Hydrogen Truck Market Size, Share, Trends, Industry Analysis Report

: By Vehicle (Heavy-Duty Trucks, Medium-Duty Trucks, and Small-Duty Trucks), Fuel Cell Technology, Range, Motor Power, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5569

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

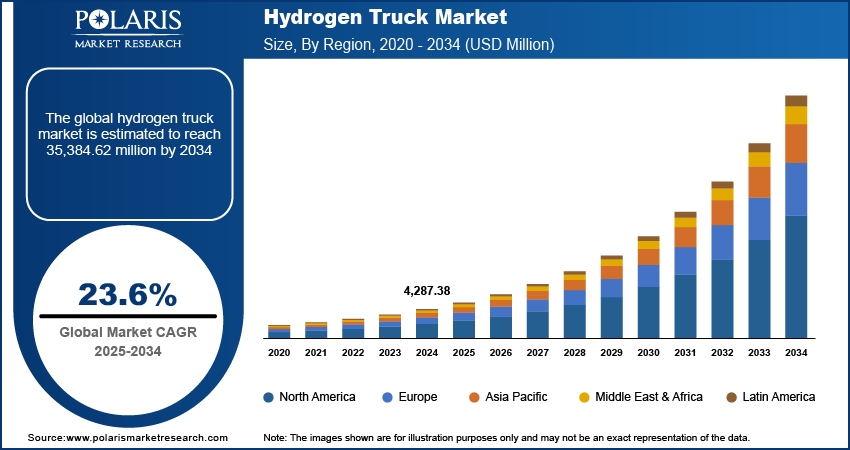

Hydrogen truck market size was valued at USD 4,287.38 million in 2024, exhibiting a CAGR of 23.6% during the forecast period. The market is driven by the global shift toward zero-emission transportation, supported by government incentives, advancing fuel cell technology, expanding hydrogen infrastructure, and increasing corporate sustainability goals, positioning hydrogen trucks as a viable, efficient, and long-range alternative to diesel in commercial and long-haul logistics.

Key Insights

- Heavy-duty trucks dominated the market in 2024 due to their suitability for long-haul transport, offering low emissions, longer range, and faster refueling than electric alternatives.

- Hydrogen trucks offer operational advantages for long-distance logistics, including fast refueling and extended range, making them a preferred zero-emission option in supply chains.

- Asia Pacific led the hydrogen truck market in 2024, driven by strong government policies, investment in hydrogen infrastructure, and leadership from China, Japan, and South Korea.

- North America is projected to witness the fastest growth, supported by massive public funding, clean hydrogen hubs, and increasing private sector adoption.

Industry Dynamics

- Growing pressure to reduce transport emissions is pushing industries to adopt hydrogen trucks as a viable zero-emission alternative to diesel.

- Rising corporate focus on sustainability is increasing investments in hydrogen trucks for cleaner logistics without compromising operational efficiency.

- Government subsidies, funding, and infrastructure development are reducing adoption barriers and making hydrogen trucks more accessible to fleet operators.

- Innovations in hydrogen fuel cells are improving vehicle range, performance, and cost efficiency, accelerating their adoption in the commercial transport sector.

- Limited availability of hydrogen refueling infrastructure remains a key challenge, particularly outside major industrial or urban transport corridors.

Market Statistics

2024 Market Size: USD 4,287.38 million

2034 Projected Market Size: USD 35,384.62 million

CAGR (2025–2034): 23.6%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The hydrogen truck market refers to hydrogen-powered trucks, which utilize hydrogen fuel cells to generate electricity for propulsion. These trucks are sustainable alternatives to conventional diesel-powered trucks, offering a solution to reduce greenhouse gas emissions and reliance on fossil fuels.

The hydrogen truck market is experiencing significant growth driven by the transportation industry's push toward zero-emission solutions. These vehicles offer advantages over battery electric alternatives, including faster refueling times and longer range capabilities critical for long-haul operations. Government emissions regulations, corporate sustainability goals, and increasing hydrogen infrastructure development are accelerating adoption. Major manufacturers are investing heavily in hydrogen fuel cell technology, particularly for heavy-duty applications where battery weight constraints pose challenges. As production scales and costs decrease, hydrogen trucks are positioned to capture substantial market share in commercial transportation's green transition.

Governments worldwide are implementing stricter emissions standards and setting ambitious sustainability goals, pushing the logistics and transportation industries to adopt cleaner technologies. Among these innovations, hydrogen trucks are emerging as a key solution to meet these regulatory requirements. the shift towards sustainable logistics practices is encouraging businesses to invest in hydrogen-powered trucks to meet corporate sustainability goals.

Market Dynamics

Government Incentives and Funding

Government incentives and funding is a key driver of the hydrogen truck market. For instance, the US Department of Energy grants up to USD 0.2 million for R&D in hydrogen and fuel cell vehicle technologies, electric vehicle (EV) chargers, EV batteries, and biodiesel innovations. Increased investments in hydrogen infrastructure, such as refueling stations, are expanding the accessibility and feasibility of hydrogen-powered trucks. Additionally, various governments are offering subsidies and tax incentives to encourage the adoption of hydrogen vehicles, helping offset the initial high costs of these trucks. These financial supports reduce the barrier to entry for both manufacturers and fleet operators, making hydrogen trucks a more viable option. Governments continue to prioritize sustainability and carbon reduction and accelerating the transition to clean energy solutions in the transport sector. The ongoing support is expected to significantly contribute to the long-term hydrogen truck market growth.

Advancements in Hydrogen Fuel Cell Technology

Advancements in hydrogen fuel cell technology are playing a pivotal role in driving the hydrogen truck market demand. Continuous innovations are enhancing the efficiency of fuel cells, allowing hydrogen trucks to achieve longer ranges and faster refueling times compared to earlier models. For instance, the Mirai's advanced fuel cell electric vehicle technology binds hydrogen and ambient oxygen to generate electricity, delivering zero tailpipe emissions and setting a new benchmark for sustainable mobility. These improvements make hydrogen trucks more feasible for long-distance and heavy-duty transport applications. Moreover, reductions in the cost of fuel cell components are lowering the overall price of hydrogen trucks, making them increasingly competitive with traditional diesel trucks. The demand for hydrogen trucks is expected to rise as fuel cell technology becomes more refined.

Segment Insights

Assessment by Vehicle

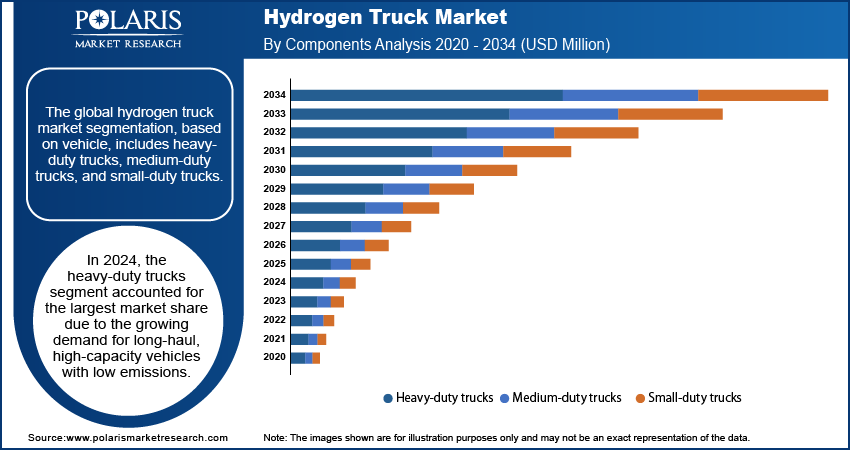

The global hydrogen truck market segmentation, based on vehicle, includes heavy-duty trucks, medium-duty trucks, and small-duty trucks. In 2024, the heavy-duty trucks segment accounted for the largest market share due to the growing demand for long-haul, high-capacity vehicles with low emissions. These trucks require significant power and efficiency, which hydrogen fuel cells provide, making them an ideal solution for freight transportation. Hydrogen trucks offer a longer driving range and shorter refueling times compared to battery electric trucks, which is a critical factor for heavy-duty applications. The increased focus on reducing carbon emissions in the freight and logistics industry is further propelling the adoption of hydrogen-powered heavy-duty trucks, enhancing the segment’s dominance in the market.

Evaluation by Application Outlook

The global hydrogen truck market segmentation, based on application, includes logistics and transport, municipal, construction, and others. In 2024, the logistics and transport segment accounted for the largest market share due to the increasing need for cleaner, more efficient transportation options in supply chains. The logistics industry is a major contributor to global emissions, and the transition to hydrogen-powered trucks offers a viable solution to meet sustainability goals without compromising operational efficiency. With the growing demand for zero-emissions freight solutions, logistics companies are increasingly adopting hydrogen trucks for long-distance transportation. The ability of hydrogen fuel cells to deliver greater range and faster refueling times compared to traditional electric trucks positions hydrogen trucks as a favorable option, thereby boosting the segment growth.

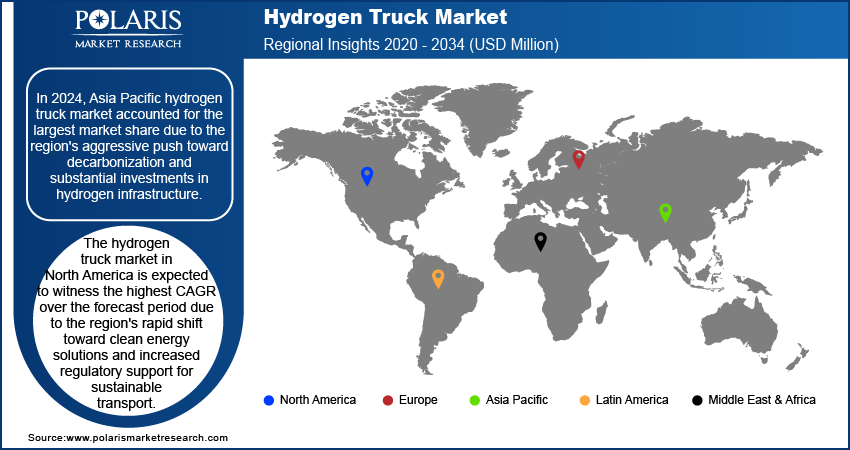

Regional Analysis

By region, the study provides hydrogen truck market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's aggressive push toward decarbonization and substantial investments in hydrogen infrastructure. Countries such as Japan, China, and South Korea are leading the way with government policies aimed at reducing emissions and increasing the adoption of hydrogen technologies. China’s growing hydrogen production capabilities, combined with Japan and South Korea's leadership in hydrogen-powered vehicle development, have propelled the region to dominate the market. For instance, according to the International Energy Agency, the Chinese government has launched a comprehensive medium- and long-term hydrogen development strategy for 2021-2035, aiming to position hydrogen as a key driver of sustainable energy transition. China targets the deployment of 50,000 hydrogen fuel-cell vehicles by 2025, supported by the establishment of an extensive network of hydrogen refueling stations to boost infrastructure readiness and market adoption. Additionally, the vast industrial landscape and increasing focus on sustainable logistics in Asia Pacific are contributing to the expansion of hydrogen truck adoption.

The hydrogen truck market in North America is expected to witness the highest CAGR over the forecast period due to the region's rapid shift toward clean energy solutions and increased regulatory support for sustainable transport. The US and Canada are making substantial investments in hydrogen infrastructure, with several public and private collaborations aiming to establish widespread hydrogen refueling networks. For instance, the US Department of Energy, under the 2021 Bipartisan Infrastructure Law, has committed USD 7 billion in funding to establish the nation’s first clean hydrogen hubs. This initiative marks the most significant public investment in hydrogen development in US history, aimed at accelerating the deployment of clean hydrogen infrastructure and encouraging a competitive hydrogen economy. Furthermore, the growing emphasis on reducing transportation emissions and achieving net-zero targets is pushing logistics companies to explore hydrogen trucks as a viable alternative to diesel-powered vehicles. The expanding hydrogen truck adoption is also driven by technological advancements in fuel cell technology, reducing costs and improving vehicle performance, further accelerating the market growth in North America.

Hydrogen Truck Key Market Players & Competitive Analysis Report

The competitive landscape of the hydrogen truck market is rapidly evolving, driven by both established automotive manufacturers and emerging startups investing in hydrogen technology. Key players such as Nikola Corporation, Hyundai, Toyota, and Daimler Trucks are at the forefront, with strategic alliances and substantial investments aimed at developing hydrogen-powered trucks. These companies are leveraging advancements in fuel cell technology, enhancing the efficiency, range, and cost-effectiveness of hydrogen trucks to meet the growing demand for sustainable transport solutions. In addition, traditional truck manufacturers such as Volvo and MAN are also entering the market, focusing on hydrogen-powered heavy-duty trucks as part of their decarbonization strategy. Moreover, partnerships between automakers, energy providers, and governments are integral to the development of hydrogen infrastructure, ensuring that refueling stations are strategically placed to support hydrogen truck fleets.

Scania is a commercial vehicle manufacturer which operates as a subsidiary of Volkswagen Truck & Bus GmbH. The company has a wide range of products available, including long-haul trucks, distribution trucks, specialized trucks, buses, and coaches, as well as engines for power generation, marine applications, and industrial settings. It provides an array of services, such as fleet management, driver training, workshop services, technology-related solutions, and customer support services. Scania's products cater to diverse markets, such as transportation, construction, agriculture, and mining. The company also offers vehicle financing, insurance, and rental services to complement its offerings. Scania is making significant strides in the development of hydrogen-powered trucks through its collaboration with Cummins Inc. The company is working on the Hydrogen Trucks project, which aims to produce an initial fleet of 20 fuel-cell electric trucks that will utilize green hydrogen as a fuel source.

Daimler Truck AG is a company that designs, manufactures, and distributes light, medium, and heavy-duty trucks and buses across Europe, North America, Asia, Latin America, and other international markets. The company is organized into five segments including Mercedes-Benz, Trucks Asia, Trucks North America, Daimler Buses, and Financial Services. Daimler Truck Holding provides a range of vehicles, including light, medium, and heavy-duty trucks, city and intercity buses, touring coaches, bus chassis, industrial engines, and specialized vehicles designed for municipal applications. They also offer new and used commercial vehicles. Daimler Truck AG is actively developing its Mercedes-Benz GenH2 Truck, powered by hydrogen, to promote sustainable long-haul logistics. This innovative truck uses liquid hydrogen as fuel, offering a range that exceeds 1,000 kilometers and providing performance comparable to traditional diesel trucks.

Key Companies

- Daimler Truck AG (Mercedes-Benz Group AG)

- Dongfeng Motor Corporation

- Foton International

- Hyundai Motor Company

- Nikola Corporation

- PACCAR Holding B.V. (DAF)

- Scania

- TRATON GROUP (MAN Truck & Bus SE)

- Volvo Group

- Yutong International Holding Co., Ltd.

Hydrogen Truck Industry Developments

December 2024: Hyundai Motor Group Metaplant America, in collaboration with Glovis America, deployed 21 Hyundai XCIENT heavy-duty hydrogen fuel cell electric trucks for sustainable logistics operations.

June 2024: XCMG launched a new hydrogen-powered dump truck as part of its strategic initiative to expand its renewable energy vehicle lineup. This innovative model leverages advanced hydrogen fuel cell technology, aimed at reducing carbon emissions while maintaining operational efficiency in construction and heavy-duty applications.

April 2024: MAN Truck & Bus launched a small series of hydrogen combustion engine trucks, becoming the first European manufacturer. This move enhances MAN's zero-emission portfolio.

Market Segmentation

By Vehicle Outlook (Revenue USD Million 2020 - 2034)

- Heavy-Duty Trucks

- Medium-Duty Trucks

- Small-Duty Trucks

By Fuel Cell Technology Outlook (Revenue USD Million 2020 - 2034)

- PEMFC

- SOFC

By Range Outlook (Revenue USD Million 2020 - 2034)

- Upto 300 miles

- 300-500 miles

- Above 500 miles

By Motor Power Outlook (Revenue USD Million 2020 - 2034)

- Upto 200 Kw

- 200-400 Kw

- Above 400 Kw

By Application Outlook (Revenue USD Million 2020 - 2034)

- Logistics and Transport

- Municipal

- Construction

- Others

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,287.38 million |

|

Market Size Value in 2025 |

USD 5,256.33 million |

|

Revenue Forecast in 2034 |

USD 35,384.62 million |

|

CAGR |

23.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen truck market size was valued at USD 4,287.38 million in 2024 and is projected to grow to USD 35,384.62 million by 2034.

The global market is projected to register a CAGR of 23.6% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to the region's aggressive push toward decarbonization and substantial investments in hydrogen infrastructure.

Some of the key players in the market are Daimler Truck AG (Mercedes-Benz Group AG); Dongfeng Motor Corporation; Foton International; Hyundai Motor Company; Nikola Corporation; PACCAR Holding B.V. (DAF); Scania; TRATON GROUP (MAN Truck & Bus SE); Volvo Group; and Yutong International Holding Co., Ltd.

In 2024, the heavy-duty trucks segment accounted for the largest market share due to the growing demand for long-haul, high-capacity vehicles with low emissions.

In 2024, the logistics and transport segment accounted for the largest market share due to the increasing need for cleaner, more efficient transportation options in supply chains.