Ozone Generator Market Share, Size, Trends, Industry Analysis Report

By Technology (Cold Plasma, Corona Discharge), By Application (Wastewater Treatment, Air Treatment), By End-use (Municipal, Commercial), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Feb-2024

- Pages: 120

- Format: pdf

- Report ID: PM4237

- Base Year: 2023

- Historical Data: 2020-2022

Report Outlook

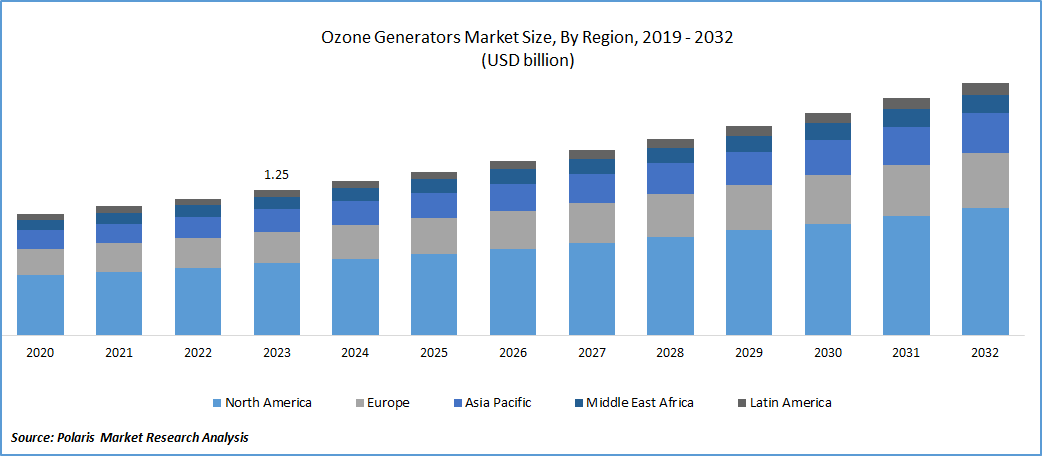

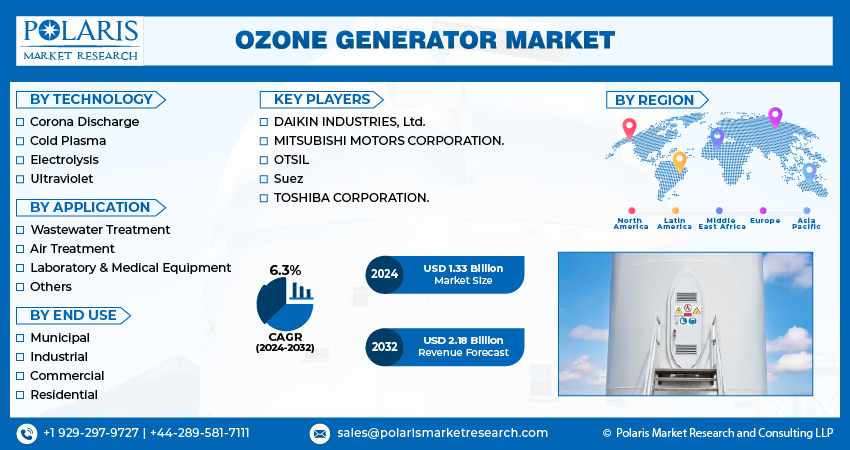

The global ozone generator market was valued at USD 1.25 billion in 2023 and is expected to grow at a CAGR of 6.3% during the forecast period.

Increasing investments in upgrading and expanding wastewater treatment facilities, along with a positive outlook toward industrial sector growth, are anticipated to drive the demand for this product in the coming years. Unlike ultraviolet sterilization, ozone reaches each corner of environment. It finds applications in various public transportation, as it does not leave any harmful residue & is generated using simple equipment.

To Understand More About this Research, Request a Free Sample Report

Ozone generators release a highly reactive oxidant called ozone, which is utilized to eliminate chemical agents and bacteria causing odors. Unlike ultraviolet sterilization, ozone can reach all areas of the environment, leaving no corner unsterilized. It leaves no harmful residue and can be generated using straightforward equipment. Ozone is suitable for public transportation modes such as high-speed railways, ships, airplanes, and buses. The ozone generator market is poised for growth in the forecast period due to rising investments in upgrading wastewater treatment facilities and the rapid advancement in the hospitality industry.

Developed countries are prioritizing the establishment of new water treatment facilities and the modernization of existing ones, driven by factors such as population growth and urban expansion. This heightened focus is leading to a surge in the demand for freshwater for both residential and commercial needs. Consequently, due to these factors, there is anticipated rapid growth in the demand for ozone generators.

The overall cost of operating and maintaining these generators is considerably high, which plays a crucial role for consumers in their decision-making process. The elevated operational expenses are primarily attributed to the electricity required for the product's functioning. Similarly, recurrent maintenance costs stem from the replacement of electrodes and other components. Electrodes and transformer parts, typically made from stainless steel and titanium, need replacement over time due to moisture deposition, leading to material oxidation and rusting.

The research report offers a quantitative and qualitative analysis of the Ozone Generator Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Growth Drivers

Increasing Awareness of Air Quality

Growing awareness about the importance of air quality and the impact of air pollution on health is driving the demand for air purification technologies, including ozone generators.

The global COVID-19 outbreak resulted in a heightened need for air purification systems to prevent the spread of various pathogens in the air. Governments and companies are investing significantly in the safe reopening of public places and offices, which were closed due to lockdowns in many countries. Ozone generators are being deployed in airplanes, malls, banks, public service offices, hotels, manufacturing facilities, and religious places to ensure their safety from the virus. With the resurgence of the Omicron variant and global cases of monkeypox, the demand for ozone generators is expected to increase, driving market demand.

Report Segmentation

The market is primarily segmented based on technology, application, end use, and region.

|

By Technology |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand More About this Research, Speak to Analyst

By Technology Analysis

Corona discharge segment held the largest share

Corona discharge segment dominated the market. Corona discharge generators stand out because they generate pure ozone without any traces of chemicals or gases. Moreover, they are priced in the mid-range and produce therapeutic or medical-grade ozone, factors that fuel their demand.

Cold plasma segment will grow at significant pace. This growth can be attributed to the high ozone concentration, low oxygen consumption, and energy efficiency of these generators. Additionally, they are low-maintenance, operate at the highest discharge pressure, and offer precise dosing through built-in controllers. However, their relatively high cost, large size, and weight pose challenges and might impede the growth of this segment in the forecast period.

By Application Analysis

Waste-water treatment segment accounted for the largest market share in 2022

Wastewater segment accounted for the largest market share. Ozone generators find extensive use in water and wastewater treatment facilities due to their superior effectiveness in eliminating bacteria and viruses. Moreover, the ozonation process requires a shorter contact time and leaves no residual substances. The demand for these generators in wastewater treatment is projected to rise substantially due to their safer handling and shipping, coupled with minimal maintenance costs.

The product is employed in groundwater remediation to effectively treat a range of contaminants such as BTEX, TCE, DCE, 1,4 Dioxane, and other typical groundwater pollutants. Additionally, these devices are utilized for managing odors and treating sewage and wastewater in cooling water towers. Moreover, they play a vital role in enhancing water quality within aquaculture systems, treating bottled water, processing fruits and vegetables, and disinfecting surfaces in gaseous form.

By End Use Analysis

Municipal segment accounted for the largest market share in 2022

Municipal segment accounted for the largest market share. The increased demand for ozone generators in municipal applications can be attributed to their potent oxidizing capabilities and effectiveness in oxidizing heavy metals. Ozone's strong oxidizing power makes it highly efficient in breaking down pollutants and contaminants in municipal water and wastewater treatment processes.

Commercial segment will grow rapidly. This segment is poised to generate substantial demand due to the elevated levels of PM2.5 and PM10 particles, coupled with the increasing emphasis on employee safety in workplaces. Additionally, advancements in technology and the rising prevalence of airborne diseases are expected to drive growth in this segment during the forecast period.

Regional Insights

North America region accounted for the largest share of global market in 2022

North America emerged as the largest region. This was primarily due to the region's focus on wastewater treatment and the demand for air treatment systems to combat strong odors, eliminate mold, and eradicate smoke smells. In the U.S., a new Public-Private Partnership (PPP) legislation was enacted to incentivize investments in upgrading domestic water purification plants and constructing new ones, further bolstering the market.

The Environmental Protection Agency (EPA) reports between 23,000 to 75,000 sanitary sewers overflowing annually in the United States. Consequently, the growing influx of new customers connecting to centralized treatment systems is expected to drive the modernization of existing treatment facilities and the construction of new wastewater treatment plants in the coming years. This trend will likely lead to an increased demand for ozone generators.

APAC will grow at the substantial pace. The region grapples with significant water pollution challenges, primarily caused by the discharge of industrial effluents, & un-treated sewage, leading to pollution in rivers and other water sources. Additionally, the limited coverage of the sewerage networks is expected to exacerbate the water pollution situation.

Key Market Players & Competitive Insights

Prominent manufacturers are focusing on enhancing water environments and extending their influence in various regions to bolster their market standings. Metawater, for instance, intends to boost its global presence by leveraging silent discharge technology, enabling efficient ozone generation,

Some of the major players operating in the global market include:

- DAIKIN INDUSTRIES, Ltd.

- MITSUBISHI MOTORS CORPORATION.

- OTSIL

- Suez

- TOSHIBA CORPORATION.

Recent Developments

- In May 2023, Xylem, completed the acquisition of the Evoqua Water Technologies in an all-stock transaction worth approximately USD 7.5 billion.

- In April 2023, Fresh Mouth unveiled its latest product, an ozone generator that doubles as a hydrogenated water producer. This innovative device is engineered to effectively and safely clean and sanitize the mouth. By generating ozone, it eliminates harmful bacteria, viruses, and fungi that contribute to issues like bad breath, gum infections, and other oral health concerns.

- In April 2022, TOSHIBA CORPORATION signed deal for 3 ozone generators to Larsen & Toubro for the Delhi Jal Board's Chandrawal Water Treatment Plant in Delhi. This installation marks one of India's most significant ozonation systems for a waste-water treatment facility.

Ozone Generator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.33 billion |

|

Revenue forecast in 2032 |

USD 2.18 billion |

|

CAGR |

6.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Navigate through the intricacies of the 2024 Ozone Generator Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

U.S. Garden Planter Market Size, Share 2024 Research Report

Alexipharmic Drugs Market Size, Share 2024 Research Report

Cleaning and Hygiene Products Market Size, Share 2024 Research Report

FAQ's

DAIKIN INDUSTRIES, Ltd., MITSUBISHI MOTORS CORPORATION. ,OTSIL are the key companies in Ozone Generator Market

Ozone Generator Market expected to grow at a CAGR of 6.3% during the forecast period.

technology, application, end use, and region are the key segments covered

Increasing Awareness of Air Quality are the key driving factors in industrial Ozone Generator Market

The global ozone generator market size is expected to reach USD 2.18 billion by 2032