Hydraulic Fracturing Market Share, Size, Trends, Industry Analysis Report

By Well Type (Horizontal, Vertical); By Technology; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4014

- Base Year: 2023

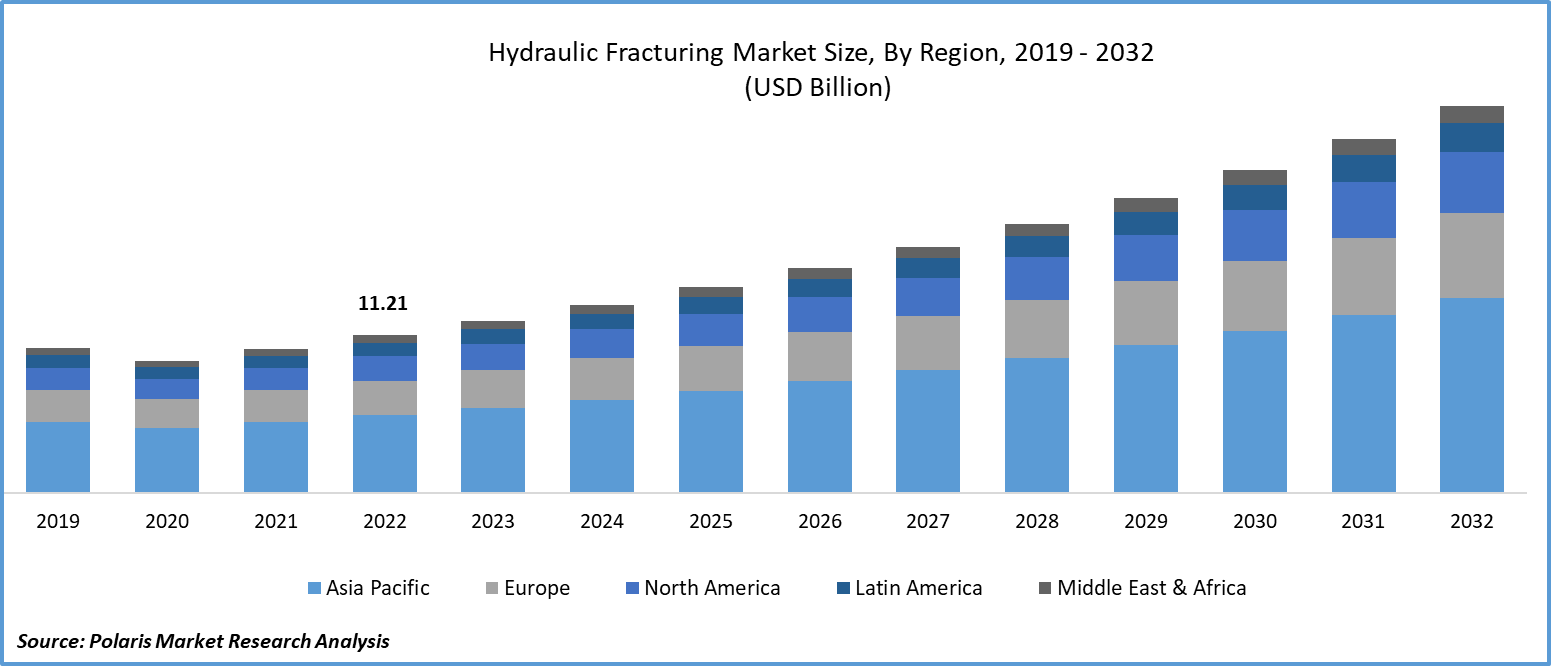

- Historical Data: 2019-2022

Report Outlook

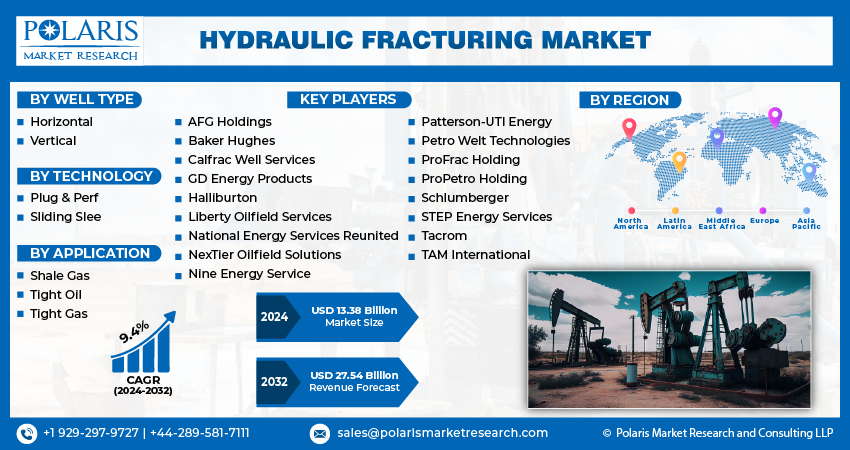

The global hydraulic fracturing market was valued at USD 12.25 billion in 2023 and is expected to grow at a CAGR of 9.4% during the forecast period.

The increasing research and development activities pertaining to hydraulic fracturing are driving the evolution of new technologies in the marketplace. For instance, in August 2022, a study review published in ACS publications explored the current research development of the application of nano-materials & technologies in different aspects of hydraulic fracturing in unconventional oil and gas reservoirs, expounding on the mechanisms and benefits of these nanomaterials and technologies in detail.

To Understand More About this Research: Request a Free Sample Report

Moreover, the global transition towards cleaner energy is in some way contributing to the demand for hydraulic fracturing, as it is necessary for countries to meet ongoing demand for natural gas in the transition period.

However, there is a chance of greenhouse gas emissions in hydraulic fracturing operations like methane, leading to climate pollution. This is becoming a primary concern for the users, impeding its use in the oil and gas industry. Conversely, to reduce methane emissions, businesses are utilizing cutting-edge technologies and best practices, such as enhanced well construction methods and leak detection systems.

The Hydraulic Fracturing Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Growth Drivers

- The global energy crisis will contribute to the need for hydraulic fracturing in the study period

Hydraulic fracturing has faced criticism due to its potential environmental impacts, including water contamination, induced earthquakes, and methane emissions. Concerns over the use of water and the disposal of wastewater have led to regulatory scrutiny and public opposition.

The growing gas exploration activities are propelling the need for efficient technology like hydraulic fracturing, which enables the flow of natural gas from rocks. The number of wells in the play that were in the 15,000-foot range increased from 4% in 2017 to 18% in 2016. A Rystad Energy analysis shows that drilling in the Permian is breaking records if measured by the total number of feet drilled per year, with the average surpassing 10,000 ft. The ongoing trend is highly imputable to the growing population at the global level, which facilitates countries meeting energy needs, driving hydraulic fracturing services soon.

Report Segmentation

The market is primarily segmented based on well type, technology, application and region.

|

By Well Type |

By Technology |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Well Type Analysis

- Horizontal segment is expected to witness the highest growth during the forecast period

The horizontal segment is projected to grow at a CAGR during the projected period, mainly driven by its greater efficiency and enhanced resource recovery. This is a type of directional drilling method. Operators employ this method to recover oil and gas when the reservoir has an unusual shape or is challenging to access. As more of the wellbore can stay in contact with the producing formation, oil or natural gas can be recovered in greater quantities with horizontal drilling, driving its use in the coming years.

The vertical segment led the industry hydraulic fracturing market with a substantial revenue share in 2022, largely attributable to its ability to offer high efficiency. A 2021 study published in Hindawi focused on the effects of hydraulic fracturing on vertical wells. A computational method for assessing the impact of fracturing in vertical wells was developed based on the characteristics of the flow in the fracture network following a large-scale hydraulic fracture.

The study conducted tests on block C Oilfield’s wells with conventional and volumetric fracturing. It was revealed that in vertical wells, volumetric fracturing is more feasible for increasing the productivity of hydraulic fracturing. These ongoing studies are revealing the potential of vertical wells in hydraulic fracturing and, in a way, creating awareness about their benefits to the oil and gas industry.

By Technology Analysis

- Plug & Perf segment accounted for the largest market share in 2022

The plug & perf segment accounted for the largest market share. The main and most popular fracturing technique for un-conventional wells is plug & perf (or limited entry). This method, which is frequently used in wells with the cemented liners, entails the pumping down bridge plug on wireline while using perforating guns. This technology is preferred by most of the operators due to its predictability and repeatability.

The sliding slee segment is expected to grow at the fastest rate over the next few years on account of its ability to quicken multi-stage fracture processes. An oil or gas well's completion typically includes a sliding sleeve. Their primary functions are to control pressure between zones or to stop flow from one or more reservoir zones. With this open-hole technique, several stages can be broken with just one pumping session, which is gaining traction nowadays among industrialists.

By Application Analysis

- Shale gas segment held the significant market revenue share in 2022

The shale gas segment held a significant market share in revenue in 2022, which is highly accelerated due to the widespread accumulation of the shale gases. Hydraulic fracturing is widely used in the extraction process of shale gas. Natural gas or oil can flow more freely and be retrieved in greater quantities thanks to hydraulic fracturing, which creates fissures in the rock formation. The rising need for energy independence by companies is propelling the demand for hydraulic fracturing in the coming years.

Regional Insights

- Asia Pacific region registered the global market in 2022

The Asia Pacific region witnessed the global market with the largest market share in 2022 and is expected to continue its dominance over the projected period. The growing population in the region is demanding power efficiency. The demand for petroleum has been rising in China over the past few decades due to the country's rapid economic expansion. The oil and gas industry in China has focused on the exploitation of unconventional resources, particularly oil in tight rocks, in order to fulfil the country's increasing demand.

According to the 2019 study, in numerous Chinese basins, including the Ordos basin, Songliao basin, Junggar basin, Bohai Bay basin, and others, tight oil has been discovered to be widely distributed. Together, the geological resources for tight oil that have been preliminary proven amount to 125 108t. This is driving oil and gas companies and the government to promote hydraulic fracturing operations, as it makes the country self-sufficient in oil and gas production, assisting consumers with the availability of natural gas. As countries in the region come forward to find the natural reserves in their countries, there will be a huge demand for hydraulic fracturing services in the coming years.

The North America region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the rising shale gas extraction activities to meet energy needs in the region. According to the U.S. Energy Information Administration (EIA), the dry natural gas produced in the U.S., in 2022 from the shale formations was nearly, 28.5 Tcf. This demonstrates the rising production of dry natural gas from shale formation, which may further the need for hydraulic fracturing as it enforces the ease of the extraction process to meet ongoing consumer demand.

Key Market Players & Competitive Insights

The hydraulic fracturing market is experiencing a rapid surge in the evolution of companies in this sector, driven by ongoing demand for oil and gas exploration. The increase in the development of new technologies among the key market players, along with industrial activities including collaborations, partnerships, mergers, and acquisitions, is enabling companies to cater to ongoing consumer needs.

Some of the major players operating in the global market include:

- AFG Holdings

- Baker Hughes

- Calfrac Well Services

- GD Energy Products

- Halliburton

- Liberty Oilfield Services

- National Energy Services Reunited

- NexTier Oilfield Solutions

- Nine Energy Service

- Patterson-UTI Energy

- Petro Welt Technologies

- ProFrac Holding

- ProPetro Holding

- Schlumberger

- STEP Energy Services

- Tacrom

- TAM International

Recent Developments

- In November 2021, a study published in Research Gate focused on reviewing waterless fracturing technologies for the petroleum industry. With its unique characteristics and exceptional performance, it is used in future un-conventional resource development.

Hydraulic Fracturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.38 billion |

|

Revenue forecast in 2032 |

USD 27.54 billion |

|

CAGR |

9.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Well Type, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2024 Hydraulic Fracturing Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Silica Flour Market Size, Share 2024 Research Report

Biophotonics Market Size, Share 2024 Research Report

Healthcare Data Integration Market Size, Share 2024 Research Report

AI in Telecommunication Market Size, Share 2024 Research Report