Hot Rolled Coil Steel Market Size, Share, Trends, Industry Analysis Report

By Thickness (Less Than or Equal to 3mm, Greater Than 3mm), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5831

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

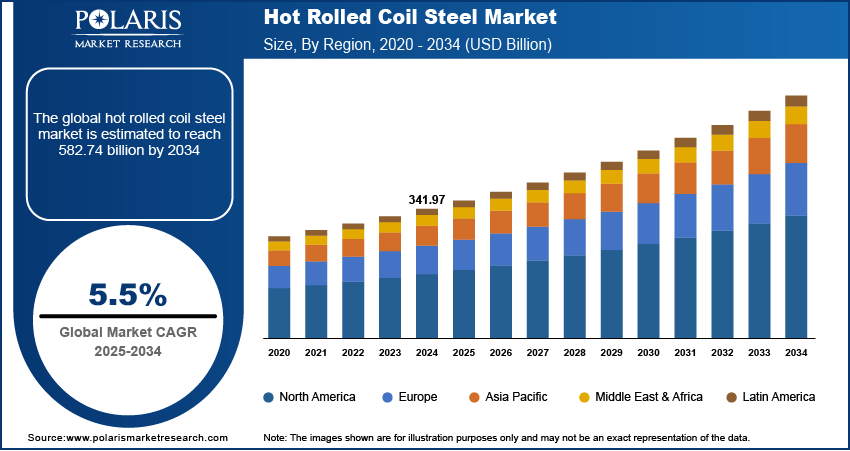

The global hot rolled coil steel market size was valued at USD 341.97 billion in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. The hot rolled coil steel market is driven by rising demand from the automotive and heavy machinery sectors, growing manufacturing activities, increased adoption in shipbuilding, and technological advancements enhancing production efficiency and material performance.

The hot rolled coil steel is a type of steel product created by heating steel billets to high temperatures and then rolling them into coils of various thicknesses and widths. This material is widely used in many industries owing to its strength, toughness, and ability to be easily shaped and welded.

To Understand More About this Research: Request a Free Sample Report

One significant growth factor is the global rise in construction and infrastructure activities. Hot rolled coil steel is essential for structural elements in buildings, bridges, highways, and railway tracks due to its high strength and weldability. Many countries such as India and China are investing heavily in new infrastructure, including large-scale road and rail projects, which directly increases the need for this type of steel and steel fiber. The U.S. also has significant infrastructure investment initiatives, such as the Infrastructure Investment and Jobs Act, which earmarks substantial funds for modernizing transportation systems and other public infrastructure, further boosting hot rolled coil steel demand.

Industry Dynamics

Construction and Infrastructure Development

The global surge in construction and infrastructure projects is a primary driver for the hot rolled coil steel. Hot rolled coil steel is essential for creating robust and durable structures, including bridges, commercial buildings, residential complexes, and transportation networks. Its strength, formability, and cost-effectiveness make it a preferred material for various structural applications.

The Ministry of Steel, Government of India, in its "Monthly Economic Report January 2025," reported a 10.7% year-on-year increase in finished steel consumption during April–January 2025, indicating sustained demand momentum. Additionally, a Press Information Bureau release from August 2024 highlighted a 6.51% CAGR in total finished steel demand over the past five financial years. This consistent growth underscores the rising requirement for hot rolled coil (HRC) steel, which is a fundamental input in producing finished steel products. The increasing consumption trend reflects the broader industrial expansion and manufacturing activity in the country, directly boosting the hot rolled coil steel market. The data affirms HRC's critical role in meeting the evolving needs of downstream steel-using sectors.

Automotive Industry Growth

In the automotive sector, hot rolled coil steel is a crucial material in vehicle manufacturing, used for various components such as chassis, structural parts, wheels, and exhaust systems. The increasing production of vehicles, especially in emerging economies, directly translates to higher demand for hot rolled coil steel.

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached approximately 93.55 million units in 2023. This figure represents a recovery from 2022's 85 million and underscores sustained growth in the automotive industry. This consistent high volume of vehicle manufacturing inherently requires a large supply of steel. The steel content in a typical passenger car is significant, demonstrating the automotive sector's continuous need for various steel products, including hot rolled coils. Therefore, the consistent output and evolution of the automotive industry propel the demand for hot rolled coil steel.

Segmental Insights

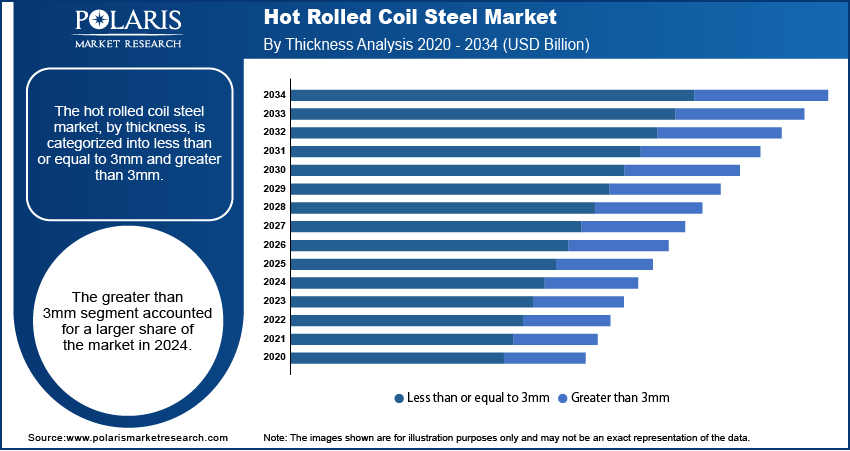

Thickness Analysis

The less than or equal to 3mm segment held a larger share in 2024, driven by increasing demand for lighter, more formable, and cost-effective materials in various industries. The automotive sector uses thinner hot rolled coil steel for body panels, internal structural parts, and underbody components to improve fuel efficiency and reduce overall vehicle weight. Similarly, the segment is seeing increased adoption in the production of home appliances, electrical enclosures, and prefabricated building systems, where ease of shaping and lighter weight are beneficial.

The greater than 3mm thickness segment is anticipated to grow at the highest rate during the forecast period. Thicker hot rolled coil steel is widely used in heavy-duty applications where strength and durability are critical. For instance, it is a primary material for large-scale construction projects such as bridges, high-rise buildings, and industrial facilities, as well as in the manufacturing of heavy machinery and shipbuilding. Its robust properties make it ideal for structural components that bear substantial loads and withstand harsh conditions.

End Use Analysis

The construction and infrastructure segment held the largest share in 2024. This dominance is driven by the widespread application of hot rolled coil steel in foundational and structural elements for buildings, bridges, roads, and other large-scale public works. Its strength, durability, and cost-effectiveness make it indispensable for these heavy-duty applications. For example, reports from the Ministry of Steel, Government of India, consistently highlight significant increases in finished steel consumption, largely attributed to ongoing national infrastructure development projects and urban expansion, directly underscoring the vital role of hot rolled coil steel in this sector.

The automotive segment is anticipated to grow at the highest rate during the forecast period, fueled by increasing global vehicle production, especially with the rising demand for both traditional and electric vehicles (EVs). Hot rolled coil steel is crucial for manufacturing various automotive components, including chassis, body structures, and other parts where strength and formability are essential. Data from organizations such as the International Organization of Motor Vehicle Manufacturers (OICA) routinely indicates high volumes of global vehicle production, which drives a continuous and growing demand for hot rolled coil steel as manufacturers seek robust and reliable materials for their evolving vehicle designs.

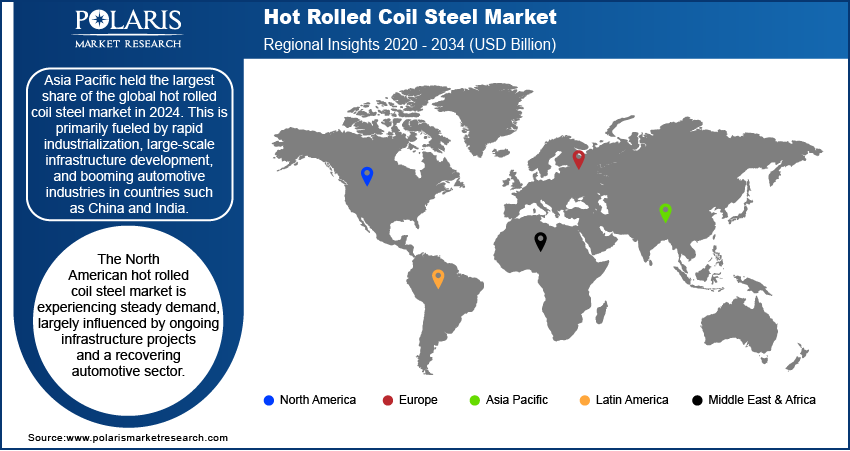

Regional Analysis

The Asia Pacific hot rolled coil steel market dominated revenues share across the world in 2024, primarily due to rapid urbanization, extensive infrastructure development, and a booming automotive sector. The region's substantial manufacturing capabilities and large-scale industrial growth create an immense requirement for hot rolled coil steel. This robust demand is further supported by government policies that encourage economic expansion and industrial output throughout the region. The China hot rolled coil steel market leads in Asia Pacific. Its vast manufacturing base and continuous investments in infrastructure projects, including large-scale construction and transportation networks, make it the world's largest consumer and producer of hot rolled coil steel. The ongoing evolution of its manufacturing sector, with a shift toward high-end products and increased use of steel in prefabricated construction, continues to drive significant demand for various hot rolled coil steel grades.

North America Hot Rolled Coil Steel Market Trends

The North America market is experiencing steady demand, largely influenced by ongoing infrastructure projects and a recovering automotive sector. Governments across the region are investing in modernizing roads, bridges, and public utilities, which drives the need for hot rolled coil steel in structural applications. The resurgence in vehicle production and the rising adoption of EVs also contribute to the demand, as hot rolled coil steel is crucial for various automotive components.

U.S. Hot Rolled Coil Steel Market Insight

In North America, the US is a significant consumer of hot rolled coil steel. The country's demand is fueled by robust activity in its construction equipment and infrastructure industries, with substantial government spending aimed at upgrading national infrastructure. The automotive sector, particularly with its increasing focus on vehicle lightweighting and EV manufacturing, also plays a key role in consuming hot rolled coil steel. For example, the Inflation Reduction Act (IRA) includes considerable investments in clean energy infrastructure and energy-efficient buildings, directly fueling the need for hot rolled coil steel.

Europe Hot Rolled Coil Steel Market Outlook

The market in Europe is showing signs of recovery from the economic slowdown caused by inflationary pressures, driven by a resurgence in key sectors such as construction, automotive manufacturing, and renewable energy. While there have been some economic headwinds, improving activity in the automotive sector, especially in Northern Europe, is providing support for market demand. Policy initiatives focused on sustainability and green modular construction are also influencing the types of steel products required, including those that offer improved mechanical properties and a reduced environmental footprint. The Germany hot rolled coil steel market holds a major revenue share in Europe. The country's industrial base, particularly its strong automotive manufacturing and machinery sectors, contributes significantly to the demand for hot rolled coil steel. Despite some fluctuations in overall crude steel production, certain specialized outputs, such as heavy-plate production, show resilience, indicating a continued need for specific hot rolled coil products in the German market.

Key Players and Competitive Insights

The hot rolled coil steel market is highly competitive, with a mix of large global players and regional producers vying for market share. Companies compete on factors such as production capacity, product quality, technological advancements, cost efficiency, and their ability to meet specific customer requirements across various end-use sectors.

A few prominent companies in the industry include Nippon Steel Corporation; ArcelorMittal; POSCO; China Baowu Group (China Baowu Steel Group Corporation Limited); HBIS Group (Hebei Iron and Steel Group Co., Ltd.); JFE Steel Corporation; Tata Steel Limited; Hyundai Steel Co., Ltd.; Shougang Group Co., Ltd.; Ansteel Group Corporation; ThyssenKrupp AG; United States Steel Corporation; Nucor Corporation; Gerdau S.A.; Jiangsu Shagang Group; and Jindal Steel & Power Ltd.

Key Players

- Ansteel Group Corporation

- ArcelorMittal

- China Baowu Group (China Baowu Steel Group Corporation Limited)

- Gerdau S.A.

- HBIS Group (Hebei Iron and Steel Group Co., Ltd.)

- Hyundai Steel Co., Ltd.

- JFE Steel Corporation

- Jindal Steel & Power Ltd.

- Nippon Steel Corporation

- POSCO

- Tata Steel Limited

Industry Developments

June 2025: Nippon Steel Corporation has finalized its acquisition of US Steel. This significant deal, valued at nearly $15 billion, creates one of the world's largest steelmakers and involves substantial investments in US steel facilities.

June 2025: ArcelorMittal is in advanced talks to sell its Bosnian operations, which include the Zenica steel mill and Prijedor iron ore mine. This move is part of the company's ongoing efforts to optimize its portfolio and focus on assets with stronger financial performance.

Hot Rolled Coil Steel Market Segmentation

By Thickness Outlook (Revenue – USD Billion, 2020–2034)

- Less than or equal to 3mm

- Greater than 3mm

By End-use Outlook (Revenue – USD Billion, 2020–2034)

- Construction & Infrastructure

- Oil & Gas/Energy

- Automotive

- Industrial Equipment

- Shipbuilding & Marine

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Hot Rolled Coil Steel Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 341.97 billion |

|

Market Size in 2025 |

USD 359.92 billion |

|

Revenue Forecast by 2034 |

USD 582.74 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 341.97 billion in 2024 and is projected to grow to USD 582.74 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

Key players in the market include Nippon Steel Corporation; ArcelorMittal; POSCO; China Baowu Group (China Baowu Steel Group Corporation Limited); HBIS Group (Hebei Iron and Steel Group Co., Ltd.); JFE Steel Corporation; Tata Steel Limited; Hyundai Steel Co., Ltd.; Shougang Group Co., Ltd.; Ansteel Group Corporation; ThyssenKrupp AG; United States Steel Corporation; Nucor Corporation; Gerdau S.A.; Jiangsu Shagang Group; and Jindal Steel & Power Ltd.

The less than or equal to 3mm segment accounted for a larger share of the market in 2024.

The automotive segment is expected to witness the fastest growth during the forecast period.