Home Standby Gensets Market Share, Size, Trends, Industry Analysis Report

By Phase (Single Phase, Three Phase), By Fuel, By Product, By Power Rating, By Region, Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 113

- Format: PDF

- Report ID: PM2231

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

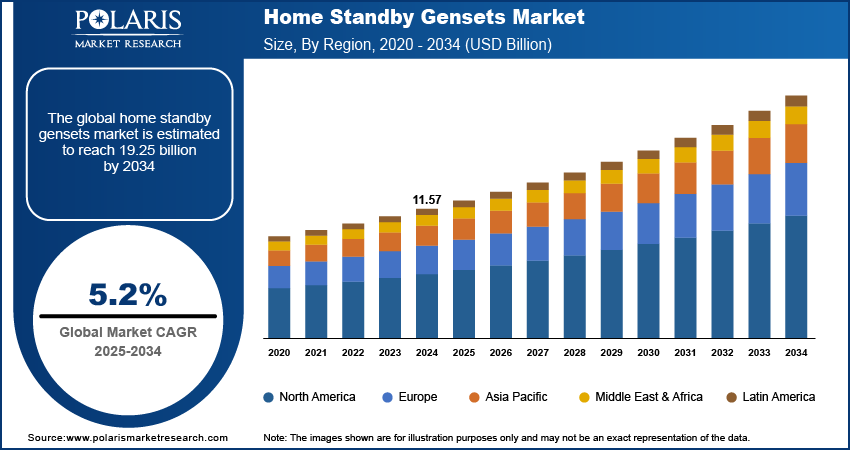

The global home standby gensets market was valued at USD 11.57 Billion in 2024 and is expected to grow at a CAGR of 5.2% during the forecast period. The growth is driven by rising numbers of strategic mergers and acquisitions, partnerships, collaborations, and product launches, among the industry players.

Key Insights

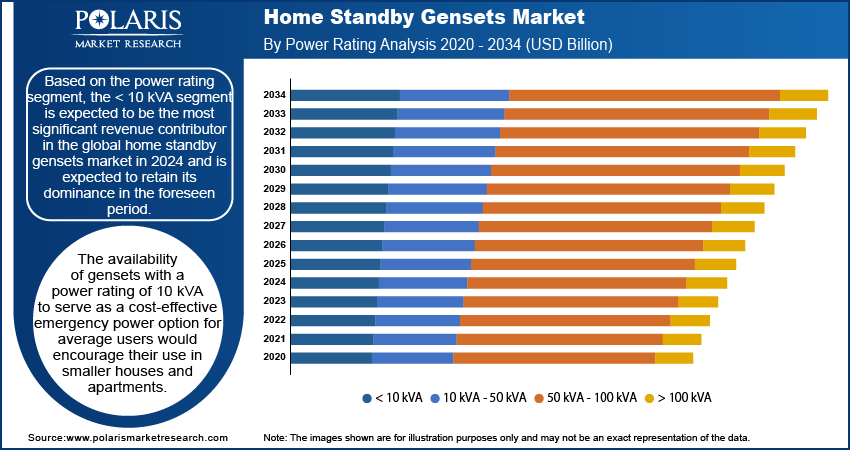

- The < 10 kVA segment is expected to be the most significant revenue contributor in the 2024 due to its cost effectiveness.

- The diesel segment accounted for largest share in the global home standby gensets market in 2024 driven by their advantages such as fuel efficiency under continuous usage.

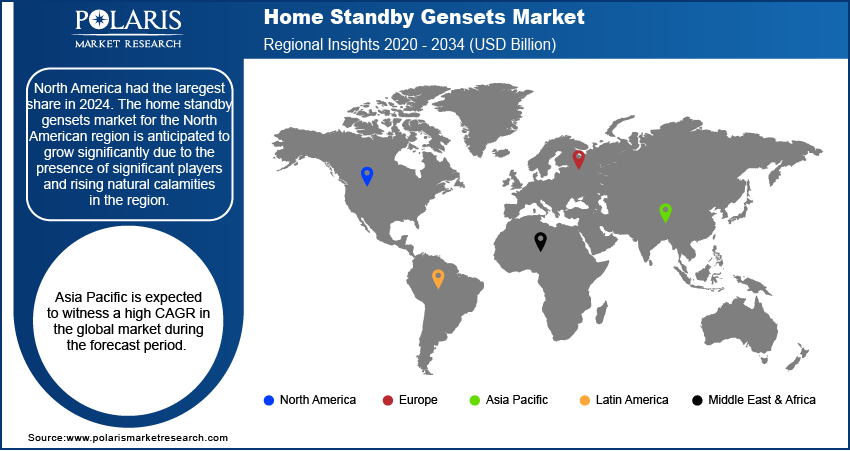

- North America held largest share due to the presence of significant players and rising natural calamities in the region.

- Asia Pacific is expected to witness a high CAGR in the global market during the forecast period due to region's fast urbanization and significant economic transformation.

Industry Dynamics

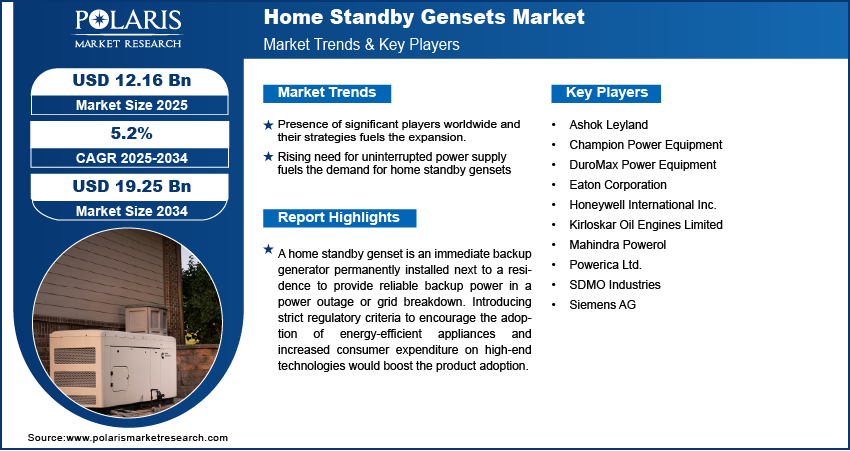

- Presence of significant players worldwide and their strategies fuels the expansion.

- Rising need for uninterrupted power supply fuels the demand for home standby gensets.

- The growing urbanization worldwide fuels the growth.

- Stringent emissions regulations and rising environmental concerns are limiting the growth.

Market Statistics

- 2024 Market Size: USD 11.57 Billion

- 2034 Projected Market Size: USD 19.25 Billion

- CAGR (2025-2034): 5.2%

- Largest Market: North America

AI Impact on the Industry

- AI improves the performance and fuel efficiency by optimizing engine parameters and load management.

- Predictive maintenance systems with help of AI use sensor data and machine learning to detect potential failures before they occur which minimize downtime and service costs.

- AI-driven grid interaction and load forecasting enable smarter integration of gensets with home energy systems.

To Understand More About this Research: Request a Free Sample Report

A home standby genset is an immediate backup generator permanently installed next to a residence to provide reliable backup power in a power outage or grid breakdown. Introducing strict regulatory criteria to encourage the adoption of energy-efficient appliances and increased consumer expenditure on high-end technologies would boost the product adoption.

For instance, according to the World Economic Forum, India has one of the world's fastest-growing economies. Consumer spending is expected to increase fourfold by 2030. By 2030, India's economy would shift from one dominated by the poor to the middle class. By 2030, the income group will account for 75% of all consumer spending.

Additionally, the expansion of the home standby gensets business is projected to be aided by substantial economic transformations brought about by rising urbanization. According to the United Nations' Our World in Data, more than 4 billion people live in cities worldwide. In addition, by 2050, more than two-thirds of the world's population is predicted to live in cities. Around 7 billion people are expected to live in urban areas by 2050. People tend to move from rural to urban regions as they get wealthy.

By 2050, urban regions are expected to house 68 percent of the world's population (an increase from 54% in 2016). In fact, by 2050, only a few countries are anticipated to have rural population proportions larger than urban. Several countries in Sub-Saharan Africa, Asia, Pacific Island States, and Latin America, including Guyana, are among them. In 2050, India (which is forecast to be the world's most populated country) is expected to have only 53% of its population living in cities.

Thus, the rising urbanization will propel the market demand for home standby gensets as the people will face changes in living standards in the urban areas, boosting the market growth during the forecast period. However, the high cost associated with the home standby gensets is restraining the home standby gensets industry growth.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The home standby gensets market has observed substantial developments over the last few decades supported by various factors such as the presence of significant players worldwide and their strategies, such as establishing the production plant, mergers and acquisitions, partnerships, collaborations, and product launches, among others. All approaches adopted by the major players have increased the market demand for home standby gensets, boosting the market growth during the forecast period.

For instance, in March 2021, Eaton, a power management firm, acquired Tripp Lite. It is a prominent provider of power source products for data centers, industrial, medical, and communications applications in the Americas, rack electrical distribution units, voltage regulators, and enclosures. Eaton's objective is to use power management technologies and services to improve people's lives and the environment.

Further, in October 2021, Generac Power Systems announced the launch of the "Guardian 26kW Home Standby Generator". It produces 26 KW of high power and saves thousands of dollars on purchase and installation. Thus, the product's launch and other strategies had boosted home standby gensets market growth.

Report Segmentation

The market is primarily segmented based on power rating, fuel, phase, product, and region.

|

By Power Rating |

By Fuel |

By Phase |

By Product |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Power Rating

Based on the power rating segment, the < 10 kVA segment is expected to be the most significant revenue contributor in the global home standby gensets market in 2024 and is expected to retain its dominance in the foreseen period. The availability of gensets with a power rating of 10 kVA to serve as a cost-effective emergency power option for average users would encourage their use in smaller houses and apartments. These generators can reliably power common household appliances such as a refrigerator, sump pump, furnace, freezer, lights, television, and microwave oven, increasing demand for gensets. In addition, insufficient power supply, frequent outages, rising consumer expenditure, and tightening emissions restrictions will shape the global home standby gensets market for 10 kVA home standby gensets during the following years.

Insight by Fuel

Based on the fuel segment, the diesel segment accounted for the largest share in global home standby gensets market in 2024 driven by its advantages in long duration operations and higher load demands. Diesel powered gensets offeres better price efficiency for long duration operations due to therir fuel efficiency, durability, and robust construction that requires less maintenance and has a longer operational lifespan. Moreover, the demand for the diesel gensets are higher in the regions with frequent power cuts for long durations.

Geographic Overview

In terms of geography, North America had the laregest share in 2024. The home standby gensets market for the North American region is anticipated to grow significantly due to the presence of significant players and rising natural calamities in the region. Local utilities in California and Texas have seen a huge rise in backup power, resulting in significant and numerous power shutoff occurrences to reduce the risk of wildfires. Similar situations have resulted in a large increase in home standby gensets system shipments within the specified timeframe. In addition, the major shift in using these generators from a supplementary power source to a basic necessity in many families is expected to boost regional market statistics.

Asia Pacific is expected to witness a high CAGR in the global market during the forecast period. This rise can be related to the region's fast urbanization and significant economic transformation. Business expansion will be accompanied by a shift in reliance on electrical and electronic products, simulating product deployment among commercial users. Additionally, rising urbanization in the region is driving the need for residential projects and such as residential buildings and individual houses. This rising need is fueling the demand for the home standby gensets for uninterrupted power supply. Moreover, rising disposable income in the region is supporting the consumers to spend on basic needs, which further fuels the growth.

Competitive Insight

Players such as Honeywell, Siemens, Eaton, Champion, DuroMax, Kirloskar, Ashok Leyland, Mahindra Powerol and Powerica operates in the industry. These players compete to capture the rising demand for home standby gensets. Honeywell, Eaton, Siemens offers premium features and energies, while Champion and DuroMax offers cost‑effective, mid‑range units. Indian brands such as Kirloskar and Ashok Leyland offer strong price competitiveness and deep regional distribution. Compliance with environmental & noise regulations, after‑sales service strength, and smart home integration are key competitive levers

Home Standby Gensets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.57 Billion |

| Market size value in 2025 | USD 12.16 Billion |

|

Revenue forecast in 2034 |

USD 19.25 Billion |

|

CAGR |

5.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Power Rating, By Fuel, By Phase, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Ashok Leyland, Champion Power Equipment, DuroMax Power Equipment, Eaton Corporation, Honeywell International Inc., Kirloskar Oil Engines Limited, Mahindra Powerol, Powerica Ltd., SDMO Industries, and Siemens AG. |

FAQ's

The market size was valued at USD 11.57 billion in 2024 and is projected to grow to USD 19.25 billion by 2034.

The market is projected to register a CAGR of 5.2% during the forecast period.

A few of the key players in the market are Ashok Leyland, Champion Power Equipment, DuroMax Power Equipment, Eaton Corporation, Honeywell International Inc., Kirloskar Oil Engines Limited, Mahindra Powerol, Powerica Ltd., SDMO Industries, and Siemens AG

The diesel segment dominated the market revenue share in 2024.

The < 10 kVA segment is projected to witness the fastest growth during the forecast period.