Hydrogen Fuel Cell Vehicles Market Size, Share, Trends, Industry Analysis Report

: By Vehicle Type (Passenger Vehicle, Commercial Vehicle, and Heavy-Duty Trucks), Technology Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1656

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

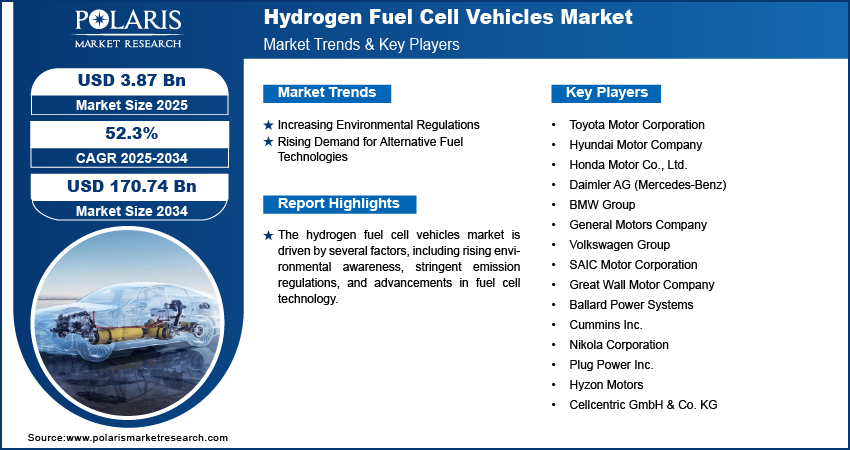

The hydrogen fuel cell vehicles market size was valued at USD 2.56 billion in 2024 and is projected to grow at a CAGR of 52.3% from 2025 to 2034. The market growth is primarily driven by growing environmental awareness, advancements in fuel cell technology, and the presence of stringent emission regulations.

Key Insights

- The passenger vehicle segment led the market in 2024. The segment’s dominance is primarily attributed to the growing consumer preference for environmentally friendly alternatives to traditional diesel and gasoline vehicles.

- The proton exchange membrane fuel cell segment dominated the market in 2024. The compact design and high efficiency of proton exchange membrane fuel cells make them ideal for automotive applications.

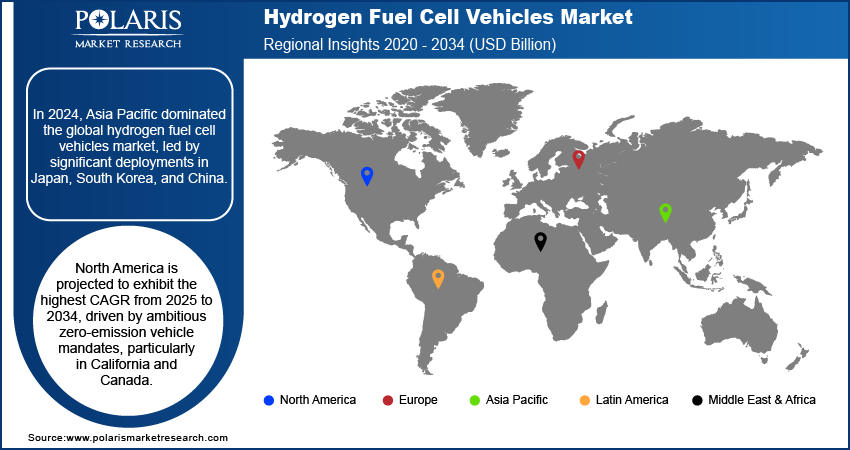

- Asia Pacific accounted for the largest market share in 2024. Extensive hydrogen infrastructure development and robust government support contribute to the regional market dominance.

- North America is anticipated to exhibit the highest CAGR during the projection period, owing to ambitious zero-emission vehicle mandates and rising investments in hydrogen infrastructure.

Industry Dynamics

- Many countries are making increasing investments in hydrogen as a sustainable alternative to traditional fuels. This rising government support and incentives for clean energy solutions drives market expansion.

- The global shift towards lowering greenhouse gas emissions is another major factor contributing to the increased demand for hydrogen fuel cell vehicles.

- Ambitious plans for hydrogen adoption and infrastructure development in emerging economies are expected to present significant market opportunities.

- The high initial cost associated with hydrogen fuel cell vehicles may present market challenges.

Market Statistics

2024 Market Size: USD 2.56 billion

2034 Projected Market Size: USD 170.74 billion

CAGR (2025-2034): 52.3%

Asia Pacific: Largest Market in 2024

Market.png)

To Understand More About this Research: Request a Free Sample Report

The global hydrogen fuel cell vehicles (HFCV) market represents a transformative shift towards sustainable transportation, leveraging hydrogen as a clean and efficient energy source. Hydrogen fuel cell vehicles utilize hydrogen gas in fuel cells to generate electricity, which powers an electric motor, offering zero tailpipe emissions. These vehicles are considered pivotal in decarbonizing the transportation sector while reducing reliance on fossil fuels. The market encompasses passenger vehicles, commercial vehicles, and heavy-duty trucks, with substantial investments being made to scale production and enhance hydrogen refueling networks.

Increasing environmental awareness, stringent emission regulations, and advancements in fuel cell technology are a few of the key factors driving the hydrogen fuel cell vehicles market growth. Governments worldwide are also actively supporting the transition to hydrogen fuel cell vehicles through subsidies, infrastructure development, and partnerships with private entities to boost hydrogen production and distribution. For instance, according to the National Portal of India, the Indian government invested USD 930 million in 2023 to boost hydrogen production and distribution. Technological innovation, coupled with a collaborative global approach, continues to further shape the adoption and commercialization of hydrogen fuel cell vehicles.

Market Dynamics

Government Support and Incentives for Clean Energy Solutions

Many countries are increasingly investing in hydrogen as a sustainable alternative to traditional fuels. For example, the European Commission has committed to investing over USD 455.80 million in hydrogen projects under the Clean Hydrogen Partnership as part of the Horizon Europe program, aiming to scale up hydrogen infrastructure. Similarly, in the US, the Hydrogen and Fuel Cell Technologies Office (HFTO), a division of the Department of Energy, supports research and development to lower the cost of hydrogen production and fuel cells. These initiatives, combined with tax credits and subsidies for FCVs, are accelerating the adoption of hydrogen-powered vehicles, thereby boosting hydrogen fuel cell vehicles market revenue.

Rising Demand for Low-Emission Vehicles

The global push toward reducing greenhouse gas emissions is another significant driver of the hydrogen fuel cell vehicles market demand. According to the International Energy Agency (IEA), transportation accounts for about 24% of global CO2 emissions, prompting governments worldwide to promote low-emission vehicles. For instance, Japan has implemented policies like the Basic Hydrogen Strategy, aiming for 800,000 fuel cell vehicles on the road by 2030. Similarly, the European Union's Green Deal includes initiatives to promote green hydrogen as a clean fuel for transportation. These efforts, combined with rising consumer awareness of environmental issues, are driving the adoption of hydrogen-powered vehicles as a zero-emission alternative to conventional gasoline or diesel cars.

Segment Analysis

Assessment Based on Vehicle Type

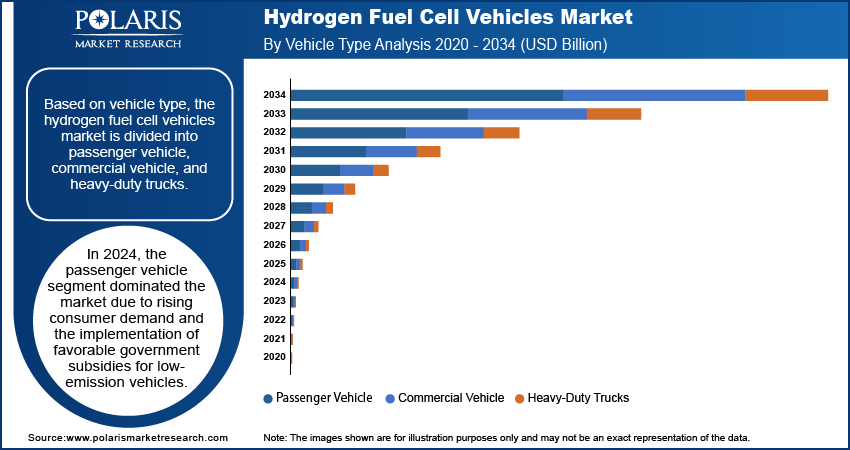

Based on vehicle type, the hydrogen fuel cell vehicles market is segmented into passenger vehicle, commercial vehicle, and heavy-duty trucks. The passenger vehicle segment dominated the hydrogen fuel cell vehicles (FCV) market in 2024, driven by growing consumer demand for low-emission, environmentally friendly alternatives to traditional gasoline and diesel vehicles. Government subsidies, tax incentives, and infrastructure development initiatives further drive the adoption of hydrogen FCVs by making them more affordable and accessible. These incentives, combined with expanding refueling stations, are encouraging consumers to transition to zero-emission hydrogen-powered passenger vehicles, driving segment growth.

Outlook Based on Technology

Based on technology, the hydrogen fuel cell vehicles market is segmented into proton exchange membrane fuel cell, phosphoric acid fuel cell, solid oxide fuel cell, and others. The proton exchange membrane fuel cell segment led the market in 2024 due to their high efficiency and compact design, making them ideal for automotive applications. Proton exchange membrane fuel cells (PEMFCs) provide excellent power density, enabling hydrogen vehicles to operate efficiently with reduced weight and space requirements, which is crucial for passenger vehicles. Their ability to start quickly and operate at lower temperatures also makes them suitable for various environments. Furthermore, advancements in PEMFC technology continue to improve cost-effectiveness, driving their adoption in the automotive fuel cell and contributing to market dominance.

Market Regional Analysis

By region, the market report offers hydrogen fuel cell vehicles market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024 due to strong government support, extensive hydrogen infrastructure development, and the presence of major FCV manufacturers. Japan, in particular, leads the regional market due to its comprehensive hydrogen strategy, established refueling infrastructure, government initiatives, and early adoption of FCVs in both passenger and commercial segments. For instance, The Tokyo Metropolitan Government allocated an increased budget for hydrogen-related initiatives, raising the funding to USD 134 million for the fiscal year 2024. This adjustment reflects a strategic commitment to advancing hydrogen technology and infrastructure within the region.

The North America hydrogen fuel cell vehicles market is projected to exhibit the highest CAGR from 2025 to 2034, driven by ambitious zero-emission vehicle mandates, particularly in California and Canada. The growth is further supported by increasing investments in hydrogen infrastructure, government incentives, and rising interest from commercial fleet operators. California stands out as the leading market in North America, benefiting from the California Fuel Cell Partnership initiatives, substantial investments in refueling infrastructure, and progressive environmental policies aimed at accelerating zero-emission vehicle adoption.

Key Players and Competitive Insights

The hydrogen fuel cell vehicles market exhibits a highly competitive landscape characterized by intense technological innovation and strategic partnerships. Toyota and Hyundai maintain market leadership through their established FCV models and extensive R&D capabilities. These companies have invested heavily in proprietary fuel cell technology and are actively expanding their product portfolios. Other manufacturers are entering the market through strategic collaborations and joint ventures, particularly in the commercial vehicle segment. Companies like Ballard Power Systems and Plug Power have strengthened their positions by focusing on specific market niches and developing specialized fuel cell solutions. The market is witnessing increased competition, with new entrants like Nikola and Hyzon Motors focusing on heavy-duty applications, while traditional automakers are accelerating their FCV development programs to maintain market relevance.

List of Key Players

- Toyota Motor Corporation

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Daimler AG (Mercedes-Benz)

- BMW Group

- General Motors Company

- Volkswagen Group

- SAIC Motor Corporation

- Great Wall Motor Company

- Ballard Power Systems

- Cummins Inc.

- Nikola Corporation

- Plug Power Inc.

- Hyzon Motors

- Cellcentric GmbH & Co. KG

Hydrogen Fuel Cell Vehicles Industry Developments

April 2025: Hyundia Motor Company announced the launch of all-new NEXO. The company stated that the vehicle comes with significant advancements in the power electronics (PE) system and fuel cell (FC) system. A redesigned motor system is also a part of the vehicle for complementing these enhancements.

March 2025: Toyota Motor Corporation introduced the 2025 Mirai. The vehicle combines hydrogen with oxygen from outside air for generating power. Standard features include digital key capability and panoramic view monitor.

October 2024, Hyundai Motor Company, an automobile manufacturer that designs, develops, manufactures, and distributes vehicles, parts, and powertrains, unveiled its INITIUM hydrogen fuel cell electric vehicle (FCEV) concept at its ‘Clearly Committed’ event held at Hyundai Motorstudio Goyang.

September 2023: Toyota, a global company that manufactures automobiles and a variety of other products and services, showcased a prototype hydrogen fuel cell electric Hilux.

August 2023: Ballard Power Systems announced the signing of a letter of intent (LOI) with Ford Trucks to supply a fuel cell system as part of the development of a hydrogen fuel cell-powered vehicle prototype. As part of the agreement, Ballard delivered two FCmove-XD 120 kW fuel cell engines to Ford Trucks in 2023.

Hydrogen Fuel Cell Vehicles Market Segmentation

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Vehicle

- Commercial Vehicle

- Heavy-Duty Trucks

By Technology Type Outlook (Revenue – USD Billion, 2020–2034)

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cell

- Solid Oxide Fuel Cell

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Private

- Commercial

- Industrial

- Government/Military

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Fuel Cell Vehicles Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.56 billion |

|

Revenue Forecast in 2025 |

USD 3.87 billion |

|

Revenue Forecast by 2034 |

USD 170.74 billion |

|

CAGR |

52.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hydrogen fuel cell vehicles market size was valued at USD 2.56 billion in 2024 and is projected to grow to USD 170.74 billion by 2034.

The global market is projected to register a CAGR of 52.3% from 2025 to 2034

Asia Pacific held the largest share of the global market in 2024

Some of the key players in the market are Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd.; Daimler AG (Mercedes-Benz); BMW Group; General Motors Company; Volkswagen Group; SAIC Motor Corporation; Great Wall Motor Company; Ballard Power Systems; Cummins Inc.; Nikola Corporation; Plug Power Inc.; Hyzon Motors; and Cellcentric GmbH & Co. KG.

The passenger vehicle segment dominated the market in 2024.