speed Blowers Market Size, Share, Trends, & Industry Analysis Report

By Type (Centrifugal Blowers, Axial Blowers, Cross-Flow Blowers, and Others), By Power Source, By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5792

- Base Year: 2024

- Historical Data: 2020-2023

Overview

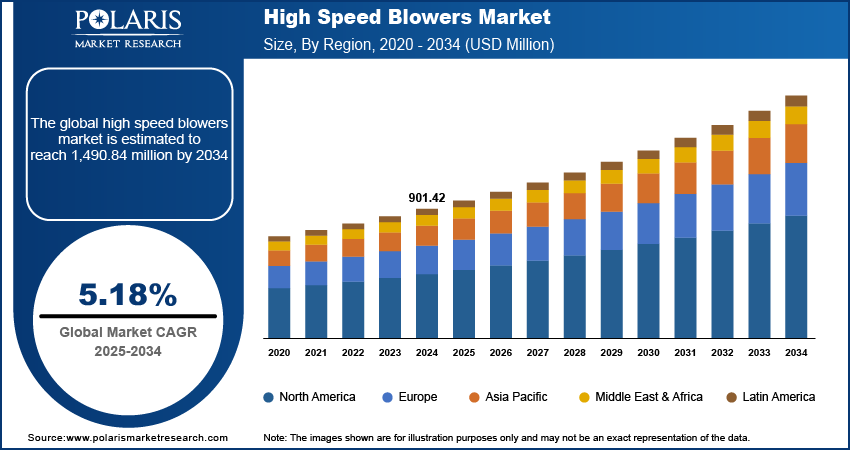

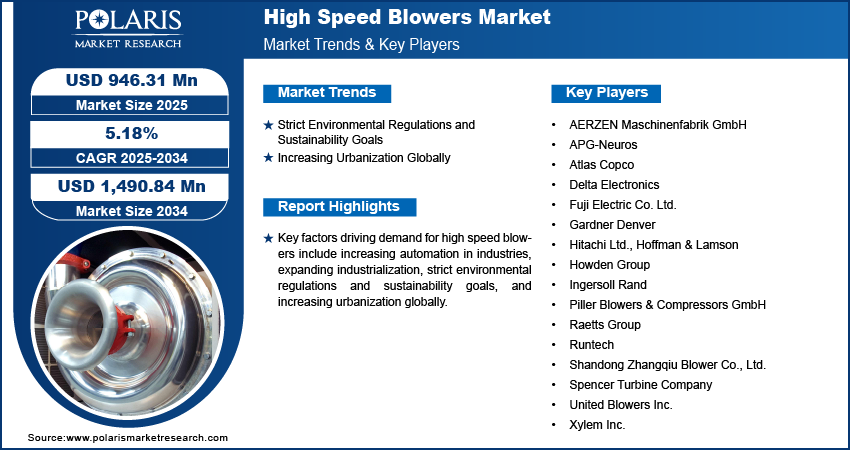

The global high speed blowers market size was valued at USD 901.42 million in 2024, growing at a CAGR of 5.18 % during 2025–2034. Key factors driving demand for high speed blowers include increasing automation in industries, expanding industrialization, strict environmental regulations and sustainability goals, and increasing urbanization globally.

High speed blowers are advanced industrial devices designed to move large volumes of air or gas at high pressure and velocity by operating at higher rotational speeds compared to conventional blowers. These blowers typically consist of an electric motor coupled with impellers. The usage of high speed blowers spans across a broad range of industrial and commercial applications due to their efficiency, compactness, and adaptability. The benefits of high speed blowers include higher energy efficiency, reduced operational noise, and enhanced reliability compared to traditional blowers.

The increasing automation in industries is driving the market growth. Automated manufacturing processes in industries require a consistent and reliable air supply for tasks such as material handling, cooling, and ventilation, where high speed blowers deliver optimal performance. These blowers integrate seamlessly with automated systems, providing precise airflow control, which reduces energy waste and improves operational reliability. Additionally, automation increases production speeds, necessitating the use air-moving solutions, including high speed blowers, to handle higher workloads without downtime. Therefore, as industries adopt smart or automated factories and IoT-enabled equipment, high speed blowers become essential for maintaining high-speed, low-maintenance operations.

The high speed blowers demand is driven by the expanding industrialization. Owing to the rapid industrialization, companies seek equipment that can efficiently manage air movement, ventilation, and cooling in high-load operations. High speed blowers meet these needs by offering the performance and energy efficiency required to support continuous, large-scale industrial processes. Various industries such as chemical, oil and gas, cement, and wastewater treatment are increasingly using these blowers to ensure stable airflow, remove contaminants, and maintain operational safety. Hence, as industrialization expands, the demand for high speed blowers also rises.

Industry Dynamics

Strict Environmental Regulations and Sustainability Goals

Governments and regulatory bodies worldwide are increasingly mandating lower emissions include CO₂, CH₄, NOₓ, SO₂, PM, VOCs, and N₂O, better waste management, and reduced energy consumption across sectors such as wastewater treatment, power generation, and manufacturing. High speed blowers help industries meet these requirements by offering high energy efficiency, lower carbon footprints, and reduced operational noise. Sustainability initiatives are also encouraging industries to upgrade aging infrastructure with modern, low-emission equipment. High speed blowers align with these goals by supporting clean air systems, efficient combustion, and optimized environmental controls. Therefore, as industries focus on complying with environmental standards and demonstrating corporate responsibility, the adoption of high speed blowers continues to rise.

Increasing Urbanization Globally

Urbanization increases the demand for efficient wastewater treatment, air purification, and HVAC systems to support residential, commercial, and industrial needs. High speed blowers play a crucial role in these applications by enabling effective aeration in sewage treatment plants, improving air circulation in densely populated buildings, and supporting clean air systems in public spaces. Urban construction and infrastructure projects also require dust control and ventilation solutions, which further increases the need for high performance blowers. Additionally, urban manufacturing hubs are prioritizing compact and energy-efficient equipment, making high speed blowers an ideal choice. World Economic Forum in its 2022 report stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Therefore, the rising urbanization is creating a strong and sustained demand for high speed blowers across multiple applications.

Segmental Insights

By Type Analysis

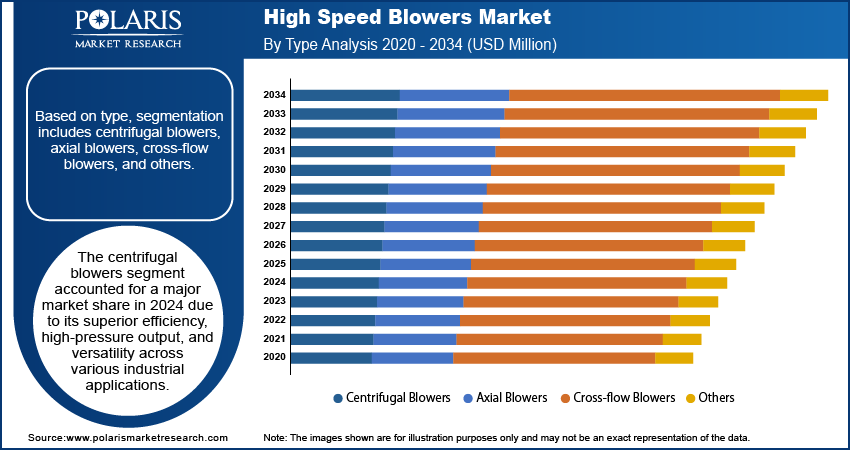

Based on type, the segmentation includes centrifugal blowers, axial blowers, cross-flow blowers, and others. The centrifugal blowers segment accounted for a major market share in 2024 due to its superior efficiency, high-pressure output, and versatility across various industrial applications. Industries such as water and wastewater treatment, chemical processing, and power generation rely heavily on these blowers for their ability to handle large volumes of air and gases under high-pressure conditions. The compact design, low noise, and ability of centrifugal blowers to operate in harsh environments have further contributed to their widespread adoption. Additionally, increasing investments in infrastructure development and environmental management projects have propelled the demand for high-performance air-moving equipment, strengthening the dominance of centrifugal blowers.

The axial blowers segment is projected to grow at a robust pace in the coming years, owing to the expanding HVAC, tunnel ventilation, and mining industries. The simple design, lower manufacturing costs, and energy efficiency of axial blowers are appealing to facility managers seeking cost-effective solutions. Moreover, technological advancements in blade design and materials are improving the reliability and performance of axial configurations, making them a preferred choice in both developed and emerging markets. The rise in urbanization and smart city initiatives is projected to fuel their adoption across commercial and public infrastructure projects.

By Power Source Analysis

In terms of power source, the segmentation includes corded electric and battery powered. The corded electric segment held a larger market share in 2024 due to its consistent power output, operational reliability, and widespread usage across industrial and commercial settings. Industries such as manufacturing, automotive, and wastewater treatment favor corded models due to their ability to support continuous, heavy-duty operations without the limitations of battery life. These blowers offer greater airflow capacity and are better suited for applications that demand sustained performance over long periods. Furthermore, the availability of stable electric infrastructure in developed regions and the relatively lower operational costs compared to fuel-powered alternatives have reinforced the dominance of corded electric units.

By Technology Analysis

Based on technology, the segmentation includes magnetic bearings and airfoil bearings. The magnetic bearings dominated the market share in 2024 due to their high precision, minimal friction, and suitability for industrial applications. Many industries such as oil and gas, semiconductor manufacturing, and power generation rely heavily on this technology for its ability to operate at extremely high speeds and under harsh conditions. The growing emphasis on energy efficiency and reduced maintenance downtime further strengthened the preference for magnetic bearings, as they enable smoother operation and lower overall lifecycle costs. Additionally, increased adoption of automation and smart control systems has driven demand for magnetic bearing technology that integrates well with digital monitoring platforms.

By Application Analysis

Based on application, the segmentation includes wastewater treatment, oil & gas, chemical, marine, food & beverages, and others. The chemical segment is projected to grow at a robust pace in the coming years, owing to stringent process requirements and increasing adoption of advanced production systems. Chemical manufacturing demands high-precision air handling equipment such as high speed blowers for processes involving combustion, drying, and ventilation. Rising global demand for specialty and fine chemicals, along with ongoing expansions of production facilities in Asia Pacific and the Middle East, is projected to drive the need for high-performance blowers with advanced bearing technologies and energy-saving features. The trend toward automation and sustainability is also expected to fuel the adoption of high speed blowers in the chemical industry.

Regional Analysis

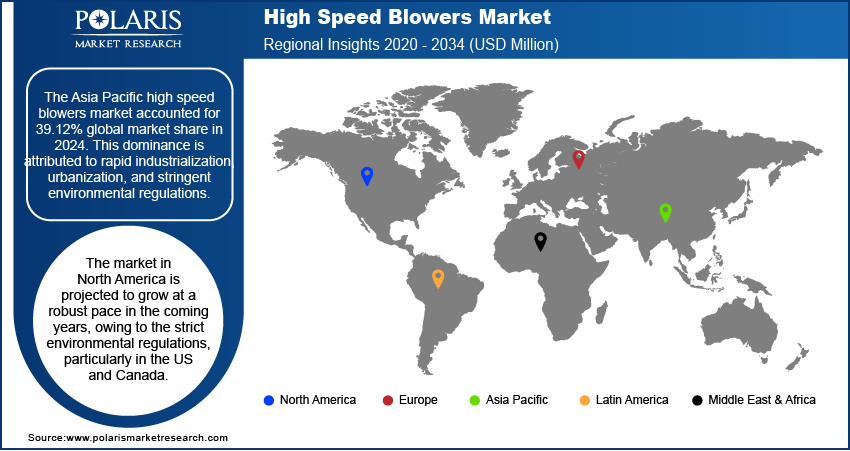

The Asia Pacific high speed blowers market accounted for 39.12% global market share in 2024. This dominance is attributed to rapid industrialization, urbanization, and stringent environmental regulations. United Nations Human Settlements Programme in its report stated that by 2050, the urban population in Asia is expected to grow by 50%. Countries such as China, Japan, and South Korea invested heavily in wastewater treatment plants, power generation, and chemical processing industries, where high speed blowers are essential for aeration and gas handling. Additionally, the shift toward energy-efficient technologies to reduce operational costs and carbon emissions boosted high speed blowers adoption in the region. Governments' investments in sustainable infrastructure further propelled market growth in the region.

India High Speed Blowers Market Insight

India accounted for a major regional market share in 2024 due to expanding wastewater treatment facilities, propelled by government initiatives such as the Namami Gange program and Smart Cities Mission. The industrial sector, including pharmaceuticals, textiles, and food processing, in the country has increasingly adopted energy-efficient high speed blowers to comply with environmental norms and reduce energy consumption. Additionally, India’s focus on renewable energy and industrial automation contributed to the need for reliable, high speed blowers in various applications such as chemical processing and wastewater treatment.

North America High Speed Blowers Market

The market in North America is projected to grow at a robust pace in the coming years, owing to the strict environmental regulations, particularly in the US and Canada, which mandate efficient wastewater and air pollution control systems. The oil & gas, chemical, and manufacturing sectors in the region are rapidly adopting high speed blowers for processes such as pneumatic conveying and combustion air supply. The trend toward modernizing aging infrastructure with energy-efficient systems is further propelling the market growth.

US High Speed Blowers Market Overview

In the US, the demand for high speed blowers is fueled by advancements in wastewater treatment, industrial automation, and HVAC systems. The EPA’s stringent emission standards are further pushing industries to adopt high speed blowers in the country. Additionally, the increasing production of shale gas in the country is propelling the consumption of high speed blowers.

Europe High Speed Blowers Market

In Europe, demand for high speed blowers is driven by the region’s strong emphasis on sustainability and energy efficiency. The EU’s Circular Economy Action Plan and strict wastewater directives are necessitating the use of advanced aeration systems such as high speed blowers in treatment plants. Industries such as food & beverage, pharmaceuticals, and chemicals in the region are adopting high speed blowers to meet regulatory standards. Additionally, Europe’s focus on renewable energy and hydrogen economy is creating new opportunities for high performance blowers.

Key Players & Competitive Analysis

The high speed blower market is witnessing intense competition as key players expand their product portfolios, forge strategic partnerships, and engage in mergers & acquisitions (M&A) to strengthen their market positions. Major manufacturers such as Atlas Copco, Ingersoll Rand, and Aerzen are investing in energy-efficient, variable-speed blower technologies to meet rising demand from wastewater treatment, pneumatic conveying, and industrial air applications. Companies such as Howden Group are broadening their offerings with integrated smart control systems and IoT-enabled solutions, enhancing operational efficiency and predictive maintenance capabilities. Strategic partnerships are playing a crucial role in market expansion. Emerging players are leveraging joint ventures to penetrate international markets, particularly in Southeast Asia and Africa.

A few major companies operating in the high speed blowers industry include APG-Neuros; Atlas Copco; Delta Electronics; Fuji Electric Co. Ltd.; Gardner Denver; Howden Group; Raetts Group; Runtech; Shandong Zhangqiu Blower Co., Ltd.; United Blowers Inc.; Spencer Turbine Company; Xylem Inc.; Ingersoll Rand; Hitachi Ltd.; Piller Blowers & Compressors GmbH; and Hoffman & Lamson.

Key Players

- AERZEN Maschinenfabrik GmbH

- APG-Neuros

- Atlas Copco

- Delta Electronics

- Fuji Electric Co. Ltd.

- Gardner Denver

- Hitachi Ltd.

- Hoffman & Lamson

- Howden Group

- Ingersoll Rand

- Piller Blowers & Compressors GmbH

- Raetts Group

- Runtech

- Shandong Zhangqiu Blower Co., Ltd.

- Spencer Turbine Company

- United Blowers Inc.

- Xylem Inc.

Industry Developments

March 2025: Runtech, a global provider of engineered systems, launched a new EP Turbo Blower model, EP650 AMB, for paper machine vacuum systems. EP650 features active magnetic bearings technology.

August 2023: Delta Electronics announced the launch of its high-speed maglev blower to improve energy efficiency and address challenges associated with traditional blower motors.

High Speed Blowers Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Centrifugal Blowers

- Axial Blowers

- Cross-flow Blowers

- Others

By Power Source Outlook (Revenue, USD Million, 2020–2034)

- Corded Electric

- Battery Powered

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Magnetic Bearings

- Airfoil Bearings

By Application Outlook (Revenue, USD Million, 2020–2034)

- Wastewater Treatment

- Oil & Gas

- Chemical

- Marine

- Food & Beverages

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Speed Blowers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 901.42 Million |

|

Market Size in 2025 |

USD 946.31 Million |

|

Revenue Forecast by 2034 |

USD 1,490.84 Million |

|

CAGR |

5.18% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 901.42 million in 2024 and is projected to grow to USD 1,490.84 million by 2034.

The global market is projected to register a CAGR of 5.18% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are APG-Neuros; Atlas Copco; Delta Electronics; Fuji Electric Co. Ltd.; Gardner Denver; Howden Group; Raetts Group; Runtech; Shandong Zhangqiu Blower Co., Ltd.; United Blowers Inc.; Spencer Turbine Company; Xylem Inc.; Ingersoll Rand; Hitachi Ltd.; Piller Blowers & Compressors GmbH; and Hoffman & Lamson.

The centrifugal blowers segment dominated the market share in 2024.

The chemical segment is expected to witness the fastest growth during the forecast period.