Immuno-Oncology Market Size, Share, Trends, Industry Analysis Report

By Treatment Approaches (Monoclonal Antibodies, Therapeutic Vaccines), By Novel Target Type, By Tumor or Cancer Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1083

- Base Year: 2024

- Historical Data: 2020-2023

Overview

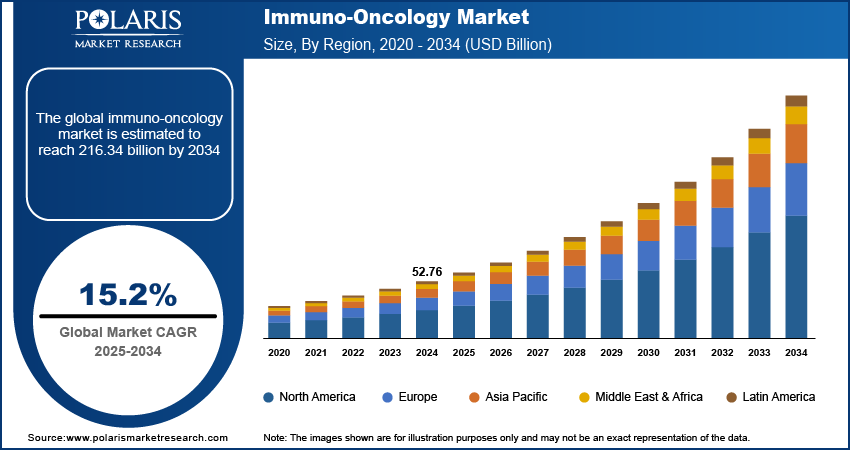

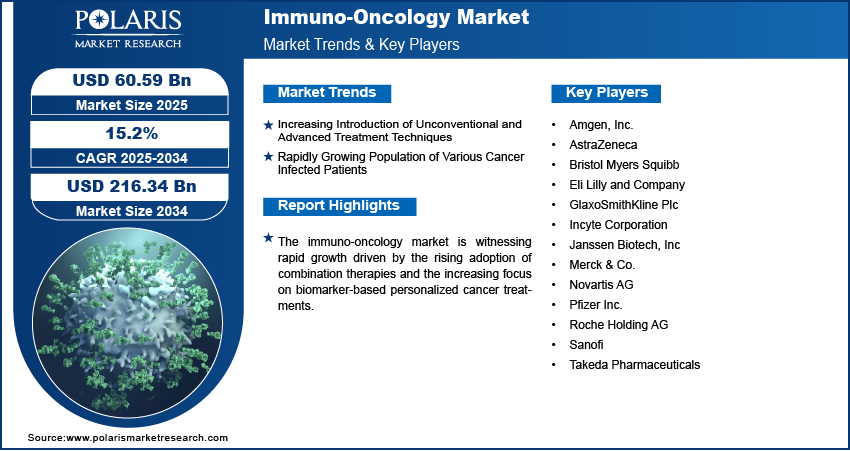

The global Immuno-Oncology Market size was valued at USD 52.76 billion in 2024, growing at a CAGR of 15.2% from 2025 to 2034. Key factors driving demand include strong pipeline of novel therapies, strategic collaborations & investments, increasing introduction of unconventional and advanced treatment techniques, and rapidly growing population of patients diagnosed with various forms of cancer.

Key Insights

- The checkpoint inhibitors segment led with 57.42% revenue share in 2024, driven by their durable clinical responses across cancers through PD-1/PD-L1 and CTLA-4 targeting.

- The A2AR antagonist/CD73i therapies segment is expected to register a CAGR of 16.1% by disrupting adenosine-mediated immunosuppression in tumors.

- The classical Hodgkin’s lymphoma segment captured 18% revenue share in 2024, benefiting from exceptional checkpoint inhibitor response rates.

- North America dominated with 31.27% global share, supported by advanced healthcare systems and biopharma innovation hubs.

- The U.S. contributed 89.23% of North America’s share, reflecting its robust clinical trial ecosystem and rapid therapy adoption.

- The Immuno-Oncology Market in Asia Pacific is expected to record a CAGR of 16.3% by 2034, fueled by rising treatment access and healthcare investments.

- India’s market grows with upgraded diagnostics, infrastructure, and global-local biopharma partnerships.

Industry Dynamics

- Emerging advanced therapies such as personalized immunotherapies and combination regimens are creating expansion opportunities by enhancing treatment precision, reducing toxicity, and improving outcomes beyond conventional approaches.

- Rising global cancer prevalence across demographics is accelerating demand for targeted therapies, as patients increasingly require more effective treatments with improved safety profiles and better survival rates.

- High treatment costs and complex manufacturing processes limit accessibility to immuno-oncology therapies, particularly in emerging markets, despite their clinical benefits.

- Advancements in biomarker research and AI-driven drug discovery enable more targeted therapies, expanding treatable patient populations and improving response rates.

Market Statistics

- 2024 Market Size: USD 52.76 billion

- 2034 Projected Market Size: USD 216.34 billion

- CAGR (2025–2034): 15.2%

- North America: Largest market in 2024

AI Impact on Immuno-Oncology Market

- AI enables rapid identification of novel therapeutic targets and predictive biomarkers, fostering the development of tailored immuno-oncology drugs and treatment regimens.

- Machine learning models enhance patient stratification and provide real-time analysis of clinical data, leading to more precise and effective immunotherapy applications.

- AI-powered platforms optimize clinical trial design, reduce costs, and increase the probability of successful treatment by predicting patient responses and minimizing adverse events.

- Integration of multi-modal data—radiology, genomics, pathology—allows clinicians to personalize immuno-oncology therapies and predict outcomes with unprecedented accuracy.

Immuno-oncology refers to a branch of cancer treatment that leverages the body’s immune system to detect, target, and eliminate tumor cells. The strong pipeline of novel therapies is fueling the growth, as advancements in cancer immunotherapy research have led to the development of innovative treatment modalities such as immune checkpoint inhibitors, CAR-T cell therapies, cancer vaccines, and bispecific antibodies. In February 2024, Astellas' Xyphos Biosciences and Kelonia Therapeutics collaborated to develop in vivo CAR-T cell therapies by combining Kelonia’s iGPS gene delivery system with Xyphos’ ACCEL platform. Kelonia received USD 40 million, with potential milestones up to USD 800 million for R&D. These next-generation therapeutics are designed to enhance immune system precision and durability of response, targeting specific pathways and tumor antigens more effectively. Additionally, the growing number of candidates in various stages of clinical trials highlights the industry’s commitment to addressing unmet medical needs, expanding treatment options, and improving patient outcomes across multiple cancer types.

The increasing number of strategic collaborations and investments, which are accelerating innovation and expanding the global reach of immuno-oncology solutions, further contribute to the growth opportunities. Partnerships between pharmaceutical companies, biotechnology firms, research institutions, and healthcare providers are enabling shared expertise, technology transfer, and co-development of novel therapeutics. Additionally, robust capital inflows from venture capital firms and large-scale investments from industry leaders are supporting advanced R&D programs, clinical trial execution, and market expansion strategies. These alliances minimize development risks and also accelerate the commercialization of breakthrough treatments, boosting a competitive yet collaborative environment that boosts the overall growth and adoption of immuno-oncology therapies worldwide.

Drivers & Opportunities

Increasing Introduction of Unconventional and Advanced Treatment Techniques: The increasing introduction of unconventional and advanced treatment techniques is driving the expansion opportunities, as it expands the scope and effectiveness of cancer therapy beyond traditional methods. Innovative approaches such as personalized immunotherapies, combination regimens, and next-generation biologics are improving treatment precision, reducing adverse effects, and enhancing patient survival rates. In June 2025, BioNTech SE and Bristol Myers Squibb agreed to co-develop and co-commercialize BNT327, a bispecific antibody targeting PD-L1 and VEGF-A for solid tumors. Currently in Phase 3 trials for ES-SCLC and NSCLC, and have treated over 1,000 patients globally. These advanced modalities leverage advanced technologies such as gene editing, immune modulation, and synthetic biology to target cancer more effectively at the molecular and cellular levels. These novel techniques are reshaping treatment protocols and offering more durable, long-term remission possibilities by overcoming limitations of conventional therapies, such as chemotherapy and radiation, thereby strengthening the growth trajectory.

Rapidly Growing Population of Various Cancer Infected Patients: The rapidly growing population of patients diagnosed with various forms of cancer is driving the market, as it directly increases the demand for more effective and targeted treatment solutions. Rising cancer incidence across diverse demographics creates an urgent need for therapies that can deliver improved clinical outcomes with fewer side effects. According to February 2024 World Health Organization data, global cancer cases are projected to rise, with an estimated 35 million new cases in 2050, with a 77% increase from the 20 million cases reported in 2022. Immuno-oncology treatments are uniquely positioned to meet this demand by offering tailored and potentially more sustainable approaches to disease management by harnessing the body’s immune system. Moreover, the expanding patient base also fuels research efforts, clinical trial enrollment, and investment in innovative digital therapeutic platforms, reinforcing the continuous development and adoption of advanced immuno-oncology solutions across global healthcare systems.

Segmental Insights

Treatment Approaches Analysis

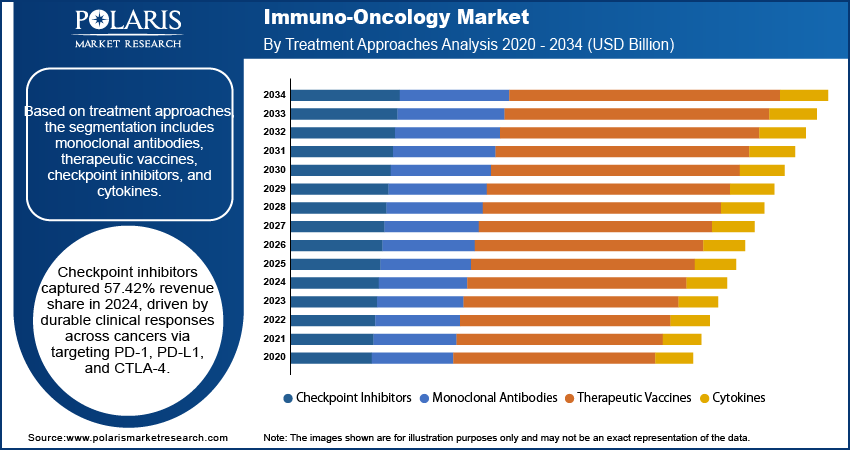

Based on treatment approaches, the segmentation includes monoclonal antibodies, therapeutic vaccines, checkpoint inhibitors, and cytokines. The checkpoint inhibitors segment accounted for 57.42% revenue share in 2024 due to their proven ability to deliver durable clinical responses across multiple cancer types by targeting immune checkpoints such as PD-1, PD-L1, and CTLA-4. These therapies work by releasing the natural brakes on the immune system, enabling T-cells to recognize and attack tumor cells more effectively. The broad clinical applicability, favorable safety profiles compared to conventional chemotherapy, and strong adoption in treatment guidelines have especially contributed to their dominance. Furthermore, ongoing research into novel checkpoint pathways and combination regimens continues to expand their therapeutic potential, reinforcing their position in the global industry.

The monoclonal antibodies segment is expected to witness a substantial CAGR of 15.3% during the forecast period due to their increasing role in targeted cancer therapy, offering high specificity in recognizing and binding to tumor-associated antigens. This precision reduces off-target effects while enhancing treatment efficacy, making monoclonal antibodies a preferred choice in combination with other immuno-oncology modalities. Additionally, technological advancements in antibody engineering, such as bispecific antibodies and antibody-drug conjugates, are further improving their therapeutic potential. Their adaptability in addressing different tumor types and compatibility with emerging personalized treatment approaches are anticipated to drive strong demand and adoption over the coming years.

Novel Target Type Analysis

In terms of novel target type, the segmentation includes IDO1i, LAG-3 CPI, oncolytic virus, STING agonist, TLR agonist, HDACi, TIL, VEGFi, MEKi, TIGIT, CPI, GITR agonist, TGF-b trap, A2AR antagonist/CD73i. The VEGFi dominated the market with a 12.03% share in 2024 due to its central role in inhibiting angiogenesis, a critical process for tumor growth and metastasis. VEGF inhibitors effectively starve tumors of the blood supply needed for their survival and proliferation by blocking vascular endothelial growth factor (VEGF) signaling pathways. Their proven clinical benefits across various cancer types and frequent inclusion in combination regimens with checkpoint inhibitors or chemotherapy have strengthened their market position. Additionally, the availability of multiple approved agents and ongoing R&D into next-generation VEGF-targeting therapies contribute to their sustained dominance.

The A2AR antagonist/CD73i segment is expected to witness the highest CAGR of 16.1% during the forecast period, owing to its innovative mechanism of targeting the adenosine signaling pathway, which plays a critical role in suppressing anti-tumor immunity within the tumor microenvironment. These therapies enhance T-cell activation and restore immune system functionality against cancer cells by blocking A2A receptors or inhibiting CD73 activity. The segment’s growth is further supported by its potential alliance with other immunotherapies, particularly checkpoint inhibitors, to improve treatment outcomes. Therefore, as clinical data supporting their efficacy continues to emerge, these agents are gaining attention from both researchers and industry players.

Tumor or Cancer Type Analysis

The segmentation, based on tumor or cancer type, includes melanoma, non-small cell lung cancer, renal cell carcinoma, head, face & neck cancer, bladder cancer, classical Hodgkin’s lymphoma, Merkel cell carcinoma, and other cancer types. The classical Hodgkin’s lymphoma segment held 18.00% revenue share in 2024 due to the remarkable effectiveness of immuno-oncology therapies, particularly checkpoint inhibitors, in achieving high response rates in this cancer type. Hodgkin’s lymphoma is characterized by overexpression of PD-L1, making it particularly responsive to PD-1/PD-L1 blockade. Favorable survival outcomes, rapid adoption into treatment guidelines, and consistent clinical success across relapsed or refractory cases have strengthened its strong share. Moreover, ongoing trials exploring combination approaches continue to expand treatment possibilities for this indication.

The non-small cell lung cancer segment is expected to witness the highest CAGR of 15.7% during the forecast period, attributed to the rising prevalence of the disease and the expanding approval of immuno-oncology agents as first-line and subsequent-line treatments. Checkpoint inhibitors, targeted therapies, and combination regimens have demonstrated improvements in survival and quality of life for patients with advanced disease. The growing use of biomarker testing, such as PD-L1 expression and tumor mutational burden, is enabling more precise patient selection and optimizing treatment outcomes. Moreover, continued innovation and integration of immuno-oncology into standard NSCLC care are expected to drive its strong growth trajectory.

Regional Analysis

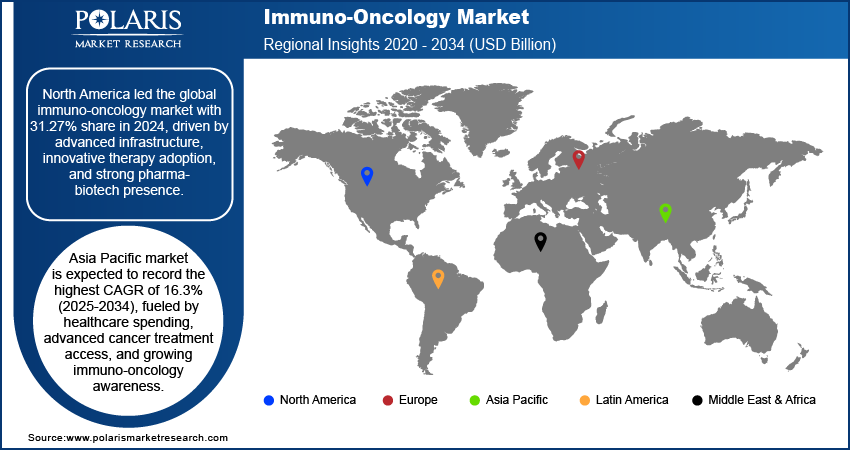

The North America Immuno-Oncology Market accounted for 31.27% of global market share in 2024. This dominance is attributed to its advanced healthcare infrastructure, high adoption rate of innovative cancer therapies, and strong presence of leading pharmaceutical and biotechnology companies. The region benefits from substantial investment in research and development, coupled with robust clinical trial activity that accelerates the introduction of novel immuno-oncology treatments. Favorable regulatory frameworks and widespread access to biomarker testing further support early adoption and personalized treatment approaches. Additionally, strong collaboration between research institutions, industry players, and healthcare providers ensures rapid translation of scientific breakthroughs into clinical practice, solidifying the region’s dominance.

U.S. Immuno-Oncology Market Insights

The U.S. held 89.23% market share in North America immuno oncology landscape in 2024 due to its strong concentration of top-tier biopharmaceutical companies, advanced clinical trial infrastructure, and rapid adoption of advanced cancer therapies. The country’s robust funding ecosystem, both public and private, supports continuous innovation and commercialization of novel immuno-oncology agents. Additionally, a well-developed reimbursement framework and widespread availability of specialized oncology centers facilitate faster patient access to advanced treatments.

Asia Pacific Immuno-Oncology Market Trends

The Immuno-Oncology Market in Asia Pacific is projected to witness the highest CAGR of 16.3% from 2025 to 2034. The growth is attributed to increasing healthcare expenditure, expanding access to advanced cancer treatments, and rising awareness about the benefits of immuno-oncology. The region is experiencing a growing focus on early detection and precision medicine, which is driving demand for targeted and personalized therapies. For instance, in April 2024, India introduced its first indigenous CAR-T cell therapy, NexCAR19, developed by IIT Bombay, Tata Memorial Centre, and ImmunoACT. This gene therapy modifies patients' immune cells to target cancer, offering an affordable treatment option with promising survival outcomes for Indian patients. Rapid improvements in healthcare infrastructure, combined with strong investment in local biotechnology and pharmaceutical sectors, are accelerating innovation and clinical research. Furthermore, a large and diverse patient population provides significant opportunities for clinical trial recruitment and treatment adoption, contributing to the region’s strong growth potential.

India Immuno-Oncology Market Overview

The market in India is expanding due to increasing investments in healthcare infrastructure, rising availability of advanced diagnostic facilities, and growing collaborations between domestic firms and global biopharmaceutical players. The country’s large patient pool, coupled with greater awareness of personalized cancer treatments, is driving demand for immuno-oncology therapies. Furthermore, government and private sector initiatives to strengthen cancer care networks are improving accessibility to innovative treatment options.

Europe Immuno-Oncology Market Analysis

Europe held a 23.17% share of the global revenue in 2024. The industry growth in Europe is attributed to its well-established oncology research ecosystem, strong focus on precision medicine, and coordinated efforts to integrate innovative therapies into public healthcare systems. The region benefits from robust clinical research networks, Pan-European collaborations, and regulatory processes that facilitate faster approval and availability of novel treatments. High adoption rates of biomarker-driven therapies and inclusion of immuno-oncology agents in treatment guidelines across multiple cancer types further reinforce market growth. Additionally, Europe’s focus on improving patient outcomes through evidence-based practices supports the steady expansion of the immuno-oncology sector across the region.

Germany Immuno-Oncology Market Assessment

The Germany market is driven by its strong clinical research capabilities, integration of immuno-oncology therapies into standardized cancer treatment protocols, and high levels of physician expertise in precision medicine. The country benefits from a supportive regulatory environment and substantial public funding for oncology research, which accelerates the development and adoption of advanced treatments. In addition, Germany’s well-structured healthcare system ensures equitable access to innovative therapies for a wide patient base.

Key Players & Competitive Analysis

The immuno-oncology market is witnessing competition, driven by strategic investments in next-generation therapies and emerging technologies such as CAR-T and bispecific antibodies. Major companies are focusing on revenue growth through expansion opportunities in developed markets while addressing latent demand in emerging market segments. Competitive intelligence reveals that companies are prioritizing future development strategies, including partnerships with small and medium-sized businesses to accelerate innovation. Industry trends highlight a shift toward personalized therapies, with technological advancements in gene editing and AI-driven drug discovery reshaping the landscape. Economic and geopolitical shifts are influencing region-wise market size dynamics, particularly in Asia-Pacific, where affordable therapies like India’s NexCAR19 are gaining traction. Vendor strategies now highlight sustainable value chains to mitigate supply chain disruptions. Expert insights suggest that disruptions and trends such as decentralized manufacturing and real-world data integration will define the future of industry ecosystems. Growth projections remain robust, with revenue opportunity tied to untapped indications and combination therapies. Key strategic developments include targeting high-growth markets with localized solutions and ensuring long-term revenue forecast stability amid evolving macroeconomic trends.

A few major companies operating in the immuno oncology industry include Amgen, Inc.; AstraZeneca; Bristol Myers Squibb; Eli Lilly and Company; GlaxoSmithKline Plc; Incyte Corporation; Janssen Biotech, Inc; Merck & Co.; Novartis AG; Pfizer Inc.; Roche Holding AG; Sanofi; and Takeda Pharmaceuticals.

Key Players

- Amgen, Inc.

- AstraZeneca

- Bristol Myers Squibb

- Eli Lilly and Company

- GlaxoSmithKline Plc

- Incyte Corporation

- Janssen Biotech, Inc

- Merck & Co.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Sanofi

- Takeda Pharmaceuticals

Immuno Oncology Industry Developments

- November 2024: Dr. Reddy’s launched toripalimab in India, the first immuno-oncology drug approved for recurrent or metastatic nasopharyngeal carcinoma (RM-NPC). It reduces progression/death risk by 48% when combined with chemotherapy.

- May 2024: Novartis acquired Mariana Oncology, a preclinical biotech developing radioligand therapies (RLTs) for cancers with unmet needs. The deal enhances Novartis’ RLT pipeline, including MC-339 (an actinium-based RLT for small cell lung cancer), and expands its oncology research and supply capabilities.

Immuno-Oncology Market Segmentation

By Treatment Approaches Outlook (Revenue, USD Billion, 2020–2034)

- Monoclonal Antibodies

- Therapeutic Vaccines

- Checkpoint Inhibitors

- Cytokines

By Novel Target Type Outlook (Revenue, USD Billion, 2020–2034)

- IDO1i

- LAG-3 CPI

- Oncolytic Virus

- STING Agonist

- TLR Agonist

- HDACi

- TIL

- VEGFi

- MEKi

- TIGIT

- CPI

- GITR Agonist

- TGF-b trap

- A2AR Antagonist/CD73i

By Tumor or Cancer Type Outlook (Revenue, USD Billion, 2020–2034)

- Melanoma

- Non-Small Cell Lung Cancer

- Renal Cell Carcinoma

- Head, Face, & Neck Cancer

- Bladder Cancer

- Classical Hodgkin’s Lymphoma

- Merkel Cell Carcinoma

- Other Cancer Types

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Immuno-Oncology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 52.76 Billion |

|

Market Size in 2025 |

USD 60.59 Billion |

|

Revenue Forecast by 2034 |

USD 216.34 Billion |

|

CAGR |

15.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 52.76 billion in 2024 and is projected to grow to USD 216.34 billion by 2034.

The global market is projected to register a CAGR of 15.2% during the forecast period.

North America Immuno-Oncology Market dominated the market with 31.27% of global share in 2024.

A few of the key players in the market are Amgen, Inc.; AstraZeneca; Bristol Myers Squibb; Eli Lilly and Company; GlaxoSmithKline Plc; Incyte Corporation; Janssen Biotech, Inc; Merck & Co.; Novartis AG; Pfizer Inc.; Roche Holding AG; Sanofi; and Takeda Pharmaceuticals.

The checkpoint inhibitors segment accounted for 57.42% revenue share in 2024.

The A2AR antagonist/CD73i segment is expected to witness the highest CAGR of 16.1% during the forecast period.