Human Microbiome Therapeutics Market Size, Share, Trends, Industry Analysis Report

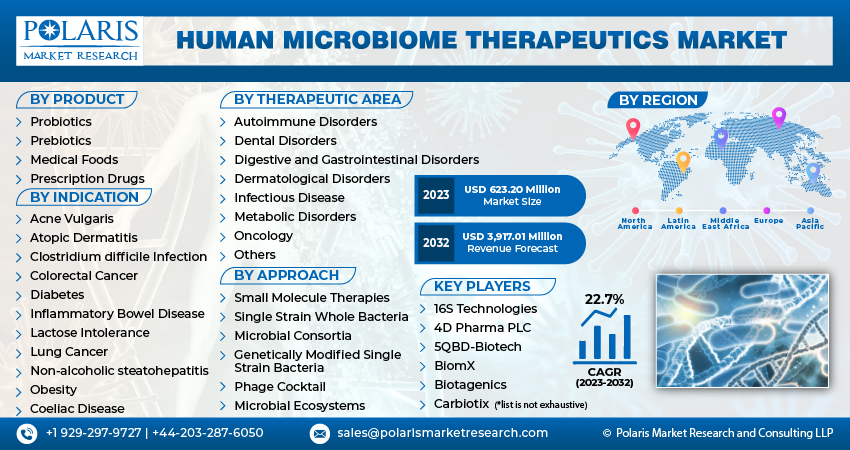

By Product (Probiotics, Prebiotics, Medical Foods, Prescription Drugs), By Therapeutic Area, By Indication, By Approach, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM1687

- Base Year: 2024

- Historical Data: 2020-2023

Overview

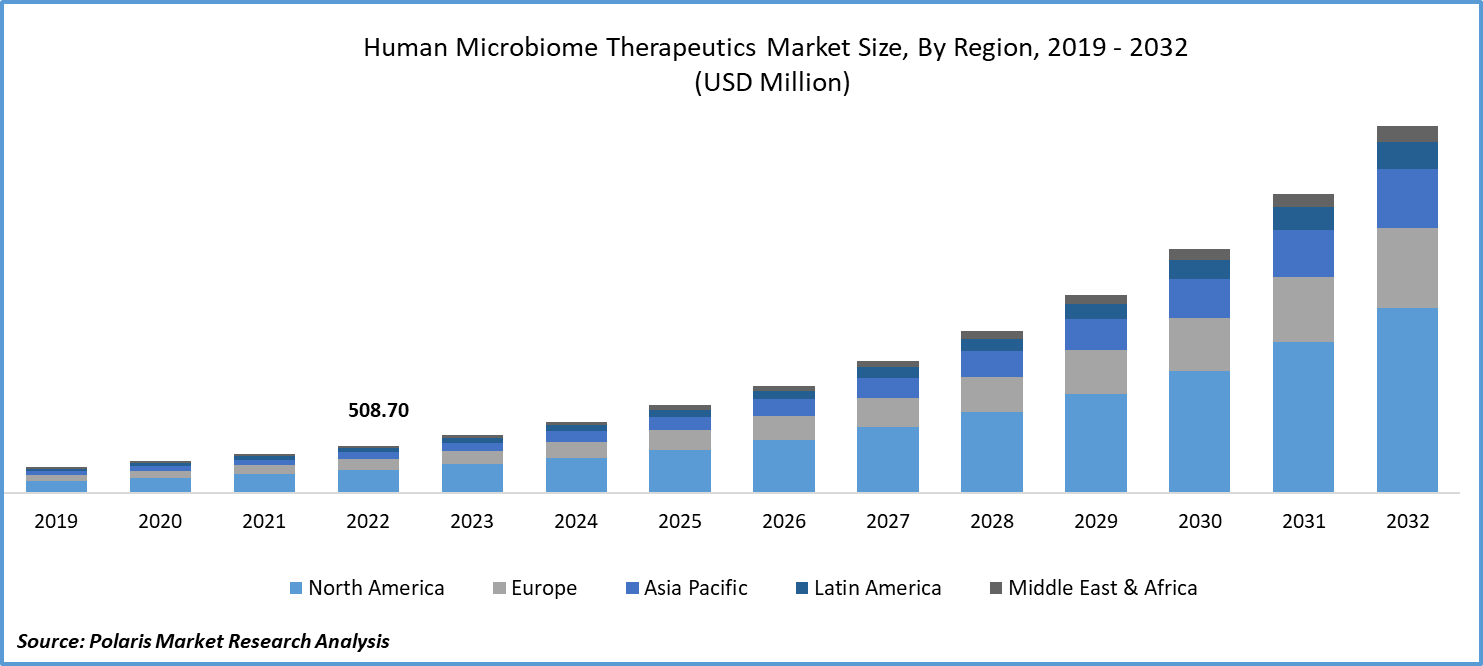

The global human microbiome therapeutics market size was valued at USD 1.01 billion in 2024, growing at a CAGR of 22.80% from 2025 to 2034. Key factors driving demand for human microbiome therapeutics include the rising incidence of gastrointestinal diseases, high prevalence of chronic diseases, and growing focus on personalized medicine.

Key Insights

- The probiotics segment accounted for a major revenue share in 2024 due to growing incidence of gastrointestinal disorders.

- The digestive and gastrointestinal disorders segment held the largest revenue share in 2024 due to the high prevalence of irritable bowel syndrome and inflammatory bowel disease.

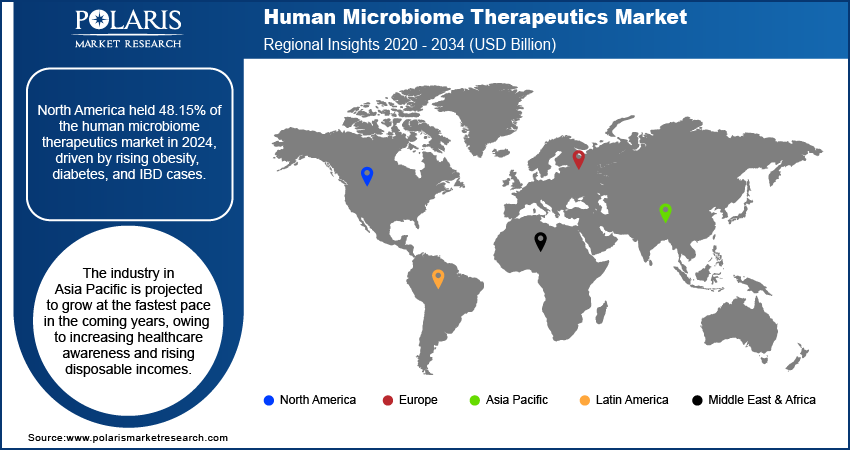

- North America human microbiome therapeutics market accounted for 48.15% of global revenue share in 2024, due to rising incidences of obesity, diabetes, and other chronic diseases.

- The U.S. held the largest revenue share in the North America human microbiome therapeutics landscape in 2024, due to the high prevalence of gastrointestinal and metabolic disorders.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing healthcare awareness.

Industry Dynamics

- The high prevalence of chronic diseases globally is fueling the demand for human microbiome therapeutics as research increasingly links gut microbiota imbalances to these conditions.

- The growing focus on personalized medicine is driving the human microbiome therapeutics market growth as each individual's gut microbiota is unique, influencing disease progression and treatment response.

- The ongoing cancer research is expected to create a lucrative market opportunity during the forecast period.

- The lack of robust clinical data and awareness hinders the market growth.

Market Statistics

- 2024 Market Size: USD 1.01 Billion

- 2034 Projected Market Size: USD 7.89 Billion

- CAGR (2025–2034): 22.80%

- North America: Largest Market Share

AI Impact on Human Microbiome Therapeutics Market

- AI enables personalized microbiome therapies by analyzing vast datasets to predict individual responses, optimizing treatment efficacy.

- Artificial intelligence (AI) accelerates the identification of novel microbiome-based therapeutics, reducing development time and costs.

- AI-powered tools enhance early detection of microbiome imbalances, enabling timely interventions for diseases such as IBD and diabetes.

- AI streamlines patient recruitment and trial design, improving outcomes in microbiome therapy research.

Human microbiome therapeutics refers to the use of beneficial microorganisms, their byproducts, or microbiome-modulating therapies to treat or prevent diseases by restoring a healthy microbial balance in the human body. The human microbiome, consisting of trillions of bacteria, viruses, fungi, and other microbes, plays a crucial role in digestion, immunity, metabolism, and even mental health. Microbiome therapeutics include probiotics & prebiotics, postbiotics, and fecal microbiota transplantation (FMT), where healthy donor microbes are transplanted to restore gut flora. Advanced approaches involve engineered bacteria, phage therapy, and microbiome-targeted drugs. These therapies are used to treat infections, metabolic disorders, allergies, and even cancer by enhancing immune responses.

The field of human microbiome therapeutics is rapidly evolving, with research exploring microbiome-based diagnostics and personalized treatments. However, challenges remain, including standardization, safety, and understanding complex microbial interactions. Despite this, microbiome therapeutics hold immense potential for revolutionizing medicine by offering natural, targeted, and sustainable solutions for chronic and previously untreatable conditions.

The global demand for human microbiome therapeutics is driven by the rising incidence of gastrointestinal diseases. Imbalances in gut microbiota are contributing to gastrointestinal diseases, making microbiome-based therapies, such as probiotics, prebiotics, and fecal microbiota transplants, a promising potential solution to restore microbial balance and improve gut health. Pharmaceutical companies and researchers are also investing heavily in microbiome therapies, responding to the urgent need for effective, targeted interventions that address the root causes of gastrointestinal disorders. Hence, the increasing incidence of gastrointestinal diseases is fueling the demand for human microbiome therapeutics.

Drivers & Opportunities

High Prevalence of Chronic Diseases: The high prevalence of chronic diseases such as diabetes, obesity, cardiovascular disorders, and autoimmune conditions is fueling demand for human microbiome therapeutics as research increasingly links gut microbiota imbalances to these conditions. According to the World Health Organization, noncommunicable or chronic diseases (NCDs) caused at least 43 million deaths in 2021. Pharmaceutical and biotech companies are accelerating development in human microbiome therapeutics, recognizing its potential to offer personalized, mechanism-driven treatments for chronic diseases. Therefore, as chronic diseases expand, the demand for human microbiome therapeutics also rises rapidly.

Growing Focus on Personalized Medicine: The growing focus on personalized medicine is boosting demand for human microbiome therapeutics, as each individual's gut microbiota is unique, influencing disease progression and treatment response. Researchers and clinicians recognize that microbiome-based therapies, such as targeted probiotics, precision prebiotics, and microbial consortia, can be tailored to a patient's specific microbial profile, offering more effective and customized care. Advances in genomic sequencing and AI-driven analytics now enable deeper insights into microbiome-disease interactions, making these therapies a key component of precision medicine strategies. Patients and healthcare providers increasingly prefer treatments that address root causes rather than offering one-size-fits-all solutions, driving investments and innovation in microbiome therapeutics. Therefore, as personalized medicine gains attraction, the microbiome’s role in modulating health becomes critical.

Segmental Insights

Product Analysis

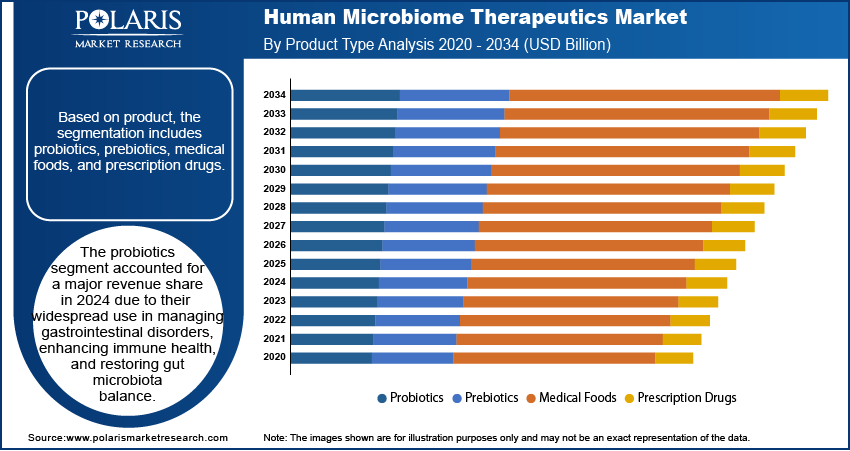

Based on product, the segmentation includes probiotics, prebiotics, medical foods, and prescription drugs. The probiotics segment accounted for a major revenue share in 2024 due to their widespread use in managing gastrointestinal disorders, enhancing immune health, and restoring gut microbiota balance. Consumers and healthcare providers favored these products due to their natural origin, minimal side effects, and growing clinical evidence supporting their efficacy in treating conditions such as irritable bowel syndrome, inflammatory bowel disease, and antibiotic-associated diarrhea. The increasing availability of over-the-counter probiotic formulations, combined with rising public awareness about gut health, further strengthened their market position. Strategic collaborations between biotechnology companies and research institutions also accelerated the development of next-generation probiotics with targeted therapeutic benefits, fueling adoption.

The medical foods segment is projected to grow at a robust pace in the coming years, owing to the rising focus on personalized nutrition and targeted disease management. These formulations address specific nutritional needs related to chronic conditions such as metabolic disorders, neurological diseases, and gastrointestinal syndromes, where standard dietary interventions prove insufficient. Physicians increasingly recommend medical foods due to their clinically validated compositions and ability to support therapeutic outcomes without the side effects of conventional drugs. Advances in microbiome science are enabling the creation of precision medical foods tailored to individual microbiota profiles, improving treatment efficacy. The growing elderly population, rising prevalence of diet-related disorders, and supportive regulatory pathways for medical food commercialization are projected to significantly boost the segment’s growth.

Therapeutic Area Analysis

In terms of therapeutic area, the segmentation includes autoimmune disorders, dental disorders, digestive and gastrointestinal disorders, dermatological disorders, infectious disease, metabolic disorders, oncology, and others. The digestive and gastrointestinal disorders held the largest revenue share in 2024 due to high global prevalence of conditions such as irritable bowel syndrome, inflammatory bowel disease, Clostridioides difficile infection, and antibiotic-associated diarrhea. Healthcare providers prioritized microbiome-based interventions in this area due to their proven ability to restore gut microbial balance and improve patient outcomes. The segment also benefited from a growing body of clinical evidence, increased patient awareness of gut health, and the expansion of probiotic, prebiotic, and live biotherapeutic product pipelines targeting specific digestive conditions.

Indication Analysis

In terms of indication, the segmentation includes acne vulgaris, atopic dermatitis, clostridium difficile infection, colorectal cancer, diabetes, inflammatory bowel disease (IBD), lactose intolerance, lung cancer, non-alcoholic steatohepatitis (NASH), obesity, and coeliac disease. The clostridium difficile infection segment dominated the revenue share in 2024 due to high recurrence rates, growing antibiotic resistance, and the urgent need for effective alternatives to conventional antimicrobial therapies. Clinicians increasingly adopted microbiome-based interventions, such as fecal microbiota transplantation and live biotherapeutics, due to their ability to restore healthy gut flora and reduce reinfection risk. The rising incidence of hospital-acquired infections, coupled with strong regulatory support for innovative treatment approaches, accelerated product development in the segment.

The inflammatory bowel disease (IBD) segment is estimated to grow at a rapid pace during the forecast period, owing to the rising prevalence of Crohn’s disease and ulcerative colitis and the limitations of current immunosuppressive therapies. Patients and healthcare providers are increasingly turning to microbiome-based solutions that target the underlying dysbiosis rather than only managing symptoms. Advances in metagenomic analysis and precision microbiome engineering are enabling the creation of highly targeted therapies that modulate specific microbial communities to reduce inflammation and improve long-term remission rates. Pharmaceutical companies are investing heavily in clinical research for next-generation live biotherapeutics in IBD, and expanding patient access through strategic partnerships with healthcare systems. The combination of growing disease burden, improved scientific understanding of gut-immune interactions, and the need for safer, more effective treatment options is projected to drive sustained growth in the segment.

By Approach Analysis

In terms of approach, the segmentation includes small molecule therapies, single strain whole bacteria, microbial consortia, genetically modified single strain bacteria, phage cocktail, microbial ecosystems. The single strain whole bacteria segment accounted for a major revenue share in 2024 due to their well-defined mechanism of action, established safety profiles, and ease of manufacturing. Researchers and clinicians favored this approach as it allows targeted modulation of the microbiome with predictable therapeutic outcomes. Commercial success rates in treating Clostridium difficile infection and certain gastrointestinal disorders strengthened the segment dominance. Increased investments in clinical trials evaluating new strains with disease-specific benefits also strengthened the market presence of the segment.

Regional Analysis

North America human microbiome therapeutics market accounted for 48.15% of global revenue share in 2024. This dominance is attributed to the rising incidences of chronic diseases such as obesity, diabetes, and inflammatory bowel disease (IBD), which pushed researchers and pharmaceutical companies to explore microbiome-based treatments. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 Americans have at least one chronic disease, and 4 in 10 have two or more chronic diseases. Increased funding for microbiome research and a strong biotechnology sector further accelerated market growth. Consumers in North America also showed a strong preference for personalized medicine, boosting interest in microbiome-targeted therapies.

U.S. Human Microbiome Therapeutics Market Insights

The U.S. held the largest revenue share of the North America human microbiome therapeutics landscape in 2024, due to strong investments in biotech innovation and a high prevalence of gastrointestinal and metabolic disorders. The FDA’s evolving regulatory framework supported clinical trials for microbiome-based drugs, encouraging pharmaceutical companies to invest. An established healthcare infrastructure and collaborations between academia and industry drove rapid advancements in the industry. Additionally, rising consumer interest in probiotics and gut health supplements expanded the market for microbiome therapies.

Europe Human Microbiome Therapeutics Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034, due to rising healthcare expenditure and a growing focus on precision medicine. Governments and private entities are funding extensive research into microbiome-based treatments for conditions such as IBD, allergies, and autoimmune diseases. Stringent regulatory standards are ensuring product safety, creating trust among consumers and investors. The presence of key players and academic research hubs in countries such as the UK and France is further stimulating growth.

Germany Human Microbiome Therapeutics Market Overview

The demand for human microbiome therapeutics in Germany is being driven by its strong pharmaceutical industry and advanced research in gut microbiota. High healthcare spending and government support for biotechnology innovation drive market expansion. The country reports a significant burden of chronic diseases, increasing the need for alternative treatments such as microbiome therapies. German companies also actively collaborate with global partners, accelerating the development of novel microbiome-based drugs.

Asia Pacific Human Microbiome Therapeutics Market

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing healthcare awareness and rising disposable incomes. Countries such as China, Japan, and India are investing heavily in microbiome research to address growing cases of diabetes, obesity, and digestive disorders. A large patient population and expanding clinical trial activities attract global pharmaceutical companies. Additionally, traditional medicine practices in the region integrate modern microbiome therapies, further boosting demand.

Key Players & Competitive Analysis

The human microbiome therapeutics market is highly competitive, with players focusing on strategic collaborations, product innovations, and clinical advancements to strengthen their market presence. Major companies are investing heavily in R&D to develop novel microbiome-based therapies targeting conditions such as gastrointestinal disorders, metabolic diseases, and immune-related ailments. Start-ups and biotech firms are attracting significant venture capital funding, while established pharmaceutical companies are expanding their portfolios through acquisitions and partnerships. Key players are also leveraging next-generation sequencing, advanced bioinformatics, and synthetic biology to enhance therapeutic efficacy and precision. Regulatory approvals and successful late-stage clinical trials remain critical competitive factors, as companies race to commercialize first-in-class microbiome therapeutics and capture market share.

A few major companies operating in the human microbiome therapeutics industry include Enterome SA, Ferring Pharmaceuticals, Finch Therapeutics Group Inc., Locus Biosciences Inc., MaaT Pharma, Microbiotica Ltd, Osel Inc., Seres Therapeutics Inc., Synlogic Inc., and Vedanta Biosciences.

Key Players

- Enterome Sa

- Ferring Pharmaceuticals

- Finch Therapeutics Group Inc.

- Locus Biosciences Inc.

- Maat Pharma

- Microbiotica Ltd

- Osel Inc.

- Seres Therapeutics Inc.

- Synlogic Inc.

- Vedanta Biosciences

Human Microbiome Therapeutics Industry Developments

In December 2023, Ferring Pharmaceuticals and Zürich-based microbiome translation company PharmaBiome announced a research & development collaboration to drive forward new microbiome-based biotherapeutics in the field of gastroenterology.

In April 2023, Seres Therapeutics, Inc. and Nestlé Health Science announced the U.S. Food and Drug Administration (FDA) approval of VOWSTTM. VOWSTTM is an orally administered microbiota-based therapeutic to prevent recurrence of C. difficile Infection (CDI) in adults.

In September 2022, Stanford University researchers created a synthetic human gut microbiome consisting of over 100 bacterial species.

Human Microbiome Therapeutics Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Probiotics

- Prebiotics

- Medical Foods

- Prescription Drugs

By Therapeutic Area Outlook (Revenue, USD Billion, 2020–2034)

- Autoimmune Disorders

- Dental Disorders

- Digestive and Gastrointestinal Disorders

- Dermatological Disorders

- Infectious Disease

- Metabolic Disorders

- Oncology

- Others

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Acne Vulgaris

- Atopic Dermatitis

- Clostridium difficile Infection

- Colorectal Cancer

- Diabetes

- Inflammatory Bowel Disease (IBD)

- Lactose Intolerance

- Lung Cancer

- Non-alcoholic steatohepatitis (NASH)

- Obesity

- Coeliac Disease

By Approach Outlook (Revenue, USD Billion, 2020–2034)

- Small Molecule Therapies

- Single Strain Whole Bacteria

- Microbial Consortia

- Genetically Modified Single Strain Bacteria

- Phage Cocktail

- Microbial Ecosystems

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Human Microbiome Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.01 Billion |

|

Market Size in 2025 |

USD 1.24 Billion |

|

Revenue Forecast by 2034 |

USD 7.89 Billion |

|

CAGR |

22.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.01 billion in 2024 and is projected to grow to USD 7.89 billion by 2034.

The global market is projected to register a CAGR of 22.80% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Enterome SA, Ferring Pharmaceuticals, Finch Therapeutics Group Inc., Locus Biosciences Inc., MaaT Pharma, Microbiotica Ltd, Osel Inc., Seres Therapeutics Inc., Synlogic Inc., and Vedanta Biosciences.

The probiotics segment dominated the market revenue share in 2024.

The inflammatory bowel disease (IBD) segment is projected to witness the fastest growth during the forecast period.